Finance Chiefs Say Too Much Data Is Making It Harder to Keep on Top of Risks

19 Luglio 2018 - 12:33PM

Dow Jones News

By Nina Trentmann and Ezequiel Minaya

Corporate finance chiefs say forming a cohesive and complete

assessment of a company from proliferating data streams in an

increasingly digital workplace has emerged as a top challenge.

Faced with the mission to modernize systems and processes to

keep pace with competitors amid increasing global risk, only 39% of

more than 670 finance executives around the world said they are

highly confident about managing their company's risks, according to

a survey by Workday Inc., a digital technology provider, released

Thursday.

Data and the ability to make sense of it has become critical for

companies in recent years, as the digitization of the global

economy picks up pace. Risks such as international trade frictions

or volatile currency markets put the spotlight on CFOs and their

ability to swiftly assess available information and respond to

these threats, a task made easier with advanced analytics and

visibility across both operational and financial data.

Finance chiefs often lack the relevant skills within their

teams, and those in the C-suite fail to collaborate effectively,

according to the survey. Workday and Longitude Research Ltd.

surveyed executives in 17 countries including the U.S., Canada, the

U.K., Germany and China. Over a third were from companies with

annual revenues of more than $1 billion.

"Finance as a department is lagging behind in supporting the

transformation toward more digital companies," said Betsy Bland, a

vice president in Workday's financial management division.

"Businesses will be at risk of not surviving if they don't make

changes," she added.

Companies including recruiter Hays PLC, containership lessor

Seaspan Corp., drinks maker Pernod Ricard SA, pharmaceuticals firm

Roche Holding AG and insurer AXA SA are already streamlining data

to increase visibility into their operations.

Hays started its data transformation process in 2008 and invests

about GBP10 million ($13 million) a year on updating its systems,

the company said. Part of that goes toward integrating nonfinancial

information, which is automatically loaded into the finance system

in a process that doesn't require the information to be

reconciled.

"We all have one version of the truth... our systems talk to

each other" Chief Financial Officer Paul Venables said. "If your

systems don't talk to each other, you will end up doing a lot of

work in excel, outside of your systems," he said.

Seaspan is spending a "significant" amount on improving its data

to maintain its current share of 8% of the global containership

letting market, at a time of heightened technological change, said

finance chief Ryan Courson. Seaspan analyzes reams of data -- for

example on pricing, vessel speed and fuel consumption -- that all

converge in the finance function.

"CFOs sit on a tremendous data asset," said Eric Dowdell, global

head of trade credit at Dun & Bradstreet Corp. He advises

companies on how to manage their data to reduce credit, fraud and

other risks, a process that takes six to 12 months before yielding

the first results.

Bryan Corkal, finance chief of fertilizer maker Anuvia Plant

Nutrients, said he would "love to have real time production data,"

from manufacturing operations as the company is seeking to expand

aggressively. He is looking to fine-tune the usage of chemicals and

other raw materials, to assess the efficiency of labor and ferret

out any bottlenecks to production.

"I think it has to do with the life cycle of a company," he

said. "At what time does cost management become a strategic driver?

I know that the quality people feel the same way in the use of data

to improve quality."

Mr. Corkal, who joined the Zellwood, Fla., company in June,

plans to expand to Anuvia's data landscape. Anuvia spends roughly

1% of annual revenue on software and consultants. Four employees

currently dedicate about a fifth of their time to the data

initiative, though Mr. Corkal expects that to increase as he seeks

to gather real-time production data.

Hiring and training the right talent is key when making these

changes. Nearly 75% of survey respondents said that finance roles

will have to be redefined amid the rise of robotics and artificial

intelligence. CFOs need to hire data scientists, statisticians,

data security professionals and IT delivery specialists to master

the transition of their department, the Workday survey said.

Seaspan is bringing in people with a background in computer

science, said Mr. Courson.

Write to Nina Trentmann at Nina.Trentmann@wsj.com and Ezequiel

Minaya at ezequiel.minaya@wsj.com

(END) Dow Jones Newswires

July 19, 2018 06:18 ET (10:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

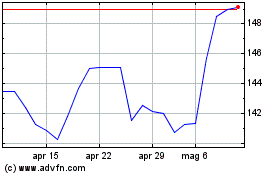

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Mar 2024 a Apr 2024

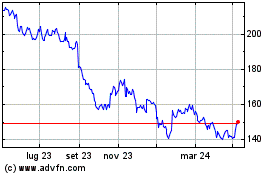

Grafico Azioni Pernod Ricard (EU:RI)

Storico

Da Apr 2023 a Apr 2024