EUROPE MARKETS: Michelin Helps Drive Gains For Europe As Investors Eye Trade Deal, U.S. Politics

12 Febbraio 2019 - 2:37PM

Dow Jones News

By Emily Horton

Michelin soars on upbeat results, outlook

European indexes were positive on Tuesday, with auto-part

companies gaining after upbeat results from Michelin and investors

optimistic about a potential trade deal and hopes the U.S. can

avoid another damaging government shutdown.

How are markets performing?

The Stoxx Europe 600 rose 0.4% to 362.66 in Tuesday, after the

index finished up 0.9% on Monday.

Germany's DAX 30 led the regions gainers, adding 1.1% to

11,137.18. As well, Italy's FTSE MIB climbed by 1.1%, while

France's CAC 40 rose by 0.9% to 5,060.35. The Spanish IBEX 35 index

rose by 0.7% to 9000.90.

The FTSE 100 was flat at 7,132.45.

The euro fell slightly to $1.1291 on Tuesday, from $1.1278 late

Monday in New York, while the pound dipped to $1.2869 from

$1.1278.

What's driving the markets?

In the U.S., Democratic and Republican lawmakers said late

Monday that a deal had been reached to avert another damaging

government shutdown, though U.S. President Donald Trump will still

need to put his final stamp of approval on the border-wall funding

agreement

(http://www.marketwatch.com/story/lawmakers-reach-border-security-deal-that-would-avert-shutdown-2019-02-11).

Investors also remain glued to ongoing trade talks in China,

entering a second day. Trump senior adviser Kellyanne Conway told

Fox News & Friends that Trump and China President Xi Jinping

seem nearer a trade deal

(https://www.newsmax.com/newsfront/kellyanne-conway-trade/2019/02/11/id/902146/).

Treasury Secretary Steven Mnuchin and U.S. Trade Representative

Robert Lighthizer are due to arrive Thursday for more high-level

discussions as a March 2 agreement deadline between the two

countries looms.

In the U.K., Prime Minister Theresa May will plead with

parliament to give her two more weeks to improve her Brexit deal

(http://www.marketwatch.com/story/brexit-brief-theresa-may-plays-for-time-with-brexit-rebels-2019-02-12).

The PM is expected to ask U.K. politicians to not to hinder her

efforts to win concessions from Brussels while talks are

ongoing.

What shares were active?

Shares of Compagnie Generale des Etablissements Michelin (ML.FR)

climbed 11% Tuesday, boosting rivals as investors cheered the

French tire maker's results

(http://www.marketwatch.com/story/michelin-shares-jump-on-upbeat-results-outlook-2019-02-12)

and outlook for the year. Continental AG (CON.XE) and Pirelli &

C. SpA (PIRC.MI) shares rose 4% and nearly 5% higher,

respectively.

Other autos-related stocks also rose, with Daimler AG (DAI.XE)

up 2% and Volkswagen AG (VOW.XE) adding 3.6%.

Gucci owner Kering (KER.FR) said its net profit had doubled in

2018 and raised its dividend for the year

(http://www.marketwatch.com/story/kering-profit-more-than-doubles-lifts-dividend-2019-02-12)

on Tuesday, but shares dropped by 2%. ING analysts said in a note

to clients that the upbeat results had largely been priced into the

stock and the company still had "little performance potential."

But Kering's results reassured other luxury brands that the

Chinese still have an appetite for luxury goods despite the

country's economic slowdown. Moet Hennessy Louis Vuitton SE (LVMUY)

gained 2% and Burberry Group PLC (BRBY.LN) added 0.7%.

Thyssenkrupp AG (TKA.XE) dropped by 2% after the company

reported a profit gain

(http://www.marketwatch.com/story/thyssenkrupp-profit-up-says-uncertainties-growing-2019-02-12),

but cited risks from economic and political uncertainties.

TUI AG lost 3% after the travel company said net losses for the

first quarter widened

(http://www.marketwatch.com/story/tui-loss-widens-but-lower-margins-for-bookings-2019-02-12)due

to the unusually long and hot summer in Northern Europe.

French car maker Renault SA (RNO.FR) lost 0.4% after it

confirmed that former chief executive Carlos Ghosn will still holds

other positions with the group

(https://www.marketwatch.com/story/renault-carlos-ghosn-still-).

Metro AG (B4B.XE) climbed by 3%, after the German retailer

announced upbeat sales

(http://www.marketwatch.com/story/metro-profit-off-13-but-same-store-sales-upbeat-2019-02-12).

(END) Dow Jones Newswires

February 12, 2019 08:22 ET (13:22 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

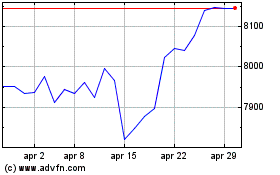

Grafico Indice FTSE 100

Da Mar 2024 a Apr 2024

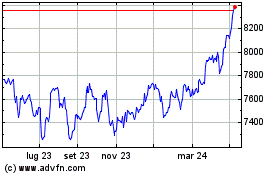

Grafico Indice FTSE 100

Da Apr 2023 a Apr 2024