Pound Appreciates On Recovery Hopes

02 Febbraio 2021 - 7:35AM

RTTF2

The pound firmed against its major counterparts in European

deals on Tuesday, as a faster pace of the U.K. vaccine rollout

spurred hopes of a quick recovery.

The upbeat market mood and receding speculation over negative

rates in the near term also underpinned the currency.

Stimulus worries eased after U.S. Senator Susan Collins said a

group of Republican U.S. senators held productive discussions with

Democratic President Joe Biden about Covid-19 relief.

There were areas of agreement in the White House meeting, while

"the president also reiterated his view that Congress must respond

boldly and urgently," White House Press Secretary Jen Psaki

said.

Market participants focus on the Bank of England's monetary

policy decision on Thursday, when it will also publish its findings

on negative interest rates.

Data from the Nationwide Building Society showed that U.K. house

prices growth slowed in January for the first time in six

months.

House prices climbed 6.4 percent on a yearly basis, but weaker

than the 7.3 percent increase logged in December. Economists had

forecast an annual growth of 6.9 percent.

The pound spiked up to 0.8795 against the euro, its highest

since May 2020. On the upside, 0.86 is possibly seen as its next

resistance level.

The pound bounced off from a 4-day low of 143.26 against the

yen, with the pair trading at 143.77. The pound may test resistance

around the 145.00 level.

The pound edged up to 1.2283 against the franc from Monday's

close of 1.2249. If the pound rises further, 1.24 is possibly seen

as its next resistance level.

In contrast, the pound gave up some of its early gains against

the greenback and was trading at 1.3677. The pound is poised to

target support around the 1.34 level.

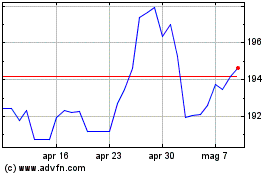

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Mar 2024 a Apr 2024

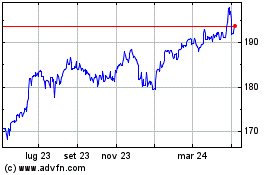

Grafico Cross Sterling vs Yen (FX:GBPJPY)

Da Apr 2023 a Apr 2024