By David Benoit, Maureen Farrell and Liz Hoffman

Banks jockeying for a role in WeWork's public debut wooed

founder Adam Neumann with sky-high valuations that would make him a

billionaire many times over. Their loans to the company told a

different story.

JPMorgan Chase & Co., Goldman Sachs Group Inc. and other

banks arranged giant fees and strict protections that reflected

their concerns about WeWork's unproven business model and Mr.

Neumann's unpredictable behavior.

When Wells Fargo & Co. signed on to a $6 billion loan

earlier this year, Mr. Neumann said: "If the largest lender in this

country can get comfortable with this, then everybody should."

Yet Wells Fargo, the fourth-largest U.S. bank, only started

lending to WeWork after an executive at the bank promised to keep

an eye on Mr. Neumann, according to people familiar with the

matter.

Banks harbored significant doubts about We Co., as the WeWork

parent is known, even as they pitched its stock to investors,

according to interviews and documents reviewed by The Wall Street

Journal. Running out of cash, the company was rescued last month by

Japanese conglomerate SoftBank Group Corp. in a deal that bounced

Mr. Neumann.

WeWork's unraveling has hit hardest the wallets and reputations

of SoftBank and other venture-capital investors who enabled Mr.

Neumann and his company's rise. But with its money and credibility,

Wall Street also fed the company's breakneck growth and its image

as a superhot technology company.

WeWork's model -- leasing office space, outfitting it with

touches like free beer and fruit-infused water, then subleasing it

-- required a constant supply of credit. Landlords demanded bank

letters that guaranteed several months of rent upfront. These

letters could be recycled as the short-term pledges expired.

JPMorgan was one of the biggest lenders to WeWork and to Mr.

Neumann, who counted CEO James Dimon and asset-management chief

Mary Erdoes, whose division had lent to Mr. Neumann, among his

confidants.

In 2015, JPMorgan led a group of banks extending a $650 million

loan to WeWork. Two years later, the company went back for another

$500 million, and Wells Fargo joined the group.

Wells Fargo bankers acknowledged internally that WeWork's

business model was unproven but agreed to lend $100 million if the

company set aside cash as collateral, according to people familiar

with the matter and a memo reviewed by the Journal.

WeWork would be a profitable client in Silicon Valley, where

Wells Fargo doesn't have a strong presence, they argued in the

memo. It also could land the bank a role in WeWork's IPO and future

stock sales, which the bankers estimated could bring in $12 million

in fees, according to the internal memo about whether to approve

the loan.

An internal committee initially rejected the loan, raising

concerns about the company's prospects and Mr. Neumann's style, the

people said. Roy March, the head of Wells Fargo's Eastdil

real-estate unit, assured executives he was close to Mr. Neumann

and would personally mentor him, the people familiar with the

situation said. Perry Pelos, a top Wells Fargo executive,

ultimately signed off after several appeals, the people said. Wells

Fargo sold most of Eastdil this year.

This summer, as WeWork prepared to go public, Mr. Neumann told

friends a new round of bank financing would "blow the market away,"

according to a person familiar with the matter. He had been meeting

with Mr. Dimon and Goldman CEO David Solomon, people familiar with

the conversations said.

Bankers at JPMorgan and Goldman, meanwhile, were vying for roles

in the company's IPO. They had told Mr. Neumann it could be worth

as much as $60 billion (JPMorgan) and $90 billion (Goldman),

according to people familiar with the matter. Lining up a loan

would help them win the assignment.

JPMorgan proposed a $6 billion loan that required WeWork to

raise $3 billion in the stock market by the year's end. The package

included a $2 billion line of credit it could use to continue to

sign deals for new space.

Goldman proposed $3.65 billion in loans, secured by income from

WeWork's buildings, people familiar with the matter said. The deal

would allow WeWork to borrow more if it hit certain milestones --

up to $10 billion over time -- and didn't require the company to go

public, some of the people said. WeWork executives wanted more

money upfront, they said.

JPMorgan won.

The bank pushed other lenders to commit at least $750 million

apiece toward the $6 billion total, dangling a role in the IPO,

according to people familiar with the negotiations. Some bankers

worried JPMorgan's initial terms were too lenient and demanded

WeWork set aside more cash to back the loan, the people said.

Eventually, the $2 billion line was 100% collateralized, meaning

WeWork would have to pledge a dollar of cash for each dollar it

borrowed, the people said. Goldman, Wells Fargo and six other big

banks agreed to participate.

The lenders would split about $250 million in fees upfront,

according to people familiar with the deal, a high sum for a

low-risk arrangement. A day after it was finalized, WeWork said it

had chosen JPMorgan and Goldman to lead its IPO. The other banks

got junior roles.

The IPO ran into trouble almost immediately after documents were

filed in August. Investors balked at WeWork's growing losses and

unusual financial arrangements between the company and Mr. Neumann.

Bankers offered shares at a lower price; investors still didn't

bite.

The company pushed Mr. Neumann out as CEO and called off the IPO

in September, which killed the loan deal. WeWork, suddenly

dangerously low on cash, found the banks unwilling to reup.

It turned back to JPMorgan, seeking a $5 billion lifeline,

people familiar with the matter said.

This time, the bank refused to lend its own money without

gauging demand from investors, people familiar with the matter

said. It eventually offered the full $5 billion itself.

WeWork took SoftBank's money instead.

Mr. Dimon defended his bank's dealings with WeWork in a

television interview this week.

"We helped WeWork get to a proper conclusion," Mr. Dimon said.

"Now it has a chance to succeed."

Eliot Brown contributed to this article.

Write to David Benoit at david.benoit@wsj.com, Maureen Farrell

at maureen.farrell@wsj.com and Liz Hoffman at

liz.hoffman@wsj.com

(END) Dow Jones Newswires

November 08, 2019 05:44 ET (10:44 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

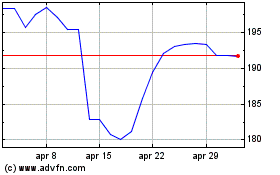

Grafico Azioni JP Morgan Chase (NYSE:JPM)

Storico

Da Mar 2024 a Apr 2024

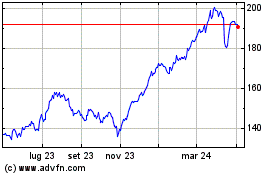

Grafico Azioni JP Morgan Chase (NYSE:JPM)

Storico

Da Apr 2023 a Apr 2024