TIDMARCM

RNS Number : 6570E

Arc Minerals Limited

03 July 2023

3 July 2023

Arc Minerals Ltd

('Arc Minerals' or the 'Company')

Annual Report - December 2022

Arc Minerals Limited announces its audited results for the year

ended 31 December 2022 (the "Annual Report") which is available to

view at the following link:

http://www.rns-pdf.londonstockexchange.com/rns/6570E_1-2023-7-2.pdf

and has also been made available on the Company's website at

http://www.arcminerals.com/investors/document-library/default.aspx

. The Chairman's Statement and primary financial statements are set

out below.

In accordance with shareholders' consent(i) to receive

information electronically and in the absence of any requests

submitted to the Company for information in print, the Annual

Report has not been distributed to shareholders in printed

format.

Notice of the Company's Annual General Meeting will be announced

in due course.

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Forward-looking Statements

This news release contains forward-looking statements that are

based on the Company's current expectations and estimates.

Forward-looking statements are frequently characterised by words

such as "plan", "expect", "project", "intend", "believe",

"anticipate", "estimate", "suggest", "indicate" and other similar

words or statements that certain events or conditions "may" or

"will" occur. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors that could cause

actual events or results to differ materially from estimated or

anticipated events or results implied or expressed in such

forward-looking statements. Such factors include, among others: the

actual results of current exploration activities; conclusions of

economic evaluations; changes in project parameters as plans

continue to be refined; possible variations in ore grade or

recovery rates; accidents, labour disputes and other risks of the

mining industry; delays in obtaining governmental approvals or

financing; and fluctuations in metal prices. There may be other

factors that cause actions, events or results not to be as

anticipated, estimated or intended. Any forward-looking statement

speaks only as of the date on which it is made and, except as may

be required by applicable securities laws, the Company disclaims

any intent or obligation to update any forward-looking statement,

whether as a result of new information, future events or results or

otherwise. Forward-looking statements are not guarantees of future

performance and accordingly undue reliance should not be put on

such statements due to the inherent uncertainty therein.

(i) Shareholder consent to receive information

electronically

At the Annual General Meeting of the Company held in September

2012, Shareholders approved electronic communication and

dissemination of information via the Company's official website,

including but not limited to Notices of General Meetings, Forms of

Proxy and Annual Reports and Accounts. Shareholders are reminded

that their right to request information in print remains unaffected

and that they can do so by contacting the Company giving no less

than 14 days' notice.

**S**

Contacts

Arc Minerals Ltd

Nick von Schirnding (Executive Chairman) +44 (0) 20 7917 2942

SP Angel (Nominated Adviser & Joint

Broker)

Ewan Leggat / Adam Cowl +44 (0) 20 3470 0470

WH Ireland Limited (Joint Broker)

Harry Ansell / Katy Mitchell +44 (0) 20 7220 1666

Chairman's Statement

2022 Overview

The past year was dominated by the Company's ongoing

negotiations with a subsidiary of Anglo American plc ("Anglo

American") to structure and finalise a joint venture in respect of

the Company's copper interests in North Western Zambia.

In May 2022 the Company announced that it, together with its

partners, had entered into an agreement with Anglo American with

the intention to form a joint venture in respect of its Zambian

copper interests. The key commercial terms of the Joint Venture

were that upon signing of a binding Joint Venture (which was

subsequently signed as announced on 20 April 2023 subject to

completing certain Conditions Precedent) Anglo American would have

an initial ownership interest of 70% with Arc and its partners the

balance.

The terms of the Joint Venture agreement included Anglo American

having the right to retain an Ownership Interest of 51% (Phase 1),

by funding exploration expenditures equal to $24m on or before 180

days after the third anniversary and making cash payments to Arc

Minerals' subsidiary Unico of $3m upon signing of the Joint Venture

Agreement and satisfying the Conditions Precedent and $1m per annum

for the following three years with a final payment of $8m by the

end of Phase 1.

Following the completion of Phase I, Anglo American will have

the right to retain an additional ownership interest equal to 9%

(for a total ownership interest of 60%) by funding $20m of

additional exploration expenditures within 2 years of the Phase I

end date and following the completion of Phase II, Anglo American

will have the right to retain an additional ownership interest

equal to 10% (for a total ownership interest of 70%) by funding

$30m within 2 years of the Phase II End Date.

At the date of this report the Company continues to work towards

finalising the Conditions Precedent referred to above.

Following the acquisition of Alvis-Crest (Propriety) Limited in

late 2021, the Company started initial exploration work on its

licenses in Botswana. These licenses lie within and adjacent to the

highly prospective Central Structural Corridor of the Kalahari

Copper Belt ("KCB") and within 10km and 50km of Khomecau's Zone 5

and Banana Zone copper projects respectively, known as the two

largest copper projects on the KCB.

These licenses already host two known copper-nickel anomalies,

both 2-3km in length overlying the favourable interpreted DKF-NPF

contact that have yet to be drill tested and now potentially may

have further targets. As a result of delays associated with the

Covid pandemic the two licenses in Botswana (PL 135/2017 and PL

162/2017) were renewed for an additional two years until 30

September 2024.

On 29 April 2022 the Company announced an update on the progress

of the acquisition of a 73.5% interest in the Misisi gold project

("Misisi") by Regency Mining Ltd ("Regency") from Golden Square

Equity Partners Limited ("Golden Square"). Regency replaced Rackla

Metals Inc. as the acquiror of Misisi. The terms of the transaction

saw Arc being paid US$250,000 with Regency procuring the issuance

to Arc of shares in a publicly listed company in Canada with a

value of US$1,250,000 ("Consideration Shares"). At the time of

writing the issuance of the shares in Canada were subject to

finalisation of an equity raise. The agreement also provides Arc

with a royalty agreement on the same terms as the previous Misisi

royalty agreement announced on 5 May 2021.

In addition, Arc held a US$5m secured loan note dated 19 March

2020 issued by Golden Square ("Loan Note"). The Loan Note has since

been replaced by the issuance to Arc of 3 million shares in a US

listed company, Tingo Inc. (OTC: TMNA) ("Security Shares"), a

agri-fintech business in Africa, in full and final settlement of

the Loan Note.

Sustainability

From an ESG perspective, I am proud to report that the Company

continued with its local outreach programme in some of the

communities where we operate in North West Zambia.

Outlook

Notwithstanding the current economic headwinds of higher energy

prices, the war in Ukraine and elevated levels of inflation and

interest rates the outlook for copper remains strong. Global demand

will require significant additional copper supply over and above

the current requirements. Prolonged underinvestment in exploration

and new mine development means the metal has a future that is well

supported by strong fundamentals.

President Hakainde Hichilema's government has prioritised

additional foreign investment into the mining sector and has made a

number of significant policy changes to support increased economic

growth in Zambia.

Acknowledgements

I would like to extend my gratitude to our shareholders for

their continued support over the past year and look forward to

reporting further on our progress.

Nicholas von Schirnding

Executive Chairman

2 July 2023

Consolidated Statement of Comprehensive Income for the year

ended 31 December 2022

31 December 31 December

2022 2021

Notes GBP 000s GBP 000s

Administrative expenses 3 (3,665) (5,447)

------------- -------------

Operating loss (3,665) (5,447)

Loss on disposal of Zamsort 4 (2,162) -

Loss for the year before tax (5,827) (5,447)

------------- -------------

Income tax expense 5 - -

Loss for the year (5,827) (5,447)

------------- -------------

Other comprehensive income:

Item that may be subsequently

reclassified to profit or loss

Currency translation differences 1,959 597

------------- -------------

Total comprehensive loss for

the year, net of tax (3,868) (4,850)

------------- -------------

Loss attributable to:

Equity holders of the parent (7,342) (5,359)

Non-controlling interest 1,515 (88)

------------- -------------

(5,827) (5,447)

------------- -------------

Total comprehensive loss attributable

to:

Equity holders of the parent (6,048) (5,142)

Non-controlling interest 2,180 292

------------- -------------

(3,868) (4,850)

------------- -------------

Earnings per share attributable to owners

of the parent during the year

- Basic (pence per share) 8 (0.50) (0.50)

- From continuing operations -

Basic 8 (0.50) (0.50)

Consolidated Statement of Financial Position as at 31 December

2022

31 December 31 December

2022 2021

Notes GBP 000s GBP 000s

ASSETS

Non-current assets

Intangible assets 10 5,233 4,490

Fixed assets 11 12 22

Total non-current assets 5,245 4,512

------------ ------------

Current assets

Trade and other receivables 14 1,096 3,971

Assets held for sale 4 - 3,592

Short term investments 16 1,738 439

Cash and cash equivalents 616 1,735

Total current assets 3,450 9,737

TOTAL ASSETS 8,695 14,249

------------ ------------

LIABILITIES

Current liabilities

Trade and other payables 18 (2,733) (1,338)

Total current liabilities (2,733) (1,338)

Non-current liabilities

Long term payables 9 (117) (4,735)

------------ ------------

TOTAL LIABILITIES (2,850) (6,067)

NET ASSETS 5,845 8,182

------------ ------------

Share Capital 19 - -

Share premium 21 64,272 62,019

Share based payment reserve 20 283 273

Warrant reserve 20 84 84

Foreign exchange reserve 1,045 (1,885)

Retained earnings (59,196) (53,385)

------------ ------------

Equity attributable to equity

holders of the parent 6,488 7,106

Non-controlling interest (643) 1,076

TOTAL EQUITY 5,845 8,182

------------ ------------

These financial statements were approved by the Board of

Directors on 2 July 2023 and signed on its behalf by:

Nicholas von Schirnding

Executive Chairman

Consolidated Statement of Cash Flows for the period ended 31

December 2022

31 December 31 December

2022 2021

Notes GBP 000s GBP 000s

--------------------------------------- ------- ------------ ------------

Cash flows from operating activities

Loss before income tax and including

discontinued operations (5,827) (5,447)

Share based payment and warrants

issued 20 27 23

Gain and losses on investments 16 2,519 -

Gain through profit and loss

on forgiven shareholder loans 3 (6,485) -

Loss through profit and loss

on disposal of Zamsort 3 5,517 -

Loss arising on deconsolidation

of Zamsort 4 2,162 -

Gains and Losses on foreign exchange 3 (168) 114

Depreciation and amortisation 10 31

Net cash used in operating activities

before changes in working capital (2,245) (5,279)

------------ ------------

Decrease in inventories - 15

Decrease (Increase) in trade

and other receivables 14 (1,004) (431)

Increase in trade and other payables 18 124 2,116

------------ ------------

Net cash used in operating activities (880) 1,700

------------ ------------

Cash flows from investing activities

Purchase of intangible assets 10 (675) (367)

Proceeds from Casa disposal 202 -

Proceeds on disposal of short

term investments 16 176 -

Net cash used in investing activities (297) (367)

------------ ------------

Cash flows from financing activities

Proceeds from issue of ordinary

shares - net of share issue costs 21 2,253 3,564

Proceeds from exercise of share

based payments - 1,199

Minority shareholder loans 50 292

Net cash from financing activities 2,303 5,055

------------ ------------

Net (decrease) increase in cash

and cash equivalents (1,119) 1,035

Cash and cash equivalents at

beginning of year 1,735 700

------------ ------------

Cash and cash equivalents at

end of the year 616 1,735

------------ ------------

Consolidated Statement of Changes in Equity as at 31 December

2022

Attributable to equity holders of the Company

Share Share Foreign Share Warrant Retained Total Non-controlling Total

capital premium exchange based reserve earnings interest equity

reserve payment

reserve

GBP GBP GBP GBP GBP

000s 000s GBP 000s 000s 000s GBP 000s 000s GBP 000s GBP 000s

Balance as at

1 January

2022 - 62,019 (1,885) 273 84 (53,385) 7,106 1,076 8,182

Loss for the

year - - - - - (5,827) (5,827) 1,515 (4,312)

Other

comprehensive

income(loss)

for the year

- currency

translation

differences - - 1,294 - - - 1,294 665 1,959

Total

comprehensive

income (loss)

for the year - - 1,294 - - (5,827) (4,533) 2,180 (2,353)

Share capital

issued - 2,253 - - - - 2,253 - 2,253

Share options

expired

during the

year - - - (16) - 16 - - -

Share options

expense

during the

year - - - 27 - - 27 - 27

Effect of

foreign

exchange on

opening

balance - - 2,550 (1) - - 2,549 (2,631) (82)

Disposal of

Zamsort - - (914) - - - (914) (1,268) (2,182)

Total

transactions

with owners,

recognised

directly in

equity - 2,253 1,636 10 - 16 3,915 (3,899) 16

--------- -------- --------- -------- -------- ---------- -------- ---------------- ---------

Balance as at

31 December

2022 - 64,272 1,045 283 84 (59,196) 6,488 (643) 5,845

--------- -------- --------- -------- -------- ---------- -------- ---------------- ---------

Attributable to equity holders of the Company

Share Share Foreign Share Warrant Retained Total Non-controlling Total

capital premium exchange based reserve earnings interest equity

reserve payment

reserve

GBP GBP GBP GBP GBP

000s 000s GBP 000s 000s 000s GBP 000s 000s GBP 000s GBP 000s

Balance as at

1 January

2021 - 55,755 (3,111) 1,368 84 (49,056) 5,040 506 5,546

Loss for the

year - - - - - (5,447) (5,447) - (5,447)

Other

comprehensive

income(loss)

for the year

- currency

translation

differences - - 597 - - - 597 - 593

Total

comprehensive

income (loss)

for the year - - 597 - - (5,447) (4,850) - (4,854)

Share capital

issued - 6,264 - - - - 6,264 - 6,264

Granted during

the year - - - 23 - - 23 - 23

Surrendered

during the

year - - - (1,118) - 1,118 - - -

Effect of

foreign

exchange on

opening

balance - - 629 - - - 629 145 774

Investment by

NCI in the

year - - - - - - - 425 425

Total

transactions

with owners,

recognised

directly in

equity - 6,264 629 (1,095) - 118 5,916 570 7,486

--------- -------- --------- -------- -------- ---------- -------- ---------------- ---------

Balance as at

31 December

2021 - 62,019 (1,885) 273 84 (53,385) 7,106 1,076 8,182

--------- -------- --------- -------- -------- ---------- -------- ---------------- ---------

Share capital represents the nominal value of the ordinary

shares.

Share Premium represents consideration less nominal value of

issued shares and costs directly attributable to the issue of new

shares.

Share based payment reserve represents stock options awarded by

the group.

Warrant reserve represents warrants granted by the group.

Foreign exchange reserve represents the translation differences

arising from translating the financial statement items from

functional currency to presentational currency and foreign exchange

differences arising on the elimination of intercompany loans

forming part of the investment of subsidiaries.

Retained earnings represents retained losses.

Non-controlling interest represents the interests of minority

shareholders in the assets and liabilities of the Group.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR RTMTTMTIMTRJ

(END) Dow Jones Newswires

July 03, 2023 02:00 ET (06:00 GMT)

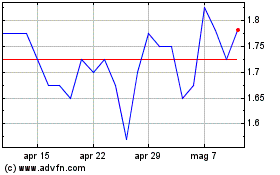

Grafico Azioni Arc Minerals (LSE:ARCM)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Arc Minerals (LSE:ARCM)

Storico

Da Mag 2023 a Mag 2024