ALSTOM SA: Emerging stronger, Alstom delivers good FY 2022/23

results in a growing Rail market

Emerging stronger,

Alstom delivers

good FY 2022/23

results in a

growing Rail market

-

Orders

received at €20.7

billion. Book-to-bill ratio at

1.25

- Sales at

€16.5

billion in 2022/23,

up 7%1

vs. last year

-

aEBIT2 at

€852 million, up 11%

- Adjusted Net

Profit2 at

€292

million

- Free Cash Flow at

€199 million

- FY

2023/24

outlook:

- aEBIT

margin: around

6%

- Free

Cash

Flow:

significantly

positive

- Mid-term

targets to be reached in

FY 2025/26:

- aEBIT

margin:

8-10%

- Free

Cash

Flow conversion3

above 80%

10

May 2023 –

Between 1 April 2022 to 31 March 2023, Alstom booked €20.7 billion

of orders. Sales were €16.5 billion, in line with the targeted

trajectory, resulting in a strong book-to-bill ratio at 1.25. The

backlog reached €87.4 billion, providing strong visibility on

future sales.

In the fiscal year 2022/23, Alstom’s adjusted

EBIT was €852 million, equivalent to a 5.2% aEBIT margin. Adjusted

net profit was €292 million and free cash flow was €199 million for

the full year.

On 31 March 2023, the Group’s net debt position

stood at €2,135 million, compared to the €2,085 million that the

Group reported on 31 March 2022. Alstom benefits from a solid

€4,787 million liquidity position and equity amounting to €9,102

million on 31 March 2023.

The Board of Directors, in its meeting of 9 May

2023, decided to propose a dividend distribution of €0.25 per share

at the next Shareholders’ meeting on 11 July 2023, which

corresponds to a 33% pay-out ratio from the adjusted net

profit4.

“We have delivered a strong commercial

performance during this year, with new orders exceeding €20 billion

and book-to-bill consistently at 1.25. Market momentum remains very

positive with an increasing orders pipeline, and compelling growth

prospects in all regions supported by a conducive policy

environment focused on the greening of transport. Alstom is

emerging stronger operationally from this year as we accelerate our

transformation. Of note, we have successfully adapted our model to

address the supply chain and electronics headwinds, while

delivering against our financial and environmental objectives. We

remain committed to our mid-term profitability and cash generation

targets, which will be reached in 2025/26.” said

Henri

Poupart-Lafarge,

Chairman of the Board of Directors and Chief Executive Officer of

Alstom.

Key

figures5

|

Actual figures(in € million) |

Full year ended 31

March 2022 |

Full year ended 31

March 2023 |

% Change Reported |

% Change Organic |

|

Orders backlog |

81,013 |

87,387 |

8% |

12% |

|

|

Orders received6 |

19,262 |

20,694 |

7% |

5% |

|

|

Sales |

15,471 |

16,507 |

7% |

5% |

|

|

Adjusted EBIT6 |

767 |

852 |

11% |

|

|

|

Adjusted EBIT margin6EBIT before PPA6 |

5.0% |

5.2%366 |

|

|

|

|

275 |

|

|

Adjusted net profit6 |

(173) |

292 |

|

|

|

|

Free Cash Flow |

(992) |

199 |

|

|

|

***

Strategic and business

update

The Group made progress on all four pillars of

its Alstom in Motion 2025 strategy in this fiscal year 2022/23.

-

Growth by offering greater value to

customers

During the fiscal year 2022/23, the Group

recorded €20.7 billion in orders, with significant commercial

success across multiple geographies, notably in Africa/Middle

East/Central Asia and in Asia/Pacific, and product lines, mostly in

Services. Orders for Services reached a new record level of €6.4

billion, or 31% of the total order intake.In Europe, Alstom

recorded €12.8 billion order intake during the fiscal year 2022/23,

compared to €12.7 billion over the same period last fiscal year. In

Germany, Alstom was awarded a landmark contract to supply 130

Coradia StreamTM High-Capacity electric double-deck trains together

with full maintenance for 30 years to Landesanstalt

Schienenfahrzeuge Baden-Württemberg (SFBW) for the

Baden-Württemberg network, including an option for up to 100

additional trains. With a value of almost €2.5 billion for the firm

order, this contract is a positive indication of Alstom’s market

share ambitions in Germany.

In France, the Group has received orders for 60

additional RER NG trains for the Île-de-France network,

representing the first option under a framework contract signed in

2017 and valued at almost €1 billion, and for additional 15

new-generation Avelia HorizonTM very high-speed trains from SNCF

Voyageurs.

Alstom also signed a historic agreement with

Sweden’s national operator SJ to supply 25 Zefiro ExpressTM

electric high-speed trains, with an option of 15 additional trains.

In Norway, Norske tog ordered 25 more CoradiaTM Nordic regional

trains under the landmark framework agreement signed at the end of

2021 together with an initial first order of 30 trains. In Romania,

the Group will supply 17 additional Coradia StreamTM inter-regional

trains and associated 15 years maintenance services to Romania

Railway Reform Authority (ARF).

In the U.K., Alstom has re-aligned the order

intake for the train service agreement of Elizabeth line with

Transport for London for a 32-year contractual concession period up

to 2046, recognizing €1.1bn in the third quarter, and the Group

signed a Technical Support and Spares Supply Agreement (TSSSA) with

Govia Thameslink Railway (GTR) for a period of five years and five

months to align with the duration of GTR’s National Rail Contract.

And in Spain, the Group has been awarded a contract by Renfe to

supply 49 additional Coradia StreamTM high-capacity trains.

In Americas, Alstom reported €2.7 billion order

intake, as compared to €4.0 billion over the same period last

fiscal year, driven by the award of a contract to provide

operations and maintenance services for the Maryland Area Rail

Commuter (MARC) Camden and Brunswick Lines and for the Innovia

monorail system at Newark Liberty International Airport in the

U.S.A., as well as several small contracts. The performance in

Americas last year was mainly driven by contracts for the Tren Maya

railway project in Mexico, for São Paulo in Brazil and for Metro de

Santiago’s new Line 7 in Chile.

In Asia/Pacific, the order intake stood at €3.0

billion, as compared to €2.3 billion over the same period last

fiscal year. In Australia, Alstom has signed a framework contract

with the Department of Transport Victoria for the provision of 100

FlexityTM low-floor Next Generation Trams (NGTs) for the largest

urban tram network in the world. Valued at approximately €700

million, the contract includes supply of rolling stock and 15-year

maintenance, making this the biggest tram contract in Australia and

in the Southern hemisphere. In India, Alstom has been awarded a

contract by Madhya Pradesh Metro Rail Corporation Limited (MPMRCL)

to deliver 156 MoviaTM metro cars with 15 years of comprehensive

maintenance and the installation of latest generation of

Communications Based Train Control (CBTC) signalling system as well

as train control and telecommunication systems, each with seven

years of comprehensive maintenance, for the Bhopal and Indore metro

projects. The Group also received a contract from Delhi Metro Rail

Corporation (DMRC) to design, manufacture, supply, test and

commission 312 standard gauge metro cars for the Delhi Metro Phase

IV expansion with maintenance services for 78 cars. In Hong Kong,

Alstom was awarded a contract to provide the signalling system for

the Lantau Extension project.

In Africa/Middle East/Central Asia, the Group

reported €2.2 billion order intake, as compared to €0.3 billion

over the same period last fiscal year, mainly driven by a contract

in Egypt to supply 55 MetropolisTM trains and 8-year maintenance to

National Authority for Tunnels (NAT) for upgrade of Cairo Metro

Line 1, valued at €0.9 billion, and an additional order from

Kazakhstan Railways (KZT) for the supply of next generation

locomotives and related maintenance support. The performance last

year was mainly driven by a contract to provide Casa Transports in

Morocco with 66 CitadisTM X05 trams.

As of 31 March 2023, the orders backlog stood at

€87.4 billion, providing the Group with strong visibility over

future sales.

Alstom’s sales amounted to €16.5 billion for the

fiscal year 2022/23, representing a growth of 7% on an actual basis

and 5% on an organic basis compared with Alstom sales last fiscal

year. Sales related to non-performing backlog, corresponding to

sales on projects with a negative margin at completion, amounted to

€2.3 billion during the fiscal year 2022/23.

Rolling stock sales reached €8.8 billion,

representing an increase of 2% on an actual basis, driven by the

continued execution of large rolling stock contracts, including the

Coradia StreamTM trains in the Netherlands, the Regio 2N regional

trains and RER NG double-deck trains for SNCF as well as EMU trains

for the Paris Metro for RATP in France and for Trenitalia in Italy,

the Barcelona Metro for Transports de Barcelona SA in Spain, the

ICE 4 trains and the S-Bahn Stuttgart trains for Deutsche Bahn in

Germany, the AventraTM trains in the United Kingdom and the

double-deck M7-type multifunctional coaches for SNCB in Belgium. On

the other hand, large Rolling Stock contracts such as the TWINDEXX

double-deck trains for SBB in Switzerland, the Coradia StreamTM

trains in Italy and the Nouvelle Automotrice Transilien project for

SNCF in France are close to completion, therefore generating lower

level of sales as compared to last year.

Services sales stood at €3.8 billion, up 12%

versus last year, benefiting from growth in Europe maintenance as

well as Train Operations & System Maintenance services in

Americas.

In Signalling, Alstom reported €2.4 billion

sales, up 7% versus last year, led by a stable execution in Europe

and in APAC and a growing performance in Germany.

Systems sales grew 28% on an actual basis and stood at €1.5

billion, reflecting an acceleration in execution on key projects

notably Cairo monorail in Egypt, Monorails project in Thailand, as

well as the Tren Maya project in Mexico.

The Group announced in July 2022 that it has

concluded the transfer of business activities related to Bombardier

Transportation’s contribution to the V300 ZEFIRO very high-speed

train to Hitachi Rail. Alstom will continue to honour its

obligations under the existing orders for Rolling Stock from

Trenitalia and ILSA to ensure a seamless transition.

In August 2022, Alstom also completed the

divestment of its Coradia Polyvalent platform, its Reichshoffen

production site in France and its TALENT3 platform to CAF.

These milestones signal the completion of the

divestment commitments to the European Commission for their

clearance of the Alstom/Bombardier Transportation transaction.

***

2. Innovation by

Pioneering Smarter and Greener Mobility for All

During the fiscal year 2022/23, Alstom reached

important delivery milestones, and launched a range of initiatives

to accelerate its transformation into a more competitive and agile

group. The R&D expenses reached €519 million7, i.e., 3.1% of

sales for the full year, reflecting the Group’s continuous

investments in innovation, focused on the following areas:

Energy efficiency: Alstom puts a high focus into

aerodynamic efficiency to reduce the energy consumption on our

high-speed trains. The new Avelia Horizon (known as TGV M) has a

resistance reduced by 16% compared with Euroduplex, which accounts

for nearly half of the energy consumption at high speed.

Noise reduction: Flexx Curve is an innovative

solution to reduce the resistance of the wheels and the noise level

in curves. It reduces curve squealing noise by ca. 15 dB and energy

consumption in curves by 80%.

Passenger experience: Alstom’s smart lighting

solution is an intelligent light control system to automatically

adjust the interior LED lighting according to the level of natural

light, weather, time of the day, season, passenger density. For

passengers, it enables to improve their well-being and creates a

pleasant ambiance, respecting the human physiological cycle.

Autonomous train: Alstom’s ATO technology

(Automatic Train Operation) aims at maximising and optimising

operations, increasing line capacity, reducing energy consumption

and costs, and improving general service (including comfort and

punctuality) for passengers. Several important milestones were

reached over the period (for SNCF in particular), both for

passenger trains (success of the first tests of autonomous trains

without any crew member in the driving cab) and for freight

transportation (successful testing of an automatic lateral

signalling system and an obstacle detection radar).

Onboard computer: Alstom is ahead of the

competition in onboard signalling control function for urban and

mainline solutions. Alstom’s solution is a dedicated cybersecurity

board with remote access for easy diagnostic and updates, enabling

space and weight reduction (equipment volume reduced by 60%

compared to the previous generation, resulting in up to one more

seat for a passenger or more room for the driver).

Green traction: The Group reached three

important milestones during 2022/23:

- the entry into full commercial

service of the world first hydrogen-powered line in Germany (fully

homologated),

- the record distance of 1,175 km

without refuelling, exceeding our expectations.

- the validation by the European

Commission of the €350 million IPCEI (for more than €5 billion of

subsidies) boosting the development of Hydrogen solutions.

Last, the Group has developed the “Innovation

Station” (a versatile platform located in strategic areas such as

Singapore, Sweden and Tel Aviv) to bring global mobility solutions

to local ecosystems and leveraging Alstom’s worldwide

footprint.

***

3. Efficiency at scale,

Powered by Digital

In the fiscal year 2022/23, Alstom’s adjusted

EBIT reached €852 million, equivalent to a 5.2% operational margin,

as compared to €767 million or a 5.0% operating margin during the

same period last fiscal year. The increase was driven from

synergies, a favourable evolution on low performing contracts,

increased volume and favourable mix, partly offset by the effect of

inflation.

Synergies generated €205 million adjusted EBIT

over FY 2022/23, versus €102 million last year.

The operational margin percentage was negatively

impacted by the €2.3 billion sales traded at zero gross margin,

mostly related to legacy Bombardier Transportation projects.

Below adjusted EBIT, Alstom recorded capital

loss on disposal of business of €(30) million mainly related to the

sale of remedies in the frame of the Bombardier Transportation

acquisition, and restructuring and rationalisation charges of

€(65)m million mainly related to the adaptation of the means of

production, especially in Germany for €(51) million, in France for

€(9) million, in Canada for €(2) million and in the United Kingdom

for €(2) million.

Integration costs & others before impairment

of tangible assets related to PPA amounted to €(249) million,

consisting of costs related to the integration of Bombardier

Transportation for an amount of €(181) million, mainly related to

our digital suite deployment, €(43) million of legal fees mainly in

the context of Bombardier Transportation’s integration remedies,

and other exceptional expenses for €(25) million.

Taking into consideration restructuring and

rationalisation charges, integration costs & others, Alstom’s

EBIT before amortisation of assets exclusively valued when

determining the purchase price allocation (“PPA”) stood at €366

million. This compares to €275 million in the same period last

fiscal year.

The share in net income from equity investments

amounted to €123 million, excluding the amortisation of the

purchase price allocation (“PPA”) from Chinese joint ventures of

€(11) million, compared to €(334) million in the same period last

fiscal year, which was impacted by a non-cash impairment charge of

€(441) million related to Transmashholding (TMH).

Adjusted net profit, representing the group’s

combined share of net profit from continued operations excluding

PPA net of tax, amounts to €292 million for the fiscal year

2022/23. This compares to an adjusted net profit of €(173) million

last fiscal year.

***

4. One Alstom

team - Agile, Inclusive and

Responsible

More than ever, decarbonisation is at the heart

of Alstom’s strategy. The Group is reducing its own direct and

indirect emissions (Scope 1 & 2) and is also committed to work

with suppliers and customers (Scope 3) to contribute to Net Zero

carbon in the mobility sector. Alstom targets have been submitted

for validation by the independent Science Based Targets initiative

(SBTi) with expected feedback by June 2023.

During the year energy efficiency plans were

deployed in all regions and, along with favourable weather

conditions, resulted in a reduction in energy consumption of 10.5%,

with a particular fall in gas consumption.

The supply of electricity from renewable sources

has also been expanded. Alstom implemented a new contract for the

supply of electricity from renewable energy source in India and

further expanded in France, United Kingdom and Germany to reach 57%

of green electricity coverage globally (vs 42% for FY 2021/22).

Altogether, this has led to a reduction of Scope

1 and 2 CO2 emissions of 22% in 2022/23 versus the previous

year.

The Group is in line with its target to reduce

energy consumption from its solutions with a 23.4% reduction

achieved, compared to 2014 performance. Performance on intensity of

Scope 3 emissions from Use of Sold Products is stable, reflecting

the mix of solutions and geographies of orders taken in recent

years and slow decarbonisation of electricity mix in some

geographies. An engagement programme with customers has been

started and will be extended in coming years.Alstom is also

engaging with suppliers on Scope 3 and committed to decreasing its

CO2 emissions intensity from the supply chain by 30% by 2030.

Regarding Diversity & Inclusion, the Alstom

in Motion (AiM) 2025 strategy targets to reach 28% of women

managers, engineers and professionals roles by 2025. As of end of

March 2023, 23.9% of manager, engineer and professional roles are

held by women. Alstom is on a positive trajectory and will continue

to accelerate its efforts in the coming months.

In addition, Alstom published for the first-year

European Taxonomy-aligned KPIs about Sales, Capex and Opex,

pursuing strong analysis initiated last year for the EU

Taxonomy-eligibility disclosure. EU Taxonomy-aligned Sales amounted

to 59% and ranked Alstom among best in class, confirming the

importance of the sector in which Alstom operates in achieving the

EU’s ambition of carbon neutrality by 2050. The EU Taxonomy purpose

is to redirect capital flows towards sustainable activities and

help navigate transition to a low carbon economy.

In 2022/23, The Group maintained its presence

among the DJSI World and CAC40 ESG index reflecting its strong

position and strategy on Sustainability.

***

Financial structure

The Group’s Free Cash Flow stands at €199

million for the fiscal year 2022/23 as compared to €(992) million

during last fiscal year. As expected, the cash generation was

notably impacted by an unfavourable €(219) million change in

working capital compared to €(1,383) million last year; owing to

continued industrial ramp-up, project stabilization and provisions

consumption.

On 31 March 2023, the Group recorded a net debt

position of €(2,135) million, including bonds with supportive

maturities and cost profile and no financial covenants.

The Group held €826 million of cash and cash

equivalent at the end of March 2023. In addition, Alstom benefits

from a strong liquidity with two Revolving Credit Facilities (RCF)

for a total of €4,250 million8. Both facilities have a one-year

extension options remaining at lenders’ discretion and are undrawn

at 31 March 2023. Both facilities have been successfully extended

by 1 year.

With these RCF lines, the level of Commercial

Papers outstanding on 31 March 2023 of €248 million and the €41

million drawdown from a short-term bank facility, the Group

benefits from solid €4.8 billion liquidity position as of 31 March

2023.

The Group also relies for its bonds and

guarantees needs on both uncommitted bilateral lines in numerous

countries and a Committed Guarantee Facility Agreement (“CGFA”)

with sixteen tier one banks, which was extended to €12.7 billion

during this fiscal year in anticipation of the growing market

demand.

Moody’s has issued a Baa3 rating with a stable

outlook, confirming Alstom Investment Grade. This rating change has

no impact on Alstom’s financial trajectory.

***

Evolution of the Board of

Directors

Alstom’s Board of Directors in its meeting of 9

May 2023 decided to submit to the next Shareholders' Meeting of 11

July 2023 the renewal of the terms of office of Mrs. Sylvie Kandé

de Beaupuy, Mr. Henri Poupart-Lafarge and Mrs. Sylvie Rucar and the

ratification of Mr. Jay Walder, who was co-opted on 15 November

2022.The Board of Directors will also propose the appointment of

Bpifrance Investissement, which holds 7.5% of Alstom's share

capital as of 10 May 2023, as a new independent Board Member.

***

Proposed dividend

At the Annual General Meeting on 11 July 2023,

the Board of Directors will propose the distribution of a dividend

of €0.25 per share. This level corresponds to a pay-out ratio of

33% of adjusted net profit9.

***

Financial trajectory

for FY 2023/24

The Group has based its FY 2023/24 outlook on a

central inflation scenario reflecting a consensus of public

institutions. The Group also assumes its continuous ability to

navigate the supply chain, macro-economic and geopolitical

challenges as it has done during FY 2022/23.

- Book to bill ratio above 1

- Sales growth consistent with

mid-term guidance: CAGR10 above 5%

- Adjusted EBIT Margin expected

around 6%

- Free Cash Flow generation

significantly positive

***

Mid-term financial trajectory and

objectives to be reached in FY

2025/26

Alstom will reach its mid-term adjusted EBIT and

Free Cash Flow objectives in FY 2025/26, one year later than

previously envisioned, as a result mainly of the new macroeconomic

environment in particular the effect of inflation.

- Sales: Between 2020/21 (proforma

sales of €14 billion) – and 2025/26, Alstom is aiming at sales

Compound Annual Growth Rate over 5% supported by strong market

momentum and unparalleled €87.4 billion backlog as of 31 March

2023, securing sales of ca. €38 to 40 billion over the next three

years. Rolling stock should grow above market rate, Services and

Signalling at high-single digit path.

- Profitability: the adjusted EBIT

margin should reach between 8% and 10% from 2025/26 onwards,

benefiting from operational excellence initiatives, strong margins

on new orders including improved indexation, the completion of the

challenging projects in backlog while synergies are expected to

deliver €400 million run rate in 2024/25 and €475 - 500 million

annually from 2025/26 onwards.

- Free Cash Flow: from 2025/26

onwards, the conversion from adjusted net profit to Free Cash Flow

should be over 80%11 driven by mid-term stability of working

capital, stabilisation of CAPEX to around 2% of sales and cash

focus initiatives while benefiting from volume and synergies take

up.

***

Alstom Investor Day 2023

Alstom will host virtually an Investor Day on Wednesday 10 May

2023 at 15.00 (CET). Connection details are available on the Alstom

website.

***

The management report and the consolidated

financial statements, as approved by the Board of Directors, in its

meeting held on 9 May 2023, are available on Alstom’s website at

www.alstom.com. These financial statements were audited by the

Statutory Auditors whose certification report is in the process of

being issued.

Alstom™, Avelia HorizonTM, AventraTM, CitadisTM, Coradia™,

Coradia Stream™, FlexityTM, Zefiro ExpressTM, MetropolisTM and

MoviaTM are trademarks of the Alstom Group

1 Of which 5% organic growth 2 Non - GAAP. See

definition in the appendix.3 From adjusted net profit4 With the

option to receive payment in cash or in new shares5 Geographic and

product breakdowns of reported orders and sales are provided in

Appendix 16 Non - GAAP. See definition in the appendix.7 Excluding

€(61) million of amortisation expenses of the purchase price

allocation of Bombardier Transportation.8 •€1,750 million Revolving

Credit Facility maturing in January 2026. This facility is undrawn

as of 31 March 2023. And €2,500 million Revolving Credit Facility

maturing on January 2028. This facility is also undrawn as of 31

March 2023.9 With the option to receive payment in cash or in new

shares, details of which will be provided in a future press

release. 10 Compound Annual Growth Rate11 Subject to short term

volatility

|

|

About Alstom |

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 63 countries and a talent base of over 80,000 people from 175

nationalities, the company focusses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €16.5 billion

for the fiscal year ending on 31 March 2023. For more information,

please visit www.alstom.com |

|

|

|

| |

Contacts |

Press:Coralie COLLET - Tel.: +33 (1) 57 06 18 81

coralie.collet@alstomgroup.com Thomas ANTOINE - Tel. : +33

(0) 6 11 47 28 60thomas.antoine@alstomgroup.comInvestor Relations

:Martin VAUJOUR – Tel. : +33 (0)6 88 40 17 57

martin.vaujour@alstomgroup.com Estelle MATURELL ANDINO –

Tel.: +33 (0)6 71 37 47 56estelle.maturell@alstomgroup.com

|

|

This press release contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause actual results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.

This press release does not constitute or form

part of a prospectus or any offer or invitation for the sale or

issue of, or any offer or inducement to purchase or subscribe for,

or any solicitation of any offer to purchase or subscribe for any

shares or other securities in the Company in France, the United

Kingdom, the United States or any other jurisdiction. Any offer of

the Company’s securities may only be made in France pursuant to a

prospectus having received the visa from the AMF or, outside

France, pursuant to an offering document prepared for such purpose.

The information does not constitute any form of commitment on the

part of the Company or any other person. Neither the information

nor any other written or oral information made available to any

recipient or its advisers will form the basis of any contract or

commitment whatsoever. In particular, in furnishing the

information, the Company, the Banks, their affiliates,

shareholders, and their respective directors, officers, advisers,

employees or representatives undertake no obligation to provide the

recipient with access to any additional information.

APPENDIX 1A – GEOGRAPHIC

BREAKDOWN

|

Actual figures |

FY |

% |

FY |

% |

|

(in € million) |

2021/22 |

Contrib. |

2022/23 |

Contrib. |

|

Europe |

12,745 |

66% |

12,759 |

61% |

|

Americas |

3,970 |

21% |

2,682 |

13% |

|

Asia/Pacific |

2,289 |

12% |

3,028 |

15% |

|

Middle East/Africa/Central Asia |

258 |

1% |

2,225 |

11% |

|

Orders by destination |

19,262 |

100% |

20,694 |

100% |

|

Actual figures |

FY |

% |

FY |

% |

|

(in € million) |

2021/22 |

Contrib. |

2022/23 |

Contrib. |

|

Europe |

44,202 |

55% |

49,146 |

56% |

|

Americas |

13,116 |

16% |

13,796 |

16% |

|

Asia/Pacific |

11,622 |

14% |

12,191 |

14% |

|

Middle East/Africa/Central Asia |

12,073 |

15% |

12,254 |

14% |

|

Backlog by destination |

81,013 |

100% |

87,387 |

100% |

|

Actual figures |

FY |

% |

FY |

% |

|

(in € million) |

2021/22 |

Contrib. |

2022/23 |

Contrib. |

|

Europe |

9,584 |

62% |

9,936 |

60% |

|

Americas |

2,563 |

17% |

2,843 |

17% |

|

Asia/Pacific |

2,172 |

14% |

2,378 |

15% |

|

Middle East/Africa/Central Asia |

1,152 |

7% |

1,350 |

8% |

|

Sales by destination |

15,471 |

100% |

16,507 |

100% |

APPENDIX 1B – PRODUCT BREAKDOWN

|

Actual figures |

FY |

% |

FY |

% |

|

(in € million) |

2021/22 |

Contrib. |

2022/23 |

Contrib. |

|

Rolling stock |

9,801 |

51% |

10,348 |

50% |

|

Services |

4,168 |

21% |

6,394 |

31% |

|

Systems |

2,654 |

14% |

1,008 |

5% |

|

Signalling |

2,639 |

14% |

2,944 |

14% |

|

Orders by product line |

19,262 |

100% |

20,694 |

100% |

|

Actual figures |

FY |

% |

FY |

% |

|

(in € million) |

2021/22 |

Contrib. |

2022/23 |

Contrib. |

|

Rolling stock |

40,832 |

50% |

42,806 |

49% |

|

Services |

26,789 |

33% |

30,741 |

35% |

|

Systems |

6,282 |

8% |

6,330 |

7% |

|

Signalling |

7,110 |

9% |

7,510 |

9% |

|

Backlog by product line |

81,013 |

100% |

87,387 |

100% |

|

Actual figures |

FY |

% |

FY |

% |

|

(in € million) |

2021/22 |

Contrib. |

2022/23 |

Contrib. |

|

Rolling stock |

8,647 |

56% |

8,784 |

53% |

|

Services |

3,406 |

22% |

3,817 |

23% |

|

Systems |

1,155 |

7% |

1,476 |

9% |

|

Signalling |

2,263 |

15% |

2,430 |

15% |

|

Sales by product line |

15,471 |

100% |

16,507 |

100% |

APPENDIX 2 – INCOME STATEMENT

|

Actual figures |

Full Year ended |

Full Year ended |

|

(in € million) |

31 March 2022 |

31 March 2023 |

|

Sales |

15,471 |

16,507 |

|

Adjusted Gross Margin before PPA* |

2,148 |

2,325 |

|

Adjusted Earnings Before Interest and Taxes

(aEBIT)* |

767 |

852 |

|

Restructuring and rationalisation costs |

(138) |

(65) |

|

Integration, acquisition, and other costs |

(209) |

(279) |

|

Reversal of net interest in equity investees pick-up |

(145) |

(142) |

|

EARNING BEFORE INTEREST AND TAXES (EBIT) BEFORE

PPA* |

275 |

366 |

|

Financial result |

(25) |

(103) |

|

Tax result |

(68) |

(70) |

|

Share in net income of equity investees |

(334) |

123 |

|

Minority interests from continued operations |

(21) |

(24) |

|

Adjusted Net profit |

(173) |

292 |

|

PPA net of tax |

(403) |

(420) |

|

Net profit – Continued operations, Group

share |

(576) |

(128) |

|

Net profit (loss) from discontinued operations |

(5) |

(4) |

|

Net profit (Group share) |

(581) |

(132) |

* See definition below

APPENDIX 3 – FREE CASH FLOW

|

Actual figures(in € million) |

Full Year ended |

Full Year ended |

|

31 March 2022 |

31 March 2023 |

|

EBIT before PPA |

275 |

366 |

|

Depreciation and amortisation1 |

445 |

441 |

| Restructuring |

100 |

12 |

| Capital

expenditure |

(303) |

(289) |

| R&D

capitalisation |

(125) |

(142) |

| Change in

Working Capital2 |

(1,383) |

(219) |

| JVs

dividends |

99 |

114 |

|

| Financial Cash

in / (out) |

9 |

(43) |

| Tax Cash

out |

(141) |

(130) |

|

Others |

32 |

89 |

|

Free Cash Flow |

(992) |

199 |

1 Before PPA2 Change in Working Capital for

€(219) million corresponds to the €(167) million changes in working

capital resulting from operating activities disclosed in the

consolidated financial statements from which the €(12) million

variations of restructuring provisions and €(40)m of variation of

Tax working capital have been excluded.

APPENDIX 4

- NON-GAAP FINANCIAL

INDICATORS DEFINITIONSThis section presents financial

indicators used by the Group that are not defined by accounting

standard setters.

Orders receivedA new order is

recognised as an order received only when the contract creates

enforceable obligations between the Group and its customer. When

this condition is met, the order is recognised at the contract

value. If the contract is denominated in a currency other than the

functional currency of the reporting unit, the Group requires the

immediate elimination of currency exposure using forward currency

sales. Orders are then measured using the spot rate at inception of

hedging instruments.

Book-to-Bill The book-to-bill

ratio is the ratio of orders received to the amount of sales traded

for a specific period.

Adjusted Gross Margin before

PPAAdjusted Gross Margin before PPA is a Key Performance

Indicator to present the level of recurring operational

performance. It represents the sales minus the cost of sales,

adjusted to exclude the impact of amortisation of assets

exclusively valued when determining the purchase price allocations

(“PPA”) in the context of business combination as well as

non-recurring “one off” items that are not supposed to occur again

in following years and are significant.

EBIT before PPAFollowing the

Bombardier Transportation acquisition and with effect from the

fiscal year 2021/22 condensed consolidated financial statements,

Alstom decided to introduce the “EBIT before PPA” indicator aimed

at restating its Earnings Before Interest and Taxes (“EBIT”) to

exclude the impact of amortisation of assets exclusively valued

when determining the purchase price allocations (“PPA”) in the

context of business combination. This indicator is also aligned

with market practice.Adjusted EBITAdjusted EBIT

(“aEBIT”) is the Key Performance Indicator to present the level of

recurring operational performance. This indicator is also aligned

with market practice and comparable to direct competitors. Starting

September 2019, Alstom has opted for the inclusion of the share in

net income of the equity-accounted investments into the aEBIT when

these are considered to be part of the operating activities of the

Group (because there are significant operational flows and/or

common project execution with these entities). This mainly includes

Chinese joint-ventures, namely CASCO, Alstom Sifang (Qingdao)

Transportation Ltd, Jiangsu ALSTOM NUG Propulsion System Co. Ltd.

(former Bombardier NUG Propulsion) and Changchun Changke Alstom

Railway Vehicles Company Ltd.

aEBIT corresponds to Earning Before Interests

and Tax adjusted for the following elements:

- net

restructuring expenses (including rationalisation costs).

- tangibles and

intangibles impairment.

- capital gains or

loss/revaluation on investments disposals or controls changes of an

entity;

- any other

non-recurring items, such as some costs incurred to realise

business combinations and amortisation of an asset exclusively

valued in the context of business combination, as well as

litigation costs that have arisen outside the ordinary course of

business;

- and including

the share in net income of the operational equity-accounted

investments.

A non-recurring item is a “one-off” exceptional

item that is not supposed to occur again in following years and

that is significant.Adjusted EBIT margin corresponds to Adjusted

EBIT expressed as a percentage of sales.

Adjusted net

profit.The “Adjusted Net Profit” indicator aims at

restating the Alstom’s net profit from continued operations (Group

share) to exclude the impact of amortisation & impairment of

assets exclusively valued when determining the purchase price

allocations (“PPA”) in the context of business combination, net of

the corresponding tax effect.

Free cash flowFree Cash Flow is

defined as net cash provided by operating activities less capital

expenditures including capitalised development costs, net of

proceeds from disposals of tangible and intangible assets. Free

Cash Flow does not include any proceeds from disposals of

activity.The most directly comparable financial measure to Free

Cash Flow calculated and presented in accordance with IFRS is net

cash provided by operating activities.

Net

cash/(debt)The net cash/(debt) is defined

as cash and cash equivalents, marketable securities and other

current financial asset, less borrowings.

Pay-out ratio The pay-out ratio

is calculated by dividing the amount of the overall dividend with

the “Adjusted Net profit from continuing operations attributable to

equity holders of the parent, Group share” as presented in the

management report in the consolidated financial statements.

Organic basis This press

release includes performance indicators presented on an actual

basis and on an organic basis. Figures given on an organic basis

eliminate the impact of changes in scope of consolidation and

changes resulting from the translation of the accounts into Euro

following the variation of foreign currencies against the Euro. The

Group uses figures prepared on an organic basis both for internal

analysis and for external communication, as it believes they

provide means to analyse and explain variations from one period to

another. However, these figures are not measurements of performance

under IFRS.

| |

FY 2021/22 |

|

FY 2022/23 |

|

|

|

|

|

(in € million) |

Actual figures |

Exchange rate and scope

impact |

Comparable Figures |

|

Actualfigures |

|

|

% Var Act. |

% Var Org. |

|

Backlog |

81,013 |

(2,746) |

78,267 |

|

87,387 |

|

|

8% |

12% |

|

Orders |

19,262 |

522 |

19,784 |

|

20,694 |

|

|

7% |

5% |

|

Sales |

15,471 |

181 |

15,652 |

|

16,507 |

|

|

7% |

5% |

- PR FY 2022-23 Results - Final

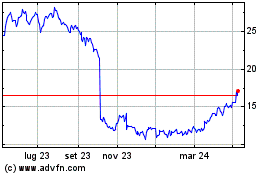

Grafico Azioni Alstom (EU:ALO)

Storico

Da Mar 2024 a Apr 2024

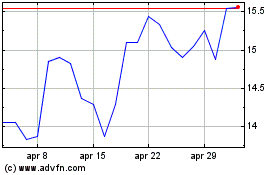

Grafico Azioni Alstom (EU:ALO)

Storico

Da Apr 2023 a Apr 2024