Broadcom Profit Surges as Enterprise Storage Business Grows -- Update

07 Settembre 2018 - 3:29AM

Dow Jones News

By Maria Armental

Broadcom Inc. plans to substantially raise payouts to

shareholders on the back of strong results that mark the sixth

straight quarter of more-than-doubled profit.

In the first earnings call since the company announced plans to

buy software company CA Inc., news that had hit Broadcom's stock

hard, Chief Executive Hock Tan defended the proposed deal saying

that CA offers a "big doorway," a "new and huge opportunity."

"We're buying CA because of their customers and [CA's]

importance to these customers," Mr. Tan said in the Thursday call

reviewing third-quarter results. "CA sells mission-critical

software to virtually all of the world's largest enterprises."

The proposed $19 billion takeover, months after its $117

billion-plus hostile bid for Qualcomm Inc. was blocked by President

Trump, represents a strategic move for Broadcom and would roughly

triple the size of its current opportunity in the estimated $200

billion market for infrastructure technology, Broadcom finance

chief Tom Krause had previously told The Wall Street Journal in an

interview.

Meanwhile, enterprise storage revenue, up nearly 60% three

quarters into the company's business year, has been bolstered by

last year's Brocade acquisition. Stripping out the Brocade

contribution, Mr. Tan told analysts in June, that the business

would be roughly flat year-over-year.

On Thursday's call, Mr. Krause said the company had fielded

questions and stressed that the company doesn't see any fundamental

changes in its long-term growth rate or that of its core

business.

In the most recent quarter, company officials said, the wired

infrastructure and enterprise storage segments again drove revenue

growth, offsetting continued weakness in wireless communications

segment. The wireless communications segment, Messrs. Tan and

Krause said Thursday, is expected to return to double-digit revenue

growth in fiscal 2020, following a temporary dip in fiscal

2019.

The enterprise storage segment, which got a big revenue boost

from the Brocade acquisition, saw revenue in the latest period

increase 70% from the year-ago period. But even without the Brocade

contribution, Mr. Tan said, "storage was robust year-over-year in

the third quarter" and storage revenue growth is expected to

accelerate in the fourth quarter.

Overall, Broadcom's third-quarter profit surged to $1.2 billion,

or $2.71 a share, from $481 million, or $1.14 a share, a year

earlier. Profit from continuing operations rose to $4.98 a share

from $4.10 a share a year earlier, while revenue from continuing

operations rose 13% to $5.07 billion.

Analysts surveyed by Thomson Reuters expected a profit of $2.70

a share, or $4.83 as adjusted, on $5.07 billion in revenue.

Gross profit margin improved to 51.7% from 48.2% a year

earlier.

This quarter, Broadcom expects about $5.4 billion in revenue,

compared with analysts' projected $5.35 billion.

Based on that forecast and the company's performance for the

first nine months of the year, Mr. Krause said Broadcom anticipates

"another substantial increase" in quarterly dividend payouts.

In December, Broadcom raised the dividend payouts to $1.75 a

share from $1.02 a share.

Broadcom's policy is to distribute half of its prior fiscal year

free cash flow to shareholders through cash dividends, with the

remainder of the money typically being used for acquisitions or to

buy back stock.

As of Aug. 5, Broadcom reported more than $2 billion///$2.13

billion ///in free cash flow.

Shares, which lag the market with a 16% decline this year, rose

3.7% to $223.94 in after-hours trading.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

September 06, 2018 21:14 ET (01:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

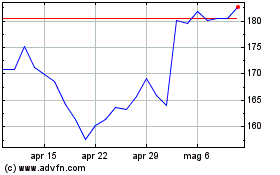

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mar 2024 a Apr 2024

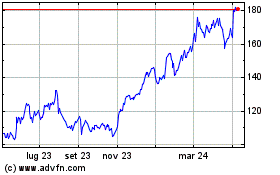

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2023 a Apr 2024