TIDMLSAA TIDMLSAB TIDMLSAD TIDMLSAE

RNS Number : 5009I

Life Settlement Assets PLC

02 April 2020

Life Settlement Assets PLC

LEI: 2138003OL2VBXWG1BZ27

(the "Company" or "LSA")

Publication of circular

Further to the announcement on 18 December 2019 relating to the

Company's share capital structure, the Company has today posted a

Circular (the "Circular") in respect of the recommended proposals

for the Merger of the A, D and E Ordinary Share Classes and notice

of a General Meeting and A, D and E Ordinary Share Class

Meetings.

Introduction and background

The Company announced on 18 December 2019 that it was

considering merging the Company's four Share Classes in order to

enhance liquidity and eliminate certain of the administrative costs

and inefficiencies of operating multiple portfolios comprised of

similar assets.

Reflecting the development of the Company through the

acquisition of different portfolios of whole and fractional

interests in life settlement policies at different times, where

each was placed into a separate asset trust and reflected by a

separate Share Class, the Company now has a resulting structure

which investors find difficult to navigate and is both more complex

and modestly more costly to administer. The Ordinary Shares in

issue as at the date of this Circular, and their attributable NAVs

as at 29 February 2020, are as follows:

Share Class NAV (US$m) Ordinary Shares in

issue

A Ordinary Share Class 89.2 39,891,391

----------- -------------------

B Ordinary Share Class 14.1 14,596,098

----------- -------------------

D Ordinary Share Class 7.7 8,792,561

----------- -------------------

E Ordinary Share Class 3.6 1,566,603

----------- -------------------

The Board has considered whether to include the B Ordinary Share

Class in the proposed Merger of Share Classes, but after careful

analysis the Board believes there would be no material benefit to

the B Ordinary Shareholders in including the B Ordinary Share Class

in the proposed Merger at this stage because of the shorter

maturity profile of this portfolio. However, this will be kept

under review and may be reconsidered at a later date depending on

how the projected maturities develop.

Overall, the Directors believe that the simplified share class

structure should provide both improved liquidity for the holders of

the merged Share Classes and a clearer investment case for new

investors in the future as well as the potential for nearer term

cashflow enhancements to the existing A Ordinary Shareholders.

Accordingly, after careful consideration of these factors, based on

the terms set out below, the Board has determined that it is in the

best interests of the Shareholders as a whole to merge the A, D and

E Ordinary Share Classes (the "A/D/E Merger").

Benefits of the A/D/E Merger

Merging the relatively small D and E Ordinary Share Classes

would provide a helpful simplification of the Company's structure.

Also, the A Ordinary Shareholders will benefit from expected

improved cash flows over the next few years and a reduced focus on

HIV-related maturities arising from the inclusion of the D and E

Ordinary Share Class portfolios. Shareholders of the merged Share

Classes will also achieve an additional benefit of consolidating

the underlying fractional Policies into the larger asset portfolio

resulting from the Merger, reducing the reliance on the performance

of third parties (which are exposed to the same Policies as the

Company) for the creation of value.

In addition to achieving some modest cost savings from merging

the A, D and E classes, the Board has already undertaken the merger

of the underlying trusts which hold the Company's investments into

one trust which is expected to yield more significant cost savings

in the region of US$250,000 per annum.

Terms of the A/D/E Merger

In considering the terms of the A/D/E Merger, the Board has

discussed the proposals with its Investment Manager, Acheron

Capital Limited, and has been mindful that Jean-Michel Paul, the

principal of the Investment Manager, indirectly holds approximately

2.79% of the A Ordinary Shares, 2.43% of the B Ordinary Shares,

80.9% of the D Ordinary Shares, and 95.8% of the E Ordinary Shares,

noting that he has a controlling position in both the D and E

Ordinary Share Classes. He also holds a 30% non-controlling

interest in a company which holds approximately 28.8% of the B

Ordinary Shares. All the members of the Board are independent of

the Investment Manager and none are interested in either the D or E

Ordinary Shares.

The proposed terms of the A/D/E Merger are that the D and E

Ordinary Share Classes be merged into the A Ordinary Share Class by

re-designating a proportion of the D and E Ordinary Shares as A

Ordinary Shares on a share-for-share basis at the NAVs attributable

to the A, D and E Ordinary Shares as at 30 April 2020. The

attributable NAVs will be calculated using the audited NAVs as at

31 December 2019 and adjusting for subsequent maturities and other

trading events that have arisen between 31 December 2019 and 29

February 2020, and will be subject to such further adjustments as

the Board considers to be necessary in order to reflect significant

changes in the financial position of the relevant Share Class

between 1 March 2020 and the Calculation Date. Any remaining D and

E Ordinary Shares will be re-designated as Deferred Shares with

nominal value.

As part of the arrangements negotiated with the Investment

Manager for the proposed A/D/E Merger, the Board has considered the

accrued but unpaid investment management performance fees

attributable to the D and E Ordinary Share Classes and also the

existing prepayment of annual premiums in respect of the policy

interests of those Share Classes. The Board has agreed that these

accrued performance fees should be paid as a result of the

implementation of the A/D/E Merger and note that it would in any

event be impracticable to continue to monitor performance fees on

the pre-Merger basis. In addition, the D and E Share Classes will

be entitled to a proportion (based on cash availability) of the

approximately $1.53 million of premiums prepaid in respect of the

current financial year for the Policies in which they have

beneficial interests, such amount to be paid by way of a special

dividend. Repayment of prepaid premiums is considered normal in

settling contracts for the transfer of policies, and, in any case,

the amount of this special dividend will be reflected in

calculating NAV for the purposes of the Merger. The accrued

performance fees will be partly paid out of available cash held by

the D and E Ordinary Share Classes after payment of the special

dividend with the remainder payable no later than 31 December 2020

and funded from cash receipts post-Merger.

The implementation of the A/D/E Merger is conditional upon the

Company having received certain Shareholder approvals. If the

Company receives all requisite Shareholder approvals except for

those proposed at the A Ordinary Share Class Meeting, the Company

will instead merge the D Ordinary Share Class with the E Ordinary

Share Class (the "D/E Merger"). The D/E Merger is similarly

expected to reduce administrative inefficiencies in respect of the

D and E Ordinary Share Classes. In this Circular, the capitalised

term "Merger" means either the A/D/E Merger or the D/E Merger (as

the case may be).

If neither the A/D/E Merger nor the D/E Merger is approved, the

Company will continue operating as it has done to date.

Coronavirus pandemic

The Board is very much aware of the current coronavirus

pandemic. Whilst there can be no guarantee that there will be no

business interruption, to date there has been no impact on the

administration of the Company or its assets and the Board has

received details from its key service providers of the steps they

are taking to protect their employees and operations. In addition,

the Board draws the attention of Shareholders to the fact that the

outbreak of coronavirus could (under certain scenarios) cause a

rise in mortality rates which would accelerate the maturity profile

of the Company's life settlement interests over the forthcoming

months.

Amendments to The Articles

The Articles do not currently contemplate the ability to merge

Share Classes and will therefore need to be amended in order to

facilitate the Merger. Accordingly, the New Articles will:

(a) reflect the changes to the Share Classes resulting from the

Merger;

(b) set out the rights attaching to the Deferred Shares; and

(c) allow for future mergers of Share Classes (subject to

Shareholder approval).

At the same time, the Company proposes to make certain minor

changes to the Articles to remove definitions and articles which

refer to redeemable preference shares and the restructuring and

liquidation of Acheron Portfolio Corporation (Luxembourg) S.A., as

these definitions and articles are now redundant.

Shareholder Meetings and recommendation

Notices convening the General Meeting and the separate A

Ordinary Share Class Meeting, D Ordinary Share Class Meeting and E

Ordinary Share Class Meeting, to be held at 14.00 p.m., 14.05 p.m.,

14.10 p.m. and 14.15 p.m. respectively on 28 April 2020, each at

Isca Administration Services Limited, Suite 8, Bridge House,

Courtenay Street, Newton Abbot, TQ12 2QS, are set out in the

Circular.

The Board considers that the A/D/E Merger, or the D/E Merger if

the A/D/E Merger is not approved, is in the best interests of the

Company and its Shareholders as a whole. Accordingly, the Board

unanimously recommends Shareholders to vote in favour of the

Resolutions to be proposed at the Shareholder Meetings.

Michael Baines, Chairman of LSA, said:

"The Board believes that there are important benefits to

shareholders arising from this transaction, including a simplified

share class structure, improved liquidity, and a clearer investment

case for new investors. Completion of the transaction should better

position the Company for the next phase of its development."

Expected timetable

2020

Latest time and date for receipt of 14.00 p.m. on 24 April

proxy votes for the General Meeting

-----------------------

Latest time and date for receipt of 14.05 p.m. on 24 April

proxy votes for the A Ordinary Share

Class Meeting

-----------------------

Latest time and date for receipt of 14.10 p.m. on 24 April

proxy votes for the D Ordinary Share

Class Meeting

-----------------------

Latest time and date for receipt of 14.15 p.m. on 24 April

proxy votes for the E Ordinary Share

Class Meeting

-----------------------

Latest date for dealing in D Ordinary 28 April

Shares and E Ordinary Shares in respect

of the A/D/E Merger, or dealing in D

Ordinary Shares in respect of the D/E

Merger

-----------------------

General Meeting 14.00 p.m. on 28 April

-----------------------

A Ordinary Share Class Meeting 14.05 p.m. on 28 April

-----------------------

D Ordinary Share Class Meeting 14.10 p.m. on 28 April

-----------------------

E Ordinary Share Class Meeting 14.15 p.m. on 28 April

-----------------------

Announcement of the results of the General 28 April

Meeting, A Ordinary Share Class Meeting,

D Ordinary Share Class Meeting and E

Ordinary Share Class Meeting

-----------------------

Calculation Date 30 April

-----------------------

Record Date for the entitlement of D Close of business on

Ordinary Shareholders and E Ordinary 30 April

Shareholders to their new holdings of

A Ordinary Shares in respect of the

A/D/E Merger, or the entitlement of

D Ordinary Shareholders to their new

holdings of E Ordinary Shares in respect

of the D/E Merger

-----------------------

CREST accounts credited for revised 5 May

holdings of new A Ordinary Shares or

new E Ordinary Shares (as applicable)

-----------------------

Expected despatch of share certificates Week commencing 11 May

for holdings of new A Ordinary Shares

or new E Ordinary Shares (as applicable)

-----------------------

Notes:

Each of the times and dates in the above timetable is subject to

change and may be extended or brought forward without further

notice. The Company will notify investors of any such changes to

these times and dates by making an announcement via a Regulatory

Information Service.

References to times are to London times unless otherwise

stated

Enquiries:

Life Settlement Assets plc

Michael Baines (Chairman)

020 7258 5990

Acheron Capital Limited (Investment Manager)

Jean-Michel Paul

020 7258 5990

Shore Capital (Financial Adviser and Broker)

Robert Finlay

020 7601 6115

ISCA Administration Services Limited

Company Secretary

01392 487056

Notes to Editors

LSA is a closed-ended investment company which manages

portfolios of whole and fractional interests in life settlement

policies issued by life insurance companies operating predominantly

in the United States. The life settlement market enables

individuals to sell their life insurance policies to investors at a

higher cash value than they would otherwise receive from insurance

companies (if they were cancelled or surrendered at the date of

sale). The Company aims to manage portfolios of life settlement

products so that the realised value of the policy maturities

exceeds the aggregate cost of acquiring the policies, ongoing

premiums, management fees and other operational costs. LSA was is

listed on the Specialist Fund Segment of the Main Market of the

London Stock Exchange.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NOGBFLLBBZLLBBX

(END) Dow Jones Newswires

April 02, 2020 02:00 ET (06:00 GMT)

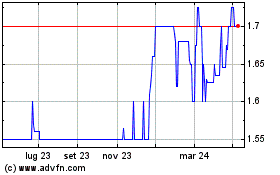

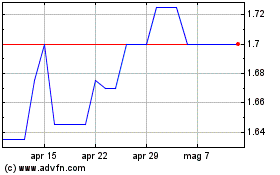

Grafico Azioni Life Settlement Assets (LSE:LSAA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Life Settlement Assets (LSE:LSAA)

Storico

Da Apr 2023 a Apr 2024