Barrick Reports Fourth Quarter and Full Year 2013 Results

TORONTO, ONTARIO--(Marketwired - Feb 13, 2014) - Barrick Gold

Corporation (NYSE:ABX)(TSX:ABX) (Barrick or the company) today

reported a fourth quarter net loss of $2.83 billion ($2.61 per

share), including after-tax impairment charges of $2.82 billion.

Adjusted net earnings were $0.41 billion ($0.37 per share).

Operating cash flow was $1.02 billion and adjusted operating cash

flow was $1.09 billion.

For the full year 2013, Barrick reported a net loss of $10.37

billion ($10.14 per share), including after-tax impairment charges

of $11.54 billion. Adjusted net earnings were $2.57 billion ($2.51

per share). Operating cash flow of $4.24 billion and adjusted

operating cash flow of $4.36 billion reflect the underlying

strength of the company's high-quality mining operations.

| OPERATING HIGHLIGHTS AND GUIDANCE |

|

|

2013 Actuals |

|

|

Gold |

Fourth Quarter |

Full Year |

2014 Guidance |

|

Production (000s of ounces) |

1,713 |

7,166 |

6,000-6,500 |

|

All-in sustaining costs ($ per ounce) |

899 |

915 |

920-980 |

|

|

|

|

|

Copper |

|

|

|

|

Production (millions of pounds) |

139 |

539 |

470-500 |

| C1

cash costs ($ per pound) |

1.81 |

1.92 |

1.90-2.10 |

|

|

|

|

|

|

TOTAL CAPITAL EXPENDITURES ($ millions) |

1,294 |

5,000 |

2,400-2,700 |

"The disciplined capital allocation framework that we adopted in

mid-2012 has been at the core of every decision we've made in the

last year and half, and has put us in a much stronger position to

deal with the challenging gold price environment our industry is

facing today. Under a comprehensive plan to strengthen the company,

we have become a leaner, more agile organization, better protected

against further downside price risk and well positioned to take

advantage of attractive investment opportunities going forward,"

said Jamie Sokalsky, Barrick's President and CEO. "We have

increased our focus on free cash flow and risk-adjusted returns,

and successfully executed on our key priorities, which include

operational excellence, a stronger balance sheet and the ongoing

optimization of our asset portfolio. This required decisive action,

including the temporary suspension of Pascua-Lama, and an even

greater focus on generating higher returns even if that means

producing fewer ounces. These were the right decisions for our

shareholders and for the company, and we are now seeing the

tangible benefits of our efforts."

Operational Excellence is a Top Priority

- Met improved gold and copper operating guidance for 2013

- Maintained the lowest all-in sustaining costs (AISC)(1) of our

peer group in 2013 and expect to retain this position in 2014

- Significantly improved Lumwana's performance in 2013 and expect

to reduce costs further in 2014

- Five core mines met expectations in 2013, producing about 4.0

million ounces or 55 percent of total production at AISC of $668

per ounce; these mines are expected to produce about 60 percent of

total production in 2014 at AISC of $750-$800 per ounce

- Implemented a flatter, more streamlined organizational model

that supports operational excellence; appointed Jim Gowans as Chief

Operating Officer in December 2013, an experienced executive who

brings four decades of global mining operations experience to

Barrick

- Reduced 2013 general and administrative costs

- Targeting $500 million in annual cost savings from the new

operating model, reduced procurement costs and other

initiatives

Strengthened Balance Sheet and Financial

Flexibility

- Termed out $3.0 billion in debt in the second quarter of

2013

- Reduced 2013 capital and operating costs by about $2.0

billion

- Improved near-term cash flow through temporary suspension of

Pascua-Lama

- Raised $3.0 billion in a bought equity deal in the fourth

quarter of 2013 to repay debt, reducing maturities over the next

four years to $1.0 billion

Continued Progress on Portfolio Optimization

- In the last six months, announced agreements to divest Barrick

Energy, six high-cost, non-core mines and other assets for a total

consideration of almost $1.0 billion

- Completed mine plans and reserve estimates using a conservative

gold price assumption of $1,100 per ounce in order to prioritize

profitable production and returns, while retaining the option to

access the metal in the future when prices and returns improve

"2013 was a tough year for Barrick by any measure, but with a

renewed focus on capital discipline and operational excellence

across the board, we have reset our focus and revitalized the

company's prospects," Mr. Sokalsky said. "We will not veer from

this course, which has delivered solid results, reduced costs and

improved financial flexibility."

FINANCIAL DISCUSSION

Fourth quarter 2013 adjusted net earnings were $0.41 billion

($0.37 per share)(1) compared to $1.16 billion ($1.16 per share) in

the prior-year period. The decrease reflects lower realized gold

and copper prices and a decline in gold and copper sales volumes.

The net loss for the fourth quarter was $2.83 billion ($2.61 per

share) compared to a net loss of $3.01 billion ($3.01 per share) in

the prior-year quarter. Significant adjusting items for the quarter

include:

- $2.82 billion in impairment charges, primarily related to

Pascua-Lama, Porgera, Veladero and the Australia Pacific gold

segment; and

- $176 million in suspension-related costs at Pascua-Lama.

The company recorded an impairment charge for the Pascua-Lama

project of $896 million(2) due to the decision to temporarily

suspend construction in the fourth quarter. At the Porgera mine,

the company recorded an impairment charge of $595 million based on

changes to the mine plan to focus primarily on higher grade

underground ore. As a result, Porgera's estimated mine life has

decreased from 13 years to nine years. Lower gold price assumptions

and the impact of sustained inflationary pressures on operating and

capital costs led to a reduction of reserves and life-of-mine

production at the Veladero mine in Argentina, resulting in an

impairment charge of $300 million. At Jabal Sayid, the annual

update to the life-of-mine plan showed a decrease in net present

value. In addition, the project's fair value was impacted by a

delay in first production. As a result, the company recorded an

impairment charge of $303 million. As part of its annual goodwill

impairment test, the company recognized a goodwill impairment

charge of $551 million for its Australia Pacific gold segment,

primarily related to the lower estimated fair value of Porgera.

Fourth quarter operating cash flow of $1.02 billion compares to

$1.85 billion in the prior-year period. The decline reflects lower

realized gold and copper prices and increased income tax payments.

Adjusted operating cash flow of $1.09 billion(3) compares to $1.93

billion in the prior-year period and removes the impact of foreign

currency and commodity derivative contract settlements.

RESERVES AND RESOURCES

Barrick calculated its reserves for 2013 using a conservative

gold price assumption of $1,100 per ounce, compared to $1,500 per

ounce in 2012. While this is well below the company's outlook for

the gold price and below current spot prices, it reflects Barrick's

focus on producing profitable ounces with a solid rate of return

and the ability to generate free cash flow. Gold reserves declined

to 104.1 million ounces(4) at the end of 2013 from 140.2 million

ounces at the end of 2012. Excluding ounces mined and processed in

2013 and divestitures, all of these ounces have transferred to

resources, preserving the option to access them in the future at

higher gold prices.

The 26 percent decline in reserves breaks down as follows

(approximations):

|

Percentage |

|

|

13 |

-

conservative gold price assumption of $1,100 per ounce |

|

6 |

-

ounces mined and processed in 2013 |

|

4 |

-

ounces that are economic at $1,100 per ounce, but do not meet

hurdle rates of return on invested capital |

|

2 |

-

ounces no longer economic due to increased costs |

|

2 |

-

divestitures of non-core, high-cost mines as part of the company's

portfolio optimization strategy |

|

(1) |

-

additions |

Measured and indicated gold resources increased to 99.4 million

ounces at the end of 2013 from 83.0 million ounces at the end of

2012. Resources were calculated based on a gold price assumption of

$1,500 per ounce compared to $1,650 per ounce for 2012. Inferred

gold resources decreased to 31.9 million ounces at the end of 2013

from 35.6 million ounces at the end of 2012.

Copper reserves increased slightly to 14.0 billion pounds based

on a copper price assumption of $3.00 per pound. Measured and

indicated copper resources decreased to 6.9 billion pounds from

10.3 billion pounds at the end of 2012 based on a copper price

assumption of $3.50 per pound, primarily as a result of further

optimization of the Lumwana mine plan. Inferred copper resources

decreased to 0.2 billion pounds from 0.5 billion pounds at the end

of 2012.

2014 OUTLOOK

Barrick's 2014 gold cost guidance is the lowest among senior

producers, with AISC expected to be $920-$980 per ounce and

adjusted operating costs projected to be $590-$640 per ounce.

The company anticipates 2014 gold production of 6.0-6.5 million

ounces. Lower production in 2014 reflects the company's strategy to

maximize free cash flow and returns over ounces, the divestment of

high-cost, short-life mines, lower production from Cortez, and the

decision to close Pierina. These declines will be partially offset

by an increase in production at Pueblo Viejo.

Detailed 2014 operating guidance, based on the company's new

operating model, and capital expenditure guidance is as

follows:

| GOLD PRODUCTION AND COSTS |

|

|

Production (millions of ounces) |

AISC ($ per ounce) |

Adj. Operating Costs ($ per ounce) |

|

Cortez |

0.925-0.975 |

750-780 |

350-380 |

|

Goldstrike |

0.865-0.915 |

920-950 |

600-640 |

|

Pueblo Viejo |

0.600-0.700 |

510-610 |

385-445 |

|

Lagunas Norte |

0.570-0.610 |

640-680 |

390-430 |

|

Veladero |

0.650-0.700 |

940-990 |

620-670 |

|

Sub-total |

3.800-4.000 |

750-800 |

450-500 |

| North

America - Other |

0.795-0.845 |

1,075-1,100 |

780-805 |

|

Australia Pacific |

1.000-1.080 |

1,050-1,100 |

825-875 |

|

African Barrick Gold |

0.480-0.510 |

1,100-1,175 |

740-790 |

|

Total Gold |

6.000-6.500(5) |

920-980 |

590-640 |

|

|

|

| COPPER PRODUCTION AND COSTS |

|

|

Production (millions of pounds) |

C1 cash costs(6) ($ per pound) |

C3 fully allocated costs(6) ($ per pound) |

|

Total Copper |

470-500 |

1.90-2.10 |

2.50-2.75 |

|

|

|

|

| CAPITAL EXPENDITURES |

|

|

($ millions) |

|

| Mine

site sustaining |

2,000-2,200 |

|

| Mine

site expansion |

300-375 |

|

|

Projects |

100-125 |

|

|

Total |

2,400-2,700 |

|

Total capital expenditures are expected to decrease by

approximately 50 percent in 2014 to $2.40-$2.70 billion, a

reduction of approximately $2.5 billion compared to 2013. The lower

expenditures reflect the temporary suspension of construction at

Pascua-Lama and lower mine site sustaining and expansion capital

requirements. The 2014 exploration budget of $200-$240 million(7)

remains focused on high quality, priority projects. About 50

percent of the budget is allocated to Nevada, the majority of which

is targeted for the Goldrush project, where measured and indicated

resources increased by 1.6 million ounces to 10.0 million ounces at

the end of 2013. Inferred resources at Goldrush were 5.6 million

ounces at the end of 2013.

The company anticipates higher finance costs of $800-$825

million in 2014 as a result of the decision to temporarily suspend

Pascua-Lama, where interest will no longer be capitalized.

Barrick's effective income tax rate in 2014 is expected to be

about 50 percent based on an average gold price of $1,300 per

ounce. Please refer to the Management Discussion and Analysis for a

full description of factors impacting the company's 2014 income tax

rate.

PASCUA-LAMA UPDATE

During the fourth quarter of 2013, Barrick announced the

temporary suspension of construction at its Pascua-Lama project,

except for those activities required for environmental and

regulatory compliance. The ramp-down is on schedule for completion

by mid-2014. The company expects to incur costs of about $300

million(8) this year for the ramp-down and environmental and social

obligations. A decision to restart development will depend on

improved economics and reduced uncertainty related to legal and

regulatory requirements. Remaining development will take place in

distinct stages with specific work programs and budgets. This

approach will facilitate more efficient planning and execution and

improved cost control. In the interim, Barrick will explore

opportunities to improve the project's risk-adjusted returns,

including strategic partnerships or royalty and other income

streaming agreements. The company will preserve the option to

resume development of this asset, which has a mine life of 25

years.

CORPORATE GOVERNANCE AND EXECUTIVE COMPENSATION

In December, 2013, Barrick announced that its Founder and

Chairman, Peter Munk, would retire as Chairman and step down from

the Board of Directors at the company's 2014 Annual General Meeting

(AGM). John Thornton, currently Co-Chairman, will become Chairman

following the 2014 AGM.

In addition, Howard Beck and Brian Mulroney will not stand for

re-election as Directors at the 2014 AGM. The Board has nominated

four new Independent Directors to stand for election at the

company's upcoming AGM: Ned Goodman, Nancy Lockhart, David Naylor

and Ernie Thrasher.

Barrick also announced it will implement a new executive

compensation plan in 2014 that is fully aligned with the principle

of pay-for-performance, and further links compensation with the

long-term interests of shareholders. The company has consulted

extensively with shareholders in the development of this plan and

continues to do so. Details will be announced in the management

proxy circular prior to the AGM.

OPERATING RESULTS DISCUSSION

Cortez

The Cortez mine produced 0.24 million ounces at AISC of $498 per

ounce in the fourth quarter. Even with lower production anticipated

in 2014, Cortez remains one of the largest and most attractive gold

assets in the world, and a cornerstone operation for Barrick. As

anticipated in the mine plan, production this year is expected to

be 0.925-0.975 million ounces, primarily due to a decrease in ore

grades. AISC are expected to increase to $750-$780 per ounce in

2014 as a result of lower production and higher sustaining capital

related to waste stripping for the Cortez Hills open pit.

Goldstrike

In the fourth quarter, Goldstrike produced 0.24 million ounces

at AISC of $770 per ounce. The autoclave facility is undergoing

modifications that will enable Goldstrike to bring forward about

4.0 million ounces of production. The total construction cost for

this project is $585 million. Expansion capital expenditures

related to the project are expected to be $245 million in 2014.

First production from the modified autoclaves is anticipated in the

fourth quarter of 2014. The modified autoclaves are expected to

contribute about 0.350-0.450 million ounces of annual production in

their first full five years of operation. Goldstrike is expected to

produce 0.865-0.915 million ounces in 2014 at AISC of $920-$950 per

ounce. Production is anticipated to increase to above 1.0 million

ounces in 2015 with a full year of operations from the modified

autoclaves(9).

Pueblo Viejo

Barrick's 60 percent share of production from Pueblo Viejo in

the fourth quarter was 0.16 million ounces at AISC of $720 per

ounce. The mine is expected to reach full capacity in the first

half of 2014 following completion of modifications to the lime

circuit. Barrick's share of production in 2014 is expected to be

0.600-0.700 million ounces at AISC of $510-$610 per ounce. The

lower anticipated AISC are based on higher production, higher

by-product credits and lower power costs following the

commissioning of the 215 megawatt power plant in the third quarter

of 2013.

Lagunas Norte

Lagunas Norte produced 0.20 million ounces at AISC of $613 per

ounce in the fourth quarter. In 2014, the mine is expected to

produce 0.570-0.610 million ounces, processing more ore tons at

lower grades compared to 2013. The increase in ore tons is mainly

due to higher fleet availability following the transfer of

equipment from the Pierina mine. Anticipated AISC of $640-$680 per

ounce in 2014 primarily reflect higher fuel and labor costs related

to the increase in tonnage, and an increase in power costs due to a

full year of operations at the carbon-in-column plant.

Veladero

Veladero produced 0.14 million ounces at AISC of $969 per ounce

in the fourth quarter. Veladero is anticipated to produce

0.650-0.700 million ounces in 2014, reflecting increased recovery

of leached ounces and higher grades from the Argenta and Filo

Federico pits(10). Higher expected AISC of $940-$990 per ounce in

2014 are primarily impacted by lower silver by-product credits,

local inflation and the foreign exchange rate of the Argentine

peso.

North America - Other

Barrick's other North American mines consist of Bald Mountain,

Round Mountain, Turquoise Ridge, Golden Sunlight, Ruby Hill and

Hemlo. This segment produced 0.23 million ounces in the fourth

quarter at AISC of $1,195 per ounce and is anticipated to produce

0.795-0.845 million ounces in 2014 at AISC of $1,075-$1,100 per

ounce.

Australia Pacific

Australia Pacific produced 0.36 million ounces at AISC of $966

per ounce in the fourth quarter. Porgera contributed 0.13 million

ounces at AISC of $1,350 per ounce. Due to the sale of four mines

and the announced divestiture of Kanowna, 2014 production is

expected to decline to 1.000-1.080 million ounces in 2014. AISC in

2014 are expected to increase to $1,050-$1,100 per ounce, primarily

due to expensing of waste removal costs at Porgera, and higher open

pit mining costs at Cowal and Kalgoorlie.

African Barrick Gold (ABG)

Fourth quarter attributable production from ABG was 0.12 million

ounces at AISC of $1,171 per ounce. Full year attributable

production for 2014 is expected to be 0.480-0.510 million ounces at

AISC of $1,100-$1,175 per ounce. Production in 2014 is anticipated

to be higher than 2013 due to higher grades at Bulyanhulu and

Buzwagi, as well as the commissioning of the new carbon-in-leach

plant at Bulyanhulu, which is scheduled to commence production in

May. The improved cost outlook reflects the impact of ABG's

operational review, lower sustaining capital costs and reduced

corporate overhead costs.

Global Copper

Copper production in the fourth quarter was 139 million pounds

at C1 cash costs of $1.81 per pound and C3 fully allocated costs of

$2.33 per pound. Lumwana contributed 67 million pounds at C1 cash

costs of $2.04 per pound. Production at Lumwana in 2014 is expected

to be similar to 2013 at slightly lower C1 cash costs. The mine is

pursuing a number of initiatives to further improve on cost

reductions achieved to date.

The Zaldívar mine produced 72 million pounds in the fourth

quarter at C1 cash costs of $1.62 per pound. Production at Zaldívar

is anticipated to decrease in 2014 with fewer ore tons mined and

processed in line with the mine plan. Production will also be

impacted by lower recoveries as the mine processes a higher

percentage of secondary sulfide material. C1 cash costs are

expected to increase as a result of the impact of lower production

on unit costs.

|

(1) |

All-in sustaining costs per ounce, adjusted net earnings and

adjusted net earnings per share are non-GAAP financial performance

measures. See pages 63-72 of Barrick's Fourth Quarter 2013

Report. |

|

(2) |

$5.1

billion in after-tax impairment charges for Pascua-Lama were

recorded in the second quarter of 2013, mainly driven by declining

metal prices. |

| (3) |

Adjusted operating cash flow is a non-GAAP financial

performance measure. See pages 63-72 of Barrick's Fourth Quarter

2013 report. |

|

(4) |

Calculated in accordance with National Instrument 43-101 as

required by Canadian securities regulatory authorities. For a

breakdown, see pages 155-160 of Barrick's Fourth Quarter 2013

Report. |

|

(5) |

Operating unit guidance ranges reflect expectations at each

individual operating unit, but do not add up to corporate-wide

guidance range total. |

|

(6) |

C1

cash costs per pound and C3 fully allocated costs per pound are

non-GAAP financial performance measures. See pages 63-72 of

Barrick's Fourth Quarter 2013 Report. |

|

(7) |

15%

expected to be capitalized. Barrick's exploration programs are

designed and conducted under the supervision of Robert Krcmarov,

Senior Vice President, Global Exploration of Barrick. |

|

(8) |

About

25% is expected to be capitalized. Actual expenditures will be

dependent on a number of factors, including environmental and

regulatory requirements. |

|

(9) |

Actual results will vary depending on how the ramp-up

progresses. |

|

(10) |

Guidance for Veladero in 2014 assumes the receipt of necessary

permit amendments. See page 26 of the MD&A. |

|

|

| Key

Statistics Barrick Gold Corporation |

|

|

|

| (in United States dollars) |

Three months ended December 31, |

|

Twelve months ended December 31, |

|

| (Unaudited) |

2013 |

|

2012 (restated)8 |

|

2013 |

|

2012 (restated)8 |

|

| Operating Results |

|

|

|

|

|

|

|

|

|

|

|

|

| Gold production (thousands of ounces)1 |

|

1,713 |

|

|

2,019 |

|

|

7,166 |

|

|

7,421 |

|

| Gold sold (thousands of ounces)1 |

|

1,829 |

|

|

2,027 |

|

|

7,174 |

|

|

7,292 |

|

| Per ounce data |

|

|

|

|

|

|

|

|

|

|

|

|

|

Average spot gold price |

$ |

1,276 |

|

$ |

1,722 |

|

$ |

1,411 |

|

$ |

1,669 |

|

|

Average realized gold price2 |

|

1,272 |

|

|

1,714 |

|

|

1,407 |

|

|

1,669 |

|

|

Adjusted operating costs2 |

|

573 |

|

|

547 |

|

|

566 |

|

|

563 |

|

|

All-in sustaining costs2 |

|

899 |

|

|

1,048 |

|

|

915 |

|

|

1,014 |

|

|

All-in costs2 |

|

1,317 |

|

|

1,433 |

|

|

1,282 |

|

|

1,404 |

|

|

Adjusted operating costs (on a co-product basis)2 |

|

592 |

|

|

564 |

|

|

589 |

|

|

580 |

|

|

All-in sustaining costs (on a co-product basis)2 |

|

918 |

|

|

1,065 |

|

|

938 |

|

|

1,031 |

|

|

All-in costs (on a co-product basis)2 |

|

1,336 |

|

|

1,450 |

|

|

1,305 |

|

|

1,421 |

|

| Copper production (millions of pounds) |

|

139 |

|

|

130 |

|

|

539 |

|

|

468 |

|

| Copper sold (millions of pounds) |

|

134 |

|

|

154 |

|

|

519 |

|

|

472 |

|

| Per pound data |

|

|

|

|

|

|

|

|

|

|

|

|

|

Average spot copper price |

$ |

3.24 |

|

$ |

3.59 |

|

$ |

3.32 |

|

$ |

3.61 |

|

|

Average realized copper price2 |

|

3.34 |

|

|

3.54 |

|

|

3.39 |

|

|

3.57 |

|

|

C1

cash costs2 |

|

1.81 |

|

|

1.93 |

|

|

1.92 |

|

|

2.05 |

|

|

Depreciation3 |

|

0.37 |

|

|

0.48 |

|

|

0.35 |

|

|

0.54 |

|

|

Other4 |

|

0.15 |

|

|

0.52 |

|

|

0.15 |

|

|

0.26 |

|

|

C3 fully allocated costs2 |

|

2.33 |

|

|

2.93 |

|

|

2.42 |

|

|

2.85 |

|

| Financial Results (millions) |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

$ |

2,926 |

|

$ |

4,149 |

|

$ |

12,511 |

|

$ |

14,394 |

|

| Net loss5 |

|

(2,830 |

) |

|

(3,013 |

) |

|

(10,366 |

) |

|

(538 |

) |

| Adjusted net earnings2 |

|

406 |

|

|

1,157 |

|

|

2,569 |

|

|

3,954 |

|

| Operating cash flow |

|

1,016 |

|

|

1,845 |

|

|

4,239 |

|

|

5,983 |

|

| Adjusted operating cash flow2 |

|

1,085 |

|

|

1,925 |

|

|

4,359 |

|

|

5,700 |

|

| Per Share Data (dollars) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss (basic) |

|

(2.61 |

) |

|

(3.01 |

) |

|

(10.14 |

) |

|

(0.54 |

) |

|

Adjusted net earnings (basic)2 |

|

0.37 |

|

|

1.16 |

|

|

2.51 |

|

|

3.95 |

|

|

Net loss (diluted) |

|

(2.61 |

) |

|

(3.01 |

) |

|

(10.14 |

) |

|

(0.54 |

) |

| Weighted average basic common shares (millions)6 |

|

1,085 |

|

|

1,001 |

|

|

1,022 |

|

|

1,001 |

|

| Weighted average diluted common shares

(millions)6,7 |

|

1,085 |

|

|

1,001 |

|

|

1,022 |

|

|

1,001 |

|

|

|

|

|

|

|

|

As at December 31, |

|

As at December 31, |

|

|

|

|

|

|

|

|

|

2013 |

|

|

2012 (restated)8 |

|

| Financial Position (millions) |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and equivalents |

|

|

|

|

|

|

$ |

2,404 |

|

$ |

2,097 |

|

| Non-cash working capital |

|

|

|

|

|

|

|

3,060 |

|

|

2,884 |

|

| 1 |

Production includes our equity share of gold production at Highland

Gold up to April 26, 2012, the effective date of our sale of

Highland Gold. Production also includes African Barrick Gold

("ABG") on a 73.9% basis and Pueblo Viejo on a 60% basis, both of

which reflect our equity share of production. Also includes

production from Yilgarn South up to September 30, 2013, the

effective date of sale of Yilgarn South assets. Sales includes our

equity share of gold sales from ABG and Pueblo Viejo. |

| 2 |

Realized price, adjusted operating costs, all-in sustaining costs,

all-in costs, adjusted operating costs (on a co-product basis),

all-in sustaining costs (on a co-product basis), all-in costs (on a

co-product basis), C1 cash costs, C3 fully allocated costs,

adjusted net earnings and adjusted operating cash flow are non-gaap

financial performance measures with no standard definition under

IFRS. Refer to the Non-Gaap Financial Performance Measures section

of the Company's MD&A. |

| 3 |

Represents equity depreciation expense divided by equity ounces of

gold sold or pounds of copper sold. |

| 4 |

For a

breakdown, see reconciliation of cost of sales to C1 cash costs and

C3 fully allocated costs per pound in the Non-Gaap Financial

Performance Measures section of the Company's MD&A. |

| 5 |

Net

loss represents net loss attributable to the equity holders of the

Company. |

| 6 |

Reflects 163.5 million shares issued on November 14, 2013. |

| 7 |

Fully

diluted includes dilutive effect of stock options. |

| 8 |

Balances related to 2012 have been restated to reflect the impact

of the adoption of new accounting pronouncements. See note 2y of

the consolidated financial statements. |

|

|

Production and Cost Summary

|

|

Gold Production (attributable ounces) (000's) |

|

All-in sustaining costs5 ($/oz) |

|

Three months ended |

|

Twelve months ended |

|

Three months ended |

|

Twelve months ended |

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

| (Unaudited) |

2013 |

2012 |

|

2013 |

2012 |

|

|

2013 |

|

2012 |

|

|

2013 |

|

2012 |

| Gold |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goldstrike |

242 |

330 |

|

892 |

1,174 |

|

$ |

770 |

$ |

708 |

|

$ |

901 |

$ |

802 |

|

Cortez |

244 |

346 |

|

1,337 |

1,370 |

|

|

498 |

|

649 |

|

|

433 |

|

608 |

|

Pueblo Viejo1 |

157 |

65 |

|

488 |

67 |

|

|

720 |

|

- |

|

|

735 |

|

- |

|

Lagunas Norte |

195 |

214 |

|

606 |

754 |

|

|

613 |

|

557 |

|

|

627 |

|

565 |

|

Veladero |

142 |

222 |

|

641 |

766 |

|

|

969 |

|

811 |

|

|

833 |

|

760 |

|

North America - Other |

231 |

215 |

|

858 |

883 |

|

|

1,195 |

|

1,273 |

|

|

1,235 |

|

1,181 |

|

Australia Pacific2 |

364 |

470 |

|

1,773 |

1,822 |

|

|

966 |

|

1,217 |

|

|

994 |

|

1,128 |

|

African Barrick Gold3 |

122 |

134 |

|

474 |

463 |

|

|

1,171 |

|

1,675 |

|

|

1,362 |

|

1,585 |

|

Other4 |

16 |

23 |

|

97 |

122 |

|

|

57 |

|

133 |

|

|

65 |

|

112 |

| Total |

1,713 |

2,019 |

|

7,166 |

7,421 |

|

$ |

899 |

$ |

1,048 |

|

$ |

915 |

$ |

1,014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Copper Production (attributable pounds) (millions) |

|

|

C1 Cash Costs5($/lb) |

|

|

Three months ended |

|

Twelve months ended |

|

|

Three months ended |

|

|

Twelve months ended |

|

|

December 31, |

|

December 31, |

|

|

December 31, |

|

|

December 31, |

|

(Unaudited) |

2013 |

2012 |

|

2013 |

2012 |

|

|

2013 |

|

2012 (restated)8 |

|

|

2013 |

|

2012 (restated)8 |

|

Total |

139 |

130 |

|

539 |

468 |

|

$ |

1.81 |

$ |

1.93 |

|

$ |

1.92 |

$ |

2.05 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Gold Production Costs ($/oz) |

|

Three months ended |

|

|

Twelve months ended |

|

|

December 31, |

|

|

December 31, |

|

| (Unaudited) |

2013 |

|

2012 (restated)8 |

|

|

2013 |

|

2012 (restated)8 |

|

|

Direct mining costs before impact of hedges at market foreign

exchange rates |

$ |

597 |

|

$ |

586 |

|

|

$ |

604 |

|

$ |

599 |

|

|

Gains realized on currency hedge and commodity hedge/economic hedge

contracts |

|

(34 |

) |

|

(58 |

) |

|

|

(41 |

) |

|

(51 |

) |

|

Other6 |

|

- |

|

|

(12 |

) |

|

|

(8 |

) |

|

(12 |

) |

|

By-product credits |

|

(19 |

) |

|

(17 |

) |

|

|

(23 |

) |

|

(17 |

) |

|

Royalties |

|

29 |

|

|

48 |

|

|

|

34 |

|

|

44 |

|

| Adjusted operating costs5 |

|

573 |

|

|

547 |

|

|

|

566 |

|

|

563 |

|

|

Depreciation |

|

146 |

|

|

207 |

|

|

|

190 |

|

|

192 |

|

|

Other6 |

|

- |

|

|

12 |

|

|

|

8 |

|

|

12 |

|

| Total production costs |

$ |

719 |

|

$ |

766 |

|

|

$ |

764 |

|

$ |

767 |

|

| Adjusted operating costs5 |

$ |

573 |

|

$ |

547 |

|

|

$ |

566 |

|

$ |

563 |

|

|

General & administrative costs |

|

34 |

|

|

61 |

|

|

|

42 |

|

|

60 |

|

|

Rehabilitation - accretion and amortization |

|

17 |

|

|

17 |

|

|

|

19 |

|

|

18 |

|

|

Mine on-site exploration and evaluation costs |

|

9 |

|

|

17 |

|

|

|

8 |

|

|

16 |

|

|

Mine development expenditures |

|

129 |

|

|

174 |

|

|

|

154 |

|

|

168 |

|

|

Sustaining capital expenditures |

|

137 |

|

|

232 |

|

|

|

126 |

|

|

189 |

|

| All-in sustaining costs5 |

$ |

899 |

|

$ |

1,048 |

|

|

$ |

915 |

|

$ |

1,014 |

|

| All-in costs5 |

$ |

1,317 |

|

$ |

1,433 |

|

|

$ |

1,282 |

|

$ |

1,404 |

|

|

|

|

|

|

|

|

|

|

|

Total Copper Production Costs ($/lb) |

|

|

Three months ended |

|

|

Twelve months ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

(Unaudited) |

2013 |

|

2012 (restated)8 |

|

|

|

2013 |

|

2012 (restated)8 |

|

| C1

cash costs5 |

$ |

1.81 |

|

$ |

1.93 |

|

|

$ |

1.92 |

|

$ |

2.05 |

|

|

Depreciation |

|

0.37 |

|

|

0.48 |

|

|

|

0.35 |

|

|

0.54 |

|

|

Other7 |

|

0.15 |

|

|

0.52 |

|

|

|

0.15 |

|

|

0.26 |

|

|

C3 fully allocated costs5 |

$ |

2.33 |

|

$ |

2.93 |

|

|

$ |

2.42 |

|

$ |

2.85 |

|

| 1 |

All-in sustaining costs for 2012 for Pueblo Viejo is nil as

commercial production was not achieved until January 2013. |

| 2 |

Reflects Yilgarn South up to September 30, 2013, the effective date

of sale of Yilgarn South assets. |

| 3 |

Figures relating to African Barrick Gold are presented on a 73.9%

basis, which reflects our equity share of production. |

| 4 |

Production figures include Pierina and our equity share of gold

production at Highland Gold up to April 26, 2012, the effective

date of our sale of Highland Gold. All-in sustaining costs include

Pierina and other general and administrative costs divided by

equity ounces of gold sold. |

| 5 |

Adjusted operating costs, all-in sustaining costs, all-in costs, C1

cash costs and C3 fully allocated costs are non-gaap financial

performance measures with no standard meaning under IFRS. Refer to

the Non-Gaap Financial Performance Measures section of the

Company's MD&A. |

| 6 |

Represents the Barrick Energy gross margin divided by equity ounces

of gold sold. |

| 7 |

For a

breakdown, see reconciliation of cost of sales to C1 cash costs and

C3 fully allocated costs per pound in the Non-Gaap Financial

Performance Measures section of the Company's MD&A. |

| 8 |

Balances related to 2012 have been restated to reflect the impact

of the adoption of new accounting pronouncements. See note 2y of

the consolidated financial statements. |

|

|

Consolidated Statements of Income

| Barrick Gold Corporation |

|

|

|

|

|

|

| For the years ended December 31 (in millions of United

States dollars, except per share data) |

|

2013 |

|

2012 (restated - note 2y) |

|

| Revenue (notes 5 and 6) |

$ |

12,511 |

|

$ |

14,394 |

|

| Costs and expenses |

|

|

|

|

|

|

| Cost of sales (notes 5 and 7) |

|

7,243 |

|

|

7,257 |

|

| General and administrative expenses (note 10) |

|

390 |

|

|

503 |

|

| Exploration and evaluation (notes 5 and 8) |

|

208 |

|

|

359 |

|

| Other expense (income) (note 9a) |

|

878 |

|

|

303 |

|

| Impairment charges (note 9b) |

|

12,687 |

|

|

6,294 |

|

| Loss from equity investees (note 15a) |

|

- |

|

|

12 |

|

| Gain on non-hedge derivatives (note 24e) |

|

(76 |

) |

|

(31 |

) |

| Loss before finance items and income taxes |

|

(8,819 |

) |

|

(303 |

) |

| Finance items |

|

|

|

|

|

|

| Finance income |

|

9 |

|

|

11 |

|

| Finance costs (note 13) |

|

(657 |

) |

|

(174 |

) |

| Loss before income taxes |

|

(9,467 |

) |

|

(466 |

) |

| Income tax (expense) recovery (note 11) |

|

(630 |

) |

|

102 |

|

| Loss from continuing operations |

|

(10,097 |

) |

|

(364 |

) |

| Loss from discontinued operations (note 4b) |

|

(506 |

) |

|

(185 |

) |

| Net loss |

$ |

(10,603 |

) |

$ |

(549 |

) |

| Attributable to: |

|

|

|

|

|

|

| Equity holders of Barrick Gold Corporation |

$ |

(10,366) |

|

$ |

(538 |

) |

| Non-controlling interests (note 31) |

$ |

(237) |

|

$ |

(11 |

) |

|

|

|

|

|

|

|

| Earnings per share data attributable to the equity

holders of Barrick Gold Corporation (note 12) |

|

|

|

|

|

|

| Loss from continuing operations |

|

|

|

|

|

|

|

Basic |

$ |

(9.65 |

) |

$ |

(0.35 |

) |

|

Diluted |

$ |

(9.65 |

) |

$ |

(0.35 |

) |

| Loss from discontinued operations |

|

|

|

|

|

|

|

Basic |

$ |

(0.49 |

) |

$ |

(0.19 |

) |

|

Diluted |

$ |

(0.49 |

) |

$ |

(0.19 |

) |

| Net loss |

|

|

|

|

|

|

|

Basic |

$ |

(10.14 |

) |

$ |

(0.54 |

) |

|

Diluted |

$ |

(10.14 |

) |

$ |

(0.54 |

) |

The notes to these

unaudited consolidated financial statements, which are contained in

the Fourth quarter and Year-end report, available on our website,

are an integral part of these consolidated financial

statements.

Consolidated Statements of Comprehensive Income

| Barrick Gold Corporation |

|

|

|

|

|

| For the years ended December 31 (in millions of United

States dollars) |

2013 |

|

2012 (restated - note 2y) |

|

| Net loss |

$ |

(10,603 |

) |

$ |

(549 |

) |

| Other comprehensive income (loss), net of taxes |

|

|

|

|

|

|

| Items that may be reclassified subsequently to profit

or loss: |

|

|

|

|

|

|

|

Unrealized gains (losses) on available-for-sale ("AFS") financial

securities, net of tax $6, $6 |

|

(68 |

) |

|

(37 |

) |

|

Realized (gains) losses and impairments on AFS financial

securities, net of tax ($3), ($6) |

|

17 |

|

|

34 |

|

|

Unrealized gains (losses) on derivative investments designated as

cash flow hedges, net of tax ($7), ($20) |

|

(63 |

) |

|

167 |

|

|

Realized (gains) losses on derivative investments designated as

cash flow hedges, net of tax $73, $96 |

|

(325 |

) |

|

(331 |

) |

|

Currency translation adjustments gain (loss), net of tax $nil,

$nil |

|

(93 |

) |

|

35 |

|

| Items that will not be reclassified to profit or

loss: |

|

|

|

|

|

|

|

Remeasurement gains (losses) of post-employment benefit

obligations, net of tax ($13), $3 |

|

24 |

|

|

(5 |

) |

| Total other comprehensive loss |

|

(508 |

) |

|

(137 |

) |

| Total comprehensive loss |

$ |

(11,111 |

) |

$ |

(686 |

) |

| Attributable to: |

|

|

|

|

|

|

| Equity holders of Barrick Gold Corporation |

|

|

|

|

|

|

|

Continuing operations |

$ |

(10,337 |

) |

$ |

(525 |

) |

|

Discontinued operations |

$ |

(537 |

) |

$ |

(149 |

) |

| Non-controlling interests |

$ |

(237 |

) |

$ |

(12 |

) |

The notes to these

unaudited consolidated financial statements, which are contained in

the Fourth quarter and Year-end report, available on our website,

are an integral part of these consolidated financial

statements.

Consolidated Statements of Cash Flow

| Barrick Gold Corporation |

|

|

|

|

|

|

| For the years ended December 31 (in millions of United

States dollars) |

2013 |

|

2012 (restated - note 2y) |

|

| OPERATING ACTIVITIES |

|

|

|

|

|

|

| Net loss |

$ |

(10,097 |

) |

$ |

(364 |

) |

| Adjustments for the following items: |

|

|

|

|

|

|

|

Depreciation |

|

1,732 |

|

|

1,651 |

|

|

Finance costs (excludes accretion) |

|

589 |

|

|

121 |

|

|

Impairment charges (note 9b) |

|

12,687 |

|

|

6,294 |

|

|

Income tax expense (recovery) (note 11) |

|

630 |

|

|

(102 |

) |

|

Increase in inventory |

|

(352 |

) |

|

(360 |

) |

|

Proceeds from settlement of hedge contracts |

|

219 |

|

|

450 |

|

|

Gain on non-hedge derivatives (note 24e) |

|

(76 |

) |

|

(31 |

) |

|

Gain on sale of long-lived assets/investments |

|

(41 |

) |

|

(18 |

) |

|

Other operating activities (note 14a) |

|

669 |

|

|

(283 |

) |

| Operating cash flows before interest and income

taxes |

|

5,960 |

|

|

7,358 |

|

| Interest paid |

|

(662 |

) |

|

(118 |

) |

| Income taxes paid |

|

(1,109 |

) |

|

(1,459 |

) |

| Net cash provided by operating activities from

continuing operations |

|

4,189 |

|

|

5,781 |

|

| Net cash provided by operating activities from

discontinued operations |

|

50 |

|

|

202 |

|

| Net cash provided by operating activities |

|

4,239 |

|

|

5,983 |

|

| INVESTING ACTIVITIES |

|

|

|

|

|

|

| Property, plant and equipment |

|

|

|

|

|

|

|

Capital expenditures (note 5) |

|

(5,501 |

) |

|

(6,773 |

) |

|

Sales proceeds |

|

50 |

|

|

18 |

|

| Acquisitions |

|

- |

|

|

(37 |

) |

| Divestitures (note 4) |

|

522 |

|

|

- |

|

| Investment sales |

|

18 |

|

|

168 |

|

| Other investing activities (note 14b) |

|

(262 |

) |

|

(311 |

) |

| Net cash used in investing activities from continuing

operations |

|

(5,173 |

) |

|

(6,935 |

) |

| Net cash used in investing activities from discontinued

operations |

|

(64 |

) |

|

(130 |

) |

| Net cash used in investing activities |

|

(5,237 |

) |

|

(7,065 |

) |

| FINANCING ACTIVITIES |

|

|

|

|

|

|

| Capital stock |

|

|

|

|

|

|

|

Proceeds on exercise of stock options |

|

1 |

|

|

18 |

|

|

Proceeds on common share offering (note 30) |

|

2,910 |

|

|

- |

|

| Debt (note 24b) |

|

|

|

|

|

|

|

Proceeds |

|

5,414 |

|

|

2,000 |

|

|

Repayments |

|

(6,412 |

) |

|

(1,393 |

) |

| Dividends (note 30) |

|

(508 |

) |

|

(750 |

) |

| Funding from non-controlling interests (note 31) |

|

55 |

|

|

505 |

|

| Deposit on silver sale agreement (note 28) |

|

- |

|

|

137 |

|

| Other financing activities (note 14c) |

|

(118 |

) |

|

(25 |

) |

| Net cash provided by financing activities from

continuing operations |

|

1,342 |

|

|

492 |

|

| Net cash used in financing activities from discontinued

operations |

|

- |

|

|

(69 |

) |

| Net cash provided by financing activities |

|

1,342 |

|

|

423 |

|

| Effect of exchange rate changes on cash and

equivalents |

|

(17 |

) |

|

7 |

|

| Net increase (decrease) in cash and equivalents |

|

327 |

|

|

(652 |

) |

| Cash and equivalents at beginning of year (note

24a) |

|

2,097 |

|

|

2,749 |

|

| Cash and equivalents at the end of year (note 24a) |

$ |

2,424 |

|

$ |

2,097 |

|

| Less cash and equivalents of assets classified as held

for sale at the end of year |

|

20 |

|

|

- |

|

| Cash and equivalents excluding assets classified as

held for sale at the end of year |

$ |

2,404 |

|

$ |

2,097 |

|

The notes to these

unaudited consolidated financial statements, which are contained in

the Fourth quarter and Year-end report, available on our website,

are an integral part of these consolidated financial

statements.

Consolidated Balance Sheets

| Barrick Gold Corporation |

|

|

|

|

| (in millions of United States dollars) |

As at December 31, 2013 |

|

As at December 31, 2012 (restated - note 2y) |

As at January 1, 2012 (restated - note 2y) |

| ASSETS |

|

|

|

|

|

|

|

| Current assets |

|

|

|

|

|

|

|

|

Cash

and equivalents (note 24a) |

$ |

2,404 |

|

$ |

2,097 |

$ |

2,749 |

|

Accounts receivable (note 17) |

|

385 |

|

|

449 |

|

426 |

|

Inventories (note 16) |

|

2,679 |

|

|

2,585 |

|

2,498 |

|

Other current assets (note 17) |

|

421 |

|

|

626 |

|

876 |

| Total current assets (excluding assets classified as

held for sale) |

|

5,889 |

|

|

5,757 |

|

6,549 |

|

Assets classified as held for sale |

|

323 |

|

|

- |

|

- |

| Total current assets |

|

6,212 |

|

|

5,757 |

|

6,549 |

|

| Non-current assets |

|

|

|

|

|

|

|

|

Equity in investees (note 15a) |

|

27 |

|

|

20 |

|

341 |

|

Other

investments (note 15b) |

|

120 |

|

|

78 |

|

161 |

|

Property, plant and equipment (note 18) |

|

21,688 |

|

|

29,277 |

|

29,076 |

|

Goodwill (note 19a) |

|

5,835 |

|

|

8,837 |

|

9,626 |

|

Intangible assets (note 19b) |

|

320 |

|

|

453 |

|

569 |

|

Deferred income tax assets (note 29) |

|

501 |

|

|

437 |

|

409 |

|

Non-current portion of inventory (note 16) |

|

1,679 |

|

|

1,555 |

|

1,153 |

|

Other assets (note 21) |

|

1,066 |

|

|

1,064 |

|

1,002 |

| Total assets |

$ |

37,448 |

|

$ |

47,478 |

$ |

48,886 |

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

Accounts payable (note 22) |

|

2,165 |

|

|

2,267 |

|

2,085 |

|

Debt

(note 24b) |

|

179 |

|

|

1,848 |

|

196 |

|

Current income tax liabilities |

|

75 |

|

|

41 |

|

306 |

|

Other current liabilities (note 23) |

|

303 |

|

|

261 |

|

326 |

| Total current liabilities (excluding liabilities

classified as held for sale) |

|

2,722 |

|

|

4,417 |

|

2,913 |

|

Liabilities classified as held for sale |

|

162 |

|

|

- |

|

- |

| Total current liabilities |

|

2,884 |

|

|

4,417 |

|

2,913 |

|

| Non-current liabilities |

|

|

|

|

|

|

|

|

Debt

(note 24b) |

|

12,901 |

|

|

12,095 |

|

13,173 |

|

Provisions (note 26) |

|

2,428 |

|

|

2,812 |

|

2,326 |

|

Deferred income tax liabilities (note 29) |

|

2,258 |

|

|

2,668 |

|

4,231 |

|

Other liabilities (note 28) |

|

976 |

|

|

850 |

|

689 |

| Total liabilities |

|

21,447 |

|

|

22,842 |

|

23,332 |

| Equity |

|

|

|

|

|

|

|

| Capital stock (note 30) |

|

20,869 |

|

|

17,926 |

|

17,892 |

| Retained earnings (deficit) |

|

(7,581 |

) |

|

3,269 |

|

4,562 |

| Accumulated other comprehensive income |

|

(69 |

) |

|

463 |

|

595 |

| Other |

|

314 |

|

|

314 |

|

314 |

| Total equity attributable to Barrick Gold Corporation

shareholders |

|

13,533 |

|

|

21,972 |

|

23,363 |

|

Non-controlling interests (note 31) |

|

2,468 |

|

|

2,664 |

|

2,191 |

| Total equity |

|

16,001 |

|

|

24,636 |

|

25,554 |

| Contingencies and commitments (notes 16, 18 and

35) |

|

|

|

|

|

|

|

| Total liabilities and equity |

$ |

37,448 |

|

$ |

47,478 |

$ |

48,886 |

The notes to these

unaudited consolidated financial statements, which are contained in

the Fourth quarter and Year-end report, available on our website,

are an integral part of these consolidated financial

statements.

Consolidated Statements of Changes in Equity

| Barrick Gold Corporation |

|

Attributable to equity holders of the company |

|

|

|

|

|

|

|

| (in millions of United States dollars) |

Common Shares (in thousands) |

Capital stock |

Retained earnings |

|

Accumulated other comprehensive income (loss)1 |

|

Other2 |

Total equity attributable to shareholders |

|

Non- controlling interests |

|

Total equity |

|

| At January 1, 2013 (restated - note 2y) |

1,001,108 |

$ |

17,926 |

$ |

3,269 |

|

$ |

463 |

|

$ |

314 |

$ |

21,972 |

|

$ |

2,664 |

|

$ |

24,636 |

|

|

Net loss |

- |

|

- |

|

(10,366 |

) |

|

- |

|

|

- |

|

(10,366 |

) |

|

(237 |

) |

|

(10,603 |

) |

|

Total other comprehensive income (loss) |

- |

|

- |

|

24 |

|

|

(532 |

) |

|

- |

|

(508 |

) |

|

- |

|

|

(508) |

|

|

Total comprehensive loss |

- |

$ |

- |

$ |

(10,342 |

) |

$ |

(532 |

) |

$ |

- |

$ |

(10,874 |

) |

$ |

(237 |

) |

$ |

(11,111 |

) |

|

Transactions with owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

|

- |

|

(508 |

) |

|

- |

|

|

- |

|

(508 |

) |

|

- |

|

|

(508 |

) |

|

|

Issued on public equity offering |

163,500 |

|

2,934 |

|

- |

|

|

- |

|

|

- |

|

2,934 |

|

|

- |

|

|

2,934 |

|

|

|

Issued on exercise of stock options |

44 |

|

1 |

|

- |

|

|

- |

|

|

- |

|

1 |

|

|

- |

|

|

1 |

|

|

|

Recognition of stock option expense |

- |

|

8 |

|

- |

|

|

- |

|

|

- |

|

8 |

|

|

- |

|

|

8 |

|

|

|

Funding from non-controlling interests |

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

55 |

|

|

55 |

|

|

|

Other decrease in non-controlling interests |

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

(14 |

) |

|

(14 |

) |

|

Total transactions with owners |

163,544 |

$ |

2,943 |

$ |

(508 |

) |

$ |

- |

|

$ |

- |

$ |

2,435 |

|

$ |

41 |

|

$ |

2,476 |

|

| At December 31, 2013 |

1,164,652 |

$ |

20,869 |

$ |

(7,581 |

) |

$ |

(69 |

) |

$ |

314 |

$ |

13,533 |

|

$ |

2,468 |

|

$ |

16,001 |

|

|

|

| At January 1, 2012 (restated - note 2y) |

1,000,423 |

$ |

17,892 |

$ |

4,562 |

|

$ |

595 |

|

$ |

314 |

$ |

23,363 |

|

$ |

2,191 |

|

$ |

25,554 |

|

|

Net loss |

- |

|

- |

|

(538 |

) |

|

- |

|

|

- |

|

(538 |

) |

|

(11 |

) |

|

(549 |

) |

|

Total other comprehensive loss |

- |

|

- |

|

(5 |

) |

|

(132 |

) |

|

- |

|

(137 |

) |

|

- |

|

|

(137 |

) |

|

Total comprehensive loss |

- |

$ |

- |

$ |

(543 |

) |

$ |

(132 |

) |

$ |

- |

$ |

(675 |

) |

$ |

(11 |

) |

$ |

(686 |

) |

|

Transactions with owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends |

- |

|

- |

|

(750 |

) |

|

- |

|

|

- |

|

(750 |

) |

|

- |

|

|

(750 |

) |

|

|

Issued on exercise of stock options |

685 |

|

18 |

|

- |

|

|

- |

|

|

- |

|

18 |

|

|

- |

|

|

18 |

|

|

|

Recognition of stock option expense |

- |

|

16 |

|

- |

|

|

- |

|

|

- |

|

16 |

|

|

- |

|

|

16 |

|

|

|

Funding from non-controlling interests |

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

505 |

|

|

505 |

|

|

|

Other decrease in non-controlling interests |

- |

|

- |

|

- |

|

|

- |

|

|

- |

|

- |

|

|

(21 |

) |

|

(21 |

) |

|

Total transactions with owners |

685 |

$ |

34 |

$ |

(750 |

) |

$ |

- |

|

$ |

- |

$ |

(716 |

) |

$ |

484 |

|

$ |

(232 |

) |

| At December 31, 2012 (restated - note 2y) |

1,001,108 |

$ |

17,926 |

$ |

3,269 |

|

$ |

463 |

|

$ |

314 |

$ |

21,972 |

|

$ |

2,664 |

|

$ |

24,636 |

|

| 1 |

Includes cumulative translation adjustments as at December 31,

2013: $80 million loss (2012: $13 million). |

| 2 |

Includes additional paid-in capital as at December 31, 2013: $276

million (December 31, 2012: $276 million) and convertible

borrowings - equity component as at December 31, 2013: $38 million

(December 31, 2012: $38 million). |

The notes to these unaudited consolidated financial statements,

which are contained in the Fourth quarter and Year-end report,

available on our website, are an integral part of these

consolidated financial statements.

| CORPORATE OFFICE |

|

TRANSFER AGENTS AND REGISTRARS |

| Barrick Gold Corporation |

|

CST Trust Company |

| Brookfield Place, TD Canada Trust Tower |

|

P.O. Box 700, Postal Station B |

| Suite 3700 |

|

Montreal, Quebec, Canada H3B 3K3 |

| 161 Bay Street, P.O. Box 212 |

|

or |

| Toronto, Canada M5J 2S1 |

|

American Stock Transfer & Trust Company,

LLC |

| Tel: (416) 861-9911 Fax:

(416)

861-0727 |

|

6201 - 15 Avenue |

| Toll-free throughout North America:

1-800-720-7415 |

|

Brooklyn, NY

11219 |

| Email: investor@barrick.com |

|

Tel: 1-800-387-0825 |

| Website: www.barrick.com |

|

Toll-free throughout North America |

|

|

Fax: 1-888-249-6189 |

| SHARES LISTED |

|

Email: inquiries@canstockta.com |

| ABX - The New York Stock Exchange |

|

Website: www.canstockta.com |

| The Toronto Stock Exchange |

|

|

|

|

|

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in

this Fourth Quarter and Year-End Report 2013, including any

information as to our strategy, projects, plans or future financial

or operating performance, constitutes "forward-looking statements".

All statements, other than statements of historical fact, are

forward-looking statements. The words "believe", "expect",

"anticipate", "contemplate", "target", "plan", "intend",

"continue", "budget", "estimate", "may", "will", "schedule" and

similar expressions identify forward-looking statements.

Forward-looking statements are necessarily based upon a number of

estimates and assumptions that, while considered reasonable by the

company, are inherently subject to significant business, economic

and competitive uncertainties and contingencies. Known and unknown

factors could cause actual results to differ materially from those

projected in the forward-looking statements. Such factors include,

but are not limited to: fluctuations in the spot and forward price

of gold and copper or certain other commodities (such as silver,

diesel fuel and electricity); changes in national and local

government legislation, taxation, controls, regulations,

expropriation or nationalization of property and political or

economic developments in Canada, the United States and other

jurisdictions in which the company does or may carry on business in

the future; diminishing quantities or grades of reserves; increased

costs, delays, suspensions and technical challenges associated with

the construction of capital projects; the impact of global

liquidity and credit availability on the timing of cash flows and

the values of assets and liabilities based on projected future cash

flows; adverse changes in our credit rating; the impact of

inflation; fluctuations in the currency markets; operating or

technical difficulties in connection with mining or development

activities; the speculative nature of mineral exploration and

development, including the risks of obtaining necessary licenses

and permits; contests over title to properties, particularly title

to undeveloped properties; risk of loss due to acts of war,

terrorism, sabotage and civil disturbances; changes in U.S. dollar

interest rates; risks arising from holding derivative instruments;

litigation; business opportunities that may be presented to, or

pursued by, the company; our ability to successfully integrate

acquisitions or complete divestitures; employee relations;

availability and increased costs associated with mining inputs and

labor; and; the organization of our African gold operations and

properties under a separate listed company. In addition, there are

risks and hazards associated with the business of mineral

exploration, development and mining, including environmental

hazards, industrial accidents, unusual or unexpected formations,

pressures, cave-ins, flooding and gold bullion, copper cathode or

gold/copper concentrate losses (and the risk of inadequate

insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect our actual

results and could cause actual results to differ materially from

those expressed or implied in any forward-looking statements made

by, or on behalf of, us. Readers are cautioned that forward-looking

statements are not guarantees of future performance. All of the

forward-looking statements made in this Fourth Quarter and Year-End

Report 2013 are qualified by these cautionary statements. Specific

reference is made to the most recent Form 40-F/Annual Information

Form on file with the SEC and Canadian provincial securities

regulatory authorities for a discussion of some of the factors

underlying forward-looking statements.

The company disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by

applicable law.

INVESTOR CONTACT: Amy SchwalmVice President, Investor

Relations(416) 307-7422aschwalm@barrick.comMEDIA CONTACT: Andy

LloydVice President, Communications(416)

307-7414alloyd@barrick.com

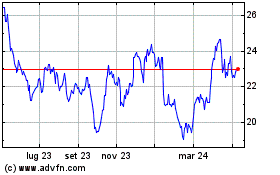

Grafico Azioni Barrick Gold (TSX:ABX)

Storico

Da Feb 2025 a Mar 2025

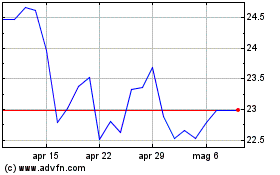

Grafico Azioni Barrick Gold (TSX:ABX)

Storico

Da Mar 2024 a Mar 2025