Extortion Charges Embroil Lawyer Involved in Roundup Litigation

19 Dicembre 2019 - 2:21PM

Dow Jones News

By Sara Randazzo and Jacob Bunge

This fall, Virginia plaintiffs' attorney Timothy Litzenburg

allegedly laid out a proposal to a chemicals company that supplies

ingredients used in the popular weedkiller Roundup.

According to a federal criminal complaint filed this week, one

of Mr. Litzenburg's clients was preparing to sue the company for

its role in making Roundup, which has been blamed for causing

cancer. Thousands of other lawsuits were likely to follow. But the

problem could go away for a $5 million settlement, he allegedly

told the company, plus a "reasonable" $200 million in consulting

fees paid to Mr. Litzenburg and two associates.

Instead of paying, the company called the U.S. Justice

Department, according to the complaint.

Federal prosecutors with the Justice Department's fraud section

charged Mr. Litzenburg this week with extortion, laying out the

alleged scheme to extract $200 million from a target they identify

as "Company 1."

That company is Amsterdam-based chemicals maker Nouryon,

according to people familiar with the matter. Nouryon is the former

chemicals unit of Akzo Nobel NV, which a consortium led by

private-equity firm Carlyle Group LP bought in 2018 for $12.6

billion.

Mr. Litzenburg was arrested Tuesday and released on bail. His

attorney, Thomas Bondurant Jr., said Wednesday his client isn't

guilty and that there appear to be inaccuracies in the charging

document. A Nouryon spokesman said, "We have nothing to contribute

to the ongoing DoJ investigation." A representative for Carlyle

didn't respond to requests for comment.

The charges come against the backdrop of the broader Roundup

litigation, which has roiled Bayer AG, the German company that owns

the weedkiller. Bayer faces lawsuits from more than 42,700 farmers,

home gardeners and landscapers who claim Roundup caused non-Hodgkin

lymphoma and other cancers. It is fighting the claims.

The criminal complaint unsealed Tuesday against 37-year-old Mr.

Litzenburg details the lawyer's alleged attempt to shift the

Roundup litigation into a new phase that would target chemical

suppliers involved in the herbicide's production.

"The [Company 1] non-Hodgkin lymphoma litigation that we are

planning will be 'Roundup Two,' and I'm excited to lead the charge

again," Mr. Litzenburg said in an Oct. 24 email to an attorney

representing the company, as quoted in the complaint. "This time,

to my great financial benefit."

Prosecutors allege Mr. Litzenburg first approached the chemicals

company in September with the draft of a complaint that he planned

to file claiming chemical compounds it and other suppliers provided

to Bayer were carcinogenic and that they failed to warn about the

risks.

He would forget the lawsuit, he told them, if they entered into

a $200 million consulting agreement that would purportedly give him

a conflict of interest that would make him unable to sue the

company, according to the complaint. The money, he made clear,

wouldn't be used as a payout to Roundup users to resolve any

lawsuits, but would go to him and two lawyers in Chicago and

Virginia.

Over a series of phone calls and emails detailed in the

complaint, he described the fee as reasonable, saying in the Oct.

24 email: "The defense costs and cost to ultimately resolve the

thousands or tens of thousands of cases would be well into the

billions, setting aside the associated drop in stock price and

reputation damage."

Mr. Litzenburg said that absent "a so-called 'global' or final

deal with me, this will certainly balloon into an existential

threat to [Company 1]."

The Justice Department recorded phone calls and a meeting

between Mr. Litzenburg and attorneys for the company after the

company approached the department about the initial

interactions.

Until last year, Mr. Litzenburg worked with the Miller Firm in

Virginia, which has been actively involved in the Roundup

litigation and played a lead role in the first Roundup case to go

to trial. That California state court case ended in a $289 million

verdict in favor of groundskeeper Dewayne Johnson, which was later

reduced to $78.5 million and is now on appeal.

On Wednesday, attorney Michael Miller said Mr. Litzenburg was

fired by the Miller Firm in September 2018 and that the firm has

nothing to do with the events laid out in the DOJ's criminal

complaint.

In an email to The Wall Street Journal last month, Mr.

Litzenburg laid out what he called his passion for holding

companies accountable for selling harmful products and his dismay

at what he views as an overly cozy relationship between industry

and regulators.

"These companies make willful, knowing choices to put deadly

products in the market anytime they figure their profits will far

exceed any sort of 'penalty' they have to pay in lawsuits when

people figure it out," he wrote.

He added: "I sleep well at night knowing I am helping injured

people as best as is currently possible."

Write to Sara Randazzo at sara.randazzo@wsj.com and Jacob Bunge

at jacob.bunge@wsj.com

(END) Dow Jones Newswires

December 19, 2019 08:06 ET (13:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

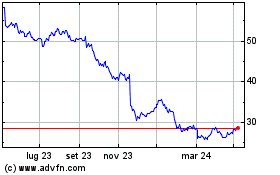

Grafico Azioni Bayer (TG:BAYN)

Storico

Da Mar 2024 a Apr 2024

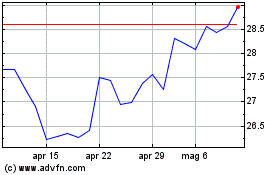

Grafico Azioni Bayer (TG:BAYN)

Storico

Da Apr 2023 a Apr 2024