Deutsche Bank Subsidiary DWS to Pay $25 Million for ESG Misstatements, Anti-Money Laundering Violations

25 Settembre 2023 - 3:54PM

Dow Jones News

By Ben Glickman

Deutsche Bank subsidiary DWS Investment Management Americas will

pay $25 million to settle two charges by the Securities and

Exchange Commission.

The SEC said Monday that DWS failed to develop a mutual fund

anti-money laundering program and made misstatements regarding its

environmental, social and governance investment process.

The company will pay $19 million for the ESG misstatements and

$6 million for the anti-mutual fund violation. DWS didn't admit or

deny the SEC's findings in its settlements.

The SEC found that DWS made misleading statements about how it

was using ESG factors in research and investment recommendations.

The company allegedly failed to use policies and procedures to

guarantee that its statements about ESG offerings were

accurate.

The SEC also alleged that the company caused mutual funds it

advised to not implement a legally-required program to prevent

money laundering.

Write to Ben Glickman at ben.glickman@wsj.com

(END) Dow Jones Newswires

September 25, 2023 09:39 ET (13:39 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

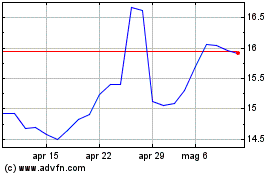

Grafico Azioni Deutsche Bank (TG:DBK)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Deutsche Bank (TG:DBK)

Storico

Da Apr 2023 a Apr 2024