TIDMPANR

RNS Number : 8107A

Pantheon Resources PLC

24 January 2024

24 January 2024

Pantheon Resources plc

Result of Annual General Meeting & Investor Presentation

Details

Pantheon Resources plc (AIM: PANR) ("Pantheon" or "the

Company"), the oil and gas company with a 100% working interest in

the Kodiak and Ahpun projects, currently spanning 193,000

contiguous acres in close proximity to pipeline and transportation

infrastructure on Alaska's North Slope, is pleased to announce that

at the Annual General Meeting ("AGM"), held today, all resolutions

were duly passed. A breakdown of the votes will be available

shortly on the Company's website.

Updated Presentation

Pantheon has uploaded an updated investor presentation to its

website, to be presented at 3.30pm GMT. The presentation includes

new information on a revised Ahpun shelf margin horizon ("topset")

well production type curve. This is based on analysis of the

Alkaid-2 re-completion and flow test, conducted in October 2023,

and subsequent analysis of fluid sample data by GeoMark.

GeoMark's pressure-volume-temperature ("PVT") analysis of the

fluid samples gathered during the test resulted in a calculated gas

oil ratio ("GOR") for the Ahpun topset of 1,012 standard cubic feet

per barrel of oil ("scf/bbl"), materially less than the calculated

2,000-3,000 scf/bbl which was previously reported for the Alkaid

ZOI. As well as the reduced GOR, GeoMark reported oil gravity at

the outlet of the separator of 35 (o) API for the Ahpun topset,

with a liquids(1) yield of 162 barrels of per million cubic feet

("bbls/mmcf"). This is a much richer stream than the 42 (o) API oil

with 98 bbls(1) /mmcf produced from the Alkaid ZOI and allows the

total liquids flow rate from the topset to be recalculated to

incorporate the yield of marketable liquids from the associated gas

production.

Pantheon reports that following incorporation of results of

GeoMark analysis, the flow rate during the Alkaid-2 recompletion in

the Ahpun topset was calculated to be 50-140 barrels per day

("bpd") of marketable liquids, 20-40 bpd higher than the originally

announced flow rate.

The pressure transient analysis performed following retrieval of

the downhole pressure gauge indicates greatly improved reservoir

quality compared to the Alkaid ZOI. The calculated effective

permeability of the Ahpun topset is estimated to be at least two

orders of magnitude (i.e. 100x) better.

Pantheon has provided an illustrative model based on Company

estimates of the Ahpun topset type well performance. This results

in an IP30 of 4,000 bpd of marketable liquids, with a first year

average production rate of 2,000 bpd, and estimated ultimate

recovery of 2 million barrels ("mmbl") of marketable liquids per

well. This is based on the development well design of 10,000 feet

lateral length, improved frac design, and recognising the improved

reservoir and fluid characteristics. Projections for cumulative

cashflows and funding requirements based on these estimates

reinforce the robustness of the Ahpun development strategy and the

ability to deploy cashflows from the initial wells to fund the

expansion to a multi-rig programme and to fund the Kodiak Field

development after its FID (expected by the end of 2028).

The presentation is available at:

https://www.pantheonresources.com/index.php/investors/presentations

(1) C5+ liquids

-ENDS-

Further information, please contact:

+44 20 7484

Pantheon Resources plc 5361

David Hobbs, Executive Chairman

Jay Cheatham, CEO

Justin Hondris, Director, Finance and Corporate

Development

Canaccord Genuity plc (Nominated Adviser +44 20 7523

and broker) 8000

Henry Fitzgerald-O'Connor

James Asensio

Ana Ercegovic

+44 20 7138

BlytheRay 3204

Tim Blythe

Megan Ray

Matthew Bowld

In accordance with the AIM Rules - Note for Mining and Oil &

Gas Companies - June 2009, the information contained in this

announcement has been reviewed and signed off by David Hobbs, a

qualified Petroleum Engineer, who has nearly 40 years' relevant

experience within the sector and is a member of the Society of

Petroleum Engineers.

Glossary

Alkaid ZOI Alkaid Zone of Interest

C5+ Hydrocarbons containing 5 or more carbon atoms (Pentane,

Hexane etc)

GOR The amount of natural gas dissolved in a barrel of produced

liquids

IP30 Average Production Rate over first 30 days of production

PVT Analysis Measurement of the fluid characteristics of samples

gathered during a test

Notes to Editors

Pantheon Resources plc is an AIM listed Oil & Gas company

focused on developing the Ahpun and Kodiak fields located on state

land on the Alaska North Slope ("ANS"), onshore USA, where it

currently has a 100% working interest in c. 193,000 acres. In

December 2023, Pantheon was the successful bidder for an additional

66,240 acres with very significant resource potential, extending

the Ahpun and Kodiak project areas. Following the issue of the new

leases, which are expected to be formally awarded in summer 2024

upon payment of the balance of the application monies, the Company

will have a 100% working interest in c. 259,000 acres. Certified

contingent resources attributable to these projects exceeds 1

billion barrels of marketable liquids, located adjacent to Alaska's

Trans Alaska Pipeline System ("TAPS").

Pantheon's stated objective is to demonstrate sustainable market

recognition of a value of $5-$10/bbl of recoverable resources by

end 2028. This will require targeting Final Investment Decision

("FID") on the Ahpun field by the end of 2025, building production

to 20,000 barrels per day of marketable liquids into the TAPS main

oil line, and applying the resultant cashflows to support the FID

on the Kodiak field by the end of 2028.

A major differentiator to other ANS projects is the close

proximity to existing roads and pipelines which offers a

significant competitive advantage to Pantheon, allowing for

materially lower infrastructure costs and the ability to support

the development with a significantly lower pre-cashflow funding

requirement than is typical in Alaska.

The Company's project portfolio has been endorsed by world

renowned experts. Netherland, Sewell & Associates ("NSAI")

estimate a 2C contingent recoverable resource in the Kodiak project

that total 962.5 million barrels of marketable liquids and 4,465

billion cubic feet of natural gas. NSAI is currently working on

estimates for the Ahpun Field.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGSEAFLLELSEIF

(END) Dow Jones Newswires

January 24, 2024 10:15 ET (15:15 GMT)

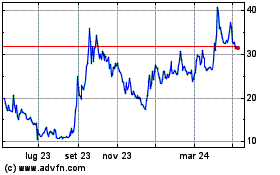

Grafico Azioni Pantheon Resources (LSE:PANR)

Storico

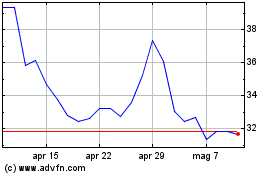

Da Mar 2024 a Apr 2024

Grafico Azioni Pantheon Resources (LSE:PANR)

Storico

Da Apr 2023 a Apr 2024