- Delivered industry-leading second-quarter earnings of $9.2

billion1, showcasing the differentiated strengths of ExxonMobil's

portfolio and its improved earnings power

- The Pioneer merger, which closed five months faster than

similar transactions and fundamentally transforms the Upstream

portfolio, contributed $0.5 billion to earnings in the first two

months post-closing2 with record production, and integration and

synergy benefits are exceeding expectations

- Also achieved record production in Guyana and heritage Permian;

Upstream total net production grew 15%, or 574,000 oil-equivalent

barrels per day, from the first quarter

- Expanded the company's value proposition by progressing new

businesses including furthering carbon capture and storage (CCS)

leadership with a new agreement that increased total contracted CO2

offtake with industrial customers to 5.5 million metric tons per

year3, more committed volume than any other company has

announced

Exxon Mobil Corporation (NYSE:XOM):

Results Summary

2Q24

1Q24

Change vs 1Q24

Dollars in millions (except per share

data)

YTD 2024

YTD 2023

Change vs YTD 2023

9,240

8,220

+1,020

Earnings (U.S. GAAP)

17,460

19,310

-1,850

9,240

8,220

+1,020

Earnings Excluding Identified Items

(non-GAAP)

17,460

19,492

-2,032

2.14

2.06

+0.08

Earnings Per Common Share 4

4.20

4.73

-0.53

2.14

2.06

+0.08

Earnings Excl. Identified Items Per Common

Share (non-GAAP) 4

4.20

4.77

-0.57

7,039

5,839

+1,200

Capital and Exploration Expenditures

12,878

12,546

+332

Exxon Mobil Corporation today announced second-quarter 2024

earnings of $9.2 billion, or $2.14 per share assuming dilution.

Cash flow from operating activities was $10.6 billion and cash flow

from operations excluding working capital movements was $15.2

billion. Shareholder distributions of $9.5 billion included $4.3

billion of dividends and $5.2 billion of share repurchases,

consistent with the company's announced plans.

“We delivered our second-highest 2Q earnings of the past decade

as we continue to improve the fundamental earnings power of the

company,” said Darren Woods, chairman and chief executive

officer.

“We achieved record quarterly production from our

low-cost-of-supply Permian and Guyana assets, with the highest oil

production since the Exxon and Mobil merger. We also achieved a

record in high-value product sales, growing by 10% versus the first

half of last year. We closed on our transformative merger with

Pioneer in about half the time of similar deals. And we’re

continuing to build businesses such as ProxximaTM, carbon materials

and virtually carbon-free hydrogen, with approximately 98% of CO2

removed, that will create value long into the future.”

1

Second-quarter earnings for the industry

peer group are actuals for companies that reported results on or

before August 1, 2024, or estimated using Bloomberg consensus as of

August 1st. Industry peer group includes BP, Chevron, Shell and

TotalEnergies.

2

Pioneer operations contributed $0.5

billion to consolidated earnings post-close (May-June), which

excludes $0.2 billion of one-time items related to the

acquisition.

3

Based on contracts to move up to 5.5 MTA

starting in 2025 subject to additional investment by ExxonMobil and

permitting for carbon capture and storage projects.

4

Assuming dilution.

Financial Highlights

- Year-to-date earnings were $17.5 billion versus $19.3 billion

in the first half of 2023. Earnings excluding identified items were

$17.5 billion compared to $19.5 billion in the same period last

year. Earnings decreased as industry refining margins and natural

gas prices declined from last year's historically high levels to

trade within the ten-year historical range2, while crude prices

rose modestly. Strong advantaged volume growth from record Guyana,

Pioneer, and heritage Permian assets, high-value products and the

Beaumont refinery expansion more than offset lower base volumes

from divestments of non-strategic assets and government-mandated

curtailments. Structural cost savings partially offset higher

expenses from scheduled maintenance, depreciation and support of

new businesses and 2025 project start-ups.

- Achieved $10.7 billion of cumulative Structural Cost Savings

versus 2019, including an additional $1.0 billion of savings during

the year and $0.6 billion during the quarter. The company is on

track to deliver cumulative savings totaling $5 billion through the

end of 2027 versus 2023.

- Generated strong cash flow from operations of $25.2 billion and

free cash flow of $15.0 billion in the first half of the year,

including working capital outflows of $2.6 billion driven by higher

seasonal cash tax payments. Excluding working capital, cash flow

from operations and free cash flow were $27.8 billion and $17.6

billion, respectively. Year-to-date shareholder distributions of

$16.3 billion included $8.1 billion of dividends and $8.3 billion

of share repurchases. Following the close of the Pioneer

transaction, the Corporation increased the annual pace of share

repurchases to $20 billion through 2025, assuming reasonable market

conditions. The company plans to repurchase over $19 billion of

shares in 2024.

- The Corporation declared a third-quarter dividend of $0.95 per

share, payable on September 10, 2024, to shareholders of record of

Common Stock at the close of business on August 15, 2024.

- The company's debt-to-capital ratio was 14% and the

net-debt-to-capital ratio was 6%3, reflecting a year-to-date debt

repayment of $3.9 billion and a period-end cash balance of $26.5

billion.

- Capital and exploration expenditures were $7.0 billion in the

second quarter including $0.7 billion from Pioneer, bringing

year-to-date expenditures to $12.9 billion. The Corporation

anticipates full-year capital and exploration expenditures to be

approximately $28 billion, which includes the top end of the

previously announced guidance for ExxonMobil of $25 billion, and

about $3 billion for 8 months of Pioneer, consistent with their

prior guidance.

1

The updated earnings factors introduced in

the first quarter of 2024 provide additional visibility into

drivers of our business results. The company evaluates these

factors periodically to determine if any enhancements may provide

helpful insights to the market. See page 9 for definitions of these

new factors.

2

10-year range includes 2010-2019, a

representative 10-year business cycle which avoids the extreme

outliers in both directions that the market experienced in recent

years.

3

Net debt is total debt of $43.2 billion

less $26.5 billion of cash and cash equivalents excluding

restricted cash. Net-debt to-capital ratio is net debt divided by

the sum of net debt and total equity of $276.3 billion.

ADVANCING CLIMATE SOLUTIONS

Virtually Carbon-Free Hydrogen

- ExxonMobil and Air Liquide reached an agreement to support the

production of virtually carbon-free hydrogen, with approximately

98% of CO2 removed, and ammonia at ExxonMobil's planned Baytown,

Texas hydrogen facility. The agreement will enable transportation

of hydrogen through Air Liquide's existing pipeline network.

Additionally, Air Liquide will build and operate four Large Modular

Air separation units (LMAs) to supply 9,000 metric tons of oxygen

and up to 6,500 metric tons of nitrogen daily to the facility. The

LMAs are expected to primarily use low-carbon electricity to reduce

the project’s carbon footprint. The production facility would be

the world's largest planned virtually carbon-free hydrogen project

and is expected to produce 1 billion cubic feet of hydrogen daily,

and more than 1 million metric tons of ammonia per year while

capturing approximately 98% of the associated CO2 emissions.

ExxonMobil aims to help enable the growth of a low-carbon hydrogen

market along the U.S. Gulf Coast to assist industrial customers

achieve their decarbonization goals.

Lithium

- ExxonMobil has signed a non-binding memorandum of understanding

(MOU) with SK On, a global leading electric vehicle (EV) battery

developer, that enables a multiyear offtake agreement of up to

100,000 metric tons of MobilTM Lithium from the company’s first

planned project in Arkansas. SK On plans to use the lithium in its

EV battery manufacturing operations in the United States.

Carbon Capture and Storage

- ExxonMobil signed its fourth carbon capture and storage (CCS)

agreement with a major industrial customer, bringing the total

contracted CO2 to store for industrial customers up to 5.5 million

metric tons per year. The new agreement is the second project with

CF Industries, a major fertilizer and ammonia producer. Under the

contract, ExxonMobil will transport and store up to 500,000 metric

tons of CO2 per year from CF's operations in Yazoo City,

Mississippi, reducing CO2 emissions from the site by up to

50%.

Products Supporting a Lower-Emissions Future

- The ProxximaTM business transforms lower-value gasoline

molecules into a high-performance, high-value thermoset resin that

can be used in coatings, light-weight construction materials, and

advanced composites for cars and trucks – including battery boxes

for electric vehicles. Materials made with ProxximaTM are lighter,

stronger, more durable, and produced with significantly fewer GHG

emissions than traditional alternatives1. In March, the company

showcased the automotive uses of ProxximaTM at the world’s leading

international composites exhibition in Paris. The company is

progressing projects in Texas, with startups anticipated in 2025,

that will significantly expand production of ProxximaTM. The

company sees the total potential addressable market for ProxximaTM

at 5 million metric tons and $30 billion dollars by 2030 with

demand growing faster than GDP and returns above 15%2.

- The Carbon Materials venture transforms the molecular structure

of low-value, carbon-rich feeds from the company's refining

processes into high-value products for a range of applications. The

company is targeting market segments including carbon fiber,

polymer additives, and battery materials with margins of several

thousand dollars per ton and growth rates outpacing GDP3.

1

EM estimate calculated based on volumetric

displacement of epoxy resin on a cradle-to-gate basis. Source:

Comparative Carbon Footprint of Product - ExxonMobil’s Proxima™

Resin System to Alternative Resin Systems, June 2023, prepared by

Sphera Solutions, Inc. for ExxonMobil Technology and Engineering

Company. The study was confirmed to be conducted according to and

in compliance with ISO 14067:2018 by an independent third-party

critical review panel.

https://www.materia-inc.com/what-do-we-do/our-products/creating-sustainable-solutions/lca-executive-summary

2

Based on internal assessment of demand for

products in existing markets. Targeting global markets in both the

coatings and composites industries: In coatings the focus is on

corrosion protection of vessels (e.g., tanks, ships, and railcars)

and insulation (e.g., subsea pipes and equipment) applications.

Within composite materials (i.e., materials containing glass or

carbon fiber) the focus is on infrastructure, wind energy, and

mobility sectors. Examples include replacing steel rebar in

flatwork applications, replacing epoxy in wind turbines, and

structural support in hydrogen tanks, EV battery casings, and other

transportation components.

3

Potential markets for carbon materials

include structural composites and energy storage. Market growth

based on internal assessment of demand for products in respective

markets.

EARNINGS AND VOLUME SUMMARY BY

SEGMENT

Upstream

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

Earnings/(Loss) (U.S. GAAP)

2,430

1,054

United States

3,484

2,552

4,644

4,606

Non-U.S.

9,250

8,482

7,074

5,660

Worldwide

12,734

11,034

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

2,430

1,054

United States

3,484

2,552

4,644

4,606

Non-U.S.

9,250

8,652

7,074

5,660

Worldwide

12,734

11,204

4,358

3,784

Production (koebd)

4,071

3,719

- Upstream year-to-date earnings were $12.7 billion, $1.7 billion

higher than the first half of 2023. The prior-year period was

negatively impacted by tax-related identified items. Excluding

identified items, earnings increased $1.5 billion due to advantaged

assets volume growth from record Guyana, heritage Permian and

Pioneer production. Year-to-date net production was 4.1 million

oil-equivalent barrels per day, an increase of 9%, or 352,000

oil-equivalent barrels per day. Higher crude realizations and

structural cost savings offset lower natural gas realizations,

higher expenses mainly from depreciation, and lower base volumes

due to divestments of non-strategic assets and government-mandated

curtailments.

- Second-quarter earnings were $7.1 billion, an increase of $1.4

billion from the first quarter driven by the Pioneer acquisition,

record Guyana and heritage Permian production, and structural cost

savings. Higher crude realizations and divestment gains more than

offset lower gas realizations. Net production in the second quarter

was 4.4 million oil-equivalent barrels per day, an increase of 15%,

or 574,000 oil-equivalent barrels per day compared to the prior

quarter due to advantaged volume growth from Pioneer, Guyana and

heritage Permian.

- On May 3, 2024, ExxonMobil completed the acquisition of Pioneer

Natural Resources. The company issued 545 million shares of

ExxonMobil common stock having a fair value of $63 billion on the

acquisition date and assumed $5 billion of debt. The merger of

ExxonMobil and Pioneer created the largest, high-return

unconventional resource development potential in the world.

- In the quarter, the Company submitted an application to the

Guyanese Environmental Protection Agency for the Hammerhead

project, the proposed seventh development. Production capacity is

expected to be 120,000 to 180,000 barrels per day, with anticipated

start-up in 2029, pending Guyanese government approval.

Energy Products

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

Earnings/(Loss) (U.S. GAAP)

450

836

United States

1,286

3,438

496

540

Non-U.S.

1,036

3,055

946

1,376

Worldwide

2,322

6,493

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

450

836

United States

1,286

3,438

496

540

Non-U.S.

1,036

3,067

946

1,376

Worldwide

2,322

6,505

5,320

5,232

Energy Products Sales (kbd)

5,276

5,469

- Energy Products year-to-date earnings were $2.3 billion, a

decrease of $4.2 billion versus the first half of 2023 due to

significantly lower industry refining margins which normalized from

historically high prior year levels as demand growth was more than

met by capacity additions. Earnings improvement from structural

cost savings and the advantaged Beaumont refinery expansion project

partially offset higher scheduled maintenance impacts and lower

volumes from non-core refinery divestments. Unfavorable timing

effects, mainly from derivatives mark-to-market impacts, also

contributed to the earnings decline.

- Second-quarter earnings totaled $0.9 billion compared to $1.4

billion in the first quarter driven by weaker industry refining

margins as additional supply outpaced record demand in the second

quarter. Stronger trading and marketing margins, as well as

favorable derivatives mark-to-market timing effects provided a

partial offset.

Chemical Products

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

Earnings/(Loss) (U.S. GAAP)

526

504

United States

1,030

810

253

281

Non-U.S.

534

389

779

785

Worldwide

1,564

1,199

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

526

504

United States

1,030

810

253

281

Non-U.S.

534

389

779

785

Worldwide

1,564

1,199

4,873

5,054

Chemical Products Sales (kt)

9,927

9,498

- Chemical Products year-to-date earnings were $1.6 billion, an

increase of $365 million versus the first half of 2023 driven by

strong performance product sales growth and higher base volumes

from modest demand improvement and lower turnaround impacts.

Despite weaker global industry margins, overall margins increased

as a result of the company's advantaged North American footprint

which benefited from lower feed and energy costs. Structural cost

savings provided a partial offset to higher project and maintenance

expenses.

- Second-quarter earnings were $779 million compared to $785

million in the first quarter. Stronger margins, high-value product

sales growth from record performance product sales and structural

cost savings offset higher maintenance impacts and project

expenses.

Specialty Products

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

Earnings/(Loss) (U.S. GAAP)

447

404

United States

851

824

304

357

Non-U.S.

661

621

751

761

Worldwide

1,512

1,445

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

447

404

United States

851

824

304

357

Non-U.S.

661

621

751

761

Worldwide

1,512

1,445

1,933

1,959

Specialty Products Sales (kt)

3,893

3,845

- Specialty Products delivered consistently strong earnings from

its portfolio of high-value products. Year-to-date earnings were

$1.5 billion, an increase of $67 million compared with the first

half of 2023. Improved finished lubes margins and structural cost

savings more than offset weaker industry basestock margins and

higher new business development expenses. Earnings also benefited

from higher volumes across the lubricants value chain, including

record first-half Mobil 1TM sales.

- Second-quarter earnings were $751 million, compared to $761

million in the first quarter. Seasonally higher expenses were

mostly offset by favorable tax impacts.

Corporate and Financing

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

(310)

(362)

Earnings/(Loss) (U.S. GAAP)

(672)

(861)

(310)

(362)

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

(672)

(861)

- Year-to-date net charges of $672 million decreased $189 million

compared to the first half of 2023 mainly due to lower financing

costs.

- Corporate and Financing second-quarter net charges of $310

million decreased $52 million versus the first quarter.

CASH FLOW FROM OPERATIONS AND ASSET

SALES EXCLUDING WORKING CAPITAL

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

9,571

8,566

Net income/(loss) including noncontrolling

interests

18,137

19,996

5,787

4,812

Depreciation and depletion (includes

impairments)

10,599

8,486

(4,616)

2,008

Changes in operational working capital,

excluding cash and debt

(2,608)

(3,885)

(182)

(722)

Other

(904)

1,127

10,560

14,664

Cash Flow from Operating Activities

(U.S. GAAP)

25,224

25,724

926

703

Proceeds from asset sales and returns of

investments

1,629

2,141

11,486

15,367

Cash Flow from Operations and Asset

Sales (non-GAAP)

26,853

27,865

4,616

(2,008)

Less: Changes in operational working

capital, excluding cash and debt

2,608

3,885

16,102

13,359

Cash Flow from Operations and Asset

Sales excluding Working Capital (non-GAAP)

29,461

31,750

(926)

(703)

Less: Proceeds associated with asset sales

and returns of investments

(1,629)

(2,141)

15,176

12,656

Cash Flow from Operations excluding

Working Capital (non-GAAP)

27,832

29,609

FREE CASH FLOW1

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

10,560

14,664

Cash Flow from Operating Activities

(U.S. GAAP)

25,224

25,724

(6,235)

(5,074)

Additions to property, plant and

equipment

(11,309)

(10,771)

(323)

(421)

Additional investments and advances

(744)

(834)

9

215

Other investing activities including

collection of advances

224

183

926

703

Proceeds from asset sales and returns of

investments

1,629

2,141

4,937

10,087

Free Cash Flow (non-GAAP)

15,024

16,443

4,616

(2,008)

Less: Changes in operational working

capital, excluding cash and debt

2,608

3,885

9,553

8,079

Free Cash Flow excluding Working

Capital (non-GAAP)

17,632

20,328

¹ Free Cash Flow definition was updated to

exclude cash acquired from mergers and acquisitions which is shown

as a separate investing line item in the statement of cash flows.

See page 10 for definition.

CALCULATION OF STRUCTURAL COST SAVINGS

Dollars in billions (unless otherwise

noted)

Twelve Months Ended December

31,

Six Months Ended June 30,

2019

2023

2023

2024

Components of Operating Costs

From ExxonMobil’s Consolidated

Statement of Income (U.S. GAAP)

Production and manufacturing expenses

36.8

36.9

18.3

18.9

Selling, general and administrative

expenses

11.4

9.9

4.8

5.1

Depreciation and depletion (includes

impairments)

19.0

20.6

8.5

10.6

Exploration expenses, including dry

holes

1.3

0.8

0.3

0.3

Non-service pension and postretirement

benefit expense

1.2

0.7

0.3

0.1

Subtotal

69.7

68.9

32.2

34.9

ExxonMobil’s share of equity company

expenses (non-GAAP)

9.1

10.5

5.0

4.7

Total Adjusted Operating Costs

(non-GAAP)

78.8

79.4

37.2

39.6

Total Adjusted Operating Costs

(non-GAAP)

78.8

79.4

37.2

39.6

Less:

Depreciation and depletion (includes

impairments)

19.0

20.6

8.5

10.6

Non-service pension and postretirement

benefit expense

1.2

0.7

0.3

0.1

Other adjustments (includes equity company

depreciation and depletion)

3.6

3.7

1.5

1.7

Total Cash Operating Expenses (Cash

Opex) (non-GAAP)

55.0

54.4

26.9

27.2

Energy and production taxes (non-GAAP)

11.0

14.9

7.5

6.8

Total Cash Operating Expenses (Cash

Opex) excluding Energy and Production Taxes (non-GAAP)

44.0

39.5

19.4

20.4

Change

vs

2019

Change

vs

2023

Estimated Cumulative vs

2019

Total Cash Operating Expenses (Cash

Opex) excluding Energy and Production Taxes (non-GAAP)

-4.5

+1.0

Market

+3.6

+0.2

Activity/Other

+1.6

+1.8

Structural Cost Savings

-9.7

-1.0

-10.7

This press release also references Structural Cost Savings,

which describes decreases in cash opex excluding energy and

production taxes as a result of operational efficiencies, workforce

reductions, divestment-related reductions, and other cost-savings

measures, that are expected to be sustainable compared to 2019

levels. Relative to 2019, estimated cumulative Structural Cost

Savings totaled $10.7 billion, which included an additional $1.0

billion in the first six months of 2024. The total change between

periods in expenses above will reflect both Structural Cost Savings

and other changes in spend, including market factors, such as

inflation and foreign exchange impacts, as well as changes in

activity levels and costs associated with new operations, mergers

and acquisitions, new business venture development, and early-stage

projects. Estimates of cumulative annual structural savings may be

revised depending on whether cost reductions realized in prior

periods are determined to be sustainable compared to 2019 levels.

Structural Cost Savings are stewarded internally to support

management's oversight of spending over time. This measure is

useful for investors to understand the Corporation's efforts to

optimize spending through disciplined expense management.

ExxonMobil will discuss financial and operating results and

other matters during a webcast at 7:30 a.m. Central Time on August

2, 2024. To listen to the event or access an archived replay,

please visit www.exxonmobil.com.

Selected Earnings Factor Definitions

Advantaged volume growth. Earnings impact from change in

volume/mix from advantaged assets, strategic projects, and

high-value products. See frequently used terms on page 11 for

definitions of advantaged assets, strategic projects, and

high-value products.

Base volume. Includes all volume/mix factors not included

in Advantaged volume growth factor defined above.

Structural cost savings. After-tax earnings effect of

Structural Cost Savings as defined on page 8, including cash

operating expenses related to divestments that were previously

included in "volume/mix" factor.

Expenses. Includes all expenses otherwise not included in

other earnings factors.

Timing effects. Timing effects are primarily related to

unsettled derivatives (mark-to-market) and other earnings impacts

driven by timing differences between the settlement of derivatives

and their offsetting physical commodity realizations (due to LIFO

inventory accounting).

Cautionary Statement

Statements related to future events; projections; descriptions

of strategic, operating, and financial plans and objectives;

statements of future ambitions, potential addressable markets, or

plans; and other statements of future events or conditions in this

release, are forward-looking statements. Similarly, discussion of

future carbon capture, transportation and storage, as well as

biofuels, hydrogen, ammonia, direct air capture, and other plans to

reduce emissions of ExxonMobil, its affiliates, and third parties,

are dependent on future market factors, such as continued

technological progress, policy support and timely rule-making and

permitting, and represent forward-looking statements. Actual future

results, including financial and operating performance; potential

earnings, cash flow, or rate of return; total capital expenditures

and mix, including allocations of capital to low carbon

investments; realization and maintenance of structural cost

reductions and efficiency gains, including the ability to offset

inflationary pressure; plans to reduce future emissions and

emissions intensity; ambitions to reach Scope 1 and Scope 2 net

zero from operated assets by 2050, to reach Scope 1 and 2 net zero

in heritage Upstream Permian Basin unconventional operated assets

by 2030 and in Pioneer Permian assets by 2035, to eliminate routine

flaring in-line with World Bank Zero Routine Flaring, to reach

near-zero methane emissions from its operated assets and other

methane initiatives, to meet ExxonMobil’s emission reduction goals

and plans, divestment and start-up plans, and associated project

plans as well as technology advances, including the timing and

outcome of projects to capture and store CO2, produce hydrogen and

ammonia, produce biofuels, produce lithium, create new advanced

carbon materials, and use plastic waste as feedstock for advanced

recycling; cash flow, dividends and shareholder returns, including

the timing and amounts of share repurchases; future debt levels and

credit ratings; business and project plans, timing, costs,

capacities and returns; resource recoveries and production rates;

and planned Pioneer and Denbury integrated benefits, could differ

materially due to a number of factors. These include global or

regional changes in the supply and demand for oil, natural gas,

petrochemicals, and feedstocks and other market factors, economic

conditions and seasonal fluctuations that impact prices and

differentials for our products; changes in law, taxes, or

regulation including environmental and tax regulations, trade

sanctions, and timely granting of governmental permits and

certifications; the development or changes in government policies

supporting lower carbon and new market investment opportunities

such as the U.S. Inflation Reduction Act or policies limiting the

attractiveness of future investment such as the additional European

taxes on the energy sector and unequal support for different

methods of emissions reduction; variable impacts of trading

activities on our margins and results each quarter; actions of

competitors and commercial counterparties; the outcome of

commercial negotiations, including final agreed terms and

conditions; the ability to access debt markets; the ultimate

impacts of public health crises, including the effects of

government responses on people and economies; reservoir

performance, including variability and timing factors applicable to

unconventional resources and the success of new unconventional

technologies; the level and outcome of exploration projects and

decisions to invest in future reserves; timely completion of

development and other construction projects; final management

approval of future projects and any changes in the scope, terms, or

costs of such projects as approved; government regulation of our

growth opportunities; war, civil unrest, attacks against the

company or industry and other political or security disturbances;

expropriations, seizure, or capacity, insurance or shipping

limitations by foreign governments or laws; opportunities for

potential acquisitions, investments or divestments and satisfaction

of applicable conditions to closing, including timely regulatory

approvals; the capture of efficiencies within and between business

lines and the ability to maintain near-term cost reductions as

ongoing efficiencies; unforeseen technical or operating

difficulties and unplanned maintenance; the development and

competitiveness of alternative energy and emission reduction

technologies; the results of research programs and the ability to

bring new technologies to commercial scale on a cost-competitive

basis; and other factors discussed under Item 1A. Risk Factors of

ExxonMobil’s 2023 Form 10-K.

Actions needed to advance ExxonMobil’s 2030 greenhouse gas

emission-reductions plans are incorporated into its medium-term

business plans, which are updated annually. The reference case for

planning beyond 2030 is based on the Company’s Global Outlook

research and publication. The Outlook is reflective of the existing

global policy environment and an assumption of increasing policy

stringency and technology improvement to 2050. Current trends for

policy stringency and deployment of lower-emission solutions are

not yet on a pathway to achieve net-zero by 2050. As such, the

Global Outlook does not project the degree of required future

policy and technology advancement and deployment for the world, or

ExxonMobil, to meet net zero by 2050. As future policies and

technology advancements emerge, they will be incorporated into the

Outlook, and the Company’s business plans will be updated

accordingly. References to projects or opportunities may not

reflect investment decisions made by the corporation or its

affiliates. Individual projects or opportunities may advance based

on a number of factors, including availability of supportive

policy, permitting, technological advancement for cost-effective

abatement, insights from the company planning process, and

alignment with our partners and other stakeholders. Capital

investment guidance in lower-emission investments is based on our

corporate plan; however, actual investment levels will be subject

to the availability of the opportunity set, public policy support,

and focused on returns.

Forward-looking and other statements regarding environmental and

other sustainability efforts and aspirations are not an indication

that these statements are material to investors or requiring

disclosure in our filing with the SEC. In addition, historical,

current, and forward-looking environmental and other

sustainability-related statements may be based on standards for

measuring progress that are still developing, internal controls and

processes that continue to evolve, and assumptions that are subject

to change in the future, including future rule-making. The release

is provided under consistent SEC disclosure requirements and should

not be misinterpreted as applying to any other disclosure

standards.

Frequently Used Terms and Non-GAAP Measures

This press release includes cash flow from operations and asset

sales (non-GAAP). Because of the regular nature of our asset

management and divestment program, the company believes it is

useful for investors to consider proceeds associated with the sales

of subsidiaries, property, plant and equipment, and sales and

returns of investments together with cash provided by operating

activities when evaluating cash available for investment in the

business and financing activities. A reconciliation to net cash

provided by operating activities for the 2023 and 2024 periods is

shown on page 7.

This press release also includes cash flow from operations

excluding working capital (non-GAAP), and cash flow from operations

and asset sales excluding working capital (non-GAAP). The company

believes it is useful for investors to consider these numbers in

comparing the underlying performance of the company's business

across periods when there are significant period-to-period

differences in the amount of changes in working capital. A

reconciliation to net cash provided by operating activities for the

2023 and 2024 periods is shown on page 7.

This press release also includes Earnings/(Loss) Excluding

Identified Items (non-GAAP), which are earnings/(loss) excluding

individually significant non-operational events with, typically, an

absolute corporate total earnings impact of at least $250 million

in a given quarter. The earnings/(loss) impact of an identified

item for an individual segment may be less than $250 million when

the item impacts several periods or several segments.

Earnings/(loss) excluding Identified Items does include

non-operational earnings events or impacts that are generally below

the $250 million threshold utilized for identified items. When the

effect of these events is significant in aggregate, it is indicated

in analysis of period results as part of quarterly earnings press

release and teleconference materials. Management uses these figures

to improve comparability of the underlying business across multiple

periods by isolating and removing significant non-operational

events from business results. The Corporation believes this view

provides investors increased transparency into business results and

trends and provides investors with a view of the business as seen

through the eyes of management. Earnings excluding Identified Items

is not meant to be viewed in isolation or as a substitute for net

income/(loss) attributable to ExxonMobil as prepared in accordance

with U.S. GAAP. A reconciliation to each of corporate earnings and

segment earnings are shown for 2024 and 2023 periods in Attachments

II-a and II-b. Earnings per share amounts are shown on page 1 and

in Attachment II-a, including a reconciliation to earnings/(loss)

per common share – assuming dilution (U.S. GAAP).

This press release also includes total taxes including

sales-based taxes. This is a broader indicator of the total tax

burden on the Corporation’s products and earnings, including

certain sales and value-added taxes imposed on and concurrent with

revenue-producing transactions with customers and collected on

behalf of governmental authorities (“sales-based taxes”). It

combines “Income taxes” and “Total other taxes and duties” with

sales-based taxes, which are reported net in the income statement.

The company believes it is useful for the Corporation and its

investors to understand the total tax burden imposed on the

Corporation’s products and earnings. A reconciliation to total

taxes is shown in Attachment I-a.

This press release also references free cash flow (non-GAAP) and

free cash flow excluding working capital (non-GAAP). Free cash flow

is the sum of net cash provided by operating activities and net

cash flow used in investing activities excluding cash acquired from

mergers and acquisitions. These measures are useful when evaluating

cash available for financing activities, including shareholder

distributions, after investment in the business. Free cash flow and

free cash flow excluding working capital are not meant to be viewed

in isolation or as a substitute for net cash provided by operating

activities. A reconciliation to net cash provided by operating

activities for the 2023 and 2024 periods is shown on page 7.

References to resources or resource base may include quantities

of oil and natural gas classified as proved reserves, as well as

quantities that are not yet classified as proved reserves, but that

are expected to be ultimately recoverable. The term “resource base”

or similar terms are not intended to correspond to SEC definitions

such as “probable” or “possible” reserves. A reconciliation of

production excluding divestments, entitlements, and government

mandates to actual production is contained in the Supplement to

this release included as Exhibit 99.2 to the Form 8-K filed the

same day as this news release.

The term “project” as used in this news release can refer to a

variety of different activities and does not necessarily have the

same meaning as in any government payment transparency reports.

Projects or plans may not reflect investment decisions made by the

company. Individual opportunities may advance based on a number of

factors, including availability of supportive policy, technology

for cost-effective abatement, and alignment with our partners and

other stakeholders. The company may refer to these opportunities as

projects in external disclosures at various stages throughout their

progression.

Advantaged assets (Advantaged growth projects) includes Permian

(heritage Permian and Pioneer), Guyana, Brazil and LNG.

Base portfolio (Base) in our Upstream segment, refers to assets

(or volumes) other than advantaged assets (or volumes from

advantaged assets). In our Energy Products segment, refers to

assets (or volumes) other than strategic projects (or volumes from

strategic projects). In our Chemical Products and Specialty

Products segments refers to volumes other than high value products

volumes.

Debt-to-capital ratio is total debt divided by the sum of total

debt and equity. Total debt is the sum of notes and loans payable

and long-term debt, as reported in the consolidated balance

sheet.

Government mandates (curtailments) are changes to ExxonMobil’s

sustainable production levels as a result of production limits or

sanctions imposed by governments.

Heritage Permian: Permian basin assets excluding assets acquired

as part of the acquisition of Pioneer Natural Resources that closed

May 3, 2024.

High-value products includes performance products and

lower-emission fuels.

Lower-emission fuels are fuels with lower life cycle emissions

than conventional transportation fuels for gasoline, diesel and jet

transport.

Net-debt-to-capital ratio is net debt divided by the sum of net

debt and total equity, where net debt is total debt net of cash and

cash equivalents, excluding restricted cash. Total debt is the sum

of notes and loans payable and long-term debt, as reported in the

consolidated balance sheet.

Performance products (performance chemicals, performance

lubricants) refers to products that provide differentiated

performance for multiple applications through enhanced properties

versus commodity alternatives and bring significant additional

value to customers and end-users.

Strategic projects includes (i) the following completed

projects: Rotterdam Hydrocracker, Corpus Christi Chemical Complex,

Baton Rouge Polypropylene, Beaumont Crude Expansion, Baytown

Chemical Expansion, Permian Crude Venture, and the 2022 Baytown

advanced recycling facility; and (ii) the following projects still

to be completed: Fawley Hydrofiner, China Chemical Complex,

Singapore Resid Upgrade, Strathcona Renewable Diesel, ProxximaTM

Venture, USGC Reconfiguration, additional advanced recycling

projects under evaluation worldwide, and additional projects in

plan yet to be publicly announced.

This press release also references Structural Cost Savings, for

more details see page 8.

Reference to Earnings

References to corporate earnings mean net income attributable to

ExxonMobil (U.S. GAAP) from the consolidated income statement.

Unless otherwise indicated, references to earnings, Upstream,

Energy Products, Chemical Products, Specialty Products and

Corporate and Financing earnings, and earnings per share are

ExxonMobil’s share after excluding amounts attributable to

noncontrolling interests.

Exxon Mobil Corporation has numerous affiliates, many with names

that include ExxonMobil, Exxon, Mobil, Esso, and XTO. For

convenience and simplicity, those terms and terms such as

Corporation, company, our, we, and its are sometimes used as

abbreviated references to specific affiliates or affiliate groups.

Similarly, ExxonMobil has business relationships with thousands of

customers, suppliers, governments, and others. For convenience and

simplicity, words such as venture, joint venture, partnership,

co-venturer, and partner are used to indicate business and other

relationships involving common activities and interests, and those

words may not indicate precise legal relationships. ExxonMobil's

ambitions, plans and goals do not guarantee any action or future

performance by its affiliates or Exxon Mobil Corporation's

responsibility for those affiliates' actions and future

performance, each affiliate of which manages its own affairs.

Throughout this press release, both Exhibit 99.1 as well as

Exhibit 99.2, due to rounding, numbers presented may not add up

precisely to the totals indicated.

ATTACHMENT I-a

CONDENSED CONSOLIDATED STATEMENT OF

INCOME

(Preliminary)

Dollars in millions (unless otherwise

noted)

Three Months Ended June 30,

Six Months Ended June 30,

2024

2023

2024

2023

Revenues and other income

Sales and other operating revenue

89,986

80,795

170,397

164,439

Income from equity affiliates

1,744

1,382

3,586

3,763

Other income

1,330

737

2,160

1,276

Total revenues and other income

93,060

82,914

176,143

169,478

Costs and other deductions

Crude oil and product purchases

54,199

47,598

101,800

93,601

Production and manufacturing expenses

9,804

8,860

18,895

18,296

Selling, general and administrative

expenses

2,568

2,449

5,063

4,839

Depreciation and depletion (includes

impairments)

5,787

4,242

10,599

8,486

Exploration expenses, including dry

holes

153

133

301

274

Non-service pension and postretirement

benefit expense

34

164

57

331

Interest expense

271

249

492

408

Other taxes and duties

6,579

7,563

12,902

14,784

Total costs and other

deductions

79,395

71,258

150,109

141,019

Income/(Loss) before income

taxes

13,665

11,656

26,034

28,459

Income tax expense/(benefit)

4,094

3,503

7,897

8,463

Net income/(loss) including

noncontrolling interests

9,571

8,153

18,137

19,996

Net income/(loss) attributable to

noncontrolling interests

331

273

677

686

Net income/(loss) attributable to

ExxonMobil

9,240

7,880

17,460

19,310

OTHER FINANCIAL DATA

Dollars in millions (unless otherwise

noted)

Three Months Ended June 30,

Six Months Ended June 30,

2024

2023

2024

2023

Earnings per common share (U.S.

dollars)

2.14

1.94

4.20

4.73

Earnings per common share - assuming

dilution (U.S. dollars)

2.14

1.94

4.20

4.73

Dividends on common stock

Total

4,285

3,701

8,093

7,439

Per common share (U.S. dollars)

0.95

0.91

1.90

1.82

Millions of common shares

outstanding

Average - assuming dilution¹

4,317

4,066

4,158

4,084

Taxes

Income taxes

4,094

3,503

7,897

8,463

Total other taxes and duties

7,531

8,328

14,691

16,423

Total taxes

11,625

11,831

22,588

24,886

Sales-based taxes

6,339

6,281

11,888

12,313

Total taxes including sales-based

taxes

17,964

18,112

34,476

37,199

ExxonMobil share of income taxes of equity

companies (non-GAAP)

907

498

1,905

1,733

1 Includes restricted shares not vested as

well as 545 million shares issued for the Pioneer merger on May 3,

2024.

ATTACHMENT I-b

CONDENSED CONSOLIDATED BALANCE

SHEET

(Preliminary)

Dollars in millions (unless otherwise

noted)

June 30, 2024

December 31, 2023

ASSETS

Current assets

Cash and cash equivalents

26,460

31,539

Cash and cash equivalents – restricted

28

29

Notes and accounts receivable – net

43,071

38,015

Inventories

Crude oil, products and merchandise

19,685

20,528

Materials and supplies

4,818

4,592

Other current assets

2,176

1,906

Total current assets

96,238

96,609

Investments, advances and long-term

receivables

47,948

47,630

Property, plant and equipment – net

298,283

214,940

Other assets, including intangibles –

net

18,238

17,138

Total Assets

460,707

376,317

LIABILITIES

Current liabilities

Notes and loans payable

6,621

4,090

Accounts payable and accrued

liabilities

60,107

58,037

Income taxes payable

4,035

3,189

Total current liabilities

70,763

65,316

Long-term debt

36,565

37,483

Postretirement benefits reserves

10,398

10,496

Deferred income tax liabilities

40,080

24,452

Long-term obligations to equity

companies

1,612

1,804

Other long-term obligations

25,023

24,228

Total Liabilities

184,441

163,779

EQUITY

Common stock without par value

(9,000 million shares authorized, 8,019

million shares issued)

46,781

17,781

Earnings reinvested

463,294

453,927

Accumulated other comprehensive income

(13,187)

(11,989)

Common stock held in treasury

(3,576 million shares at June 30, 2024,

and 4,048 million shares at December 31, 2023)

(228,483)

(254,917)

ExxonMobil share of equity

268,405

204,802

Noncontrolling interests

7,861

7,736

Total Equity

276,266

212,538

Total Liabilities and Equity

460,707

376,317

.

ATTACHMENT I-c

CONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS

(Preliminary)

Dollars in millions (unless otherwise

noted)

Six Months Ended June 30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES

Net income/(loss) including noncontrolling

interests

18,137

19,996

Depreciation and depletion (includes

impairments)

10,599

8,486

Changes in operational working capital,

excluding cash and debt

(2,608)

(3,885)

All other items – net

(904)

1,127

Net cash provided by operating

activities

25,224

25,724

CASH FLOWS FROM INVESTING

ACTIVITIES

Additions to property, plant and

equipment

(11,309)

(10,771)

Proceeds from asset sales and returns of

investments

1,629

2,141

Additional investments and advances

(744)

(834)

Other investing activities including

collection of advances

224

183

Cash acquired from mergers and

acquisitions

754

—

Net cash used in investing

activities

(9,446)

(9,281)

CASH FLOWS FROM FINANCING

ACTIVITIES

Additions to long-term debt

217

136

Reductions in long-term debt

(1,142)

(6)

Reductions in short-term debt

(2,771)

(172)

Additions/(Reductions) in debt with three

months or less maturity

(6)

(172)

Contingent consideration payments

(27)

(68)

Cash dividends to ExxonMobil

shareholders

(8,093)

(7,439)

Cash dividends to noncontrolling

interests

(397)

(293)

Changes in noncontrolling interests

16

11

Common stock acquired

(8,337)

(8,680)

Net cash provided by (used in)

financing activities

(20,540)

(16,683)

Effects of exchange rate changes on

cash

(318)

132

Increase/(Decrease) in cash and cash

equivalents

(5,080)

(108)

Cash and cash equivalents at beginning of

period

31,568

29,665

Cash and cash equivalents at end of

period

26,488

29,557

Non-Cash Transaction: The

Corporation acquired Pioneer Natural Resources in an all-stock

transaction on May 3, 2024, having issued 545 million shares of

ExxonMobil common stock having a fair value of $63 billion and

assumed debt with a fair value of $5 billion.

.

ATTACHMENT II-a

KEY FIGURES: IDENTIFIED ITEMS

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

9,240

8,220

Earnings/(Loss) (U.S. GAAP)

17,460

19,310

Identified Items

—

—

Tax-related items

—

(182)

—

—

Total Identified Items

—

(182)

9,240

8,220

Earnings/(Loss) Excluding Identified

Items (non-GAAP)

17,460

19,492

2Q24

1Q24

Dollars per common share

YTD 2024

YTD 2023

2.14

2.06

Earnings/(Loss) Per Common Share (U.S.

GAAP) ¹

4.20

4.73

Identified Items Per Common Share

¹

—

—

Tax-related items

—

(0.04)

—

—

Total Identified Items Per Common Share

¹

—

(0.04)

2.14

2.06

Earnings/(Loss) Excl. Identified Items

Per Common Share (non-GAAP) ¹

4.20

4.77

¹ Assuming dilution.

ATTACHMENT II-b

KEY FIGURES: IDENTIFIED ITEMS BY

SEGMENT

Second Quarter 2024

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate &

Financing

Total

Dollars in millions (unless otherwise

noted)

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

2,430

4,644

450

496

526

253

447

304

(310)

9,240

Total Identified Items

—

—

—

—

—

—

—

—

—

—

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

2,430

4,644

450

496

526

253

447

304

(310)

9,240

First Quarter 2024

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate &

Financing

Total

Dollars in millions (unless otherwise

noted)

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

1,054

4,606

836

540

504

281

404

357

(362)

8,220

Total Identified Items

—

—

—

—

—

—

—

—

—

—

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

1,054

4,606

836

540

504

281

404

357

(362)

8,220

YTD 2024

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate &

Financing

Total

Dollars in millions (unless otherwise

noted)

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

3,484

9,250

1,286

1,036

1,030

534

851

661

(672)

17,460

Total Identified Items

—

—

—

—

—

—

—

—

—

—

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

3,484

9,250

1,286

1,036

1,030

534

851

661

(672)

17,460

YTD 2023

Upstream

Energy Products

Chemical Products

Specialty Products

Corporate &

Financing

Total

Dollars in millions (unless otherwise

noted)

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

U.S.

Non-U.S.

Earnings/(Loss) (U.S. GAAP)

2,552

8,482

3,438

3,055

810

389

824

621

(861)

19,310

Identified Items

Tax-related items

—

(170)

—

(12)

—

—

—

—

—

(182)

Total Identified Items

—

(170)

—

(12)

—

—

—

—

—

(182)

Earnings/(Loss) Excl. Identified Items

(non-GAAP)

2,552

8,652

3,438

3,067

810

389

824

621

(861)

19,492

ATTACHMENT III

KEY FIGURES: UPSTREAM VOLUMES

2Q24

1Q24

Net production of crude oil, natural gas

liquids, bitumen and synthetic oil, thousand barrels per day

(kbd)

YTD 2024

YTD 2023

1,261

816

United States

1,038

802

760

772

Canada/Other Americas

767

645

4

4

Europe

4

4

215

224

Africa

220

213

714

711

Asia

712

725

30

30

Australia/Oceania

30

35

2,984

2,557

Worldwide

2,771

2,424

2Q24

1Q24

Net natural gas production available for

sale, million cubic feet per day (mcfd)

YTD 2024

YTD 2023

2,900

2,241

United States

2,570

2,357

114

94

Canada/Other Americas

104

94

331

377

Europe

354

461

167

150

Africa

158

110

3,486

3,274

Asia

3,380

3,473

1,245

1,226

Australia/Oceania

1,236

1,276

8,243

7,362

Worldwide

7,802

7,771

4,358

3,784

Oil-equivalent production (koebd)¹

4,071

3,719

1 Natural gas is converted to an

oil-equivalent basis at six million cubic feet per one thousand

barrels.

ATTACHMENT IV

KEY FIGURES: MANUFACTURING THROUGHPUT

AND SALES

2Q24

1Q24

Refinery throughput, thousand barrels per

day (kbd)

YTD 2024

YTD 2023

1,746

1,900

United States

1,823

1,794

387

407

Canada

397

403

987

954

Europe

970

1,199

446

402

Asia Pacific

424

514

174

180

Other

177

176

3,740

3,843

Worldwide

3,791

4,086

2Q24

1Q24

Energy Products sales, thousand barrels

per day (kbd)

YTD 2024

YTD 2023

2,639

2,576

United States

2,607

2,601

2,681

2,656

Non-U.S.

2,669

2,867

5,320

5,232

Worldwide

5,276

5,469

2,243

2,178

Gasolines, naphthas

2,210

2,290

1,718

1,742

Heating oils, kerosene, diesel

1,730

1,806

344

339

Aviation fuels

342

328

181

214

Heavy fuels

197

221

834

759

Other energy products

797

823

5,320

5,232

Worldwide

5,276

5,469

2Q24

1Q24

Chemical Products sales, thousand metric

tons (kt)

YTD 2024

YTD 2023

1,802

1,847

United States

3,649

3,286

3,071

3,207

Non-U.S.

6,278

6,212

4,873

5,054

Worldwide

9,927

9,498

2Q24

1Q24

Specialty Products sales, thousand metric

tons (kt)

YTD 2024

YTD 2023

506

495

United States

1,001

991

1,428

1,464

Non-U.S.

2,892

2,855

1,933

1,959

Worldwide

3,893

3,845

ATTACHMENT V

KEY FIGURES: CAPITAL AND EXPLORATION

EXPENDITURES

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

Upstream

2,773

2,269

United States

5,042

4,314

2,974

2,313

Non-U.S.

5,287

4,876

5,747

4,582

Total

10,329

9,190

Energy Products

185

179

United States

364

707

367

348

Non-U.S.

715

709

552

527

Total

1,079

1,416

Chemical Products

157

152

United States

309

437

345

281

Non-U.S.

626

1,053

502

433

Total

935

1,490

Specialty Products

21

8

United States

29

25

73

68

Non-U.S.

141

169

94

76

Total

170

194

Other

144

221

Other

365

256

7,039

5,839

Worldwide

12,878

12,546

CASH CAPITAL EXPENDITURES

2Q24

1Q24

Dollars in millions (unless otherwise

noted)

YTD 2024

YTD 2023

6,235

5,074

Additions to property, plant and

equipment

11,309

10,771

314

206

Net investments and advances

520

651

6,549

5,280

Total Cash Capital Expenditures

11,829

11,422

ATTACHMENT VI

KEY FIGURES: EARNINGS/(LOSS)

Results Summary

2Q24

1Q24

Change vs 1Q24

Dollars in millions (except per share

data)

YTD 2024

YTD 2023

Change vs YTD 2023

9,240

8,220

+1,020

Earnings (U.S. GAAP)

17,460

19,310

-1,850

9,240

8,220

+1,020

Earnings Excluding Identified Items

(non-GAAP)

17,460

19,492

-2,032

2.14

2.06

+0.08

Earnings Per Common Share ¹

4.20

4.73

-0.53

2.14

2.06

+0.08

Earnings Excl. Identified Items per Common

Share (non-GAAP) ¹

4.20

4.77

-0.57

7,039

5,839

+1,200

Capital and Exploration Expenditures

12,878

12,546

+332

¹ Assuming dilution.

ATTACHMENT VII

KEY FIGURES: EARNINGS/(LOSS) BY

QUARTER

Dollars in millions (unless otherwise

noted)

2024

2023

2022

2021

2020

First Quarter

8,220

11,430

5,480

2,730

(610)

Second Quarter

9,240

7,880

17,850

4,690

(1,080)

Third Quarter

—

9,070

19,660

6,750

(680)

Fourth Quarter

—

7,630

12,750

8,870

(20,070)

Full Year

—

36,010

55,740

23,040

(22,440)

Dollars per common share¹

2024

2023

2022

2021

2020

First Quarter

2.06

2.79

1.28

0.64

(0.14)

Second Quarter

2.14

1.94

4.21

1.10

(0.26)

Third Quarter

—

2.25

4.68

1.57

(0.15)

Fourth Quarter

—

1.91

3.09

2.08

(4.70)

Full Year

—

8.89

13.26

5.39

(5.25)

1 Computed using the average number of

shares outstanding during each period; assuming dilution.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240802738079/en/

Media Relations 737-272-1452

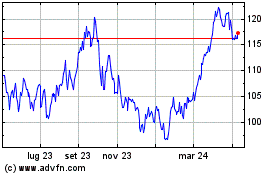

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Nov 2024 a Dic 2024

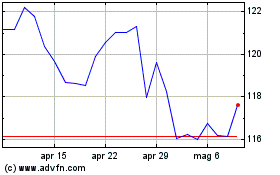

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Dic 2023 a Dic 2024