Boeing Reports Record Annual Loss

27 Gennaio 2021 - 2:50PM

Dow Jones News

By Doug Cameron

Boeing Co. reported its biggest-ever annual loss and took a huge

financial hit on its new 777X jetliner, reflecting the pandemic's

worsening toll on the plane maker.

The write-down comes just as the 737 MAX re-enters service and

Boeing tries to recover from a series of botched jetliner and

military programs that more than halved its market value over the

past two years. That was even before the coronavirus pandemic

brought a decadelong boom in aircraft sales to a halt, prompting

the company to shed 31,000 jobs.

The company took a $6.5 billion pretax charge on the 777X to

reflect lower profits over the life of the wide-body plane that is

now expected to enter service in 2023, three years late. Airlines

have shied away from big jets like the 777X as international travel

demand collapsed.

Boeing's fourth-quarter loss lifted its annual deficit to $11.94

billion, with sales for the year slipping 24% to $58.2 billion.

That dropped Boeing to fourth spot by that measure behind Raytheon

Technologies Corp, Lockheed Martin Corp. and Airbus SE.

Chicago-based Boeing didn't provide any financial guidance on

Wednesday. Analysts expect sales to increase this year with the

resumption of 787 deliveries following quality problems that halted

customers taking any new jets since October.

The return of the MAX will also boost revenue. It restarted

deliveries of the MAX in December from a backlog of 450 finished

planes. European regulators on Wednesday approved the aircraft to

resume commercial flights.

Boeing burned through $18.4 billion in cash last year as

aircraft deliveries halved from 2019. It doesn't expect to be cash

flow positive until next year.

Monthly production of the MAX is still expected to spool up to

31 in early 2022, with output of the 787 dropping to five later

this year. Boeing said 787 output remains under review because of

the parlous state of international travel demand amid quarantines

and other restrictions.

Boeing's per-share loss of $14.65 in the latest quarter compared

with the $1.60 consensus among analysts polled by FactSet. It

included a previously announced $744 million charge related to a

$2.5 billion settlement with the Justice Department related to the

MAX that included a fine and additional compensation for crash

victims' families and customers.

The company also took another $275 million charge for the KC-46A

military tanker.

Boeing shares were down almost 4% in premarket trading.

Write to Doug Cameron at doug.cameron@wsj.com

(END) Dow Jones Newswires

January 27, 2021 08:35 ET (13:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

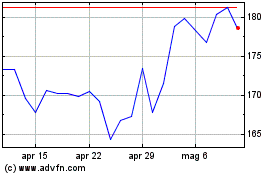

Grafico Azioni Boeing (NYSE:BA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Boeing (NYSE:BA)

Storico

Da Apr 2023 a Apr 2024