McPhy Energy: McPhy renews an equity financing line with Vester

Finance

Grenoble, December 19, 2023 – 6:45 pm

CET – McPhy Energy (the « Company »), a

specialist in low-carbon hydrogen production and distribution

equipment (electrolyzers and refuling stations), announces the

set-up of a new equity financing line with Vester Finance1 in the

form of a PACEO, limited to a maximum of 14.6% of its capital2.

Jean-Baptiste Lucas, Chief Executive

Officer of McPhy, comments: « Ensuring our financial

visibility is a key factor of our development. Among our financing

options under consideration, we have chosen to reiterate an equity

line, already successfully carried out in the past alongside Vester

Finance executive, as it strengthens our equity by enabling us to

adjust its use according to our actual needs, thanks to its

flexibility. This transaction, together with the entry into

exclusive negotiations with Atawey for the sale of our station’s

business, further strengthens our financing plan. »

Under the terms of the agreement signed on

December 19, 2023, Vester Finance has agreed to subscribe for a

maximum of 4,800,000 shares in the Company, representing up to

14.6% of the share capital, at its own initiative, over a maximum

period of 24 months, subject to certain customary contractual

conditions.

The shares will be issued based on the average

stock market price preceding each issuance3, less a maximum

discount of 5,0%, in compliance with the pricing and the cap rules

set by the Annual General Meeting4. Vester Finance will receive a

variable commission of 2.0%.

The Company is committed to a minimum drawdown

up to 2 million euros from the equity line, corresponding at the

current share price to a dilution of around 2.0%, beyond which the

Company retains the right to suspend or terminate this agreement at

any time and at no cost.

This transaction was decided by the Chief

Executive Officer, acting on a delegation of authority from the

Company's Board of Directors, in accordance with the 21st

resolution of the Annual General Meeting of May 24, 20235.

Assuming full use of this equity line, a

shareholder holding 1.00% of the Company’s share capital before its

implementation would see a reduction in its stake to 0.854% of the

capital on a non-diluted basis6 and 0.851% of the capital on a

diluted basis7. Based on the current share price, total net

financing would amount to 16.4 million euros8.

This transaction is not subject to the

preparation of a prospectus submitted for approval to the Autorité

des Marchés Financiers (AMF), based on article 1 of Regulation (EU)

2017/1129 as amended (Prospectus Regulation), granting an exemption

when a transaction involves a dilution of less than 20% of the

Company's share capital over a 12-month period.

The number of shares issued under this agreement

and admitted to trading will be reported on the Company's

website.

This equity financing line was structured and

underwritten by Vester Finance, a European company that regularly

invests in growth companies known as "small caps". Vester Finance,

acting here as an investor with no intention of remaining a

shareholder, will sell the shares over time, sooner or later.

Risk factors

The sale of shares on the market is likely to have an impact on

the volatility and liquidity of the stock, as well as on the

Company's share price.

Risk factors affecting the Company are presented

in section 2.1 of the Universal Registration Document as filed with

the AMF on April 25, 2023 and available on the Company's website

(at mcphy-finance.com).

Next financial event:

- Publication of 2023 Annual Revenue, February 5,

2024, after market close

About McPhy

Specialized in hydrogen production and

distribution equipment, McPhy is contributing to the global

deployment of low-carbon hydrogen as a solution for energy

transition. With its complete range of products dedicated to the

industrial, mobility and energy sectors, McPhy offers its customers

turnkey solutions adapted to their applications in industrial raw

material supply, recharging of fuel cell electric vehicles or

storage and recovery of electricity surplus based on renewable

sources. As designer, manufacturer and integrator of hydrogen

equipment since 2008, McPhy has three development, engineering and

production centers in Europe (France, Italy, Germany). Its

international subsidiaries provide broad commercial coverage for

its innovative hydrogen solutions. McPhy is listed on Euronext

Paris (compartment B, ISIN code: FR0011742329, MCPHY).

CONTACTS

|

NewCap |

|

|

Investor RelationsEmmanuel

HuynhT. +33 (0)1 44 71 94 99mcphy@newcap.eu |

Media RelationsNicolas

MerigeauT. +33 (0)1 44 71 94 98 Gaëlle FromaigeatT.+33 (0)1 44

71 98 52mcphy@newcap.eu |

Follow us on @McPhyEnergy

Disclaimer

This press release and the information contained

herein do not constitute an offer to sell or subscribe for, or the

solicitation of an order to buy or subscribe for, McPhy shares in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. The distribution of this

press release may, in certain jurisdictions, be restricted by local

regulations. Persons who obtain possession of this document are

required to comply with all local regulations applicable to this

document.

1 Vester Finance and its executive have carried

out more than 100 equity financing operations in 20 years of

experience, one of which was awarded the "Best Financing Operation

of the Year" prize by the Club des Trente (Source Vester

Finance)

2 On a non-diluted basis (i.e. excluding dilutive instruments

granted to executives and employees of the Group)

3 Lower of the two daily volume-weighted average prices over the

period immediately preceding each issuance

4 The issue price of the shares must be « at

least equal to the weighted average of share prices for the three

trading days preceding the setting of the issue price, possibly

reduced by a maximum discount of 10%. »

5 Delegation of authority to increase the

Company's capital, with the cancellation of preferential

subscription rights to the benefit of a categories of persons with

defined characteristics

6 Based on 27, 997,800 capital shares

outstanding to date

7 Based on 90,913 shares that may be issued upon

exercise of the dilutive instruments issued by the Company to

date

8 Value of shares issued, in the event of full utilization of

the financing line, after deduction of the maximum discount of 5%

and the variable commission of 2% based on the VWAP D-1, i.e.

€3.68

- PR_MCPHY Equity Financing Line_VF

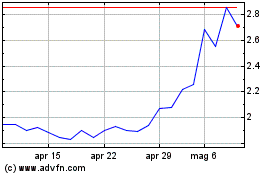

Grafico Azioni Mcphy Energy (EU:MCPHY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Mcphy Energy (EU:MCPHY)

Storico

Da Apr 2023 a Apr 2024