ALSTOM SA: Alstom’s orders and sales for the first three months of

2023/24. Market dynamics and pipeline confirmed.

Alstom’s orders and sales

for the first three

months of

2023/24. Market

dynamics and pipeline confirmed.

- Q1 order intake at €3.9

billion

- Book-to-bill above 1

confirmed for FY 2023/24

- Q1 sales at €4.2 billion,

up 4.3% vs. last year, of which 7.6% organic, in line with

announced growth trajectory

- Full year outlook and

mid-term objectives confirmed

25

July

2023 – Over the first quarter of

2023/24 (from 1 April to 30 June 2023), Alstom booked €3.9 billion

of orders. The Group’s sales reached €4.2 billion in the quarter,

up 4.3% vs. last year, in line with announced growth trajectory.

The backlog, as of 30 June 2023, settled at €87 billion, providing

strong visibility on future sales.

Key figures

|

Actual figures(in € million) |

2022/23Q1

|

2023/24Q1 |

% ChangeReported |

% ChangeOrganic |

|

Orders received |

5,601 |

3,875 |

(30.8)% |

(28.9)% |

|

Sales |

4,002 |

4,175 |

+4.3% |

+7.6% |

Geographic and product breakdowns of reported orders and sales

are provided in Appendix 1. All figures mentioned in this release

are unaudited.

“Alstom’s first quarter saw the booking of

important Systems contracts in the Philippines and Romania, we also

secured a landmark tramways project in Philadelphia, US. The market

environment remains positive with a large pipeline of opportunities

over the next three years. Our focus on execution has enabled our

organic sales to increase in line with our announced trajectory.

Confident in the resilience of our business model, we confirm our

short and mid-term targets.” said Henri

POUPART-LAFARGE, Alstom Chairman and Chief

Executive Officer.

***

Detailed review

During the

first quarter of

2023/24

(from 1 April

to 30 June

2023),

Alstom recorded

€3,875 million

in orders,

compared to

€5,601 million

over the same period last fiscal

year. Last year’s performance was mainly

driven by a landmark contract awarded by Landesanstalt

Schienenfahrzeuge Baden-Württemberg (SFBW) network in Germany for

almost €2.5 billion.Over three months, orders for Services,

Signalling and Systems reached 64% of the total order intake. On a

regional level, Europe accounted for 48% of the Group total order

intake. Alstom was awarded a contract with the Cluj-Napoca City

Hall for the construction of Cluj-Napoca Metro Line 1, in Romania,

as part of a consortium with the civil works companies Gulermak and

Arcada. The full value of this state-of-the-art turnkey project

comes to around €1.8 billion, with Alstom’s share reaching

approximately €400 million.

In Americas, the Group has signed a contract

with the Southeastern Pennsylvania Transportation Authority

(SEPTA), to deliver 130 full low floor electric streetcars in

Philadelphia valued at over €667 million, with options to build an

additional 30 streetcars.

In the Asia/Pacific region, Alstom has been

awarded, in a consortium with Colas Rail, by Mitsubishi Corporation

a contract to provide an integrated railway system for the

extension of the North-South Commuter Railway project (NSCR) in the

Philippines. Alstom’s contract share is worth approximately €1

billion.

Sales were

€4,175

million in Q1

2023/24

(from 1 April to 30 June 2023)

versus

€4,002

million in

Q1

2022/23

(+4.3%).

Sales in Rolling Stock in the quarter stood at

€2,294 million, up 5.5% versus Q1 2022/23, reflecting a sound level

of execution during the quarter notably in Europe, Brazil and

Kazakhstan.

Signalling sales stood at €599 million, up 13%

versus last year, on the back of a consistent execution across all

regions.

In Systems, Alstom reported €326 million sales,

down 16% vs. last year, impacted by a few projects ending during

this quarter.

Services delivered a sustained performance in

the quarter and reported €956 million of sales, up 5.1% versus last

year, driven by a good performance of Assets Life Management

activity, notably in Italy and North America.

The book-to-bill ratio is 0.93 over the

quarter.

***

Main highlights of

the first quarter

of

2023/24

During the quarter, Alstom reached important

delivery milestones, and launched a range of initiatives to

accelerate its transformation into a more competitive and agile

group.

In June 2023, Alstom announced the entry into

passenger service of the MRT Yellow Line in Bangkok. The project

delivery, led by Alstom’s Turnkey regional hub in Bangkok, included

system integration, installation and test and commissioning of the

Innovia monorail trains, Cityflo 650 GOA4 driverless signalling,

communication systems, power supply and conductor rail, track

switches, platform screen doors and depot equipment. Bangkok’s

first driverless urban line features 30 four-car monorail train

sets, fully automated train control and integrated wayside railway

systems. Alstom is also delivering the system for the MRT Pink

Line, expected to enter service in 2024.

Also in June, the “lumière” tram, from Alstom’s

Citadis range, has entered commercial service on the new T10

tramway line, which now links La Croix de Berny (Antony) to Jardin

Parisien station (Clamart) in 20 minutes, via Châtenay-Malabry and

Le Plessis-Robinson, in the south of Paris. This new line, almost 7

km long and serving 13 stations, will accommodate almost 25,000

passengers a day.

With its first participation in VivaTech, Alstom

established itself as the leader of smart and green mobility.

Alstom succeeded in blending its native field of expertise – rail

and mobility - with ideas around tech, innovation, agility and

sustainability. Alstom’s presentation was focused on 3 main

areas:

-

Artificial Intelligence: From predictive maintenance to

optimisation of operation, improved safety and energy

consumption,

-

Cybersecurity: The cybersecurity portfolio of Alstom is made of

several type of offers (consulting services, vulnerability

management, cybersecurity enhancement, security monitoring),

- Open

Innovation: Alstom's approach to working with start-ups is focused

on creating a mutually beneficial relationship. Alstom appeared

at VivaTech with a few promising start-ups: SolCold

(Energy/nanotech materials), SoWhen (Digital/VR/AI), Poolp (3D

printing using plastic waste as raw material).

By staying at the forefront of this evolution,

Alstom is pioneering the products and services of the future.

-

One Alstom team Agile, Inclusive and

Responsible

Alstom has announced on the 6th of July the

validation of its CO2 emissions reduction targets by the SBTi

(Science Based Targets initiative) as consistent with levels

required to meet the goals of the Paris Agreement (including

targets for Scope 1&2 in line with a 1.5°C trajectory).

Furthermore, Alstom signed this quarter a major

Power Purchase Agreement focused on solar development in Spain. The

solar farm which will be built in Andalusia is expected to begin

operations early 2025 with a 10-years contract. The project will

cover the equivalent of 80% of Alstom’s electricity consumption in

Europe, so this is a major step in reaching our target of 100%

electricity consumption from renewables.

***

Financial trajectory for FY

2023/24

The Group has based its FY 2023/24 outlook on a

central inflation scenario reflecting a consensus of public

institutions. The Group also assumes its continuous ability to

navigate the supply chain, macro-economic and geopolitical

challenges as it has done during FY 2022/23.

- Book to bill ratio above 1

- Sales growth consistent with

mid-term guidance: CAGR1 above 5%

- Adjusted EBIT Margin expected

around 6%

- Free Cash Flow generation

significantly positive

***

Mid-term financial trajectory and

objectives to be reached in FY

2025/26

- Sales: Between 2020/21 (proforma

sales of €14 billion) – and 2025/26, Alstom is aiming at sales

Compound Annual Growth Rate over 5% supported by strong market

momentum and unparalleled €87 billion backlog as of 30 June 2023,

securing sales of ca. €38 to 40 billion over the next three years.

Rolling stock should grow above market rate, Services and

Signalling at high-single digit path.

- Profitability: the adjusted EBIT

margin should reach between 8% and 10% from 2025/26 onwards,

benefiting from operational excellence initiatives, strong margins

on new orders including improved indexation, the completion of the

challenging projects in backlog while synergies are expected to

deliver €400 million run rate in 2024/25 and €475 - 500 million

annually from 2025/26 onwards.

- Free Cash Flow: from 2025/26

onwards, the conversion from adjusted net profit to Free Cash Flow

should be over 80%2 driven by mid-term stability of working

capital, stabilisation of CAPEX to around 2% of sales and cash

focus initiatives while benefiting from volume and synergies take

up.

1 Compound Annual Growth Rate2 Subject to short

term volatility

|

|

About Alstom |

|

|

|

Alstom commits to contribute to a low carbon future by developing

and promoting innovative and sustainable transportation solutions

that people enjoy riding. From high-speed trains, metros,

monorails, trams, to turnkey systems, services, infrastructure,

signalling and digital mobility, Alstom offers its diverse

customers the broadest portfolio in the industry. With its presence

in 63 countries and a talent base of over 80,000 people from 175

nationalities, the company focusses its design, innovation, and

project management skills to where mobility solutions are needed

most. Listed in France, Alstom generated revenues of €16.5 billion

for the fiscal year ending on 31 March 2023. For more information,

please visit www.alstom.com |

|

|

|

| |

Contacts |

Press:Philippe MOLITOR - Tel.: +33 (0) 7 76 00 97

79 philippe.molitor@alstomgroup.com Thomas ANTOINE -

Tel. : +33 (0) 6 11 47 28 60thomas.antoine@alstomgroup.com

Investor relations :Martin

VAUJOUR – Tel. : +33 (0) 6 88 40 17

57martin.vaujour@alstomgroup.com Estelle MATURELL ANDINO –

Tel.: +33 (0)6 71 37 47 56estelle.maturell@alstomgroup.com

|

|

This press release contains forward-looking

statements which are based on current plans and forecasts of

Alstom’s management. Such forward-looking statements are relevant

to the current scope of activity and are by their nature subject to

a number of important risks and uncertainty factors (such as those

described in the documents filed by Alstom with the French AMF)

that could cause actual results to differ from the plans,

objectives and expectations expressed in such forward-looking

statements. These such forward-looking statements speak only as of

the date on which they are made, and Alstom undertakes no

obligation to update or revise any of them, whether as a result of

new information, future events or otherwise.

This press release does not constitute or form

part of a prospectus or any offer or invitation for the sale or

issue of, or any offer or inducement to purchase or subscribe for,

or any solicitation of any offer to purchase or subscribe for any

shares or other securities in the Company in France, the United

Kingdom, the United States or any other jurisdiction. Any offer of

the Company’s securities may only be made in France pursuant to a

prospectus having received the visa from the AMF or, outside

France, pursuant to an offering document prepared for such purpose.

The information does not constitute any form of commitment on the

part of the Company or any other person. Neither the information

nor any other written or oral information made available to any

recipient, or its advisers will form the basis of any contract or

commitment whatsoever. In particular, in furnishing the

information, the Company, the Banks, their affiliates,

shareholders, and their respective directors, officers, advisers,

employees or representatives undertake no obligation to provide the

recipient with access to any additional information.

APPENDIX 1A – GEOGRAPHIC

BREAKDOWN

|

Actual figures |

2022/23 |

% |

2023/24 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Europe |

3,933 |

70% |

1,850 |

48% |

|

Americas |

405 |

7% |

848 |

22% |

|

Asia / Pacific |

1,235 |

22% |

1,168 |

30% |

|

Middle East / Africa |

28 |

1% |

9 |

0% |

|

Orders by destination |

5,601 |

100% |

3,875 |

100% |

|

Actual figures |

2022/23 |

% |

2023/24 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Europe |

2,412 |

60% |

2,516 |

60% |

|

Americas |

661 |

17% |

772 |

19% |

|

Asia / Pacific |

574 |

14% |

546 |

13% |

|

Middle East / Africa |

355 |

9% |

341 |

8% |

|

Sales by destination |

4,002 |

100% |

4,175 |

100% |

APPENDIX 1B – PRODUCT BREAKDOWN

|

Actual figures |

2022/23 |

% |

2023/24 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Rolling stock |

3,013 |

54% |

1,387 |

36% |

|

Services |

1,844 |

33% |

554 |

14% |

|

Systems |

271 |

5% |

1,465 |

38% |

|

Signalling |

473 |

8% |

469 |

12% |

|

Orders by product line |

5,601 |

100% |

3,875 |

100% |

|

Actual figures |

2022/23 |

% |

2023/24 |

% |

|

(in € million) |

3 months |

Contrib. |

3 months |

Contrib. |

|

Rolling stock |

2,175 |

54% |

2,294 |

55% |

|

Services |

909 |

23% |

956 |

23% |

|

Systems |

388 |

10% |

326 |

8% |

|

Signalling |

530 |

13% |

599 |

14% |

|

Sales by product line |

4,002 |

100% |

4,175 |

100% |

APPENDIX 2 - NON-GAAP

FINANCIAL INDICATORS DEFINITIONS

This section presents financial indicators used

by the Group that are not defined by accounting standard

setters.

Orders receivedA

new order is recognised as an order received only when the contract

creates enforceable obligations between the Group and its customer.

When this condition is met, the order is recognised at the contract

value. If the contract is denominated in a currency other than the

functional currency of the reporting unit, the Group requires the

immediate elimination of currency exposure using forward currency

sales. Orders are then measured using the spot rate at inception of

hedging instruments.

Book-to-Bill The book-to-bill

ratio is the ratio of orders received to the amount of sales traded

for a specific period.

Adjusted Gross Margin before

PPAAdjusted Gross Margin before PPA is a Key Performance

Indicator to present the level of recurring operational

performance. It represents the sales minus the cost of sales,

adjusted to exclude the impact of amortisation of assets

exclusively valued when determining the purchase price allocations

(“PPA”) in the context of business combination as well as

non-recurring “one off” items that are not supposed to occur again

in following years and are significant.

EBIT before PPAFollowing the

Bombardier Transportation acquisition and with effect from the

fiscal year 2021/22 condensed consolidated financial statements,

Alstom decided to introduce the “EBIT before PPA” indicator aimed

at restating its Earnings Before Interest and Taxes (“EBIT”) to

exclude the impact of amortisation of assets exclusively valued

when determining the purchase price allocations (“PPA”) in the

context of business combination. This indicator is also aligned

with market practice.

Adjusted EBITAdjusted EBIT

(“aEBIT”) is the Key Performance Indicator to present the level of

recurring operational performance. This indicator is also aligned

with market practice and comparable to direct competitors. Starting

September 2019, Alstom has opted for the inclusion of the share in

net income of the equity-accounted investments into the aEBIT when

these are considered to be part of the operating activities of the

Group (because there are significant operational flows and/or

common project execution with these entities). This mainly includes

Chinese joint-ventures, namely CASCO, Alstom Sifang (Qingdao)

Transportation Ltd, Jiangsu ALSTOM NUG Propulsion System Co. Ltd.

(former Bombardier NUG Propulsion) and Changchun Changke Alstom

Railway Vehicles Company Ltd.

aEBIT corresponds to Earning Before Interests

and Tax adjusted for the following elements:

- net

restructuring expenses (including rationalisation costs).

- tangibles and

intangibles impairment.

- capital gains or

loss/revaluation on investments disposals or controls changes of an

entity.

- any other

non-recurring items, such as some costs incurred to realise

business combinations and amortisation of an asset exclusively

valued in the context of business combination, as well as

litigation costs that have arisen outside the ordinary course of

business.

- and including

the share in net income of the operational equity-accounted

investments.

A non-recurring item is a “one-off” exceptional

item that is not supposed to occur again in following years and

that is significant.Adjusted EBIT margin corresponds to Adjusted

EBIT expressed as a percentage of sales.

Adjusted net profit.The

“Adjusted Net Profit” indicator aims at restating the Alstom’s net

profit from continued operations (Group share) to exclude the

impact of amortisation & impairment of assets exclusively

valued when determining the purchase price allocations (“PPA”) in

the context of business combination, net of the corresponding tax

effect.

Free cash flowFree Cash Flow is

defined as net cash provided by operating activities less capital

expenditures including capitalised development costs, net of

proceeds from disposals of tangible and intangible assets. Free

Cash Flow does not include any proceeds from disposals of

activity.The most directly comparable financial measure to Free

Cash Flow calculated and presented in accordance with IFRS is net

cash provided by operating activities.

Net

cash/(debt)The net cash/(debt) is defined

as cash and cash equivalents, marketable securities and other

current financial asset, less borrowings.

Pay-out ratio The pay-out ratio

is calculated by dividing the amount of the overall dividend with

the “Adjusted Net profit from continuing operations attributable to

equity holders of the parent, Group share” as presented in the

management report in the consolidated financial statements.

Organic basis This press

release includes performance indicators presented on an actual

basis and on an organic basis. Figures given on an organic basis

eliminate the impact of changes in scope of consolidation and

changes resulting from the translation of the accounts into Euro

following the variation of foreign currencies against the Euro. The

Group uses figures prepared on an organic basis both for internal

analysis and for external communication, as it believes they

provide means to analyse and explain variations from one period to

another. However, these figures are not measurements of performance

under IFRS.

| |

Q1

2022/23 |

|

Q1

2023/24 |

|

|

|

|

(in € million) |

Actual figures |

Exchange rate and scope impact |

Comparable Figures |

|

Actualfigures |

|

% Var Act. |

% Var Org. |

|

Orders |

5,601 |

152 |

5,449 |

|

3,875 |

|

(30.8)% |

(28.9)% |

|

Sales |

4,002 |

123 |

3,879 |

|

4,175 |

|

+4.3% |

+7.6% |

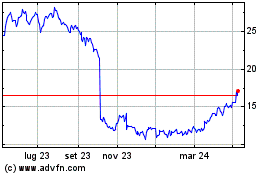

Grafico Azioni Alstom (EU:ALO)

Storico

Da Apr 2024 a Mag 2024

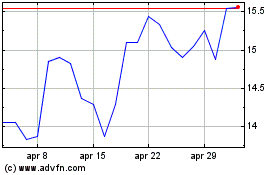

Grafico Azioni Alstom (EU:ALO)

Storico

Da Mag 2023 a Mag 2024