Brace For Impact: Mt. Gox Set To Inject 142,000 BTC And 143,000 Bitcoin Cash Into The Market- Here’s When

14 Maggio 2024 - 4:00PM

NEWSBTC

Tokyo-based Bitcoin exchange, Mt. Gox is preparing to release a

substantial amount of Bitcoin (BTC) into the market, signaling the

upcoming disbursement of payments to creditors who had been

affected by its hack attack in 2011. Mt. Gox Set To

Release 142,000 Bitcoin Into Market Reports from Reddit reveal that

the Kraken Bitcoin (BTC) and Bitcoin Cash (BCH) API interface have

signaled that Mt. Gox is getting ready to release its substantial

cryptocurrency and fiat holdings, which include 142,000 BTC and

143,000 BCH, and 69 billion yen. Related Reading: Theta

Network Breakout Imminent: Why A 100% Rise Is Possible From Here As

of May 13, the interface began reading “payment in preparation,”

indicating that funds would soon be distributed to creditors. The

date for the anticipated disbursement has also been slated for

October 31, 2024. This decision comes after years of

undergoing legal proceedings and negotiations aimed at reimbursing

creditors who lost funds following the Bitcoin exchange’s crash.

Earlier in 2011, Mt. Gox was hacked, resulting in the loss of

850,000 BTC now worth over $51 billion. Shortly after the

unfortunate attack, Mt. Gox filed for bankruptcy and has since been

gathering funds to compensate creditors. Reports from a few

customers have revealed that the exchange has begun distributing

funds in fiat currency. One particular Reddit user disclosed

earlier in April, that he had received USD payments into an HSBC

currency account with zero fees. While the long-awaited

distribution process comes as great news to creditors, the release

of such a large amount of Bitcoin could have a significant effect

on the current Bitcoin market. Additionally, discussions

about whether creditors would sell or retain their Bitcoin holdings

once they receive their funds have been circulating. Nonetheless,

the disbursement process presents a step towards closure and

recovery for victims of the exchange’s hack and bankruptcy.

Will Creditors Sell Or Hold? With the Bitcoin market presently in a

fragile position after experiencing a series of declines following

the halving event on April 20, the possibility of a large-scale

sell-off could lead to drastic changes in the market, potentially

resulting in a crash. Commenting on Mt. Gox’s 142,000 BTC

distribution plans, a Reddit community member suggested that the

exchange’s upcoming repayments could become a catalyst for the next

BTC dump in 2024. Related Reading: Gaming The System: Pundit

Reveals Why XRP Price Will Reach $33 In response, another Reddit

user expressed doubt about the likelihood of a widespread sell-off,

especially at the beginning of the bull market. The user surmised

that investors who have been waiting for Mt. Gox’s payments for

over a decade are unlikely to sell off their Bitcoin holdings

quickly. Instead, he suggested that many creditors, like

himself, would be more inclined to HODL their Bitcoin holdings,

having acquired a deeper understanding of the pioneer

cryptocurrency during the decade-long wait. Featured image from

U.Today, chart from Tradingview.com

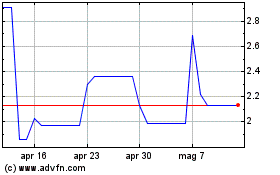

Grafico Azioni Theta (COIN:THETAUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Theta (COIN:THETAUSD)

Storico

Da Dic 2023 a Dic 2024