FastForward Innovations Limited Placing and Issue of Equity (8473B)

13 Ottobre 2020 - 8:00AM

UK Regulatory

TIDMFFWD

RNS Number : 8473B

FastForward Innovations Limited

13 October 2020

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF REGULATION 2014/596/EU. IN ADDITION, MARKET

SOUNDINGS WERE TAKEN IN RESPECT OF THE MATTERS CONTAINED IN THIS

ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF

SUCH INSIDE INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT,

THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN POSSESSION

OF INSIDE INFORMATION.

FastForward Innovations Ltd / AIM: FFWD / Sector: Closed End

Investments

13 October 2020

FastForward Innovations Ltd ("FastForward" or, "FFWD")

Placing to raise GBP2 million

Issue of Equity

FastForward Innovations Ltd, the AIM quoted company focusing on

making investments in fast growing and industry leading businesses,

is pleased to announce that it has placed 23,529,646 new Ordinary

Shares of 1p each (the 'Placing Shares') at a price of 8.5p per

Placing Share (the "Placing Price") with a number of new investors

raising gross proceeds of approximately GBP2million (together the

'Placing'). In addition, it has issued 70,588 Ordinary Shares (the

"Adviser Shares") at the Placing Price to settle accrued adviser

fees.

The Placing Price represents a discount of approximately 4% to

the Company's most recently published Net Asset Value ('NAV') per

share of 8.82p and a 12.8% discount to the closing price of the

Company's ordinary shares on 9 October 2020, being the business day

prior to completion of the Placing.

As part of the Placing the Company has issued one warrant for

every two Placing Shares (the "Placing Warrants").

Shard Capital are sole brokers to the Placing.

Reasons for the Placing

FastForward has experienced largely positive developments year

to date as the Company focuses on delivering its core objective of

providing investors with exposure to disruptive growth

opportunities, in particular medical cannabis, that have near-term

re-rating potential and would otherwise be inaccessible. The

proceeds from the Placing will be used to fund a number of

opportunities in line with this investment strategy.

The Placing Warrants

Each Placing Warrant will entitle the holder to subscribe for

one further ordinary share of GBP0.01 in the capital of the Company

upon payment of 12.75p pence per share on or before that date which

is 24 months from the Settlement Date. The Warrants will also be

subject to an accelerator provision, such as if at any time during

the 24 month duration of the Warrants the 5 day volume-weighted

average price (VWAP) of Fast Forward ordinary shares exceeds 17p

per share, the Company may give warrant holders notice to exercise

their Warrants within 10 business days following the Company's

notice and to pay the exercise price in full within 20 business

days following the Company's notice, failing which the Warrants

will automatically expire.

The Warrants are fully transferable, will not be traded on any

exchange and will otherwise be issued subject to the terms and

conditions set out in a warrant instrument to be executed by the

Company.

Ed McDermott, CEO of FastForward, commented: "The support we

have experienced from new and existing shareholders in this

fundraise endorses FastForward's investment strategy to be an

investment destination for individuals and institutions seeking

exposure to the unique opportunities the board of FFWD have access

to.

"Whilst we continue to support and develop our portfolio of

existing investments in the life sciences and technology sectors, I

welcome the recent guidance from the FCA in relation to potential

applications seeking admission to the Official List in the medical

cannabis-related sector, a sector in which we already have a

significant exposure to and confidence for future returns. With a

number of our current portfolio assets on their way to near term

liquidity events we want to move swiftly into a number of new

positions to support VC/PE type returns for our shareholders"

Admission and Total Voting Rights

The Placing Shares and Adviser Shares will rank pari passu with

the existing ordinary shares of the Company and application for the

admission to trading on AIM of 23,600,234 has been made. Admission

to trading on AIM of the Placing Shares and Adviser Shares is

anticipated to occur on 27 October 2020.

The issued ordinary share capital of the company will consist of

190,513,962 ordinary shares of 1 pence each with voting rights

(including 5,413,623 held in treasury). Accordingly, 185,100,339

Ordinary Shares may be used by shareholders as the denominator for

the calculations which will determine whether they are required to

notify their interest in the company, or any change to that

interest, under the Financial Conduct Authority's Disclosure and

Transparency Rules.

ENDS

For further information on the Company please visit www.fstfwd.co or contact:

Ed McDermott / Lance FastForward Innovations Email: info@fstfwd.co

de Jersey Ltd

James Biddle / Roland Beaumont Cornish Tel: +44 (0) 207

Cornish Limited, 628 3396

Nomad

------------------------ ----------------------

Isabella Pierre/Damon Shard Capital Partners Tel: (0)207 186

Heath LLP 9927

------------------------ ----------------------

Isabel De Salis / Beth St Brides Partners Tel: +44 (0)207

Melluish Ltd, 236 1177

Financial PR

------------------------ ----------------------

Notes

FastForward Innovations is an AIM quoted investment company

focused primarily on disruptive high growth life sciences and

technology businesses particularly within the medical cannabis

arena. The Company's strategy is to identify early stage

opportunities that have an upcoming investment catalyst and grow

its portfolio in terms of value whilst limiting the number of

investee companies to a level where relevant time can be devoted to

each.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEKZMMGVZLGGZM

(END) Dow Jones Newswires

October 13, 2020 02:00 ET (06:00 GMT)

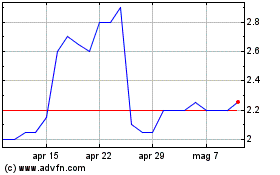

Grafico Azioni Seed Innovations (LSE:SEED)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Seed Innovations (LSE:SEED)

Storico

Da Mag 2023 a Mag 2024