Crédit Agricole and Worldline announce the launch of their

joint-venture

Press

Release

A new major step in their partnership to

provide digital payments to merchants in France:

Crédit Agricole and Worldline announce the launch of their

joint-venture

Montrouge, Paris La Défense, 20 March

2024 - After receiving unconditional authorization from the

European Commission, Crédit Agricole [Euronext: ACA] and Worldline

[Euronext: WLN] announce the creation of their joint-venture for

digital payment services for merchants in France.

At the first Board meeting, held on 19

March 2024, Laurent Bennet, Chief Executive Officer of Crédit

Agricole des Savoie, was elected Chairman of the Board of Directors

and Meriem Echcherfi was appointed Chief Executive Officer. The

commercial brand of the joint venture will be unveiled very

soon.

The joint-venture aims to become a major player

in payment services in France. It will leverage Worldline’s

technological performance and innovation capabilities, particularly

in the area of acceptance, and Crédit Agricole group’s merchant

acquiring performance in the French market. The joint-venture will

also be responsible for the commercial development of this alliance

with merchants, while providing active support to the banks within

the Crédit Agricole group. The joint venture is 50% owned plus one

share by Worldline and will therefore be fully consolidated. Crédit

Agricole holds 50% of the capital less one share and will supervise

the joint venture.

The joint venture will integrate the "Cartes

Bancaires" (CB) domestic payment scheme. In addition to French

merchants, Worldline will offer its international merchants access

to the CB scheme, thereby extending its wide range of local payment

methods through access to one of the most powerful European

domestic payment schemes.

Gilles Grapinet, CEO of

Worldline: “With the unconditional approval received from

the European Commission at the beginning of March, we are

particularly pleased to announce today the finalization of the

agreements enabling the implementation of our joint-venture, which

will be headed by Meriem Echcherfi. This is another key step in our

strategic partnership with the Crédit Agricole group in France, a

market offering extremely important development prospects for

Worldline. By combining Worldline's technological expertise and

offerings in payments with Crédit Agricole's performance and

distribution power, this unique collaboration promises to meet the

ever-changing needs of merchants. Together, we have the greatest

ambitions for our joint-venture, which will offer the best of our

two groups to merchants and retailers operating in France in both

physical and online commerce.”

Jean-Paul Mazoyer, Deputy General

Manager of Crédit Agricole S.A. in charge of Technology, Digital

and Payments: "After a period of preparation, the launch

of our joint-venture marks the real starting point of our

partnership with Worldline. This partnership with a major player in

the payments business reflects Crédit Agricole's ambition to

strengthen its leadership in the payments business, a service at

the heart of the banking relationship. Our joint-venture, which

combines Worldline's technological expertise in the acceptance

business with the performance and commercial dynamism of the banks

in Crédit Agricole group, indeed reflects our shared ambition to

offer our merchants customers the very best payment solutions.

Under the responsibility of Meriem Echcherfi, Managing Director,

our joint-venture will rapidly become a key player and leader in

the French market.”

Calendar

- 2023-2024: joint

investment phase of €80 million financed by Worldline and Crédit

Agricole, to develop products and offerings and implement the joint

venture;

- 2024: finalization

of commercial agreements, establishment of the operational

structure, regulatory procedures and preparation of dedicated

offers and announcement of the new brand;

- Early 2025: the

joint venture becomes fully operational and starts generating sales

and gross operating income.

Biographies

Mr Laurent Bennet, Chairman of the Board

of Directors of the joint-venture After starting his

career in an agricultural trade organisation, Mr Laurent Bennet

spent most of his career at Crédit Agricole, firstly at the

Morbihan Regional Bank as a corporate account manager, then as

agricultural market manager and deputy credit manager. In 2004, he

joined the Pyrénées Gascogne Regional Bank, where he held a number

of positions, including Business Manager and Network Manager. He

was appointed Deputy General Manager of the Savoie Regional Bank in

2009. In 2013, he joined Crédit Agricole S.A. as Deputy Head of

Group Risks and Permanent Controls before being appointed Head of

Agriculture, Agrifood and Business Services. Since January 2019,

Laurent Bennet has been Chief Executive Officer of Crédit Agricole

des Savoie.Laurent Bennet is a graduate of AgroParisTech and the

Institut Technique de Banque.

Mrs Meriem Echcherfi, Managing Director

of the joint-ventureMeriem Echcherfi began her career at

Société Générale in 2004, within the risk department on the Basel

II project implementation and then in the corporate and investment

banking division as director of market Risk Advisory and derivative

sales for corporate clients. In 2012, she joined the Boston

Consulting Group as project leader for financial institutions in

Paris and Casablanca, before becoming Head of Mastercard Advisors

France in 2016, then Vice President in charge of business

development in 2018. Meriem Echcherfi joined Crédit Agricole in

2019 as head of Credit Agricole SA Group Strategy, then Head of

Merchant Services in 2023.Meriem Echcherfi is a graduate of

Centrale Paris in strategy and mathematics applied to

finance.Contacts

Worldline’s

Investor

Relations

Laurent

Marie laurent.marie@worldline.comGuillaume

Delaunay guillaume.delaunay@worldline.com

Worldline’s

Communication

Sandrine van der Ghinst

+32 4 99 58 53

80 sandrine.vanderghinst@worldline.comHélène

Carlander +33

7 72 25 96

04 helene.carlander@worldline.com

Crédit Agricole’s Relations

Investor

Relations

|

Institutional shareholders |

+ 33 1 43 23 04 31 |

investor.relations@credit-agricole-sa.fr |

| Individual

shareholders |

+ 33 8 00 00 07

77 |

relation@actionnaires.credit-agricole.com |

|

Cécile Mouton |

+ 33 1 57 72 86 79 |

cecile.mouton@credit-agricole-sa.fr |

Crédit Agricole’s

Communication Alexandre

Barat +

33 1 57 72 12

19 alexandre.barat@credit-agricole-sa.fr Olivier

Tassain

+ 33 1 43 23 25

41 olivier.tassain@credit-agricole-sa.frBénédicte

Gouvert +

33 1 49 53 43

64 benedicte.gouvert@ca-fnca.fr

About Worldline

Worldline [Euronext: WLN] helps businesses of

all shapes and sizes to accelerate their growth journey – quickly,

simply, and securely. With advanced payments technology, local

expertise and solutions customised for hundreds of markets and

industries, Worldline powers the growth of over one million

businesses around the world. Worldline generated a 4.6 billion

euros revenue in 2023.

Worldline’s corporate purpose (“raison d’être”)

is to design and operate leading digital payment and transactional

solutions that enable sustainable economic growth and reinforce

trust and security in our societies. Worldline makes them

environmentally friendly, widely accessible, and supports social

transformation.

About Crédit Agricole

The Crédit Agricole Group is the leading

financier of the French economy and one of the top banks in Europe.

A leader in retail banking in Europe, the Group is also Europe's

leading asset manager, Europe's leading bancassurer and Europe's

third-largest provider of project finance.

Backed by its cooperative and mutualist

foundations, its 145,000 employees and 27,000 Local and Regional

Bank directors, the Crédit Agricole Group is a responsible and

useful bank serving 53 million customers, 11.5 million members and

800,000 individual shareholders.

Thanks to its local universal banking model -

the close association between its local banks and the related

business lines - the Crédit Agricole group supports its customers

in their projects in France and around the world: day-to-day

banking, mortgages and consumer credit, savings, insurance, asset

management, real estate, leasing, factoring, corporate and

investment banking.

At the service of the economy, Crédit Agricole

also stands out for its dynamic and innovative corporate social

responsibility policy. It is based on a pragmatic approach that

permeates the entire Group and puts every employee into action.

Disclaimer

This document contains forward-looking

statements that involve risks and uncertainties, including

references, concerning the Group's expected growth and

profitability in the future which may significantly impact the

expected performance indicated in the forward-looking statements.

These risks and uncertainties are linked to factors out of the

control of the Company and not precisely estimated, such as market

conditions or competitors’ behaviors. Any forward-looking

statements made in this document are statements about Worldline’s

beliefs and expectations and should be evaluated as such.

Forward-looking statements include statements that may relate to

Worldline’s plans, objectives, strategies, goals, future events,

future revenues or synergies, or performance, and other information

that is not historical information. Actual events or results may

differ from those described in this document due to a number of

risks and uncertainties that are described within the 2022

Universal Registration Document filed with the French Autorité des

marchés financiers (AMF) on April 28, 2023 under the filling

number: D.23-0371, and its Amendment filed on July 28, 2023.

Revenue organic growth and Operating Margin

before Depreciation and Amortization (OMDA) improvement are

presented at constant scope and exchange rate. OMDA is presented as

defined in the 2022 Universal Registration Document. All amounts

are presented in € million without decimal. This may in certain

circumstances lead to non-material differences between the sum of

the figures and the subtotals that appear in the tables. 2023

objectives are expressed at constant scope and exchange rates and

according to Group’s accounting standards.

Worldline does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document is disseminated for information

purposes only and does not constitute an offer to purchase, or a

solicitation of an offer to sell, any securities in the United

States or any other jurisdiction. Securities may not be offered or

sold in the United States unless they have been registered under

the U.S. Securities Act of 1933, as amended (the “U.S. Securities

Act”) or the securities laws of any U.S. state, or are exempt from

registration. The securities that may be offered in any transaction

have not been and will not be registered under the U.S. Securities

Act or the securities laws of any U.S. state and Worldline does not

intend to make a public offering of any such securities in the

United States.

- PR_Closing_Strategic Partnership_Worldline_Crédit Agricole

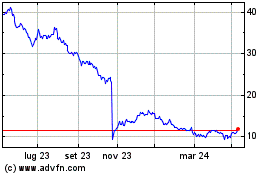

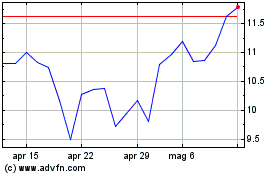

Grafico Azioni Worldline (EU:WLN)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Worldline (EU:WLN)

Storico

Da Nov 2023 a Nov 2024