Bayer Weighs Structural Changes But Rules Out Three-Way Split -- 2nd Update

08 Novembre 2023 - 9:40AM

Dow Jones News

By Mauro Orru

Bayer Chief Executive Bill Anderson said he is looking at

options to overhaul the company's structure and remove multiple

layers of management in a move that will result in significant job

cuts, but ruled out splitting the group into three businesses.

Anderson, who took the helm of the German pharmaceutical and

agricultural conglomerate from Werner Baumann in June, said he had

engaged a team of advisors to look at various structural options,

including the separation of either its crop science or consumer

health divisions.

Bayer is one of few remaining groups housing pharmaceutical and

consumer-health assets under the same roof. Last month, French drug

giant Sanofi set out plans to spin off its consumer-health

business, the latest company to hive off a division selling

over-the-counter medicines and other retail products to focus on

more commercially lucrative but scientifically riskier prescription

drugs following similar moves by Johnson & Johnson, Pfizer and

GSK.

"We considered simultaneously splitting the company into three

businesses. We're ruling that option out," Anderson said. "A

three-way split would require a two-step process."

Shareholders such as Bluebell Capital Partners had been calling

for Bayer to split into three businesses--crop science, consumer

health and pharmaceuticals--saying the divisions had nothing to do

with each other.

Bayer plans to cut into several layers of management by the end

of next year to streamline operations. "We are redesigning Bayer to

focus only on what's essential for our mission -- and getting rid

of everything else," Anderson said.

Bayer's three divisions reported lower sales and earnings for

the third quarter, particularly at its agricultural division, which

booked impairment losses due to high interest rates. The company

has also been grappling with lower prices for glyphosate, the

active ingredient found in herbicides and other weed-control

products, a development that in July forced the group to slash its

overall sales and earnings guidance for the year.

Bayer on Wednesday posted a net loss of 4.57 billion euros

($4.89 billion) for the three months to the end of September

compared with profit of EUR546 million in last year's third

quarter.

Earnings before interest, taxes, depreciation, amortization and

special items--a profitability metric that is closely watched by

analysts and investors--plunged 31% to EUR1.69 billion. Core

earnings per share--another key profitability indicator--slumped to

EUR0.38 from EUR1.13.

Sales fell 8.3% to EUR10.34 billion. Bayer's agricultural

business, crop science, recorded a 7% contraction in sales to

EUR4.37 billion. Sales at its pharmaceuticals division fell 8.4% to

EUR4.54 billion, while the consumer health business contributed

EUR1.41 billion in sales, down 8.9% on year.

Analysts had forecast a net profit of EUR33 million, Ebitda

before special items of EUR1.73 billion, core EPS of EUR0.73 and

sales of EUR10.44 billion, according to a Vara Research

consensus.

Bayer continues to expect Ebitda before special items between

EUR11.3 billion and EUR11.8 billion for the full year, core EPS of

EUR6.20 to EUR6.40, and sales between EUR48.5 billion and EUR49.5

billion, all on a currency-adjusted basis based on the average

monthly exchange rates in 2022. It expects soft growth and

persisting challenges next year.

"We're not happy with this year's performance. Nearly EUR50

billion in revenue but zero cash flow is simply not acceptable,"

Anderson said.

Write to Mauro Orru at mauro.orru@wsj.com

(END) Dow Jones Newswires

November 08, 2023 03:25 ET (08:25 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

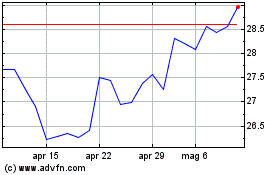

Grafico Azioni Bayer (TG:BAYN)

Storico

Da Mar 2024 a Apr 2024

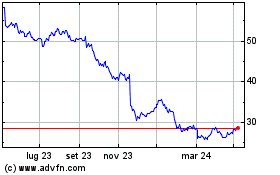

Grafico Azioni Bayer (TG:BAYN)

Storico

Da Apr 2023 a Apr 2024