Singapore's Temasek to Slow Investments Amid Global Economic Worries -- Update

10 Luglio 2018 - 10:52AM

Dow Jones News

By P.R. Venkat and Gaurav Raghuvanshi

SINGAPORE--Singapore's Temasek Holdings Pte. Ltd. will slow its

investment pace over the next one to two years due to concerns

about the global economy, especially given trade tensions.

The Singapore state investment firm invested 29 billion

Singapore dollars (US$22 billion) in sectors including technology,

life sciences and nonbank financial services in the fiscal year

that ended March 31. During that period, some of the companies that

Temasek invested in included U.S firm Global Healthcare Exchange

LLC, an exchange for health care providers, and Chinese tech giant

Tencent Holdings Ltd. (0700.HK).

So far this year, Temasek has participated in the US$14 billion

fundraising by Ant Financial, the Chinese fintech firm that

operates the Alipay payments platform. It also invested 3 billion

euros (US$3.5 billion) to increase its stake in Bayer AG

(BAYN.XE).

"We continue to maintain a disciplined approach. Given the

market outlook, we may recalibrate and slow our investment pace

over the next nine to 18 months," Alpin Mehta, Temasek's managing

director of investments, said.

Temasek has stakes in companies like Standard Chartered PLC

(STAN.LN) and China Construction Bank Ltd. (0939.HK). It also owns

controlling stakes in some of Singapore's largest companies, from

airlines to ports. Its net portfolio value for the period ended

March. 31 rose 12% to S$308 billion from S$275 billion a year

earlier.

It said it will seek opportunities in sectors that ride on

"transformational" technologies and changing consumption patterns

of rising middle class populations.

During the past year, the company's investment in the U.S. took

a larger share, followed by China and Europe. Temasek has stepped

up its exposure to the U.S and Europe, which now account for nearly

a quarter of its overall portfolio.

During the last fiscal year, divestments totaled S$16 billion,

including the sale of stake in Swiss duty-free stores Dufry AG

(DUFN.EB) and a partial divestment of its stake in Industrial &

Commercial Bank of China Ltd. (1398.HK).

Michael Buchanan, Temasek's head of strategy, said that the

chances of "broader and wider" trade tensions were higher than

before. However, a full-blown trade war isn't expected at this

stage, he added.

Temasek officials also said that downside risks to the global

economy have increased in the near term, amid rising global

interest rates and political risks in Europe.

Net profit last fiscal year rose to S$21 billion from S$14

billion and the company said its balance sheet gives it the

flexibility to ride out short-term market volatility.

Write to Gaurav Raghuvanshi at gaurav.raghuvanshi@wsj.com and

P.R. Venkat at venkat.pr@wsj.com

(END) Dow Jones Newswires

July 10, 2018 04:37 ET (08:37 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

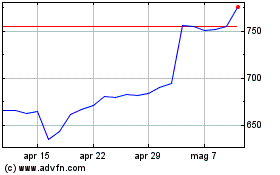

Grafico Azioni Standard Chartered (LSE:STAN)

Storico

Da Mar 2024 a Apr 2024

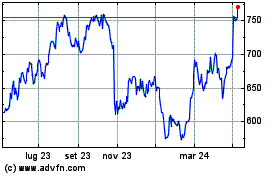

Grafico Azioni Standard Chartered (LSE:STAN)

Storico

Da Apr 2023 a Apr 2024