Is This VC Cashing Out? Moves UNI, COMP, AAVE, And SNT Tokens To Binance

02 Ottobre 2024 - 4:30AM

NEWSBTC

Fenbushi Capital, a blockchain-centric venture capital (VC),

appears to be cashing out after moving four tokens, including Aave

(AAVE) and Compound (COMP), to Binance. The VC is moving these

tokens to the exchange, possibly to sell and lock in their profits

or cut losses when market participants expect prices to tick

higher. Fenbushi Capital Cashing Out? Sends AAVE, UNI, SNT, and

COMP Tokens To Binance After the series of lower lows after crypto

prices peaked, mainly in Q1 2024, the consensus is that Bitcoin and

Ethereum prices are ready to turn the corner. If Bitcoin breaches

$70,000 and Ethereum soars above $3,000, shaking off recent

weakness, they could lift other less liquid altcoins, including

those Fenbushi chose to send to Binance. Related Reading: Crypto

Researcher Reveals Why XRP Price Reaching $1,000 Is Not A Pipe

Dream According to on-chain data, the VC transferred 146,537 UNI

worth $1.12 million, over 10.1 million SNT worth $244,000, 10,681

COMP worth $510,000, and 11,616 AAVE worth $1.89 million, to

Binance. The VC secured over $1.20 million in profits, assuming

they sold all these tokens at spot rates. Of all these tokens,

their AAVE holdings has seen them gain over $1.1 million in

profits. However, at spot rates, they are in red from their COMP

holdings. COMP is the native governance token of Compound, a

lending protocol. Fenbushi received these tokens nearly two

years ago, in 2022, months after most of them had soared to record

highs in the last DeFi and NFT-driven bull run. When writing, no

statement from Fenbushi explained their decision to transfer most

of these DeFi tokens to the exchange. DeFi Rising And Protocols

Building: Wrong Timing To Exit? Whenever coins are moved to a

centralized exchange could signal weakness and be seen as bearish.

However, considering the current crypto sentiment, Fenbushi’s

raises eyebrows and could slow down the uptrend. Related Reading:

Bitcoin Price Could Skyrocket To $118,000 By Year-End: Here’s Why

According to DeFiLlama, the total value locked (TVL) across DeFi

protocols is over $88 billion. At spot rates, TVL is up by over

100% from 2022 lows of around $36 billion. Out of this, Aave,

Uniswap, and Compound are some of the largest platforms. Aave

manages over $12.7 billion of assets, while Uniswap controls over

$4.8 billion. Beyond the sharp uptick in total DeFi TVL, these

protocols are also actively building. Uniswap, the decentralized

exchange, plans to release its v4 in the coming months, while Aave

actively attracts new users. By late September, the lending app had

received close to $20 billion in user deposits, cementing its

position in DeFi. Feature image from iStock, chart from TradingView

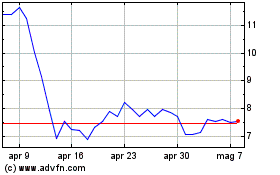

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Nov 2023 a Nov 2024