TIDMLSAA TIDMLSAB

RNS Number : 2170A

Life Settlement Assets PLC

27 September 2020

LIFE SETTLEMENT ASSETS PLC

LEI: 2138003OL2VBXWG1BZ27

(the "Company" or "LSA")

Half-Year Announcement

LSA, a closed-ended investment company which manages portfolios

of whole and fractional interests in life settlement policies

issued by life insurance companies operating predominantly in the

United States, is pleased to announce its unaudited half-year

results for the period ended 30 June 2020.

Highlights

-- Distributions totalling USD 5.5 million made during the period

-- Total maturities for the first six months amounted to USD

12.2 million (HY2019: USD 33.9 million), generating gains from life

settlement portfolios of USD 0.6 million (HY2019: gains of USD 15.6

million)

-- Total net loss of USD 2.9 million (HY2019: profit of USD 9.2 million)

Company performance

Performance analysis by Share Class is provided in the tables

below:

A Share Class

As at As at Percentage

30 June 31 December Change

2020 2019 (%)

Net assets attributable

to Shareholders (USD '000) 92,639 89,108 (4.0)

----------- ------------- -----------

Shares in issue 43,724,059 39,891,391 9.6

----------- ------------- -----------

NAV per share (USD) 2.12 2.23 (4.9)

----------- ------------- -----------

Closing share price (USD) 1.95 1.78 9.6

----------- ------------- -----------

(Discount) to NAV (%) (8.0) (20.2) 12.2

----------- ------------- -----------

As at As at Percentage

30 June 30 June Change

2020 2019 (%)

Total maturities (USD '000) 8,862 23,981 (63.0)

--------- --------- -----------

Net income from portfolio

(USD '000) 1,004 13,207 (92.4)

--------- --------- -----------

(Loss)/profit for the period

(USD '000) (1,792) 8,036 (122.3)

--------- --------- -----------

This includes a contribution of USD 508,000 in respect of the D

& E share class profit in the period before the merger.

B Share Class

As at As at Percentage

30 June 31 December Change

2020 2019 (%)

Net assets attributable

to Shareholders (USD '000) 13,800 14,863 (7.1)

----------- ------------- -----------

Shares in issue 14,596,098 14,596,098 -

----------- ------------- -----------

NAV per share (USD) 0.95 1.02 (7.4)

----------- ------------- -----------

Closing share price (USD) 0.70 0.63 11.1

----------- ------------- -----------

(Discount) to NAV (%) (26.3) (38.2) 11.9

----------- ------------- -----------

As at As at Percentage

30 June 30 June Change

2020 2019 (%)

Total maturities (USD '000) 1,448 2,079 (30.3)

--------- --------- -----------

Net income from portfolio

(USD '000) (728) (872) 16.5

--------- --------- -----------

Loss for the period (USD

'000) (1,063) (1,248) 14.8

--------- --------- -----------

Enquiries:

Acheron Capital Limited (Investment Manager)

Jean-Michel Paul

020 7258 5990

Shore Capital (Financial Adviser and Broker)

Robert Finlay

020 7408 4080

ISCA Administration Services Limited

Company Secretary

Tel: 01392 487056

CHAIRMAN'S STATEMENT

On behalf of the Board, I am pleased to present the Company`s

half-year results for the period ended 30 June 2020. I am also very

conscious that I am writing against an uncertain economic

background as the world tries to deal with the ongoing Coronavirus

pandemic ("Covid-19").

Investment Overview

The financial highlights above show the results for the half

year to 30 June 2020.

The NAV of Class A decreased by 4.9% and the NAV of class Class

B decreased by 7.4% over the period both reflecting a lower than

anticipated level of maturities. The Class A NAV reduction also

reflects the distributions made during the period to Class A

Shareholders and the former holders of D and E Class shares. When

adding back the dividends paid to Shareholders during the period

and the effect of the merger with class D and E shares the NAV

decreased by 2.0% per A share. Further details on the dividends

paid are set out under the paragraph headed "Distributions"

below.

The Company has continued with its declared policy of retaining

a significant proportion of cash in class A against future

investment opportunities. The Board continues to monitor this

carefully and to review the decision with its Investment Manager on

a regular basis.

The Life Settlement Market

Over the past five years, the life settlement industry has grown

both in funds committed to the sector and consumer awareness. In

fact, a 2020 industry report showed a 11% increase in policies sold

in 2019 compared to 2018, while the face amount of life insurance

policies sold increased from USD 3.8 billion to USD 4.4 billion in

the same period.

It is somewhat premature to speculate how the Covid-19 Pandemic

will impact the Life Settlement Market. As regards the primary

market for life insurance policies, there may be an increase in

individuals needing to sell policies due to their financial

circumstances. Although LSA does not acquire policies directly from

the individual holders, there may be an increase in supply at a

time when there is greater competition elsewhere for capital in the

financial markets, potentially creating purchasing opportunities

for LSA in the secondary market.

Structural changes

The proposals to merge the share classes A, D and E as set out

in the Circular published by the Company on 2 April 2020, were

approved by Shareholders at the class meetings held on 29 April

2020 and the merger was completed on 5 May 2020. Given the very

different nature of the structure of Class B, with no exposure to

HIV policies, the Board decided not to propose the merger of class

B at this stage, although this will be kept under review. As a

result of the reconstruction the 8,792,561 D shares and 1,566,603 E

shares were re-designated as 2,700,812 and 1,131,856 A shares

respectively. The Company now has two classes of shares being A and

B shares.

Merging the relatively small D and E Share Classes provided a

helpful simplification of the Company's structure. In addition, the

A Ordinary Shareholders have already benefitted from improved cash

flows which should continue over the next few years. Other benefits

include a reduced focus on HIV-related maturities arising from the

inclusion of the D and E Ordinary Share Class portfolios together

with the benefit through consolidation of the underlying fractional

policies into the larger portfolio.

Furthermore, as mentioned in the Annual Report, on 31 March

2020, the four trusts through which the Company invests in the

underlying assets of the Company were merged into a single trust in

order to reduce annual operating costs and operational risks.

Portfolio

The overall portfolio is subdivided into portfolios exposed to

either HIV-positive policy holders or non-HIV positive policy

holders. The following table provides information on the Company's

policies by Share Class and by exposure to HIV and non-HIV positive

insureds as at 30 June 2020.

HIV and Non-HIV Exposed Policies (all values in USD)

Share Class A HIV Non-HIV Total

Number of policies 4,329 173 4,502

---------- --------- ----------

Total face value

(USD '000) 372,435 93,297 465,732

---------- --------- ----------

Valuation

(USD '000) 50,000 19,996 69,996

---------- --------- ----------

Percentage of

face 13.4% 21.4% 15.0%

---------- --------- ----------

Share Class B

---------- --------- ----------

Number of policies N/A 93 93

---------- --------- ----------

Total face value

(USD '000) N/A 44,108 44,108

---------- --------- ----------

Valuation

(USD'000) N/A 10,722 10,722

---------- --------- ----------

Percentage of

face N/A 24.3% 24.3%

---------- --------- ----------

During the first half of 2020 small lots of fractional policies

to which the trusts were already exposed totalling 49 fractions in

all with a face value of $2.2 million, were added to the

portfolio.

Maturities

Maturities in the six months ended 30 June 2020, can be seen in

the table below.

Class A Class B Class D* Class E*

HIV Maturities

(USD '000) 3,609 N/A - -

-------- -------- --------- ---------

Non-HIV Maturities

(USD '000) 5 253 1,448 1,308 584

-------- -------- --------- ---------

Total Maturities

(USD '000) 8,862 1,448 1,308 584

-------- -------- --------- ---------

*Maturities to 29 February 2020 in Class D and E

While the impact of Covid-19`s first wave has been very

significant in terms of cases in the US, the impact observed on the

Company's portfolio has been small. This may reflect the fact that

the estimated number of resulting deaths in the US of between 150k

to 200k, whilst a multiple of the yearly influenza casualties, is

only a small fraction of total deaths observed; a specific

geographical distribution not matching the portfolio (concentration

of casualties in the north east); and the concentrated nature of

the portfolio being non representative. Either way, the mortality

observed for the first half of the year has not seen a surge and

remains in line with pre-Covid-19 model expectations.

In the period under review, the HIV segment of the portfolio had

an estimated AE ("Actual to Expected") of close to 100%. While the

HIV portfolio has performed to expectations, the elderly segment of

the Share Class B portfolio has shown fewer maturities than had

been expected. The elderly segment in Class A was, however, close

to 100% of expectation.

AE* All classes

HIV 94%

------------

Non-HIV 83%

------------

* in maturity dollar amounts, estimated until June

Portfolio Composition

Further information on the composition of the portfolio of each

Share Class as at 30 June 2020 can be found on our website

https://www.lsaplc.com/investor-relations/reports-company-literature

Distributions

The maturities received in the period were such that the Company

was able to make distributions to Shareholders by way of special

dividends on 3 April 2020 as follows:

- for A Ordinary Shareholders, a special dividend of 6.267 cents

per share totalling USD 2.5 million.

- for D Ordinary Shareholders, a special dividend of 15.922

cents per share totalling USD 1.4 million.

- for E Ordinary Shareholders, a special dividend of 38.299

cents per share totalling USD 0.6 million.

In addition, as part of the restructuring discussed above the

following dividends were paid on 30 June 2020.

- for D Ordinary Shareholders, a special dividend of 4.94932

cents per share totalling USD 0.4 million.

- for E Ordinary Shareholders, a special dividend of 35.99451

cents per share totalling USD 0.6 million.

Subsequent to the period end, the Company has declared a further

interim dividend of 4.5741 cents per Class A share totalling USD

2.0 million. The dividend will be paid on 29 October 2020 to all

class A Shareholders on the register on 9 October 2020.

Board Changes

After serving on the Board (and predecessor Company) for a

number of years, Frank Mathe, has expressed his intention to step

down from the Board at the end of September. Frank has been a

strong supporter of the Company and the Board wishes to record its

thanks to him for the valuable advice and guidance he has

given.

Separately the Board is currently giving consideration to its

current composition. At the time LSA listed on the London Stock

Exchange in March 2018, the Board's membership largely reflected

that of its predecessor company listed in Luxembourg. Accordingly,

the Board believes that it is now appropriate to consider the

future shape of the Board taking into account the standards and

norms applicable to London listed companies. Further announcements

in this regard will be made in due course.

Outlook

As stated in the Annual Report, the mortality of the insureds in

the portfolio will continue to be the most significant factor that

will affect the financial results of the Company. We will continue

to follow the recent research on mortality in general and

especially on long-term HIV trends.

In the face of the many challenges and uncertainty facing global

economies, communities and individuals, as they grapple with the

impact of Covid-19, the Board believes that the investment

opportunity offered by LSA, and the underpinning effect of its

engagement with the life settlement market in the USA, will

continue to offer value to Shareholders.

The Board remains confident that both share classes offer our

investors important defensive qualities, which remain highly

decorrelated from equities and bonds and the current volatility of

those markets.

Michael Baines

Chairman

25 September 2020

KEY PERFORMANCE INDICATORS (KPIs)

The Board monitors success in implementing the Company's

strategy against a range of key performance indicators (KPIs),

which are viewed as significant measures of success over the longer

term. These key indicators are those provided in the performance

tables above. Although performance relative to the KPIs is

monitored over quarterly periods, it is success over the long-term

that is viewed as more important. This is particularly important

given the inherent volatility of maturities and short-term

investment returns.

The Board has chosen the following KPIs:

-- Share Price - a key measure for Shareholders to show the most

likely realisable value of this investment if it was sold. Changes

in the share price are closely monitored by the Board.

-- NAV per share - as this is the primary indicator of the

underlying value attributable to each share.

-- Premium/(discount) to NAV - as this measure can be used to

monitor the difference between the underlying Net Asset Value and

share price.

-- Total maturities (USD) - the value of the total maturities in

USD provides an indicator of the underlying cash flow that the

Company receives from its main source of income - policy

maturities. There are factors which could impact the outcome of

this performance measure including: average life expectancy and the

age of the underlying policy holders.

Please note that the Actual to Expected ("A/E") ratio, which is

closely linked to the total maturities KPI, is a key method by

which the Board monitors the level of maturities. The A/E ratio

measures the declared maturities compared to the projected

maturities based on the actuarial models. A ratio close to 100%

indicates maturities correspond exactly to the model. A percentage

greater than 100% means the maturities are more than anticipated by

the models and less than 100% the opposite is the case.

-- Profit/(loss) for the period - this is a key measure of

financial performance used to assess the fortunes of the Company

over each financial period.

Please Note: The Company regularly uses alternative performance

measures to present its financial performance. These measures may

not be comparable to similar measures used by other companies, nor

do they correspond to IFRS standards or other accounting

principles.

Directors' Statement of Principal Risks and Uncertainties

The important events that have occurred during the period under

review and the key factors influencing the financial statements are

set out in the Chairman's Statement above.

In accordance with DTR 4.2.7, the Directors consider that the

principal risks and uncertainties facing the Company have not

materially changed since the publication of the Annual Report and

Accounts for the year ended 31 December 2019.

The principal risks faced by the Company include, but are not

limited to:

-- Mortality risk

-- Premium management risk

-- Volatility risk

-- Fractional premium risk

-- Advance age mortality risk

-- Discount rate risk

-- Modelling risk

-- Tax

-- Breach of applicable legislative obligations

-- Counterparty risk

A more detailed explanation of these risks and the way in which

they are managed can be found in the Strategic Report on pages 20

to 23 and in Note 4 to the Financial Statements on pages 62 to 64

of the 2019 Annual Report and Accounts - copies can be found via

the Company's website, www.lsaplc.com .

There have been no significant changes in the related party

disclosures set out in the Annual Report.

Directors' Statement of Responsibilities in Respect of the

Financial Statements

In accordance with Disclosure and Transparency Rule (DTR) 4.2.10

Michael Baines (Chairman), Christopher Casey (Chairman of the Audit

Committee), Robert Edelstein, Franck Mathe, Yves Mertz and Guner

Turkmen, the Directors, confirm that to the best of their

knowledge:

-- The condensed set of financial statements contained within

this Half-Yearly financial report have been prepared in accordance

with International Accounting Standard ("IAS") 34 'Interim

Financial Reporting' as adopted by the European Union and gives a

true and fair view of the assets, liabilities, financial position

and loss of the Company; and

-- The Half-Yearly financial report includes a fair review of

the information required by the FCA's Disclosure and Transparency

Rule 4.2.7R being disclosure of important events that have occurred

during the first six months of the financial year, their impact on

the condensed set of financial statements and a description of the

principal risks and uncertainties for the remaining six months of

the year; and

-- The Half Yearly financial report includes a fair review of

the information required by the FCA's Disclosure and Transparency

Rule 4.2.8R being disclosure of related party transactions during

the first six months of the financial year, how they have

materially affected the financial position of the Company during

the period and any changes therein.

This Half-Yearly Report was approved by the Board of Directors

on 25 September 2020 and the above responsibility statement was

signed on its behalf by:

Michael Baines

Chairman

25 September 2020

Life Settlement Assets Plc

Condensed Statement of Comprehensive Income

for the six months ended 30 June 2020

______________________________________________

Six months ended Six months ended Year ended

30 June 2020 30 June 2019 31 December 2019

(unaudited) (unaudited) (audited)

Note Revenue Capital Total Revenue Capital Total Revenue Capital Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Income

Income from life

settlement

portfolios 450 - 450 435 - 435 868 - 868

Gains from life

settlement

portfolios 3 - 555 555 - 15,604 15,604 - 23,381 23,381

Other income 56 - 56 74 - 74 941 - 941

Net foreign exchange

loss (6) - (6) (12) - (12) (17) - (17)

______ ______ ______ ______ ______ ______ _______ _______ ______

Total income 500 555 1,055 497 15,604 16,101 1,792 23,381 25,173

Operating expenses

Investment management

fees 4 (855) 647 (208) (978) (2,066) (3,044) (1,852) (3,285) (5,137)

Other expenses (3,101) - (3,101) (3,104) - (3,104) (5,994) - (5,994)

______ ______ ______ ______ ______ ______ _______ _______ _____

(Loss)/profit

before finance

costs and taxation (3,456) 1,202 (2,254) (3,585) 13,538 9,953 (6,054) 20,096 14,042

Finance costs

Interest payable (617) - (617) (639) - (639) (1,201) - (1,201)

______ ______ ______ ______ ______ ______ _______ _______ _____

(Loss)/profit/before

taxation (4,073) 1,202 (2,871) (4,224) 13,538 9,314 (7,255) 20,096 12,841

Taxation 16 - 16 - (70) (70) (130) - (130)

______ ______ ______ ______ ______ ______ _______ _______ _____

(Loss)/profit

for the period (4,057) 1,202 (2,855) (4,224) 13,468 9,244 (7,385) 20,096 12,711

====== ===== ====== ====== ===== ====== ======= ====== =====

Return per class

A share USD 6 (0.092) 0.048 (0.044) (0.070) 0.247 0.177 (0.135) 0.369 0.234

Return per class

B share USD 6 (0.019) (0.054) (0.073) (0.024) (0.062) (0.086) (0.036) (0.052) (0.088)

Return per class

D share USD 6 n/a n/a n/a (0.042) 0.189 0.147 (0.069) 0.313 0.244

Return per class

E share USD 6 n/a n/a n/a (0.160) 0.788 0.628 (0.271) 1.328 1.057

All revenue and capital items in the above statement derive from

continuing operations of the Company.

The Company does not have any income or expense that is not

included in the loss for the period and therefore the loss for the

period is also the total comprehensive income for the period.

The total column of this statement is the Statement of Total

Comprehensive Income of the Company. The supplementary revenue and

capital columns are prepared in accordance with the Statement of

Recommended Practice ("SORP") issued by the Association of

Investment Companies ("AIC") in October 2019.

The notes form part of these financial statements.

Life Settlement Assets Plc

Condensed Statement of Financial Position

as at 30 June 2020

As at As at As at

30 June 30 June 31 December

2020 2019

(unaudited) 2019 (audited)

Note (unaudited)

USD'000 USD'000 USD'000

Non-current assets

Financial assets at fair value through

profit or loss:

- Life settlement investments 8 80,718 83,798 78,041

_______ _______ _______

80,718 83,798 78,041

Current assets

Maturities receivable 11,110 11,709 3,867

Trade and other receivables 600 1,060 697

Premiums paid in advance 9,552 11,089 9,231

Cash and cash equivalents 14,421 36,564 28,992

_______ _______ _______

35,683 60,422 42,787

_______ _______ _______

Total assets 116,401 144,220 120,828

_______ _______ _______

Current liabilities

Other payables (5,555) (2,460) (981)

Provision for performance

fees (4,407) (4,879) (5,054)

_______ _______ _______

Total liabilities (9,962) (7,339) (6,035)

_______ _______ _______

Net assets 106,439 136,881 114,793

====== ====== ======

Represented by

Capital and reserves

Share capital 9 583 711 648

Special reserve 10 101,959 133,013 107,458

Capital redemption reserve 128 - 63

Capital reserve 22,712 14,882 21,510

Revenue reserve (18,943) (11,725) (14,886)

_______ _______ _______

Total equity attributable

to ordinary shareholders of 106,439 136,881 114,793

the Company ====== ====== ======

Net Asset Value per share

basic and diluted

Class A shares 11 2.119 2.194 2.234

Class B shares 11 0.945 1.021 1.018

Class D shares 11 n/a 1.394 0.831

Class E shares 11 n/a 5.386 2.242

The notes form part of these financial statements.

Registered in England and Wales with Company Registration

number: 10918785

Condensed Statement of Changes in Equity

for the six months ended 30 June 2020

________________________________________________________

Capital

Share Share Special redemption Capital Revenue

capital premium reserve reserve reserve reserve Total

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

Six months ended 30 June

2020

Balance as at 1 January

2020 648 - 107,458 63 21,510 (14,886) 114,793

Comprehensive income for

the period - - - - 1,202 (4,057) (2,855)

Conversion of D shares

to A shares (61) - - 61 - - -

Conversion of E shares

to A shares (4) - - 4 - - -

Contributions by and

distributions

to owners

Dividends paid in the period - - (5,499) - - - (5,499)

_____ ______ _______ _______ ______ _______ _______

Balance as at 30 June 2020 583 - 101,959 128 22,712 (18,943) 106,439

===== ====== ======= ======= ====== ======= =======

Of which:

Realised gains 17,492

Unrealised gains 5,220

Six months to 30 June 2019

Balance as at 1 January

2019 711 133,013 - - 1,414 (7,501) 127,637

Comprehensive income for

the period - - - - 13,468 (4,224) 9,244

Contributions by and

distributions

to owners

Cancellation of share premium

account (note 10) - (133,013) 133,013 - - - -

____ _______ _______ _______ ______ _______ _______

Balance as at 30 June 2019 711 - 133,013 - 14,882 (11,725) 136,881

==== ======= ====== ======= ====== ======= =======

Of which:

Realised gains 15,937

Unrealised losses (1,055)

Period ended 31 December

2019

Balance as at 31 December

2018 711 133,013 - - 1,414 (7,501) 127,637

Comprehensive income for

the year - - - - 20,096 (7,385) 12,711

Contributions by and

distributions

to owners

C ancellation of share

premium account (note 10) - (133,013) 133,013 - - - -

Tender Offer July 2019 (56) - (10,050) 56 - - (10,050)

Share buybacks for

cancellation (7) - (1,005) 7 - - (1,005)

Dividends paid in year - - (14,500) - - - (14,500)

_____ _______ _______ _______ ______ _______ _______

Balance as at 31 December

2019 648 - 107,458 63 21,510 (14,886) 114,793

===== ======= ======= ======= ====== ====== =======

Of which:

Realised gains 17,619

Unrealised gains 3,891

The notes form part of these financial statements.

The Special reserve was created as a result of the cancellation

of the Share premium account following a court order issued on 18

June 2019. The Special reserve is distributable and may be used to

fund purchases of the Company's own shares and to make

distributions to Shareholders.

The revenue and realised capital reserves are also distributable

reserves.

Life Settlement Assets Plc

Condensed Cash Flow Statement

for the six months ended 30 June 2020

____________________________________________________

Six Six

months ended months ended Year ended

30 June 2020 30 June 2019 31 December

2019

(unaudited) (unaudited) (audited)

USD'000 USD'000 USD'000

Cash flows (used in)/from operating

activities

(Loss)/profit for the period (2,855) 9,244 12,711

Non-cash adjustment

* movement on portfolios 1,980 7,379 15,989

* value adjustment on shares in subsidiary - - (360)

Investment in life settlement

portfolios (58) (1,077) (1,167)

Movements in "policy advances" (4,599) (286) (3,050)

-

Changes in operating assets

and liabilities

Changes in maturities receivables (7,243) 6,088 13,930

Changes in trade and other receivables 97 (120) 243

Changes in premiums paid in

advance (321) 2,239 4,097

Changes in other payables 4,574 2,510 (1,034)

Changes in performance fee provision (647) - 2,241

Changes in liabilities to subsidiary - - 360

______ ______ ______

Net cash (outflows)/inflows

(used in)/from operating activities (9,072) 25,977 43,960

Cash flow used in financing

activities

Dividends paid (5,499) - (14,500)

Tender Offer and buybacks for

cancellation - - (11,055)

_____ ______ ______

Net cash flows used in financing

activities (5,499) - (25,555)

______ ______ ______

Net changes in cash and cash

equivalents (14,571) 25,977 18,405

Cash balance at the beginning

of the period 28,992 10,587 10,587

______ ______ ______

Cash balance at the end of the

period 14,421 36,564 28,992

====== ====== ======

The notes form part of these financial statements.

Life Settlement Assets Plc

Notes to the Condensed Financial Statements

for the six months ended 30 June 2020

Note 1 General information

Life Settlement Assets ("Life Settlement Assets" or the

"Company") is a public company limited by shares and an investment

company under section 833 of the Companies Act 2006. It was

incorporated in England and Wales on 16 August 2017 with a

registration number of 10918785. The registered office of the

Company is 115 Park Street, 4th Floor, London W1K 7AP.

The principal activity of Life Settlement Assets is to manage

investments in whole and partial interests in life settlement

policies issued by life insurance companies operating predominantly

in the United States.

In May 2018, the Company received confirmation from HM Revenue

& Customs of its approval as an investment trust for tax

accounting periods commencing on or after 26 March 2018, subject to

the Company continuing to meet the eligibility conditions contained

in section 1158 of the Corporation Tax Act 2010 and the ongoing

requirements in Chapter 3 of Part 2 of the Investment Trust

(Approved Company) (Tax) Regulations 2011(Statutory Instrument

2011/2999).

The Company currently has two classes of Ordinary Shares in

issue, namely A and B, each of which principally participates in a

separate portfolio of life settlement assets and associated

liabilities, which were acquired from Acheron Portfolio Corporation

(Luxembourg) SA ("APC" or the "Predecessor Company") on 26 March

2018.

The Ordinary Share classes D and E were cancelled following the

merger of Ordinary Share Classes A, D and E on 5 May 2020.

Note 2 IFRS accounting policies

2.1 Basis of preparation

These condensed interim financial statements have been prepared

using the same accounting policies and methods of computation as in

the 2019 annual financial statements.

The condensed financial statements, which comprise the unaudited

results of the Company have been prepared in accordance with

International Reporting Standards ("IFRS") as issued by the

International Accounting Standards Board ("IASB"), as adopted by

the European Union. They have also been prepared in accordance with

the SORP for investment companies issued by the AIC in October

2019, except to the extent that it conflicts with IFRS. The

accounting policies are as set out in the Report and Accounts for

the period ended 31 December 2019.

The half-year financial statements have been prepared in

accordance with IAS 34 "Interim Financial Reporting".

The financial information contained in this Half-Yearly

financial report does not constitute statutory accounts as defined

by the Companies Act 2006.The financial information for the periods

ended 30 June 2020 and 30 June 2019 have not been audited or

reviewed by the Company's Auditor. The figures and financial

information for the year ended 31 December 2019 are an extract from

the latest published audited statements and do not constitute the

statutory accounts for that year. Those accounts have been

delivered to the Registrar of Companies and include a report of the

Auditor, which was unqualified and did not contain a statement

under either Section 498(2) or 498(3) of the Companies Act

2006.

2.2 Changes in accounting policy and disclosures

Standards and amendments to existing standards that are not yet

effective and have not been early adopted by the Company

The following new standard has been published but is not

effective for the Company's accounting period beginning on 1

January 2020. The Directors do not expect the adoption of the

following new standard to have a significant impact on the

financial statements of the Company in future periods.

IFRS 17 "Insurance contracts" applies to insurance contracts,

including reinsurance contracts issued by an entity; reinsurance

contracts held by an entity; and investment contracts with

discretionary participation features issued by an entity that

issues insurance contracts. IFRS 17 will be effective for reporting

periods beginning on or after 1 January 2023. As IFRS 17 is not

relevant to the life settlement market, it is expected that it will

have no impact on the Company's financial statements.

Going concern

The Directors have made an assessment of the Company's ability

to continue as a going concern and are satisfied that the Company

has adequate resources to continue in operational existence for the

foreseeable future (being a period of 12 months from the date these

financial statements were approved). Furthermore, the Directors are

not aware of any material uncertainties that may cast significant

doubt upon the Company's ability to continue as a going concern,

having taken into account the liquidity of the Company's investment

portfolio and the Company's financial position in respect of its

cash flows, liabilities from its assets and the ongoing charges,

including annual premiums which are approximately 16% of net

assets. Therefore, the financial statements have been prepared on

the going concern basis and on the basis that approval as an

investment trust will continue to be met.

Note 3 Gains from life settlement portfolios

30 June 30 June 31 December

2020 2019 2019

USD'000 USD'000 USD'000

Realised gains:

* Maturities 12,202 33,948 58,725

* Acquisition cost of maturities and fair value

movement (3,309) (6,323) (17,218)

______ ______ ______

Sub total 8,893 27,625 41,507

Incurred premiums (9,667) (10,966) (19,355)

Unrealised gains/(losses)

* Fair value adjustments 1,329 (1,055) 1,229

______ ______ ______

555 15,604 23,381

====== ====== ======

When a maturity is declared, a realised capital gain or loss is

recognised on the investment in the policy, calculated by deducting

from the value of the maturity the initial acquisition cost and the

previously unrealised fair value adjustments.

The amount of premiums incurred during the period is reflected

as a deduction of income from life settlement portfolios. The

amount of premiums paid in advance amounted to USD 9,552,000 as at

30 June 2020 (30 June 2019: USD 11,089,000, 31 December 2019: USD

9,231,000).

Note 4 Management fees and performance fees

30 June 30 June 31 December

2020 2019 2019

USD'000 USD'000 USD'000

Acheron Capital management

fees 855 978 1,852

Performance fees (647) 2,066 3,285

______ _____ _____

208 3,044 5,137

===== ===== =====

Under an agreement dated 26 March 2018, the Investment Manager

is entitled to a management fee payable by the Trust at an annual

rate of no more than 1.5% of the Net Asset Value for classes A and

B. Previously, until the merger of classes A, D and E on 5 May

2020, an annual rate of no more than 1.5% of the Net Asset Value

was payable in respect of classes A, B and D and 2% in respect of

class E. Management fees paid in the period amounted to USD 855,000

(30 June 2019: USD 978,000, 31 December 2019:USD 1,852,000).

The Performance fee in respect of the Trust shall be an amount

equal to 25% of the sum of the distributions made to the holders of

the Shares in the Company corresponding to the Trust, in excess of

the Performance Hurdle (assessed at the time of each

distribution).

The "Performance Hurdle" is met when (from time to time) the

aggregate distributions (in excess of the Catch-Up Amount) made to

the holders of the corresponding Ordinary Shares compounded at 3%

per annum for classes A and B, and prior to 5 May 2020, 5% for

classes D and E (from the date of each distribution) equal the

aggregate investment made by the Ordinary Shares in the Company

(from time to time) compounded at 3% and 5% respectively.

The "Catch-Up Amount" is an amount equal to the distributions

that would have been required to be made to the Predecessor

Company's shareholders of the corresponding share class in order

for the Accrued Performance Distributions (less, where applicable,

any clawback of such Accrued Performance Distributions) to be paid

(determined as at 30 June 2020), reduced by an amount equal to any

distributions paid to the Predecessor Company's shareholders of the

relevant share class prior to the Acquisition.

Note 5 Taxation

The Company has an effective UK tax rate of 0% for the year

ending 31 December 2020. The estimated effective tax rate is 0% as

investment gains are exempt from tax owing to the Company's status

as an investment trust and there is expected to be an excess of

management expenses over taxable income.

The company suffers US withholding tax on income received

dividends and interest. The tax credit for the period amounted to

USD 16,000.

Withholding tax on matured policies

In accordance with the taxation treaty between the United States

of America and the United Kingdom, withholding tax on matured

policies is not due if at least 6% of the average capital stock of

the main class of Shares is traded during the previous year on a

recognised stock exchange. The Board believes that in the period

ended 31 December 2019 the Company has fulfilled this

requirement.

Note 6 Return per share

As stated in Note 9, the share capital of the Company comprises

58,320,157 shares represented by 43,724,059 A Shares and 14,596,098

B Shares. Share Classes D and E were cancelled following the merger

of Share Classes A,D and E on 5 May 2020. All Shares are fully

paid. Neither unpaid shares nor any kind of option are outstanding,

so the basic (loss)/profit per share is also the diluted

(loss)/profit per share.

As the different classes of Shares have specific rights in

relation to their investments, the net (loss)/profit per share is

given for each Share Class:

Six months ended 30 Class A Class Class Class

June 2020 B D E

Earnings per share:

Revenue return (USD'000) (3,776) (283) n/a n/a

Capital return (USD'000) 1,984 (780) n/a n/a

Total return (USD'000) (1,792) (1,063) n/a n/a

Weighted average number

of shares in the period 41,070,674 14,596,098 n/a n/a

Income return per share

(USD) (0.092) (0.019) n/a n/a

Capital return per share

(USD) 0.048 (0.054) n/a n/a

Basic and diluted total

earnings per share (USD) (0.044) (0.073) n/a n/a

Six months ended 30 Class A Class Class Class

June 2019 B D E

Earnings per share:

Revenue return (USD'000) (3,207) (349) (391) (276)

Capital return (USD'000) 11,243 (899) 1,757 1,366

Total return (USD'000) 8,036 (1,248) 1,366 1,090

Weighted average number

of shares in the period 45,446,946 14,596,098 9,292,561 1,733,269

Income return per share

(USD) (0.070) (0.024) (0.042) (0.160)

Capital return per share

(USD) 0.247 (0.062) 0.189 0.788

Basic and diluted total

earnings per share (USD) 0.177 (0.086) 0.147 0.628

Period ended 31 December Class A Class Class Class

2019 B D E

Earnings per share:

Revenue return (USD'000) (5,768) (531) (632) (454)

Capital return (USD'000) 15,778 (755) 2,852 2,221

Total return (USD'000) 10,010 (1,286) 2,220 1,767

Weighted average number

of shares in the year 42,691,999 14,596,098 9,106,812 1,672,113

Income return per share

(USD) (0.135) (0.036) (0.069) (0.271)

Capital return per share

(USD) 0.369 (0.052) 0.313 1.328

Basic and diluted total

earnings per share (USD) 0.234 (0.088) 0.244 1.057

Note 7 Financial instruments measured at fair value

The life settlement portfolios have been classified as financial

assets held at fair value through profit or loss as their

performance is evaluated on a fair value basis.

The fair value hierarchy set out in IFRS 13 groups financial

assets and liabilities into three levels based on the significant

inputs used in measuring the fair value of the financial assets and

liabilities.

The fair value hierarchy has the following levels:

- level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities;

- level 2: inputs other than quoted prices included within Level

1 that are observable for the assets or liabilities, either

directly (i.e. as prices) or indirectly (i.e. derived from prices);

and

- level 3: inputs for the assets or liabilities that are not

based on observable market data (unobservable inputs).

The life settlement portfolios of USD 80,718,000 (30 June 2019:

USD 83,798,000, 31 December 2019: USD 78,041,000) are all

classified as level 3.

Note 8 Financial assets held at fair value through profit or

loss: Life Settlement Portfolios

Movements for the period are as follows:

As at 30 As at 30 As at 31

June June December

2020 2019 2019

USD'000 USD'000 USD'000

Opening valuation 78,041 89,813 89,813

Acquisitions during the period 58 1,077 1,167

Proceeds from matured policies (12,202) (33,948) (58,725)

Net realised gains on policies 8,893 27,625 41,507

Movements in cash from policy

advances 4,599 286 3,050

Movements in unrealised valuation 1,329 (1,055) 1,229

_______ _______ ______

Closing valuation 80,718 83,798 78,041

======= ======= ======

Details at period end: USD'000 USD'000 USD'000

Acquisition value 90,113 104,169 93,364

Unrealised capital gains 5,220 1,607 3,891

Policy advances (14,615) (21,978) (19,214)

_______ _______ _______

Closing valuation 80,718 83,798 78,041

======= ======= =======

Distribution of the portfolio by class of Shares and by type of

risk:

30 June 2020 Class Class B Class Class Total

A D E

USD'000 USD'000 USD'000 USD'000 USD'000

Elderly life insurance

(non-HIV) portfolio 19,996 10,722 - (-) 30,718

HIV portfolio 50,000 - - (-) 50,000

(______) (_____) (_____) (_____) (______)

Balance as at

30 June 2020 69,996 10,722 - (-) 80,718

====== ===== ===== ===== ======

Fair market value reflects the view of Acheron Capital Ltd, the

Investment Manager of the trust in which the policies of Class A

and B are kept.

30 June 2019 Class A Class Class Class Total

B D E

USD'000 USD'000 USD'000 USD'000 USD'000

Elderly life insurance

(non-HIV) portfolio 20,715 9,832 5,200 2,757 38,504

HIV portfolio 41,773 - 2,484 1,037 45,294

(_____) (_____) (_____) (_____) (_____)

Balance as at

30 June 2019 62,488 9,832 7,684 3,794 83,798

===== ===== ===== ==== =====

31 December 2019 Class A Class Class Class Total

B D E

USD'000 USD'000 USD'000 USD'000 USD'000

Elderly life insurance

(non-HIV) portfolio 15,751 10,739 4,527 1,841 32,858

HIV portfolio 42,380 - 1,916 887 45,183

(______) (_____) (_____) (_____) (______)

Balance as at

31 December 2019 58,131 10,739 6,443 2,728 78,041

====== ===== ===== ===== ======

Note 9 Share Capital

At the 30 June 2020, (the Company's share capital amounts to USD

583,202 (30 June 2019: USD 710,689, 31 December 2019: 648,467) and

is represented by 58,320,157 ordinary shares of USD 0.01 each.

Share classes D and E were cancelled on 5 May 2020 following the

merger of Share Classes A, D and E.

Class Class Class Class Total

A B D E

USD'000 USD'000 USD'000 USD'000 USD'000

Balance as at

31 December 2018 455 146 93 17 711

Buybacks and

Tender Offer

in the year (56) - (5) (2) (63)

_____ _____ _____ _____ _____

Balance as at

31 December 2019 399 146 88 15 648

_____ _____ _____ _____ _____

Capital reorganisation

on 5 May 2020 38 - (88) (15) (65)

(_____) (_____) (_____) (____) (_____)

Balance as at

30 June 2020 437 146 - - 583

_____ _____ _____ ____ _____

The issued and fully paid share capital is comprised of

43,724,059 Class A shares, and 14,596,098 Class B shares.

Class A and Class B shares relate to specific investments

determined by the Board of Directors or as the case may be, by a

general meeting of Shareholders. Each investment is undertaken for

the exclusive benefit and risk of the relevant class of shares. All

shares have equal voting rights.

As announced on 4 May 2020, the Company undertook a capital

reorganisation whereby the shares of Classes D and E were merged

into class A shares. A total of 8,792,561 D shares and 1,566,603 E

shares were redesignated as 3,832,668 A shares.

Note 10 Special reserve

The Special reserve was created as a result of the cancellation

of the Share premium account following a court order issued on 18

June 2019. The Special reserve is distributable and may be used to

fund purchases of the Company's own shares and to make

distributions to Shareholders.

Note 11 Net assets and net asset value per Share Class

The Net Asset Value (NAV) for each Share Class is shown

below.

30 June 2020 Class A Class B Class Class Total

D E

Net assets (USD'000) 92,639 13,800 n/a n/a 106,439

Number of shares 43,724,059 14,596,098 n/a n/a 58,320,157

NAV per share

(USD) 2.119 0.945 n/a n/a

30 June 2019 Class A Class B Class Class Total

D E

Net assets (USD'000) 99,687 14,901 12,957 9,336 136,881

Number of shares 45,446,946 14,596,098 9,292,561 1,733,269 71,068,874

NAV per share

(USD) 2.194 1.021 1.394 5.386

31 December 2019 Class A Class B Class Class Total

D E

Net assets (USD'000) 89,108 14,863 7,310 3,512 114,793

Number of shares 39,891,391 14,596,098 8,792,561 1,566,603 64,846,653

NAV per share

(USD) 2.234 1.018 0.831 2.242

Note 12 Related party transactions

Related parties to the Company are the members of the Board of

Directors of the Company, Compagnie Européenne de Révision S.à r.l.

as Administrator who has a member on the Board of Directors and the

Trustee of the US trust who is also a member of the Board of

Directors.

30 June

2020

USD'000

Per income statement:

Trustee fees 62

Compagnie Européenne de Révision

S.à r.l. 115

Directors' fees 78

Amounts payable per balance sheet:

Compagnie Européenne de Révision

S.à r.l. 50

Directors' fees 23

=====

Shares held by related parties (Directors and

companies under their control) - Michael Baines

75,000 B shares

All transactions with related parties are undertaken at arm's

length.

Note 13 Post balance sheet events

Subsequent to the period end, the Company has declared an

interim dividend of 4.5741 cents per Class A share totalling USD

2.0 million. Further details are given in the Chairman's

statement.

ADDITIONAL INFORMATION

Additional information of exhibits I and II do not form part of

the condensed financial statements.

EXHIBIT I (unaudited)

Life Settlement Assets Plc

Class A Shares

Statement of Comprehensive Income

for the six months ended 30 June 2020

Six months Six months Year ended

ended ended 31 December

30 June 2020 30 June 2019 2019

(unaudited) (unaudited) (audited)

USD'000 USD'000 USD'000

Income

Income from life settlement

portfolios 399 372 752

Gains from life settlement

portfolios 605 12,800 18,091

Other income 6 47 601

Net foreign exchange loss (6) (12) (17)

______ ______ ______

Total income 1,004 13,207 19,427

Operating expenses

Investment management fees 53 (2,174) (3,655)

Other expenses (2,758) (2,295) (4,447)

______ ______ ______

(Loss)/profit before finance

costs and taxation (1,701) 8,738 11,325

Finance costs

Interest payable (615) (632) (1,185)

______ ______ ______

(Loss)/profit before taxation (2,316) 8,106 10,140

Taxation 16 (70) (130)

______ ______ ______

(Loss)/profit for the period (2,300) 8,036 10,010

Contribution from merger

of Share Classes D & E 508 - -

______ ______ ______

(Loss)/profit for the period (1,792) 8,036 10,010

====== ====== ======

EXHIBIT I (unaudited)

Life Settlement Assets Plc

Class A Shares

Statement of Financial Position

as at 30 June 2020

As at As at As at

30 June 30 June 31 December

2019

2020 2019 (audited)

(unaudited) (unaudited) USD'000

USD'000 USD'000

ASSETS

Non-current assets

Financial assets at fair

value through profit or

loss:

- Life settlement investments 69,996 62,488 58,131

______ ______ ______

69,996 62,488 58,131

Current assets

Maturities receivables 10,569 8,099 2,822

Trade and other receivables 491 702 377

Premiums paid in advance 8,151 7,359 6,536

Cash and cash equivalents 13,096 23,263 23,995

Inter-class receivables 208 842 219

______ ______ ______

32,515 40,265 33,949

______ ______ ______

Total assets 102,511 102,753 92,080

______ _______ ______

Current liabilities

Other payables (5,465) (1,580) (659)

Provision for performance

fees (4,407) (1,486) (2,313)

______ ______ ______

Total liabilities (9,872) (3,066) (2,972)

______ ______ ______

Net assets 92,639 99,687 89,108

====== ====== ======

Represented by

Capital and reserves

Share capital 437 455 399

Special reserve 83,501 95,006 82,454

Capital redemption reserve 128 - 56

Capital reserve 26,044 13,132 17,667

Revenue reserve (17,471) (8,906) (11,468)

______ ______ ______

Total equity attributable

to ordinary shareholders 92,639 99,687 89,108

of the Company ====== ====== ======

EXHIBIT II (unaudited)

Life Settlement Assets Plc

Class B Shares

Statement of Comprehensive Income

for the six months ended 30 June 2020

Six months Six months Year ended

ended ended 31 December

30 June 30 June 2019 2019

2020

(unaudited) (unaudited) (audited)

USD'000 USD'000 USD'000

Income

Income from life settlement portfolios 6 19 31

Losses from life settlement portfolios (783) (899) (755)

Other income 49 8 116

______ _____ ______

Total income (728) (872) (608)

Operating expenses

Investment management fees (111) (121) (242)

Other expenses (223) (253) (432)

______ _____ ______

Loss before finance costs and

taxation (1,062) (1,246) (1,282)

Finance costs

Interest payable (1) (2) (4)

______ _____ ______

Loss before taxation (1,063) (1,248) (1,286)

Taxation - - -

______ _____ ______

Loss for the period (1,063) (1,248) (1,286)

===== ==== =====

EXHIBIT II (unaudited)

Life Settlement Assets Plc

Class B Shares

Statement of Financial Position

as at 30 June 2020

As at As at As at

30 June 30 June 31 December

2020 2019 2019

(unaudited) (unaudited) (audited)

USD'000 USD'000 USD'000

ASSETS

Non-current assets

Financial assets at fair

value through profit or

loss:

Life settlement investments 10,722 9,832 10,739

______ ______ _______

10,722 9,832 10,739

Current assets

Maturities receivables 541 1,169 513

Trade and other receivables 109 114 113

Premiums paid in advance 1,401 1,828 1,385

Cash and cash equivalents 1,325 2,781 2,269

______ ______ _______

3,376 5,892 4,280

______ ______ _______

Total assets 14,098 15,724 15,019

______ ______ _______

Current liabilities

Other payables (90) (482) (122)

Inter class payables (208) (341) (34)

______ ______ _______

Total liabilities (298) (823) (156)

______ ______ _______

Net assets 13,800 14,901 14,863

===== ===== ======

Represented by

Capital and reserves

Share capital 146 146 146

Special reserve 18,458 18,459 18,458

Capital reserve (3,332) (2,696) (2,552)

Revenue reserve (1,472) (1,008) (1,189)

______ ______ _______

Total equity attributable 13,800 14,901 14,863

to ordinary shareholders ====== ====== ======

of the Company

COMPANY INFO RMATION

Directors

Michael Baines Chairman

Christopher Casey

Robert Edelstein

Franck Mathé

Yves Metz

Guner Turkman

Registered Office

115 Park Street

4th Floor

London W1K 7AP

Auditors

BDO LLP

55 Baker Street

London

W1U 7EU

Trust's Investment Manager

Acheron Capital Limited

115 Park Street

4th Floor

London W1K 7AP

Share Registrars

Link Asset Services

34 Beckenham Road

Beckenham

Kent BR3 4TU

Brokers

Shore Capital

Cassini House

57 St James Street

London

SW1A 1LD

Company Secretary

ISCA Administration Services Limited

Suite 8,

Bridge House

Courtenay Street

Newton Abbot

TQ12 2QS

Email: lsa@iscaadmin.co.uk

Telephone: 01392 487056

LEI: 2138003OL2VBXWG1BZ27

Website - https://www.lsaplc.com

Registered in England and Wales with Company Registration

number: 10918785

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UBANRROUKUAR

(END) Dow Jones Newswires

September 28, 2020 02:00 ET (06:00 GMT)

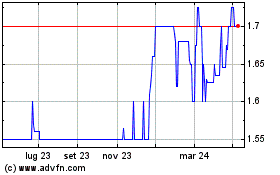

Grafico Azioni Life Settlement Assets (LSE:LSAA)

Storico

Da Mar 2024 a Apr 2024

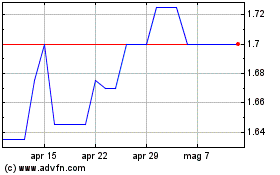

Grafico Azioni Life Settlement Assets (LSE:LSAA)

Storico

Da Apr 2023 a Apr 2024