- Outperformance of the 2022 revenues target announced at the

time of the IPO (€35 million) with a year ahead of the targets:

- Confirmation of the achievement of a consolidated EBITDA rate

of around 10% in 2022

- Continued strong sales momentum in a market environment that

remains favorable:

- Backlog1 up sharply to €45 million at December 31, 2022, vs.

€5.5 million at December 31, 2021

- Strong cash position of €21.8 million at the end of December

2022

- Confirmation of 2026 objectives: revenues of €175 million

and consolidated EBITDA rate of around 20%

Regulatory News:

Groupe OKwind (FR0013439627 - ALOKW) (Paris:ALOKW), which

is specialized in the design, manufacture and sale of intelligent

energy generation and management systems dedicated to

self-consumption, today announces its revenues and cash position as

of December 31, 2022.

Louis MAURICE, Founder and Chairman of Groupe OKwind,

said: "The release of Groupe OKwind's 2022 revenues

demonstrates that we are fully respecting the roadmap presented at

the time of our IPO and are outperforming the objectives defined 6

months ago. The very good commercial momentum we are currently

experiencing confirms the value-added of our solutions in a

favorable context marked by the explosion of the energy bill. It is

with great enthusiasm that we take the opportunity of this release

to confirm our 2026 objectives and to announce that we aim to

achieve, a year ahead of the planned roadmap, €80 million in

revenues for the 2023 fiscal year. With a strong cash position, our

ambition to distribute our immediately available, competitive and

sustainable solution to the greatest number of both professionals

and individuals remains intact".

Outperformance of the 2022 revenues

target announced at the time of the IPO (€35 million):

in €m

12/2022

12/2021

Change

in %

Revenues

41.8

25.2

+65.9%

of which BtoB revenues

37.1

22.6

+64.2%

of which BtoC revenues

4.7

2.6

+80.8%

Over the course of the last quarter 2022, Groupe OKwind recorded

strong growth in its three business segments (farms, local

authorities/industrial sites and individuals).

The electricity price environment remains at ever-high levels.

As a result, many professionals concerned about reducing their

energy bills have chosen Groupe OKwind's solutions, which offer

them low-carbon energy at a reduced and constant cost.

In total, 2022 revenues amount to €41.8 million, an increase by

65.9% compared to December 31, 2021, a level significantly above

the €35 million target set at the time of the Company's IPO in July

2022.

At the same time, the acceleration of the commercial momentum

has continued across all business segments with firm order intake

growing exponentially to €80.6 million for fiscal year 2022, an

increase by 186% compared to 2021.

As a result, the backlog has significantly increased and

amounted to €45 million at December 31, 2022, compared to €5.5

million at December 31, 2021.

The growth in revenues has been accompanied by an EBITDA

performance in line with expectations. The Company confirms the

achievement of a consolidated EBITDA rate of around 10% for the

year 2022.

Cash and cash equivalents at December

31, 2022

As of December 31, 2022, the Group's cash position amounted to

€21.8 million, compared to €2.7 million a year earlier. The success

of the initial public offering in July 2022 with a €20.5 million

capital increase and the issuance of a €3.0 million convertible

bond in favor of Sofiprotéol has strengthened the Company's

financial resources.

During the second half of 2022, the Company experienced a

virtuous operating cycle with control of its Working Capital

Requirements and the acceleration of cash generation.

Post-closing event

On the occasion of the Board of Directors meeting held today,

and pursuant to the authorization granted by the Company's General

Meeting on May 6, 2022, a free share allocation plan equivalent to

approximately 1% of the capital was approved. This plan is intended

for all employees of Groupe OKwind, on the basis of an equal

distribution model. In concrete terms, the individual distribution

of 550 free shares will be made on an equal basis, without taking

into account the hierarchical level or seniority of employees with

a 2-year vesting period and no lock-up period.

Development strategy and

outlook

2023 will enable Groupe OKwind to accelerate its commercial

deployment in all its business segments and more specifically in

the farming market, the Company's 1st market, and with local

authorities and industrial sites. As for the activity with private

individuals (Lumioo), Groupe OKwind will reinforce the coverage of

this vertical throughout France.

In parallel, the Company will consider international development

opportunities.

Groupe OKwind will also focus on consolidating its technological

progress with new product developments, in particular a new range

of trackers currently at the pre-production stage, as well as new

energy management and storage systems.

Currently in a hyper-growth phase, the Company is particularly

careful in structuring its operational development.

To this end, the national network will be strengthened with the

opening of 3 new offices over the course of 2023, bringing their

number to 8. In addition, the Company intends to strengthen its

partnerships with players specialized in the assembly and

installation of trackers.

At the level of production teams, the Company will increase its

resources and optimize its industrial performance by improving the

flow management in its production workshop.

Finally, the supply environment is improving as the continuous

rise in prices seems to be over and supply times are now much

shorter.

With a robust business model and a solid and high-quality

backlog, Groupe OKwind targets revenues of around €80 million for

the year 2023.

In the near term, the Company confirms its 2026 objectives with

revenues of €175 million and a consolidated EBITDA rate of around

20%.

Next financial publication: 2022 Annual results and

Revenues for the 1st quarter of 2023, on April 17, 2023 after

market close.

About Groupe OKwind

Founded in 2009 by Louis Maurice, Chairman and CEO, Groupe

OKwind develops solutions for the production and consumption of

green energy in short supply chains. Our comprehensive approach,

combining energy generation and management, aims to strengthen

energy autonomy and thus accelerate the ecological transition.

Thanks to its unique technological ecosystem, Groupe OKwind enables

self-consumption to assert itself as a new avenue for energy. A

solution that can be quickly deployed, managed in real time and at

a competitive price, without subsidies. Every day, we work to

deploy local, low-carbon, fixed-cost energy for professionals and

individuals. In 2022, Groupe OKwind generated consolidated revenues

of €41.8 million and today has 164 employees, with more than 3,280

installations throughout France.

For more information: www.okwind.fr

1The backlog corresponds to orders for which a purchase

order has been signed, some of which are invoiced on delivery and

the remainder on commissioning of the trackers.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230126005729/en/

Groupe OKwind Investor Relations investors@okwind.com

NewCap Mathilde Bohin / Thomas Grojean Investor Relations

okwind@newcap.eu T.: +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations okwind@newcap.eu

T.: +33 (0)1 44 71 94 98

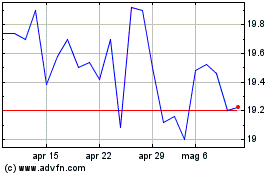

Grafico Azioni Groupe Okwind (EU:ALOKW)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Groupe Okwind (EU:ALOKW)

Storico

Da Mag 2023 a Mag 2024