Polygon Ecosystem On Fire: Daily Active Addresses And Transactions Soar, MATIC Gains 5%

27 Luglio 2024 - 8:30AM

NEWSBTC

Layer 2 scaling solution Polygon has maintained strong network

activity even as the broader cryptocurrency market and its native

token, MATIC, experienced a downturn in the second quarter of 2024,

according to a new report from market intelligence platform

Messari. Polygon Weathers Crypto Market Downturn While MATIC saw a

44.3% drop in its circulating market cap to $5.5 billion over the

quarter, placing it as the 20th largest crypto asset (currently at

the 26th position), the protocol’s on-chain metrics remained

strong. This is in contrast to larger cryptocurrencies such

as Bitcoin and Ethereum, which saw their market capitalization

decline by 12% and 6%, respectively, over the same period. Related

Reading: Why Is ETH Price Struggling Despite The Spot Ethereum ETFs

Launch? The key driver behind Polygon’s stability in network

performance during the second quarter of the year, according to

Messari, was the implementation of Ethereum Improvement Proposal

(EIP) 4844 on the Polygon mainnet in Q1 2024. This upgrade,

which introduced “blobs” to the network, significantly reduced the

average transaction fee on Polygon from $0.017 to just $0.01,

resulting in a decrease of 41.1%. As a result, Polygon’s revenue

derived from network transaction fees fell 40.6% to $4 million in

Q2 2024. However, this drop was not due to a decrease in user

activity, but rather the lower fees enabled by EIP-4844. In fact,

Polygon’s user metrics continued to soar, with the protocol seeing

strong growth across several key indicators. On-Chain

Activity And Ecosystem Growth According to the report, the average

number of daily active addresses climbed to 1.2 million, a 47.6%

increase quarter-over-quarter (QoQ). The average number of daily

returning addresses rose even more, up 50.5% to 1 million.

Moreover, new addresses being added to the network grew by 31.7% to

167,800 per day on average. The report also notes that Polygon’s

transaction volume also held steady, averaging 4.1 million daily

transactions, just below its all-time high and representing a 3.9%

increase from the prior quarter. In comparison, fellow Layer

2 networks Arbitrum (ARB) and Base saw average daily active

addresses of 545,000 and 528,000 respectively. Related Reading:

Crypto AI Token RENDER Soars 15.6% After Rebrand, Can It Hit $10?

While Polygon’s decentralized finance (DeFi) total value locked

(TVL) dropped 22.9% to $1 billion, this was largely attributable to

the decline in MATIC’s price rather than a net outflow of capital.

Messari reported that TVL denominated in MATIC actually increased

by 38.1% to 1.8 billion tokens. However, DeFi protocols on Polygon

saw mixed results, with Aave, Uniswap, and SushiSwap all

experiencing declines in TVL ranging from 13% to 25%. Quickswap saw

the largest drop at 35%. Lastly, Polygon’s non-fungible token (NFT)

market also remained stable, with average daily NFT volume dipping

slightly by 5.7% to $1.8 million. However, the number of daily NFT

sales actually increased by 1.8% to 52,000, underscoring ongoing

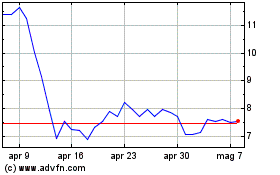

collector interest. At the time of writing, MATIC has experienced a

mere 5% increase to a trading price of $0.512, after hitting a

2-year low of $0.428 on July 5th. Coupled with this worrying

price action, the token has seen a 30% decrease in trading volume

over the past few days, amounting to $197 million, according to

CoinGecko data. All of this has resulted in an 82% difference to

MATIC’s all-time high of $2.91, which was set during the 2021 bull

run. Featured image from Shutterstock, chart from

TradingView.com

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Nov 2023 a Nov 2024