Lloyds Banking Group Suspends Buyback Program After Spike in PPI Claims

09 Settembre 2019 - 8:52AM

Dow Jones News

By Carlo Martuscelli

Lloyds Banking Group PLC (LLOY.LN) said Monday that it was

suspending its share buyback program following a spike in

information requests over missold payments protection

insurance.

The British banking group said it now expects to book 1.2

billion to 1.8 billion pounds ($1.47 billion-$2.21 billion) in

PPI-related charges in its third-quarter results. This is after a

surge in complaints in the final month before the deadline.

Around GBP600 million of capital that was allocated to buy back

shares from the market will now be held in reserve, Lloyds Banking

Group said. However, the company said it continues to target a

progressive ordinary dividend at the year end.

The lender said it has revised its guidance downward. It is no

longer targeting a yearly capital build of 170 basis points to 200

basis points, and a statutory return on tangible equity of 12% for

2019.

The banking group joins a number of other financial services

companies that have had to book unexpected charges relating to

missold PPI-claims, including Royal Bank of Scotland Group PLC

(RBS.LN) and CYBG PLC (CYBG.LN).

Write to Carlo Martuscelli at carlo.martuscelli@dowjones.com

(END) Dow Jones Newswires

September 09, 2019 02:37 ET (06:37 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

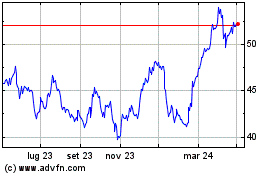

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024