By Mike Cherney in Sydney and Lucy Craymer in Hong Kong

The thousands of flight cancellations that have brought global

passenger travel to a near standstill are making it tougher and

more expensive to send fresh food, mail and merchandise around the

world.

Before the coronavirus pandemic, more than half of all air cargo

traveled on passenger flights, according to data from the

International Air Transport Association. Fliers essentially

subsidized the cost of many air shipments, and carriers devoted

roughly a third of their cargo space to letters, packages and

commercial goods, according to industry newsletter Aircraft

Commerce.

Now, with fewer passenger planes in the air, airfreight costs

have risen sharply, tripling in some cases, forcing businesses and

individuals to choose between getting items to their destination

quickly and getting them there at a price they are willing to

pay.

American Airlines Group Inc., United Airlines Holdings Inc. and

Qantas Airways Ltd. are among commercial carriers using empty

passenger planes to move cargo internationally. Deutsche Lufthansa

AG is stripping out passenger seats on some of its planes to

increase cargo capacity. Airbus SE is developing a modification for

its A330 and A350 planes that would allow airlines to install

freight pallets directly onto seat tracks in passenger cabins.

Available freight capacity on passenger planes in March was

still down around 44% from a year ago, according to the air

transport association. While dedicated air freighters added more

flights, total air-cargo capacity was down 25% versus the prior

year in March, the most recent data available.

Some companies have lost orders due to higher shipping costs;

some are relying more on sea freight, which takes much longer and

increases the risk that perishable products will expire before

reaching store shelves. Toy maker Hasbro Inc. recently said it

incurred higher airfreight costs in moving products out of China,

where they were manufactured.

"The cost of moving that cargo is almost going up day by day,"

said Paul Golland, owner of PG Logistics, a freight-forwarding

business in Australia. "You used to get a quote valid for 30 days.

Now you're getting it valid for 24 hours, because tomorrow the

situation may change again."

Warren Evans, co-owner of a company that makes fitness equipment

in China and sells it to U.S. customers on Amazon.com, has seen

higher demand from locked-down customers who can't go to the gym.

Carriers recently increased airfreight charges three times over a

two-week period when he was preparing to send jump ropes from

Shanghai to Chicago, where they would be picked up and transported

to an Amazon warehouse.

Mr. Evans said he needed to maintain his high seller ranking, so

he went ahead with the shipment, which cost more than three times

the usual rate.

Mr. Evans said he would probably send fewer shipments via air,

and instead rely more on sea freight while costs remain high. So

far he is absorbing the extra cost, but might raise prices on the

jump ropes if demand continues. "It's going to be a continuing

battle," he said.

Borderfree Inc., an e-commerce company that helps U.S. and U.K.

retailers including Gap Inc. and Macy's Inc. ship online purchases

all over the globe, has told customers in more than two dozen

countries that they can't place orders due to service interruptions

caused by Covid-19.

International postal services have been among the hardest hit.

Many have reduced or suspended international mail in recent weeks

due to a lack of flights.

The U.S. Postal Service last week said it would start shipping

mail by sea to 10 European countries. The U.K.'s Royal Mail said

the only other time it experienced similar disruptions was a decade

ago, when a volcano erupted in Iceland and spewed a giant ash cloud

that blocked air travel.

Deutsche Post AG, which delivers mail in Germany and owns

international courier DHL, in April said the scarcity of airfreight

capacity could continue after countries lift lockdown rules,

because it will take time for passenger traffic to return to

prepandemic levels.

In Australia, 80% to 85% of air cargo normally arrives and

leaves the country on passenger flights, according to the

Australian Federation of International Forwarders. Governments are

subsidizing the cost of some cargo flights out of New Zealand and

Australia to keep trade routes open.

"There is no book to open up and read what to do in this

situation because it has never happened before," said Mark Coleman,

director at ICAL, a logistics company in Australia.

In normal times, Australian grass-fed beef producer OBE Organic

would mostly use airfreight to send chilled premium beef overseas,

and use sea freight for frozen trimmings that make meatballs and

hamburgers.

Dalene Wray, the company's managing director, said it is sending

more meat by sea due to higher air-cargo costs. She said a sea

shipment of chilled beef, worth tens of thousands of dollars, en

route to Dubai was scheduled to reach supermarket shelves in

roughly 30 days. That compares to the seven days it would take by

air, including time for customs clearance and inspections.

"We just have to be more agile" to adapt to the situation, she

said.

The cargo crunch is hitting consumers like Anita Lau, an

American living in Hong Kong, who tried to send a box of face masks

to her elderly parents in Boston early last month. Regular airmail

service to the U.S was suspended so she used the post office's

international courier service, which costs roughly $40 to send a

500-gram parcel.

Nearly two weeks later, the tracking record showed the parcel

was still at its origin. Ms. Lau requested it be returned to her,

and said she now plans to use a private shipping option.

(END) Dow Jones Newswires

May 05, 2020 10:15 ET (14:15 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

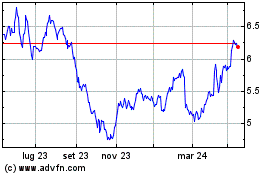

Grafico Azioni Qantas Airways (ASX:QAN)

Storico

Da Dic 2024 a Gen 2025

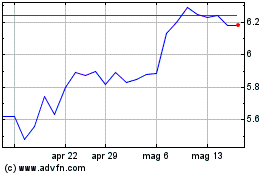

Grafico Azioni Qantas Airways (ASX:QAN)

Storico

Da Gen 2024 a Gen 2025