Regulatory News:

MedinCell (Paris:MEDCL):

The 2022-23 Universal Registration Document (URD) filed with

the French market authority (Autorités des Marchés Financiers, or

AMF) under the reference D.23-0628 includes:

- the Annual Financial Report for the year ending on March 31,

2023

- the management report

- the CSR report

- the report on corporate governance

- the proposed text of the resolutions to be submitted to the

Shareholders' Meeting of September 12, 2023

The URD can be consulted on the Company’s website

(medincell.com) and on the AMF’s website

(www.amf-france.org).

Updated selected financial information for the year

2022-2023

Following the completion of the audit procedures on the

Company’s 2022-23 consolidated financial statements by the

Company’s statutory auditors, some changes in figures have been

made compared to those communicated by the Company on June 26,

2023.

Selected financial information for the year 2022-2023

Key consolidated data - IFRS (In

thousands of €)

31/03/2023 12

months

31/03/2022 12

months

PROFIT AND LOSS ACCOUNT

Revenue

9 889

4 090

Other income from ordinary activities

3 766

4 247

Current operating loss

(24 025)

(23 812)

Operating loss

(24 046)

(23 814)

Financial result

(7 964)

(992)

Net result

(32 010)

(24 806)

CASHFLOW

Net cashflow used by operating

activities

(21 005)

(21 362)

Net cashflow from investing activities

1 298

(316)

Net cashflow from financing activities

1 556

(800)

BALANCE SHEET

Equity of the consolidated group

(42 294)

(13 371)

Total non-current liabilities

14 608

19 433

Total current liabilities

57 025

38 241

Total non-current assets

9 772

10 229

Of which financial assets and other

non-current assets

1 460

1 519

Total current assets

19 568

34 074

Of which cash and cash equivalents

6 467

24 617

FINANCIAL DEBT

Financial debt, non-current portion

11 708

16 249

Financial debt, current portion

39 757

27 764

Derivative liabilities

3 055

-

GROSS FINANCIAL DEBT

54 520

44 014

Cash and cash equivalents

6 467

24 617

Capitalization contract *

-

2 560

NET FINANCIAL DEBT **

48 053

16 837

* The Group had funds immobilized in a capitalization contract

and euro funds given as collateral for a bank loan of €7.0m, the

balance of which was repaid in 2022/2023. ** Lease liability

excluded (IFRS 16)

Cash position significantly strengthened

On March 31, 2023, MedinCell had € 6.5 million of cash and cash

equivalents (compared to € 24.6 million of cash and cash

equivalents and € 2.6 million of current and non-current non-risky

financial assets a year ago).

The financial strategy of the Company was adjusted following

FDA’s Complete Response Letter received by Teva on April 19, 2022,

which resulted in commercialization of MedinCell’s first product

approximately one year later than expected.

In November 2022, the Company signed a loan agreement for € 40

million with the European Investment Bank (EIB). The two first

tranches of the credit facility, for a total amount of € 30

million, have been drawn in Q4 2022 and Q1 2023, of which around €

23.3 million have been used to repay the existing EIB loan from

2018 as specified in the agreement. Disbursement of the last € 10

million was conditioned to approval by U.S. FDA of UZEDY that

occurred on April 28, 2023. On July 21, 2023, the company thus

obtained formal approval from the EIB to release Tranche C of the

loan agreement for an amount of €10 million. The funds are expected

to be received on July 31, 2023, at the same time as 313,607

warrants are issued to the EIB. In addition to the new EIB loan,

the Company successfully completed a € 23.2 million net capital

raise in May 2023 through an offering to French and international

investors via a Private Placement and to retail investors in

France.

Considering these financing operations and anticipated revenues

from existing collaboration, MedinCell has the resources to

continue its portfolio development.

As of March 31, 2023, one of the EIB loan covenants had not been

met, giving EIB the right to ask for partial or total early

repayment of the existing loan. On June 12, 2023, the Company

obtained a waiver from EIB, in which it abandons this right. In the

Company's current base-case cash forecast, that does not include

potential new partner service or licensing revenue, or new funding

sources, it is likely that this covenant may not be met again

during the 2023/2024 financial year. If this happens and in the

absence of a new waiver from EIB, and if EIB decides to exercise

its right to ask for partial or total early repayment of the

existing loan, the company may, depending on of the amount asked,

not having the means to meet the EIB's request. This is a

significant uncertainty on the going concern. To avoid this, the

Company is continuing its discussions with the EIB to modify or

remove this covenant.

Consolidated cashflow statement

(In thousands of €)

31/03/2023 12

months

31/03/2022 12

months

A

Net cashflow used by operating

activities

(21 005)

(21 362)

B

Net cashflow from investing activities

1 298

(316)

C

Net cashflow from financing activities

1 556

(800)

Impact of non-monetary items and foreign

exchange rate changes

-

-

Change in net cash position

(18 150)

(22 478)

Cash and cash equivalents - opening

balance

24 617

47 095

Cash and cash equivalents - closing

balance

6 467

24 617

A- Net cashflow used by operating activities

During the year, the Company's cash consumption was similar to

the previous year at € 21 million. Over the same period, operating

expenses increased from € 32.2 million to € 37.7 million, mainly

due to the increase in Research & Development activities.

The Company points out that the first revenues directly linked

to product sales should be royalties from the commercialization of

UZEDY. In the meantime, due to the product development cycle and

depending on the financial parameters set up in the context of

partnerships (which may or may not include certain elements such as

invoicing for formulation services, milestone payments, royalties,

cost sharing, profit sharing, etc.), revenues may vary

significantly from one year to the next.

B- Net cashflow from investing activities

The increase of € 1.6 million compared to previous year

corresponds to the end of the capitalization contract in Q1 2023 (€

2.6 million) partially offset by the acquisition of machinery and

fixed instruments, improvements at the Jacou site for € 0.6

million, and the acquisition of intangible assets for € 0.5 million

related to intellectual property.

C- Net cashflow from financing activities

The net cashflow from financing activities is driven by the new

contract with the EIB signed in November 2022, of which € 30

million have been withdrawn as of March 31, 2023. This cash has

been partly used to early repay the 2018 EIB loan in January 2023

of € 23.3 million.

Profit and loss account

Income from ordinary activities: € 13.7 million

For the year ended March 31, 2023, revenues correspond to:

Development services of € 5.8 million, mainly related to

activities for mdc-WWM and mdc-STM products financed by

international health foundations and agencies, compared to €4.0

million in the previous year.

- The development of a long-acting injectable malaria product

supported by the Unitaid health agency generated revenue of € 2.2

million compared to € 1.3 million in the prior year.

- The development of a long-acting contraceptive product

supported by the Bill & Melinda Gates Foundation generated

revenue of € 2.0 million compared to € 2.4 million in the prior

year.

- Reflecting the intensification of Business Development, R&D

activities related to new partnered programs (proof of feasibility)

generated € 1.6 million revenue compared to € 0.3 million in the

prior year.

In addition, the Company received a milestone payment from Teva

of € 2.9 million after their decision in August 2022 to start Phase

3 clinical activities for mdc-TJK, the second schizophrenia product

candidate.

The Company also received a € 1.2 million royalty payment from

the joint venture, CM Biomaterials, dedicated to the sale of

polymers to the Company's partners, significantly higher than the €

0.1 million the year before.

The Research Tax Credit recognized during the period amounted to

€ 3.7 million (€ 4.2 million in the prior year).

Current operating expenses aligned with the Company's plan: €

37.7 million

Current operating expenses increased by 17% compared to the

previous year. This increase was mainly driven by R&D

activities, which accounted for 74% of operating expenses, reaching

€ 27.9 million, compared to € 23.6 million in the previous year.

This increase is driven by the advancement of the current portfolio

and increased cash requirements in the preclinical stages and the

clinical study conducted during the year.

Resuming to normal activities after the pandemic crisis led to a

14% increase in marketing and business development costs, as travel

is no longer as restrictive as it was in the recent past. Also,

G&A expenses increased by 14%, driven by additional consulting

fees and salaries and benefits increase.

Financial result: € (7.9) million

The financial result is mainly composed of interest expenses on

the EIB loan for € 3.5 million as of 31 March 2023 compared to €1.3

million as of March 31, 2022. The change in fair value of the EIB

loan amounts to € 5.2 million and is composed of:

- Following the renegotiation of the EIB loan carried out on

November 22, 2022, the extinguishment of the old loan and the

accounting for the new loan generate a net expense of € 0.1

million.

- Change in the estimation of variable remuneration has an impact

of € 2.0 million.

- Fair value of the put option related to the EIB loan stock

warrants "BSA" component has an impact of € 3.1 million in

financial expenses.

Consolidated income statement

(In € thousands)

March 31, 2023

March 31, 2022

Net sales

9 889

4 090

Other income from continuing

operations

3 766

4 247

Revenue

13 655

8 338

Costs of goods and services sold

-

-

Research and development costs

(27 925)

(23 607)

Sales and marketing costs

(2 588)

(2 272)

General and administrative costs

(7 167)

(6 271)

Current operating income /

(expense)

(24 025)

(23 812)

Other non-current operating expenses

(99)

(112)

Other non-current operating income

78

110

Operating income / (expense)

(24 046)

(23 814)

Interest income

41

46

Gross borrowing costs

(9 138)

(1 844)

Other financial expenses

(57)

(23)

Other financial income

1 190

829

Financial income / (expense)

(7 964)

(992)

Share of net income / (loss) of

associates

-

-

Income / (loss) before tax

(32 010)

(24 806)

Tax income / (expense)

-

-

NET INCOME / (LOSS)

(32 010)

(24 806)

- Attributable to owners of MedinCell

(32 010)

(24 806)

- Attributable to non-controlling

interests

-

-

Earnings / (loss) per share (€)

(1.27)

(1.00)

Diluted earnings / (loss) per share

(€)

(1.27)

(1.00)

Balance sheet

March 31, 2023

March 31, 2022

Equity of the consolidated group

(42 294)

(13 371)

Total non-current liabilities

14 608

19 433

Total current liabilities

57 025

38 241

Total Equity and Liabilities

29 339

44 303

Total non-current assets

9 772

10 229

Of which financial assets and other

non-current assets

1 460

1 519

Total current assets

19 568

34 074

Of which cash and cash equivalents

6 467

24 617

Total Assets

29 339

44 303

About MedinCell

MedinCell is a commercial-stage technology pharmaceutical

company developing long-acting injectable drugs in many therapeutic

areas. Our innovative treatments aim to guarantee compliance with

medical prescriptions, to improve the effectiveness and

accessibility of medicines, and to reduce their environmental

footprint. They combine already known and used active ingredients

with our proprietary BEPO® technology which controls the delivery

of a drug at a therapeutic level for several days, weeks or months

from the subcutaneous or local injection of a simple deposit of a

few millimeters, entirely bioresorbable. The first treatment based

on BEPO technology, intended for the treatment of schizophrenia,

was approved by the FDA in April 2023, and is now distributed in

the United States by Teva under the name UZEDY™ (BEPO technology is

licensed to Teva under the name SteadyTeq™). We collaborate with

leading pharmaceutical companies and foundations to improve global

health through new treatment options. Based in Montpellier,

MedinCell currently employs more than 140 people representing more

than 25 different nationalities.

UZEDY™ and SteadyTeq™ are trademarks of Teva Pharmaceuticals

This press release contains forward-looking statements,

including statements regarding Company’s expectations for (i) the

timing, progress and outcome of its clinical trials; (ii) the

clinical benefits and competitive positioning of its product

candidates; (iii) its ability to obtain regulatory approvals,

commence commercial production and achieve market penetration and

sales; (iv) its future product portfolio; (v) its future partnering

arrangements; (vi) its future capital needs, capital expenditure

plans and ability to obtain funding; and (vii) prospective

financial matters regarding our business. Although the Company

believes that its expectations are based on reasonable assumptions,

any statements other than statements of historical facts that may

be contained in this press release relating to future events are

forward-looking statements and subject to change without notice,

factors beyond the Company's control and the Company's financial

capabilities.

These statements may include, but are not limited to, any

statement beginning with, followed by or including words or phrases

such as "objective", "believe", "anticipate", “expect”, "foresee",

"aim", "intend", "may", "anticipate", "estimate", "plan",

"project", "will", "may", "probably", “potential”, "should",

"could" and other words and phrases of the same meaning or used in

negative form. Forward-looking statements are subject to inherent

risks and uncertainties beyond the Company's control that may, if

any, cause actual results, performance, or achievements to differ

materially from those anticipated or expressed explicitly or

implicitly by such forward-looking statements. A list and

description of these risks, contingencies and uncertainties can be

found in the documents filed by the Company with the Autorité des

Marchés Financiers (the "AMF") pursuant to its regulatory

obligations, including the Company's registration document,

registered with the AMF on September 4, 2018, under number I.

18-062 (the "Registration Document"), as well as in the documents

and reports to be published subsequently by the Company. In

particular, readers' attention is drawn to the section entitled

"Facteurs de Risques" on page 26 of the Registration Document.

Any forward-looking statements made by or on behalf of the

Company speak only as of the date they are made. Except as required

by law, the Company does not undertake any obligation to publicly

update these forward-looking statements or to update the reasons

why actual results could differ materially from those anticipated

by the forward-looking statements, including in the event that new

information becomes available. The Company's update of one or more

forward-looking statements does not imply that the Company will

make any further updates to such forward-looking statements or

other forward-looking statements. Readers are cautioned not to

place undue reliance on these forward-looking statements.

This press release is for information purposes only. The

information contained herein does not constitute an offer to sell

or a solicitation of an offer to buy or subscribe for the Company's

shares in any jurisdiction, in particular in France. Similarly,

this press release does not constitute investment advice and should

not be treated as such. It is not related to the investment

objectives, financial situation, or specific needs of any

recipient. It should not deprive the recipients of the opportunity

to exercise their own judgment. All opinions expressed in this

document are subject to change without notice. The distribution of

this press release may be subject to legal restrictions in certain

jurisdictions. Persons who come to know about this press release

are encouraged to inquire about, and required to comply with, these

restrictions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230731855452/en/

MedinCell David Heuzé Head of Communications

david.heuze@medincell.com +33 (0)6 83 25 21 86

NewCap Louis-Victor Delouvrier/Alban Dufumier Investor

Relations medincell@newcap.eu +33 (0)1 44 71 94 94

NewCap Nicolas Merigeau Media Relations

medincell@newcap.eu +33 (0)1 44 71 94 94

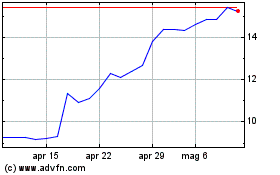

Grafico Azioni Medincell (EU:MEDCL)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Medincell (EU:MEDCL)

Storico

Da Mag 2023 a Mag 2024