Uniswap Rallies In Bearish Conditions, Can UNI Break New Grounds?

11 Ottobre 2024 - 2:00AM

NEWSBTC

Uniswap is making a surprising move, rallying in the face of

bearish market conditions, and showing signs of resilience despite

the downward pressure seen across the crypto space. As bullish

sentiment begins to build, market participants are now focused on

whether UNI can maintain this upward momentum and break new

ground. As UNI continues to display strength, this analysis

aims to determine whether Uniswap’s recent upward movement in spite

of the broader bearish market conditions, has the potential to

break through key resistance levels and reach new highs by

examining the current price action and technical indicators.

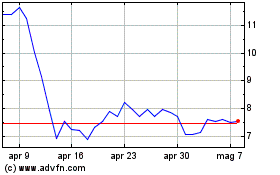

Indicators Point Toward More Upward Movement For Uniswap On the

4-hour chart, Uniswap is showing strength as it approaches the $8.7

resistance level while trading above the 100-day Simple Moving

Average (SMA). UNI’s positioning above the SMA indicates a firm

trend, suggesting that buyers are gaining confidence with the

potential of targeting higher resistance levels. An analysis of the

4-hour Relative Strength Index (RSI) points to the possibility of

continued upward movement, as the RSI has rebounded to the 73%

threshold after previously dipping to 52%. This rise indicates that

positive momentum is gaining traction, suggesting that buyers are

increasingly in control and that further gains could be on the

horizon. Related Reading: UNI Bullish Rebound Signals Upsurge,

Targets $8.7 Resistance Ahead After successfully breaking above the

daily 100-day SMA, UNI has been exhibiting strong upbeat movement

signifying a shift in market sentiment, with buyers gaining

confidence and pushing the price higher. If Uniswap can sustain

this push, it may open the door for additional price appreciation

and challenge higher resistance levels. Furthermore, the RSI on the

daily chart is currently at 65%, having risen from a previous low

of 43%. This upward movement suggests that UNI is gaining momentum,

signaling more growth. If buying interest continues to hold steady,

the positive trajectory indicated by the RSI could support an

extended rally for Uniswap, reinforcing positive sentiment in the

market. Potential Upside Targets: How Far Can the Bulls Push UNI?

As Uniswap maintains its upward momentum, the immediate resistance

level to watch is $8.7, which could pave the way for a challenge of

higher thresholds if surpassed. A breakout above this level could

see UNI targeting the $10.3 mark, where significant psychological

resistance may come into play. Related Reading: UNI In Trouble? Key

Indicators Cites Potential Drop Amid Market Downturn However, if

Uniswap fails to maintain this strength and breaks above the $8.7

resistance level, it could result in a pullback, with the price

sliding back toward the $6.7 support zone. A breakdown below this

level could lead to more losses, possibly targeting lower support

areas. Featured image from Adobe Stock, chart from Tradingview.com

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Uniswap (COIN:UNIUSD)

Storico

Da Dic 2023 a Dic 2024