Analyst Foresees Bitcoin Downtrend Until GBTC Is Liquidated

22 Gennaio 2024 - 5:00PM

NEWSBTC

Chris J Terry, a cryptocurrency analyst and enthusiast, has

revealed his insights on the price action of Bitcoin, predicting a

continuous decline in the price of the crypto asset. Analyst Says

Bitcoin Will Continue To Drop The crypto analyst shared his

insights regarding Bitcoin with the cryptocurrency community on the

social media platform X (formerly Twitter), anticipating a possible

“continuation of a flat or declining trend.” Related Reading:

Crypto Analyst Predicts Potential Trend For Bitcoin As Price Slips

He highlighted that the downtrend will continue until Grayscale

Bitcoin Trust (GBTC) is fully “liquidated.” According to him, the

liquidation will be possible with a whopping $25 billion worth of

selling activity over the next few weeks. Terry cites Grayscale’s

choice to keep Bitcoin ETF fees at 1.5% as the cause of what he

sees to be the “biggest strategic error” in cryptocurrency history.

This implies that Grayscale’s action might have a long-term impact

on the crypto market and may prevent wider adoption. The post read:

Looks like the BTC price will continue flat/down until GBTC is

liquidated, $25B of selling over the next few weeks. Grayscale

decision to keep ETF fees at 1.5% will go down as the biggest

strategic error in crypto history. Greedy idiots. His analysis

emphasizes how investment vehicles are interconnected and how this

affects the state of the cryptocurrency market as a whole. However,

this has attracted disbelief from a few famous figures in the

community. One of the figures who has expressed disbelief is Galaxy

Digital CEO Mike Novogratz. He asserted that he “disagrees” with

Chris Terry’s analysis because although Novogratz experts some

selling pressure activity, he believes investors will move to other

ETFs, especially supporting BTCO. Novogratz also pointed out that

the Invesco Galaxy Bitcoin ETF (BTCO) is his favorite among the

products. Furthermore, Novogratz highlights the significance of

maintaining perspective in light of transient market conditions. He

noted that the latest development will facilitate older investors’

or boomers’ entry into the crypto landscape. In addition, he has

highlighted the potential for enhanced leverage by having 4×5

exposure to Bitcoin via BTCO. He then shared an optimistic look,

noting that “BTC will go higher in the next six months after this

indigestion.” BTC Sees $25 Million Outflows A recent report

from Coinshares has revealed that Bitcoin witnessed an outflow of a

whopping $25 million. Coinshares shared the information in its most

recent weekly “Digital Asset Fund Flows.” Related Reading: Bitcoin

Whale Carries Out Massive Sell-Off As BTC Price Suppression

Continues It also noted a massive $11.8 billion in BTC trading

volume last week. According to Coinshares, this is seven times more

than the average weekly trading activity recorded in 2023. There

were notable withdrawals from digital asset investment products

last week, totaling about $24.7 million. Notably, this spike in

trading activity indicates that ETFs account for 63% of all Bitcoin

volumes on reliable exchanges. As of the time of writing, Bitcoin

was trading at $40,827, indicating a decline of 2.16% in the past

day. Despite the price drop, its trading volume is currently up by

over 81% in the last 24 hours. Featured image from iStock, chart

from Tradingview.com

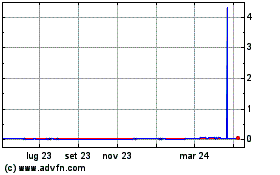

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Gala (COIN:GALAUSD)

Storico

Da Feb 2024 a Feb 2025