Regulatory News:

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO ANY

JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR DISTRIBUTE

THIS DOCUMENT.

THE SECURITIES REFERRED TO HEREIN HAVE NOT BEEN AND WILL NOT

BE REGISTERED UNDER THE U.S. SECURITIES ACT AND MAY NOT BE OFFERED

OR SOLD IN THE UNITED STATES, OR TO OR FOR THE ACCOUNT OR BENEFIT

OF, U.S. PERSONS, EXCEPT PURSUANT TO AN APPLICABLE EXEMPTION FROM

REGISTRATION. NO PUBLIC OFFERING OF SECURITIES IS BEING MADE IN THE

UNITED STATES.

Elior Group S.A. (the “Company”) (Paris:ELIOR), has

launched an offering (the “New Notes Offering”) of €500

million in aggregate principal amount of fixed rate senior notes

due 2030 (the “New Notes”).

The New Notes will rank pari passu with the Company’s senior

debt, including its new revolving credit facility. The Company will

also enter into a new revolving credit facility agreement for an

amount of €430 million upon the completion of the New Notes

Offering and cancel its existing senior facilities agreement.

The Company additionally announces today that it has commenced

an offer to holders of its outstanding senior notes due 2026 (the

“Existing Notes”) to tender for cash any and all of their

Existing Notes (the “Tender Offer” and, collectively with

the New Notes Offering, the “Transactions”), subject to the

conditions set out in the tender offer memorandum dated today’s

date (the “Tender Offer Memorandum”). The Tender Offer

Memorandum sets forth full details of the Tender Offer and holders

of the Existing Notes are urged to read the Tender Offer Memorandum

in its entirety. Any terms not defined herein have the meaning

ascribed to them in the Tender Offer Memorandum.

The Company intends to use the gross proceeds from the New Notes

Offering, together with cash on hand and amounts drawn under the

new revolving credit facility agreement, to (i) repurchase the

Existing Notes in the Tender Offer, (ii) repay the drawing under

its existing revolving credit facility, and pay certain fees and

expenses in connection with the Transactions. If not all the

Existing Notes are repurchased in the Tender Offer, the Company

intends to redeem them at or prior to their maturity in accordance

with the terms of the indenture governing the Existing Notes.

Description of the Existing

Notes

Outstanding Principal

Amount

ISIN/Common Code

Purchase Price(1)

Amount subject to the Tender

Offer

3.750% Senior Notes due 2026

€550,000,000

ISIN: XS2360381730 / Common Code:

236038173

100%

Any and all, subject to the New

Financing Condition.

(1) Expressed as a percentage of principal

amount of Existing Notes validly tendered, exclusive of any accrued

and unpaid interest, which will be paid to, but not including, the

Settlement Date.

Whether the Company will accept for purchase any Existing Notes

validly tendered in the Tender Offer and complete the Tender Offer

is subject, without limitation, to the successful completion (in

the sole determination of the Company) of the issue of the New

Notes. Other conditions to the consummation of the Tender Offer are

described in the Tender Offer Memorandum. Subject to applicable

law, the Company reserves the right, in its sole discretion, to

waive any and all conditions to the Tender Offer.

Existing Notes purchased by the Company pursuant to the Tender

Offer are expected to be cancelled and will not be re-issued or

resold.

Set forth below is a summary of the important dates in

connection with the Transactions. Holders of the Existing Notes are

advised to check with any bank, securities broker or other

intermediary through which they hold Existing Notes when such

intermediary would need to receive instructions from a holder of

the Existing Notes in order for such holder to be able to

participate in, or (in the limited circumstances in which

revocation is permitted) revoke its instruction to participate in,

the Tender Offer before the deadlines specified below. The

deadlines set by any such intermediary and each Clearing System for

the submission of Tender Instructions (as defined in the Tender

Offer Memorandum) will be earlier than the relevant deadlines

specified below.

- Commencement of Tender Offer and launch of the New Notes

Offering: January 20, 2025.

- Pricing of the New Notes (if any): Expected to be prior to the

Expiration Time.

- Expiration Time of the Tender Offer: 4:00 p.m. London time on

January 27, 2025, unless extended, re-opened, amended or earlier

terminated pursuant to the terms set forth in the Tender Offer

Memorandum.

- Announcement of Tender Offer Results: as soon as reasonably

practicable after the Expiration Time

- Settlement Date of the Tender Offer: We currently anticipate

this date would be February 5, 2025, and in any case, one Business

Day after the settlement of the New Notes, provided that all

conditions to the occurrence of the Settlement Date have been

satisfied or waived.

A mechanism of priority allocation in the New Notes may be

applied at the sole and absolute discretion of the Company for

holders of the Existing Notes who participate in the Tender Offer

and who wish to subscribe to the New Notes.

Additional Information

The Tender Offer Memorandum will also be made available to

holders of Existing Notes through the Tender Agent:

Kroll Issuer Services Limited The Shard 32 London Bridge

Street London SE1 9SG United Kingdom Tel: +44 20 7704 0880

Attention: David Shilson Email: eliorgroup@is.kroll.com Website:

https://deals.is.kroll.com/eliorgroup

For other information, please contact:

The Dealer Managers

BNP Paribas 16, boulevard des Italiens 75009 Paris France

Tel: +33 1 55 77 78 94 Attention: Liability Management Group

liability.management@bnpparibas.com

Crédit Agricole Corporate and Investment Bank 12 place

des États-Unis CS 70052 92547 Montrouge Cedex France Tel: +44 207

214 5903 Attention: Liability Management

liability.management@ca-cib.com

****************

Important notice

This press release constitutes a public disclosure of inside

information under Regulation (EU) 596/2014 (16 April 2014) and

Implementing Regulation (EU) No 2016/1055 (10 June 2016).

The New Notes will be offered and the Tender Offer is being made

only in offshore transactions outside the United States pursuant to

Regulation S under the U.S. Securities Act of 1933, as amended (the

“Securities Act”), subject to prevailing market and other

conditions. There is no assurance that the Transactions will be

completed or, if completed, as to the terms on which it is

completed. The New Notes have not been registered under the

Securities Act or the securities laws of any other jurisdiction and

may not be offered or sold in the United States absent registration

or unless pursuant to an applicable exemption from the registration

requirements of the Securities Act and any other applicable

securities laws. This press release does not constitute an offer to

sell or the solicitation of an offer to buy any securities, nor

shall it constitute an offer, solicitation or sale in any

jurisdiction in which such offer, solicitation or sale would be

unlawful.

The New Notes are not intended to be offered, sold or otherwise

made available to and should not be offered, sold or otherwise made

available to any retail investor in the European Economic Area

(“EEA”). For these purposes, a retail investor means a

person who is one (or more) of: (i) a retail client as defined in

point (11) of Article 4(1) of Directive 2014/65/EU (as amended,

“MiFID II”); (ii) a customer within the meaning of Directive

(EU) 2016/97 (as amended), where that customer would not qualify as

a professional client as defined in point (10) of Article 4(1) of

MiFID II; or (iii) not a qualified investor as defined in

Regulation (EU) 2017/1129 (as amended, the “Prospectus

Regulation”).

The New Notes are not intended to be offered, sold or otherwise

made available to and should not be offered, sold or otherwise made

available to any retail investor (as defined above) in the United

Kingdom. The expression “retail investor” in relation to the United

Kingdom means a person who is one (or more) of the following: (i) a

retail client, as defined in point (8) of Article 2 of Regulation

(EU) No 2017/565 as it forms part of domestic law by virtue of the

European Union (Withdrawal) Act 2018 (the “EUWA”); (ii) a

customer within the meaning of the provisions of the Financial

Services and Markets Act 2000 and any rules or regulations made

thereunder to implement Directive (EU) 2016/97, where that customer

would not qualify as a professional client, as defined in point (8)

of Article 2(1) of Regulation (EU) No 600/2014 as it forms part of

domestic law by virtue of the EUWA; or (iii) not a qualified

investor as defined in Article 2 of Regulation (EU) 2017/1129 as it

forms part of domestic law by virtue of the EUWA.

This announcement does not constitute and shall not, in any

circumstances, constitute a public offering nor an invitation to

the public in connection with any offer within the meaning of the

Prospectus Regulation or otherwise. The offer and sale of the New

Notes will be made pursuant to an exemption under the Prospectus

Regulation from the requirement to produce a prospectus for offers

of securities.

In the United Kingdom, this announcement is directed only at (i)

persons having professional experience in matters relating to

investments falling within Article 19(5) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005 (the

“Order”), or (ii) high net worth entities falling within

Article 49(2)(a) to(d) of the Order, or (iii) persons to whom it

would otherwise be lawful to distribute them, all such persons

together being referred to as “Relevant Persons.” The New Notes are

only available to, and any invitation, offer or agreement to

subscribe, purchase or otherwise acquire such New Notes will be

engaged in only with, Relevant Persons.

MiFID II professionals/ECPs-only/ No PRIIPs KID – Manufacturer

target market (MIFID II product governance) is eligible

counterparties and professional clients only (all distribution

channels). No PRIIPs key information document (KID) has been

prepared as not available to retail investors in EEA.

UK MIFIR professionals/ECPs-only/ No UK PRIIPS KID –

Manufacturer target market (UK MIFIR product governance) is

eligible counterparties and professional clients only (all

distribution channels). No UK PRIIPs key information document (KID)

has been prepared as not available to retail investors in the

United Kingdom.

Neither the content of the Company’s website nor any website

accessible by hyperlinks on the Company’s website is incorporated

in, or forms part of, this announcement. The distribution of this

announcement into certain jurisdictions may be restricted by law.

Persons into whose possession this announcement comes should inform

themselves about and observe any such restrictions. Any failure to

comply with these restrictions may constitute a violation of the

securities laws of any such jurisdiction.

Forward-looking statements

This press release may include forward-looking statements. These

forward-looking statements can be identified by the use of

forward-looking terminology, including the terms “believes”,

‟estimates”, ‟anticipates”, “expects”, “intends”, “may”, “will” or

“should” or, in each case, their negative, or other variations or

comparable terminology. These forward-looking statements include

all matters that are not historical facts and include statements

regarding the Company’s or its affiliates’ intentions, beliefs or

current expectations concerning, among other things, the Company’s

or its affiliates’ results of operations, financial condition,

liquidity, prospects, growth, strategies and the industries in

which they operate. By their nature, forward-looking statements

involve risks and uncertainties because they relate to events and

depend on circumstances that may or may not occur in the future.

Readers are cautioned that forward-looking statements are not

guarantees of future performance and that the Company’s or its

affiliates’ actual results of operations, financial condition and

liquidity, and the development of the industries in which they

operate may differ materially from those made in or suggested by

the forward-looking statements contained in this press release. In

addition, even if the Company’s or its affiliates’ results of

operations, financial condition and liquidity, and the development

of the industries in which they operate are consistent with the

forward-looking statements contained in this press release, those

results or developments may not be indicative of results or

developments in subsequent periods.

The forward-looking statements and information contained in this

announcement are made as of the date hereof and the Company

undertakes no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events or otherwise, unless so required by

applicable securities laws.

About Elior Group

Founded in 1991, Elior Group is a world leader in contract

catering and multiservices, and a benchmark player in the business

& industry, local authority, education and health & welfare

markets. With strong positions in eleven countries, the Group

generated €6.053 million in pro forma revenue in fiscal 2023-2024.

Our 133,000 employees cater for 3.2 million people every day at

20,200 restaurants and points of sale on three continents.

The Group’s business model is built on both innovation and

social responsibility. Elior Group has been a member of the United

Nations Global Compact since 2004, reaching advanced level in

2015.

To find out more, visit www.eliorgroup.com / Follow Elior Group

on Twitter: @Elior_Group

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250119911005/en/

Investor Contact Didier Grandpré –

investor@eliorgroup.com

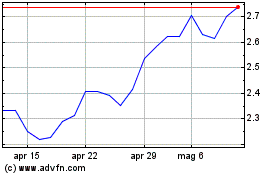

Grafico Azioni Elior (EU:ELIOR)

Storico

Da Dic 2024 a Gen 2025

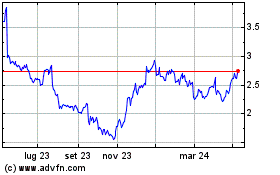

Grafico Azioni Elior (EU:ELIOR)

Storico

Da Gen 2024 a Gen 2025