Record-Breaking Bitcoin Surge Post-Trump Election: Futures Market Hints At More To Come

06 Novembre 2024 - 7:32PM

NEWSBTC

The futures market is signaling that the current Bitcoin rally,

spurred by Donald Trump’s recent election victory on Tuesday, might

be starting. According to Vetle Lunde, head of research at K33

Research, the election’s immediate aftermath has seen a “risk-on

rotation” across derivatives, indicating a surge in investor

confidence. Bitcoin Options Market Targets $80,000 By Late November

On the Chicago Mercantile Exchange (CME), the basis—the difference

between the spot market price and futures contract prices—has risen

sharply from 7% to over 15% in a single day, reflecting heightened

interest from institutional investors. Additionally, perpetual

futures contracts, favored by offshore investors, are now trading

at their largest premiums to the spot market since March, further

underscoring rising demand for leverage. Related Reading: Ethereum

Volatility Soon? Derivatives Exchanges Receive 82,000 ETH In

Deposits Bitcoin recently surpassed $75,000 for the first time,

buoyed by expectations that a second Trump presidency will usher in

more favorable policies and regulations for the cryptocurrency

sector, as he has vowed to support the growth of the market, with

BTC at the heart of what could be a new economic policy for the

nation. Before the election, NewsBTC reported that the

Bitcoin options market had already set its sights on an ambitious

target of $80,000 for expiries slated for late November, showcasing

the optimism surrounding the asset’s potential. Analysts Predict

Strong ETF Inflows Post-Election Michael Safai, founding partner at

quantitative trading firm Dexterity Capital, told Bloomberg that

Trump’s administration promises decreased regulatory intervention

in the US, a development many crypto investors have advocated

during previous years of heightened scrutiny. While exchange-traded

funds (ETFs) backed by Bitcoin experienced one of the largest

outflows on Monday, Safai suggests that traders remain optimistic

about a potential reversal. Lunde also indicated that the

European trading session had been relatively quiet. Still, Bitcoin

appears to be finding support at its former all-time highs, a

positive sign for continued upward momentum. Anticipating strong

ETF inflows during US trading hours on Wednesday, the analyst

expects the combination of rising CME premiums and post-election

clarity to bolster Bitcoin’s performance. “The backdrop of

burgeoning CME premiums presents carry opportunities that should

support strong performance,” Lunde explained. However, amidst the

positive outlook, some traders advise caution regarding potential

price corrections. Related Reading: Uniswap Surges Toward $8.74 –

Can UNI Push Through To New Heights? Previous bullish runs, such as

the one witnessed in March following the introduction of Bitcoin

exchange-traded funds, led to significant liquidations across both

directions of the market, with the cryptocurrency recording drops

of over 20% following the record peak. Nathanaël Cohen,

co-founder at INDIGO Fund, cautioned that profit-taking could

trigger corrections at current levels. However, he remains

optimistic about the overall trend moving higher in the coming

months. At the time of writing, BTC was trading at $74,430, up 6.2%

on a 24-hour basis and nearly 4% every week. Featured image from

DALL-E, chart from TradingView.com

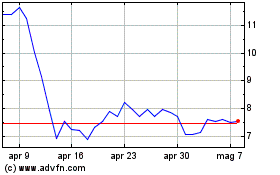

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Mar 2024 a Mar 2025