Life Settlement Assets PLC Net Asset Value(s) (6841Y)

03 Gennaio 2020 - 10:55AM

UK Regulatory

TIDMLSAA TIDMLSAB TIDMLSAD TIDMLSAE

RNS Number : 6841Y

Life Settlement Assets PLC

03 January 2020

LIFE SETTLEMENT ASSETS PLC

LEI: 2138003OL2VBXWG1BZ27

(the "Company" or "LSA")

Monthly NAV Performance Report

LSA, a closed-ended investment company which manages portfolios

of whole and fractional interests in life settlement policies

issued by life insurance companies operating predominantly in the

United States, today announces its Net Asset Value (NAV) for its

four classes of ordinary shares - A Ordinary Shares ("A Shares"), B

Ordinary Shares ("B Shares"), D Ordinary Shares ("D Shares") and E

Ordinary Shares ("E Shares") for the month ended 30 November 2019.

The NAV figures are after the Tender Offer (A Shares), the special

dividend payments for A Shares, D Shares and E Shares first

announced on 14 May 2019, the special dividend payments for D

Shares and E shares first announced on 24 October 2019 and the

Class D and Class E buyback payments.

The information and further commentary on each of its share

classes will be available on LSA's website,

www.lsaplc.com/investor-relations/reports-company-literature.

A Shares

Estimated NAV NAV per share

US$90,349,904 US$2.2649

--------------

B Shares

Estimated NAV NAV per share

US$13,712,133 US$0.9394

--------------

D Shares

Estimated NAV NAV per share

US$7,526,608 US$0.8560

--------------

E Shares

Estimated NAV NAV per share

US$3,754,899 US$2.3968

--------------

For further information contact

Acheron Capital Limited (Investment Manager)

Jean-Michel Paul

020 7258 5990

Shore Capital (Financial Adviser and Broker)

Robert Finlay

020 7601 6115

ISCA Administration Services Limited

Company Secretary

01392 487056

TB Cardew (Financial PR)

Shan Shan Willenbrock

020 7930 0777

Notes to Editors

LSA is a closed-ended investment company which manages

portfolios of whole and fractional interests in life settlement

policies issued by life insurance companies operating predominantly

in the United States. The life settlement market enables

individuals to sell their life insurance policies to investors at a

higher cash value than they would otherwise receive from insurance

companies (if they were cancelled or surrendered at the date of

sale). The Company aims to manage portfolios of life settlement

products so that the realised value of the policy maturities

exceeds the aggregate cost of acquiring the policies, ongoing

premiums, management fees and other operational costs. LSA was is

listed on the Specialist Fund Segment of the Main Market of the

London Stock Exchange.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVSSFSUDESSEIF

(END) Dow Jones Newswires

January 03, 2020 04:55 ET (09:55 GMT)

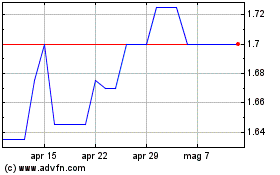

Grafico Azioni Life Settlement Assets (LSE:LSAA)

Storico

Da Apr 2024 a Mag 2024

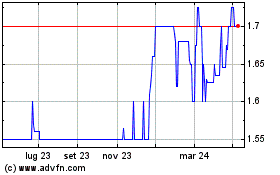

Grafico Azioni Life Settlement Assets (LSE:LSAA)

Storico

Da Mag 2023 a Mag 2024