Vast Resources plc Placing To Raise Gbp600,000 Before Costs

16 Aprile 2020 - 1:34PM

UK Regulatory

TIDMVAST

Vast Resources plc / Ticker: VAST / Index: AIM / Sector: Mining

16 April 2020

Vast Resources plc

("Vast" or the "Company")

Placing to raise GBP600,000 before costs

Appointment of Joint Broker

Baita Plai Project and Chiadzwa Community Diamond Project update

Vast Resources plc, the AIM-listed mining company, is pleased to

announce that it has raised in aggregate GBP600,000 before costs through

a placing (the 'Placing') of 392,156,863 ordinary shares of 0.1p in the

Company ('Ordinary Shares') at a price of 0.153p per Ordinary Share (the

'Placing Shares').

The Company is also pleased to announce the appointment today of Axis

Capital Markets Limited, by whom the Placing was undertaken, as a joint

broker to the Company.

The cash raised from the Placing will be used to maintain the Company's

working capital in the light of the anticipated conclusion of the

Chiadzwa Community Diamond Concession joint venture in Zimbabwe

('Chiadzwa JV') and potential increased mobilisation and other costs due

to the impact of the Covid-19 pandemic. The Company remains confident

that the Chiadzwa JV will nevertheless be concluded shortly.

The Company can reconfirm that shipping of equipment from China as

previously announced remains all on track and that all equipment

critical for the start of production at Baita Plai is now on the water.

As matters stand, production at Baita Plai remains targeted to commence

within the six month timeline from funding (in July) in accordance with

previous announcements. The Company can also confirm that the drilling

programme at Baita Plai announced on 10 March 2020 is progressing

according to plan, and a proportion of the capital raised will be used

to purchase additional drilling equipment to make the process both more

cost and time efficient whilst we look to enhance the JORC resource.

Admission of and dealings in the Placing Shares

Application has been made to AIM for the Placing Shares, which will rank

pari passu with existing Ordinary Shares, to be admitted to trading on

AIM ('Admission' ) in two tranches. It is expected that Admission will

become effective and dealing will commence in respect of the issue of

98,047,386 of the Placing Shares on or around 22 April 2020 (the "First

Admission") and that Admission will become effective and dealing will

commence in respect of the issue of 294,109,477 of the Placing Shares on

30 April 2020 (the "Second Admission"). The Placing is conditional on

Admission.

Following the First Admission, the total issued share capital of the

Company will be 10,385,113,145 and following the Second Admission this

will be 10,679,222,622. The above figures of 10,385,113,145 and

10,679,222,622 respectively may then be used by shareholders, following

the respective dates at which the Shares are issued, as the denominator

for the calculations by which they will determine if they are required

to notify their interest in Vast under the FCA's Disclosure and

Transparency Rule.

**ENDS**

For further information, visit www.vastplc.com or please contact:

Vast Resources plc www.vastplc.com

Andrew Prelea (Chief Executive +44 (0) 1491 615 232

Officer)

Andrew Hall

Beaumont Cornish - Financial & www.beaumontcornish.com

Nominated Adviser +44 (0) 020 7628 3396

Roland Cornish

James Biddle

SP Angel Corporate Finance LLP www.spangel.co.uk

-- Joint Broker +44 (0) 20 3470 0470

Richard Morrison

Caroline Rowe

Axis Capital Markets Limited -- www.axcap247.com

Joint Broker +44 (0) 20 3206 0320

Richard Hutchison

Blytheweigh www.blytheweigh.com

Tim Blythe +44 (0) 20 7138 3204

Megan Ray

The information contained within this announcement is deemed by the

Company to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 ("MAR").

ABOUT VAST RESOURCES PLC

Vast Resources plc, is an AIM listed mining company with mines in

Romania and Zimbabwe focused on the rapid advancement of high quality

brownfield projects by recommencing production at previously producing

mines in Romania and commencement of the joint venture mining agreement

on the Chiadzwa Community Concession Block of the Chiadzwa Diamond

Fields in Zimbabwe.

The Company's portfolio includes an 80% interest in the Baita Plai

Polymetallic Mine in Romania, where work is now currently underway

towards developing and recommissioning the mine and the Community

Concession Block in Chiadzwa, Zimbabwe.

Vast Resources owns the Manaila Polymetallic Mine in Romania, which was

commissioned in 2015, currently on care and maintenance.

Attachment

-- Placing to raise GBP600,000 before costs

https://ml-eu.globenewswire.com/Resource/Download/80429786-22c6-49f9-a269-161abaf0798b

(END) Dow Jones Newswires

April 16, 2020 07:34 ET (11:34 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

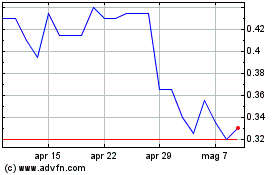

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Mar 2024 a Apr 2024

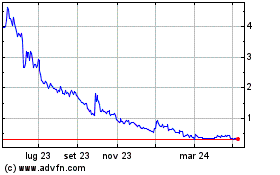

Grafico Azioni Vast Resources (LSE:VAST)

Storico

Da Apr 2023 a Apr 2024