RM Secured Direct Lending PLC Net Asset Value(s) (8872W)

16 Dicembre 2019 - 8:00AM

UK Regulatory

TIDMRMDL TIDMRMDZ TIDMTTM

RNS Number : 8872W

RM Secured Direct Lending PLC

16 December 2019

RM Secured Direct Lending Plc and RM ZDP PLC

("RMDL" or the "Company")

LEI: 213800RBRIYICC2QC958

Net Asset Value

RMDL announces that its unaudited net asset value per ordinary

share as at 30 November 2019, on a cum income basis, was 98.45

pence (31 October 2019: 98.24 pence).

RM ZDP PLC announces that the unaudited accrued capital entitlement

per ZDP share as at 30 November 2019 was 105.88 pence (31 October

2019: 105.59 pence).

NAV

The NAV total return for the month was 0.21%, bringing the cumulative

year to date figure to 7.05%.

The Ordinary Share NAV as at 30(th) November 2019 was 98.45 pence

per share, which is 0.21 pence higher than at 31(st) October

2019, comprising interest income net of expenses of 0.58 pence

per share and a decrease in portfolio valuations of 0.37 pence

per share which includes all credit and currency movements.

During the month the Company announced a total dividend payable

in respect of Q3 2019 of 1.70 pence per share, which went ex-dividend

on the 5(th) December and will be paid on the 27(th) December.

This brings the total payments distributed to Shareholders over

last four quarters to 6.95 pence and a cumulative NAV return

over this period with dividends re-invested of 8.01%.

Portfolio Activity

As at the 30(th) November 2019, the Company's portfolio consisted

of 35 debt investments with a weighted average yield of 8.72%,

spread across 13 sectors, with a percentage split between fixed

and floating rate of 56% to 44%. The Investment Manager is focused

on reducing interest rate risk by keeping the tenors on fixed

rate investments generally shorter dated.

The portfolio has the following breakdown: 59% in bilateral private

loans; 36% in club or syndicated private loans; and 5% in more

liquid corporate debt. Consequently, private debt investments

represent 95% of the portfolio.

The transactions highlights for the month are as follows:

* Four further drawdowns to Loans previously documented

with two borrowers. These loans relate to Social

Infrastructure and Energy Efficiency (Student

Accommodation & Receivables Finance).

* A new GBP4m bilateral private Loan, secured over real

estate and benefiting from a 30-year Full Repairing &

Insuring "FRI" lease with a listed hospitality group.

* GBP5m participation to a private syndicated Loan to

Busy Bees nurseries, a leading childcare provider

operating 374 nurseries across the UK and Ireland.

* A new c.GBP6m social infrastructure investment to

Uninn Group, to fund four operating Student

Accommodation assets located across key university

cities, Newcastle, Sheffield, Leicester, and

Coventry.

* An additional GBP2m participation in a private

syndicated Loan to MFG, a leading independent

forecourt operator within the UK, operating in excess

of 900 sites.

* An additional GBP2m participation in a private

syndicated Loan to EG Group, the global independent

forecourt operator and convenience retailer operating

in excess of 5,000 sites.

These investments meet the Company's strict credit criteria and

the majority of the proceeds of the Company's recent fundraise

have now been deployed.

The Company also announces that the Monthly Report for the period

to 30 November 2019 is now available to be viewed on the Company

website:

https://rmdl.co.uk/investor-centre/monthly-factsheets/

END

For further information, please contact:

RM Capital Markets Limited - Investment Manager

James Robson

Pietro Nicholls

Tel: 0131 603 7060

International Fund Management - AIFM

Chris Hickling

Shaun Robert

Tel: 01481 737600

Tulchan Group - Financial PR

James Macey White

Elizabeth Snow

Tel: 0207 353 4200

PraxisIFM Fund Services (UK) Limited - Administrator and Company

Secretary

Anthony Lee

Ciara McKillop

Tel: 020 7653 9690

Nplus1 Singer Advisory LLP - Financial Adviser and Broker

James Maxwell

Lauren Kettle

Tel: 020 7496 3000

About RM Secured Direct Lending

RM Secured Direct Lending Plc ("RMDL" or the "Company") is a

closed-ended investment trust established to invest in a portfolio

of secured debt instruments.

The Company aims to generate attractive and regular dividends

through loans sourced or originated by the Investment Manager

with a degree of inflation protection through index-linked returns

where appropriate. Loans in which the Company invests are predominantly

secured against assets such as real estate or plant and machinery

and/or income streams such as account receivables.

For more information, please see

https://rmdl.co.uk/investor-centre/monthly-factsheets/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVGGGGPPUPBGMW

(END) Dow Jones Newswires

December 16, 2019 02:00 ET (07:00 GMT)

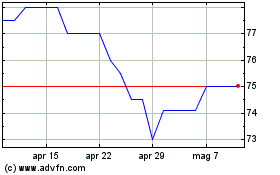

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Rm Infrastructure Income (LSE:RMII)

Storico

Da Apr 2023 a Apr 2024