Current Report Filing (8-k)

28 Settembre 2021 - 10:20PM

Edgar (US Regulatory)

false0000035527Fifth Third BancorpDepositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock00000355272021-09-272021-09-270000035527us-gaap:CommonStockMember2021-09-272021-09-270000035527fitb:DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf6.625FixedToFloatingRateNotCumulativePerpetualPreferredStockSeriesI2Member2021-09-272021-09-270000035527fitb:DepositarySharesRepresentingA140thOwnershipInterestInAShareOf6.00NotCumulativePerpetualClassBPreferredStockSeriesAMember2021-09-272021-09-270000035527fitb:DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf4.95NotCumulativePerpetualPreferredStockSeriesKMember2021-09-272021-09-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): September 27, 2021

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ohio

|

|

001-33653

|

|

31-0854434

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fifth Third Center

|

|

|

|

38 Fountain Square Plaza

|

,

|

Cincinnati

|

,

|

Ohio

|

|

45263

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

(800) 972-3030

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, Without Par Value

|

|

FITB

|

|

The

|

NASDAQ

|

Stock Market LLC

|

|

Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series I

|

|

FITBI

|

|

The

|

NASDAQ

|

Stock Market LLC

|

|

Depositary Shares Representing a 1/40th Ownership Interest in a Share of 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A

|

|

FITBP

|

|

The

|

NASDAQ

|

Stock Market LLC

|

|

Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 4.95% Non-Cumulative Perpetual Preferred Stock, Series K

|

|

FITBO

|

|

The

|

NASDAQ

|

Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

As previously announced, on July 23, 2021, Fifth Third Bancorp (“Fifth Third”) entered into an accelerated share repurchase transaction with Citibank, N.A. (“Citi”) pursuant to which Fifth Third would purchase approximately $550 million of its outstanding common stock under two $275 million confirmations (the “July 2021 Repurchase”). Fifth Third is repurchasing these shares of its common stock as part of its 100 million share repurchase program previously announced in a press release on June 18, 2019 and a current report on Form 8-K filed on June 20, 2019 (the "June 2019 Repurchase Program").

On September 27, 2021, Fifth Third was notified by Citi that it had finished purchasing shares in connection with both $275 million confirmations from the July 2021 Repurchase. A total of 13,065,958 shares were repurchased upon execution of the July 2021 Repurchase (6,532,979 for each separate confirmation), and an additional 711,814 shares will be repurchased tomorrow, September 29, 2021, upon completion of the first confirmation and 701,397 shares will be repurchased tomorrow upon completion of the second confirmation. In total, 7,244,793 shares will have been repurchased at an average price of $38.6583 per share under the first confirmation and 7,234,376 shares will have been repurchased at an average price of $38.7130 per share under the second confirmation.

After completion of the July 2021 Repurchase, Fifth Third will have approximately 48 million shares of remaining repurchase authority under the aforementioned June 2019 Repurchase Program.

Citi and certain of its affiliates have performed, and in the future may perform, various financial advisory and other services for Fifth Third and Fifth Third’s affiliates for which they have received, and may in the future receive, customary fees and expenses.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

FIFTH THIRD BANCORP

(Registrant)

September 28, 2021 By: /s/ BRYAN PRESTON

Bryan Preston

Senior Vice President and Treasurer

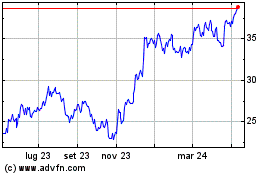

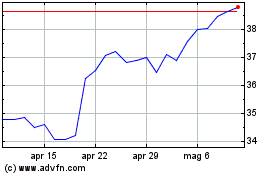

Grafico Azioni Fifth Third Bancorp (NASDAQ:FITB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Fifth Third Bancorp (NASDAQ:FITB)

Storico

Da Apr 2023 a Apr 2024