Falco Pacific Announces Initial Horne 5 Resource of 2.15 Million oz

Gold (2.8 Million oz Gold Equivalent)

Inferred resource estimated at: 25.3 million tonnes @ 2.64 g/t

Gold, 0.23% Copper, 0.70% Zinc (3.41 g/t Gold Equivalent)

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Mar 4, 2014) - Falco

Pacific Resource Group Inc. ("Falco Pacific" or the "Company")

(TSX-VENTURE:FPC) today announced an initial mineral resource

estimate for the upper portion of its 100% owned Horne 5 deposit in

Rouyn-Noranda, Quebec.

Highlights:

- At a CDN$80/tonne net payable metal or net smelter return

("NSR") cut-off, the upper portion of the deposit hosts an inferred

resource of: 25.3 million tonnes @ 2.64 g/t gold, 0.70 % zinc and

0.23% copper (or 3.41 g/t gold equivalent "AuEq").

- At this cut-off the resource contains an estimated 2.15 million

ounces of gold, 131 million pounds of copper, and 393 million

pounds of zinc (see Table 1) for a total of 2.8 million AuEq

ounces. Gold accounts for 77% of the total gold equivalent

resource.

- At lower NSR cut-off's the resource tonnage and contained

metals increase substantially providing significant leverage to

higher gold and base metal prices. At a CDN$50/tonne cut-off the

estimated inferred resource increases to 67.6 million tonnes at

2.48 g/t AuEq, containing 3.95 million ounces of gold and 5.39

million AuEq ounces (Table 1). The scale and continuity of the

deposit suggests potential for the employment of low cost,

underground bulk mining methods similar to those employed at other

precious metal mines in the region.

- Metal price assumptions of $US1300/oz gold, $3.30/lb copper,

and $0.95/lb zinc were used in the NSR and gold equivalent

calculations. Other key assumptions used in these estimates are

summarized below.

- While silver is present within the deposit in significant

quantities it has not been incorporated in this resource estimate

as it was not systematically assayed for by Noranda Inc. In 1963

Noranda collected and milled 76 bulk samples (140,000 metres of

drill core) from the upper portion of the Horne 5 deposit which

returned an historic average assayed silver grade of 16.8 g/t. A

qualified person has not done sufficient work with respect to the

historically reported silver content of the Horne 5 deposit to

allow for its incorporation into the current mineral resource

estimate and the Company is not treating the historic estimate of

silver grade as part of the current mineral resource.

The estimated inferred resource for the Horne 5 deposit over a

range of cut-off NSR values is:

| Table 1 |

| Horne 5 Deposit |

| Mineral Resource Estimate |

|

|

Resource Class |

Cut-off (NSR C$) |

Tonnes (Mt) |

Au Eq g/t |

Au g/t |

Cu % |

Zn % |

Contained Gold Eq (Moz) |

Contained Gold (Moz) |

Contained Copper (Mlbs) |

Contained Zinc (Mlbs) |

|

|

> 50 |

67.62 |

2.48 |

1.82 |

0.17 |

0.72 |

5.4 |

3.95 |

260.81 |

1,072.51 |

|

|

> 60 |

50.36 |

2.75 |

2.05 |

0.19 |

0.73 |

4.5 |

3.32 |

213.67 |

814.19 |

|

|

> 70 |

35.86 |

3.07 |

2.33 |

0.21 |

0.72 |

3.5 |

2.69 |

168.38 |

572.95 |

|

Inferred |

> 80 |

25.32 |

3.41 |

2.64 |

0.23 |

0.70 |

2.8 |

2.15 |

131.05 |

393.09 |

|

|

> 90 |

17.93 |

3.77 |

2.98 |

0.26 |

0.69 |

2.2 |

1.72 |

101.65 |

272.09 |

|

|

> 100 |

12.84 |

4.17 |

3.35 |

0.28 |

0.67 |

1.7 |

1.38 |

78.91 |

189.89 |

|

|

> 110 |

9.50 |

4.57 |

3.72 |

0.30 |

0.66 |

1.4 |

1.13 |

62.61 |

138.29 |

- The effective date of the resource estimate is February 17,

2014. The Independent and Qualified Persons for the Mineral

Resource Estimate as required by National Instrument 43-101 are

Carl Pelletier, B.Sc., P.Geo. and Karine Brousseau, P.Eng., both

employees of InnovExplo Inc..

- NSR estimates are based on the following assumptions:

exchange rate of $Cdn1.05/$US, metal prices of (all $US): gold

$1,300/oz, copper $3.30/lb, zinc $0.95/lb, payable metal of 87% for

gold, 65% for copper and 37% for zinc (based on conservative

estimates of milling and smelting terms for comparable operations

within the southern Abitibi district). Current metallurgical

testing is underway to facilitate optimization of these estimates

utilizing available Horne 5 drill core. Gold equivalent

calculations assume these same metal prices.

- Resources were compiled at NSR cut-offs of C$50, C$60,

C$70, C$80, C$90, C$100, and C$110 per tonne. The base case

resource estimate is reported at a C$80 per tonne NSR cut-off. The

appropriate NSR cut-off will vary depending on prevailing economic

and operational parameters, for example gold price, exchange rate,

mining method and cost.

- Mineral Resources are not Mineral Reserves and have not

demonstrated economic viability.

- The quantity and grade of reported Inferred Resources in

this estimate are uncertain in nature and there has not been

sufficient work to define these Inferred Resources as Indicated or

Measured Resources. It is uncertain if further work will result in

upgrading them to an Indicated or Measured mineral resource

category.

- While the results are presented undiluted and in situ, the

reported mineral resources are considered by the Qualified Persons

to have reasonable prospects for economic extraction.

The Horne 5 resource estimate is based on 4,384 underground

diamond drill holes (305,788 metres) drilled by Noranda between

1924 and 1976 (Figure 1). Holes were collared at depths ranging

from 600 to 2,300 metres below surface across a strike length of up

to 1,000 metres. The majority of drilling was conducted as

radiating "fan drilling" from 40 underground working levels

developed throughout the deposit on 15 metre centres. The 15 metre

spacing is significantly closer than standard drill spacing used in

resource estimation work today providing a very high level of

confidence in the data. Noranda dominantly sampled at 3 metre core

lengths (which homogenizes individual higher grade results),

generating the more than 83,000 assays that were used in this

resource estimate.

The Horne 5 deposit is a massive to semi-massive sulfide body of

volcanogenic massive sulphide ("VMS") affinity that physically

underlays the historic Horne copper-gold mine (54Mt @ 6.1 g/t gold,

2.2% copper, and 13 g/t silver (Figure 4)). Gold mineralization is

associated with fine-grained pyrite within a gangue of quartz and

sericite. Interstitial chalcopyrite and sphalerite are present

throughout the deposit in varying quantities. The deposit is a

tabular, stratiform body that extends to a depth of at least 2,800

vertical metres and for up to 1,200 metres along strike, varying

between 40 and 120 metres in thickness. A limited tonnage of

copper/gold-rich ore was mined by Noranda from four stopes within

the Horne 5 deposit. These areas have been excluded from the

resource estimate.

The Horne 5 deposit remains open for extension to depth (see

Figure 1 & 2, Table 2). Limited historical drilling has

intersected broad mineralized zones below that portion of the Horne

5 deposit included in this resource estimate. These intercepts

extend the deposit to a minimum vertical depth of 2,800 metres from

surface, 500 meters below the deepest elevation incorporated in

this resource estimate.

"The initial resource estimate for Horne 5 has exceeded our

expectations confirming the presence of a large, continuous,

gold-rich deposit with a strong grade profile and abundant upside"

said Darin Wagner, Chairman of Falco Pacific. "Work to optimize the

value of this important asset and outline the economic parameters

for any potential development of Horne 5 and several nearby

deposits owned by Falco Pacific is already underway with the

assistance of InnovExplo and Falco Senior Mining Advisor Mr.

Paul-Henri Girard, former Vice President Canada for Agnico Eagle

Mines."

Resource Expansion

Potential:

The current resource estimate is for the upper portion of the

Horne 5 deposit only. The deposit is known to extend for at least

500 metres below the 1,700 vertical metres included in this initial

resource estimate.

In addition another 6,600 historic drill holes (totalling

460,000 metres) including 217,000 gold, silver, copper and zinc

assays are currently being added to the Horne mine complex

database. A significant number of these holes are in areas not

previously mined and include areas adjacent to the Horne 5 deposit

and other proximal zones of mineralization such as the Lower H,

Remnor and Horne West zones.

Key target areas of focus for the Company over the near term are

as follows:

Horne 5 Deposit Down-Dip Extension

The high grade D mineralized domain ("HG_D") constitutes the

deepest and highest grade portion of the Horne 5 deposit included

in the current resource estimate (see Table 2 below). This

open-ended sub-zone demonstrates that at its deeper levels the

Horne 5 deposit hosts mineralization similar to that found in the

former producing Horne deposit and the currently producing

Bousquet-LaRonde deposits located 40 kilometres to the east.

| Table 2 |

| Horne 5 Deposit HG_D Sub-Zone |

| Mineral Resource Estimate |

|

|

Resource Class |

Cut-off (NSR C$) |

Tonnes |

Au Eq g/t |

Au g/t |

Cu % |

Zn % |

Contained Au (oz) |

Contained Cu (lbs) |

Contained Zn (lbs) |

|

Inferred |

> 50 |

1.91 |

5.18 |

3.99 |

0.42 |

0.95 |

0.24 |

17.49 |

39.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

> 60 |

1.85 |

5.29 |

4.07 |

0.42 |

0.96 |

0.24 |

17.31 |

39.28 |

|

|

|

|

|

|

|

|

|

|

|

|

|

> 70 |

1.77 |

5.45 |

4.20 |

0.44 |

0.98 |

0.24 |

17.04 |

38.11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

> 80 |

1.67 |

5.64 |

4.35 |

0.45 |

0.99 |

0.23 |

16.68 |

36.49 |

|

|

|

|

|

|

|

|

|

|

|

|

|

> 90 |

1.57 |

5.84 |

4.52 |

0.47 |

0.99 |

0.23 |

16.25 |

34.20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

> 100 |

1.49 |

5.99 |

4.66 |

0.48 |

0.98 |

0.22 |

15.91 |

32.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

> 110 |

1.43 |

6.11 |

4.77 |

0.49 |

0.97 |

0.22 |

15.61 |

30.58 |

|

|

|

|

|

|

|

|

|

|

|

Noranda drilled a total of 37 holes below the HG_D domain from

unground levels 57 and 65 (Figure 2; Table 3). These results are

not included in the current resource estimate due to limitations in

overall drill coverage and drill density. They clearly illustrate

that the deposit continues to depth for at least an additional 500

metres down dip and continues to exhibit a strong grade profile.

These results along with metal ratio/zoning studies completed

during the resource modelling process suggest potential for

continuity of good grade gold-copper-silver mineralization to

depth.

Table 3 highlights results from this area and defines an

open-ended exploration target having minimum dimensions of 880 x

500 metres with mineralized intercepts ranging from 3 to over 50

metres in true thickness.

| Table 3 |

|

|

|

Drill Hole Number |

From (metres) |

To (metres) |

Core Length (metre) |

True Width (metre) |

Gold* g/t |

Silver g/t |

Copper % |

Zinc % |

|

HN_57-8936 |

0.00 |

21.34 |

21.34 |

21.30 |

5.26 |

19.30 |

0.05 |

1.00 |

|

including |

9.14 |

21.34 |

12.19 |

12.16 |

9.09 |

28.97 |

0.03 |

0.48 |

|

HN_57-8946 |

60.96 |

76.20 |

15.24 |

15.21 |

2.98 |

3.09 |

0.18 |

N/A |

|

including |

60.96 |

64.01 |

3.05 |

3.04 |

4.46 |

5.14 |

0.23 |

N/A |

|

HN_65-8966 |

121.92 |

128.02 |

6.10 |

5.72 |

3.94 |

0.00 |

0.23 |

0.19 |

|

HN_57-9053 |

45.72 |

51.82 |

6.10 |

6.09 |

3.26 |

82.80 |

0.23 |

0.70 |

|

HN_57-9055 |

42.67 |

45.72 |

3.05 |

2.79 |

17.14 |

0.00 |

0.08 |

0.08 |

|

HN_57-9055 |

60.96 |

70.10 |

9.14 |

8.61 |

2.51 |

67.20 |

0.50 |

0.38 |

|

HN_57-9064 |

173.74 |

249.94 |

76.20 |

50.52 |

3.34 |

41.95 |

0.29 |

0.63 |

|

including |

173.74 |

231.65 |

57.91 |

37.73 |

4.54 |

53.06 |

0.24 |

0.47 |

|

including |

213.36 |

225.55 |

12.19 |

8.27 |

15.17 |

196.89 |

0.18 |

0.68 |

|

HN_65-9057 |

18.29 |

91.44 |

73.15 |

41.31 |

6.25 |

52.40 |

0.48 |

0.24 |

|

including |

33.53 |

70.10 |

36.58 |

20.54 |

11.06 |

88.94 |

0.62 |

0.16 |

|

including |

51.82 |

70.10 |

18.29 |

11.26 |

18.51 |

160.17 |

0.75 |

0.21 |

|

HN_65-9059 |

18.29 |

85.34 |

67.06 |

38.96 |

3.62 |

27.60 |

0.32 |

0.27 |

|

including |

21.34 |

67.06 |

45.72 |

25.82 |

4.96 |

33.99 |

0.33 |

0.32 |

|

including |

27.43 |

33.53 |

6.10 |

3.23 |

25.03 |

117.26 |

0.32 |

0.56 |

|

HN_65-9060 |

12.19 |

45.72 |

33.53 |

28.01 |

2.34 |

27.74 |

0.27 |

0.21 |

|

including |

15.24 |

24.38 |

9.14 |

7.53 |

4.00 |

27.89 |

0.22 |

0.47 |

|

HN_65-9063 |

15.24 |

36.58 |

21.34 |

21.34 |

2.79 |

42.27 |

0.35 |

0.13 |

|

including |

18.29 |

30.48 |

12.19 |

12.19 |

3.86 |

59.06 |

0.41 |

0.14 |

|

HN_65-9065 |

21.34 |

54.86 |

33.53 |

27.70 |

3.37 |

116.98 |

0.51 |

0.39 |

|

including |

21.34 |

33.53 |

12.19 |

9.94 |

5.49 |

260.49 |

0.34 |

0.81 |

|

HN_65-9089 |

18.29 |

39.62 |

21.34 |

21.27 |

3.36 |

45.16 |

0.33 |

0.01 |

|

including |

27.43 |

33.53 |

6.10 |

6.08 |

5.66 |

80.06 |

0.70 |

0.02 |

|

HN_65-9091 |

36.58 |

57.91 |

21.34 |

17.62 |

1.42 |

17.39 |

0.46 |

0.02 |

|

including |

39.62 |

45.72 |

6.10 |

4.95 |

3.09 |

40.46 |

0.95 |

0.02 |

|

HN_65-9262 |

42.67 |

204.22 |

161.54 |

29.55 |

3.55 |

36.01 |

0.19 |

0.76 |

|

including |

60.96 |

134.11 |

73.15 |

10.45 |

5.20 |

45.76 |

0.21 |

0.78 |

|

including |

54.86 |

91.44 |

36.58 |

4.55 |

4.77 |

65.37 |

0.18 |

0.75 |

|

including |

106.68 |

134.11 |

27.43 |

4.41 |

7.20 |

28.84 |

0.20 |

0.57 |

| * All reported grades are

uncapped |

Horne West Zone

The Horne West Zone is located 500 metres to the west of Horne 5

deposit. This gold (+/-zinc) zone was initially discovered from

drilling off Horne 5 sublevels in the 1940's, with near surface

mineralization subsequently discovered in the 1980's. The deeper

mineralization appears to correlate well with the shallower

drilling outlining a sub-vertical zone of gold mineralization that

extends down dip for 1,500 metres and remains open at depth. The

Horne West Zone shows zonation from gold rich to the west to more

zinc rich to the east and also appears to be of VMS affinity.

Highlights from Noranda historic intercepts through the Horne West

Zone include:

| Table 4 |

|

|

|

|

From |

To |

Core Length* |

Gold |

|

Hole-ID |

(m) |

(m) |

(m) |

(g/t) |

|

HN_21-5994 |

414.53 |

420.62 |

6.09 |

9.76 |

|

HN_65-9068 |

496.82 |

505.97 |

9.15 |

31.54 |

|

HW-07-06 |

405.80 |

454.30 |

48.50 |

1.57 |

|

RN_9-26 |

252.50 |

263.65 |

11.15 |

3.74 |

|

RN_9-42 |

213.36 |

220.68 |

7.32 |

5.15 |

|

RN_9-73 |

239.57 |

255.42 |

15.85 |

3.37 |

|

RN_9-77 |

237.13 |

254.81 |

17.68 |

3.18 |

|

RN_9-90 |

260.21 |

280.84 |

20.63 |

5.49 |

|

RN_9-92 |

284.68 |

290.78 |

6.10 |

5.37 |

| * Insufficient work has been done at this time to determine

the true widths of the reported intercepts, all reported values are

uncapped. |

"With a large initial resource at Horne 5 now confirmed, clear

potential to further expand this resource and the opportunity to

add other nearby unmined and remnant deposits to our resource and

exploration model, Falco Pacific is uniquely positioned for further

low cost, high impact growth" said Mr. Kelly Klatik, President and

CEO of Falco Pacific. "For our shareholders the best part may be

that we have accomplished all of this at very low cost on a small

fraction of the 700+ square kilometres we hold in this world-class

mining district."

The technical report in support of this resource estimate will

be filed on SEDAR (www.sedar.com) and placed on the Company's

website within the next 45 days and the Company will advise its

shareholders once the report is available.

Resource Modeling

Notes:

- Densities for zone ENV_A and HG_A to E were estimated from

drill hole iron assay data using a 3-pass ID2 interpolation method.

The average density for these zones ranges from 3.17 to 3.54

g/cm3. Limited density data was available for

zones ENV_B to D and a fixed density of 2.88 g/cm3

representing the average of the available data was assumed for

these zones.

- A minimum true thickness of 7.0 m was applied, using the

grade of the adjacent material when assayed, or a zero value when

not assayed. Compositing was done on drill hole sections falling

within the mineralized zones (composite = 3.0 metres).

- The estimate was generated using GEMS(c) software based on

a three dimensional block model (5x5x5 metre blocks). Nine

contiguous mineralized domains (5 high-grade gold bearing and 4

low-grade gold bearing) were identified, defined, and modelled from

600 metres to 2,300 metres depth. Wireframes were used as hard

boundaries to constrain the interpolation of grades into the block

model. Interpolation parameters were derived based on

geostatistical analysis conducted on 3 metre composited drill hole

data. Block grades have been estimated using Inverse Distance

Squared (ID2) interpolation method and the mineral resources have

been classified based on proximity to sample data and the

continuity of mineralization in accordance with CIM best

practices.

- Capping of high grade gold values was done on raw assay

data and established on a per zone basis: HG_A: 35 g/t, HG_B:

70g/t, HG_C: 25g/t, HG_D: 35g/t, HG_E: 25g/t, ENV_A: 70g/t, ENV_B:

25g/t, ENV_C: 25g/t, ENV_D: g/t25. No upper capping was applied to

copper and zinc data.

- Tonnage estimates were rounded to the nearest hundred

tonnes. Any discrepancies in the totals are due to rounding

effects. Rounding practice follows the recommendations set out in

Form 43-101F1.

- CIM definitions and guidelines were followed in estimating

Mineral Resources.

- InnovExplo is not aware of any known environmental,

permitting, legal, title-related, taxation, socio-political,

marketing or other relevant issue that could materially affect the

Mineral Resource Estimate.

- InnovExplo's data verification included, a review of core

from sixteen (16) different diamond drill holes, validation of 100%

of the drill hole collar locations and of down holes surveys were

made and 10% of the assays were validated. 121 core samples from

historical core were sent to ALS Chemex Laboratory for check

assays. Assays show good correlation to historic assays for gold,

silver, copper, and zinc, and recent specific gravity

determinations depict excellent reproducibility compared to

calculated specific gravity values. The check assays program used

regular QAQC protocols which included the insertion of blank,

standard and duplicate samples. InnovExplo is of the opinion that

the final drill hole database is adequate to support a mineral

resource estimate for the Horne 5 deposit.

Technical information related to the 2014 Horne 5 Project

Resource Estimate contained in this news release has been reviewed

and approved by Carl Pelletier, B.Sc., P.Geo. and Karine Brousseau,

Eng (InnovExplo Inc.) who are independent Qualified Persons as

defined by NI 43-101 who have the ability and authority to verify

the authenticity and validity of this data. By reason of their

education, affiliation with a professional association and past

relevant work experience, Carl Pelletier and Karine Brousseau

fulfill the requirements to be a "qualified person" for the

purposes of NI 43-101.

Stéphane Poitras, Senior Exploration Geologist (P.Geo.) an

employee of Falco Pacific, is the non-independent qualified person

for this release as defined by NI 43-101 and has reviewed and

verified the technical information contained herein other than the

resource estimate.

About Falco Pacific Resource Group

Founded in 2012 with the acquisition of the 728 square kilometre

Rouyn Noranda Project in Quebec, Falco Pacific is focussed on the

evaluation of precious and base metal targets in one of the world's

great mining camps. Horne 5 Deposit represents the largest,

partially developed gold deposit in the southern portion of the

Abitibi greenstone belt. Horne 5 is one of a number of known zones

of gold and gold-base metal mineralization, which form the Horne

Mine Complex, centered around the former producing Horne

copper-gold deposit.

For more information, please go to www.falcopacific.com.

On behalf of the Board of Directors of FALCO PACIFIC RESOURCE

GROUP

Kelly Klatik, President and CEO

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this press release.

Cautionary Notes

Cautionary Note Regarding Forward-Looking

Statements

This news release contains forward-looking statements and

forward-looking information (together, "forward-looking

statements") within the meaning of applicable securities laws and

the United States Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical fact, included

herein including, without limitation, statements regarding the

anticipated content, commencement and cost of exploration programs

and work with respect to the historical data on the Horne 5

deposit, anticipated exploration program results, the discovery and

delineation of mineral deposits/resources/reserves, metal price

assumptions, the ability of the Company to optimize the value of

the Horne 5 deposit and to outline the economic parameters for any

potential development of Horne 5 and several nearby deposits, the

ability of the Company to add other nearby unmined and remnant

deposits to the Company's current model, the ability of the Company

to continue low cost, high impact growth, the potential for any

production decision to be made in respect of the Horne 5 deposit,

the potential for any mining at or mineral production from Horne 5

or any surrounding deposits, the potential for the identification

of multiple deposits surrounding Horne 5, business and financing

plans and business trends. Information concerning mineral resource

estimates may also be deemed to be forward-looking statements in

that it reflects a prediction of the mineralization that would be

encountered, and the results of mining it, if a mineral deposit

were developed and mined. Generally, forward-looking information

can be identified by the use of terminology such as "plans",

"expects", "estimates", "intends", "anticipates", "believes" or

variations of such words, or statements that certain actions,

events or results "may", "could", "would", "might", "will be

taken", "occur" or "be achieved". Forward-looking statements

involve risks, uncertainties and other factors that could cause

actual results, performance, prospects and opportunities to differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause actual results to differ

materially from these forward-looking statements include those

risks set out in the Company's public documents filed on SEDAR at

www.sedar.com. Although the Company believes that the assumptions

and factors used in preparing the forward-looking statements are

reasonable, undue reliance should not be placed on these

statements, which only apply as of the date of this news release,

and no assurance can be given that such events will occur in the

disclosed times frames or at all. Except where required by law, the

Company disclaims any intention or obligation to update or revise

any forward-looking statement, whether as a result of new

information, future events or otherwise.

Cautionary Note Regarding References to Resources and

Reserves

National Instrument 43 101 - Standards of Disclosure for

Mineral Projects ("NI 43-101") is a rule developed by the Canadian

Securities Administrators which establishes standards for all

public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Unless otherwise

indicated, all resource estimates contained in or incorporated by

reference in this press release have been prepared in accordance

with NI 43-101 and the guidelines set out in the Canadian Institute

of Mining, Metallurgy and Petroleum (the "CIM") Standards on

Mineral Resource and Mineral Reserves, adopted by the CIM Council

on November 14, 2004 (the "CIM Standards") as they may be amended

from time to time by the CIM.

United States shareholders are cautioned that the

requirements and terminology of NI 43-101 and the CIM Standards

differ significantly from the requirements and terminology of the

SEC set forth in the SEC's Industry Guide 7 ("SEC Industry Guide

7"). Accordingly, the Company's disclosures regarding

mineralization may not be comparable to similar information

disclosed by companies subject to SEC Industry Guide 7. Without

limiting the foregoing, while the terms "mineral resources",

"inferred mineral resources", "indicated mineral resources" and

"measured mineral resources" are recognized and required by NI

43-101 and the CIM Standards, they are not recognized by the SEC

and are not permitted to be used in documents filed with the SEC by

companies subject to SEC Industry Guide 7. Mineral resources which

are not mineral reserves do not have demonstrated economic

viability, and US investors are cautioned not to assume that all or

any part of a mineral resource will ever be converted into

reserves. Further, inferred resources have a great amount of

uncertainty as to their existence and as to whether they can be

mined legally or economically. It cannot be assumed that all or any

part of the inferred resources will ever be upgraded to a higher

resource category. Under Canadian rules, estimates of inferred

mineral resources may not form the basis of a feasibility study or

prefeasibility study, except in rare cases. The SEC normally only

permits issuers to report mineralization that does not constitute

SEC Industry Guide 7 compliant "reserves" as in-place tonnage and

grade without reference to unit amounts. The term "contained

ounces" is not permitted under the rules of SEC Industry Guide 7.

In addition, the NI 43-101 and CIM Standards definition of a

"reserve" differs from the definition in SEC Industry Guide 7. In

SEC Industry Guide 7, a mineral reserve is defined as a part of a

mineral deposit which could be economically and legally extracted

or produced at the time the mineral reserve determination is made,

and a "final" or "bankable" feasibility study is required to report

reserves, the three-year historical price is used in any reserve or

cash flow analysis of designated reserves and the primary

environmental analysis or report must be filed with the appropriate

governmental authority.

Caution Regarding Adjacent or Similar Mineral

Properties

This news release contains information with respect to

adjacent or similar mineral properties in respect of which the

Company has no interest or rights to explore or mine. The Company

advises US investors that the mining guidelines of the US

Securities and Exchange Commission (the "SEC") set forth in the

SEC's Industry Guide 7 ("SEC Industry Guide 7") strictly prohibit

information of this type in documents filed with the SEC. Readers

are cautioned that the Company has no interest in or right to

acquire any interest in any such properties, and that mineral

deposits on adjacent or similar properties, and any production

therefrom or economics with respect thereto, are not indicative of

mineral deposits on the Company's properties or the potential

production from, or cost or economics of, any future mining of any

of the Company's mineral properties.

This press release is not, and is not to be construed in any

way as, an offer to buy or sell securities in the United

States.

Falco Pacific Resource GroupMr. Dean LindenBusiness

Development1.425.449.9442info@falcopacific.comwww.falcopacific.com

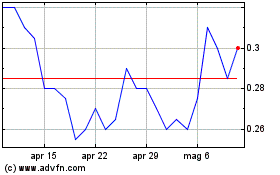

Grafico Azioni Falco Resources (TSXV:FPC)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Falco Resources (TSXV:FPC)

Storico

Da Dic 2023 a Dic 2024