TIDMTON

RNS Number : 9417Z

Titon Holdings PLC

19 May 2023

19 May 2023

LEI: 213800ZHXS8G27RM1D97

THIS ANNOUNCEMENT RELATES TO THE DISCLOSURE OF INFORMATION THAT

QUALIFIED OR MAY HAVE QUALIFIED AS INSIDE INFORMATION FOR THE

PURPOSES OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EU) 596/2014

AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018.

Titon Holdings Plc

Unaudited Interim Results for the six months to 31 March 2023

and Investor Presentation via Investor Meet Company

Titon Holdings Plc ("Titon", the "Group" or the "Company"), a

leading international manufacturer and supplier of ventilation

systems and window and door hardware, today announces its unaudited

interim results for the six months ended 31 March 2023 ("H1

2023").

Financial Results

Six months Six months % Change

ended 31 March ended 31 March

2023 2022

Net revenue GBP12.08m GBP11.48m 5.2%

EBITDA GBP0.18m GBP0.28m (35.7)%

Loss before tax GBP0.45m GBP0.25m (80.0)%

Basic loss per share 2.86p 1.46p (96.0)%

Interim dividend per 0.5p 1.5p (66.7)%

share

Cash balance GBP1.61m GBP3.73m (56.8)%

Financial highlights

-- Group net revenue rose by 5.2% due to stronger trading in the

UK and Europe, which was slightly ahead of the Board's

expectations

-- EBITDA was GBP0.18 million (2022: GBP0.28m), reflecting lower

gross margins (26% in H1 2023 against 28% in H1 2022) as the Group

continued to manage labour, material and energy cost inflation

-- Loss before tax of GBP0.45m after depreciation and

amortisation charges of GBP0.49m (H1 2022 loss before tax:

GBP0.25m)

-- Cash balance of GBP1.6m at the end of the period (30

September 2022: GBP1.7m) after the payment of dividends to Titon

shareholders. The balance includes a receipt of a dividend from the

Group's Associate, Browntech Sales Co. Ltd

-- Interim dividend of 0.5p per share approved by the Board to be paid on 7 July 2023.

Operational highlights

-- Ventilation Systems sales rose by 31% against H1 2022, driven

by a strong European performance where sales rose by 124% as

component shortages eased and production caught up with demand

-- Window and Door Hardware sales fell by 9%. We continue to

develop a new product partnership, whilst sales of Titon

manufactured products increased by 16%

-- Good progress made against all 2023 key business imperatives,

having caught up on our order backlog and improved management of

stock levels for the main product lines

-- Trading conditions in South Korea remained challenging due to

the weak housing market and the movement to mechanical ventilation

products. Sales were marginally lower against the same period last

year and losses were higher

-- New product development is continuing with a number of new

mechanical and hardware product launches planned, targeting

specific applications and market opportunities.

Current trading and outlook

-- In March 2023 the Office for Budget Responsibility forecast

two quarters of negative growth in GDP before the economy starts

growing again in Q3 2023. The Construction Products Association now

forecasts that private housebuilding output will fall by 17% in

2023 before recovering by 4% in 2024 and with falls in RM&I of

9% in 2023 and rising by 2% in 2024 in the UK

-- The Board remains committed to achieving all of its business

imperatives for the rest of the year and continues to focus on

managing the cost base and improving efficiency throughout the

business

-- Against the macro-economic backdrop, the Group anticipates

that H2 revenues from the UK and Europe will be slightly lower than

H1 as the slowdown in the housing market activity occurs. On a full

year basis, we continue to expect trading at our UK and European

businesses to be in line with our prior expectations, supported by

the H1 performance

-- In South Korea we anticipate that trading conditions will

remain difficult and we expect that losses will continue in H2. As

a result of the weaker trading in South Korea, we anticipate that

the Group's full year results will be lower than previously

expected. As previously reported, we intend to streamline the

corporate structure and operations of the Korean business

-- The Board of Titon remains confident in the long-term

prospects of the Group given the broad product spread and the

Group's strong balance sheet at the period end, together with the

growth opportunities available to the Group, supported by recent

regulatory changes and new product development.

Non-executive Chair Keith Ritchie said:

"The trading performance of the Group over the six months period

to 31 March 2023 generated good levels of sales in our main UK and

European markets for our products. Trading in South Korea remained

difficult as the construction market saw projects delayed, and

losses were higher than we expected. Although our full year

performance in the UK and Europe is expected to be consistent with

our prior expectations, our Group results for the full year to 30

September 2023 will be lower than we previously expected as a

result of the weak trading in South Korea that we continue to

suffer from. We have continued to invest in our products and people

during the period, with a number of new hires as we seek to change

and improve the business. We have started a recruitment process to

hire a new Chief Executive after the departure of Alexandra French

and will update shareholders at the appropriate time.

We continue to benefit from the strength of our balance sheet,

the range of products that we manufacture and sell and markets in

which we trade. The Group is well capitalised with a strong balance

sheet and no debt. We remain confident in the long-term prospects

of the business."

Notice of Investor Presentation

Titon is pleased to announce that Keith Ritchie (Non-executive

Chair) and Carolyn Isom (Chief Financial Officer) will provide a

live presentation relating to the Interim Report via Investor Meet

Company on 26 May 2023 at 9.30am.

The presentation is open to all existing and potential

shareholders. Questions can be submitted pre-event via your

Investor Meet Company dashboard up until 9am the day before the

meeting or at any time during the live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet Titon via:

https://www.investormeetcompany.com/titon-holdings-plc/register-investor

Investors who already follow Titon on the Investor Meet Company

platform will automatically be invited.

For the purposes of UK MAR and Article 2 of the binding

technical standards published by the Financial Conduct Authority in

relation to MAR as regards Commission Implementing Regulation (EU)

2016/1055, this announcement is made by Keith Ritchie,

Non-executive Chair.

For further information please contact

Titon Holdings Plc

Keith Ritchie +44 (0) 7748 146834

Shore Capital - Nominated Adviser and Broker

Daniel Bush +44 (0)20 7408 4090

Tom Knibbs

Titon Holdings PLC

Interim results for the six months to 31 March 2023

Chair's statement

As we anticipated and set out in the Group's 2022 Annual Report,

the business environment has remained challenging for us in the six

months to 31 March 2023 as the pressure on our margins continued,

resulting in a reported Group loss before tax for the period of

GBP0.45m (2022 loss before tax: GBP0.25m). However, I am pleased to

report that sales were 5% higher than in the period to 31 March

2022 although, as we had forecast, our gross margins are lower

compared to last year due to the cost increases we have continued

to suffer. I am pleased that in this period we received a dividend

from our Associate Company in South Korea of GBP0.3m, which has

benefited our cash position. As indicated in the Group's AGM

trading update, overall revenues in the six months to 31 March 2023

were slightly in line with the Board's expectations.

We identified a number of key business imperatives that we

wanted to deliver on in 2023 and I am pleased to report that

progress has been made in all of these. I can also report that our

new ERP system, which caused us some significant challenges in 2022

is working well and we now seek to enhance this system to bring

further process improvement and automation where we can. We are

committed to achieving all the business imperatives for the rest of

the year and these will be replaced by our next set of objectives

which will be separate from the work required to set out our

medium-term strategic plan, which we will commence this year.

Income Statement

In the six months to 31 March 2023, Titon's net revenue (which

excludes inter-segment activity) increased by 5.2% to GBP12.1

million (2022: GBP11.5 million). Sales of Window and Door Hardware

products fell by 9% in the period due to the lower sales of

bought-in hardware products following the ending of a distributor

relationship, which benefited the prior year revenues, offset

somewhat by growth in sales of Titon manufactured hardware

products. Sales of Ventilation Systems products rose by 31% as the

backlog of orders from both our UK and European customers were

manufactured and despatched. Sales in Titon Korea, our 51% owned

subsidiary fell slightly by 1% reflecting the continuing difficult

trading conditions and market dynamics in South Korea.

Gross margins fell to 26.1% (2022: 28.0%) due mainly to the cost

increases we have been unable to reflect in our own pricing to

customers, but also the lower contribution from Titon Korea. EBITDA

was 36% lower at GBP0.18 million (2022: GBP0.28 million), whilst we

made an operating loss of GBP0.39 million (2022 loss: GBP0.21

million). The results from the Group's associate, Browntech Sales

Co. Ltd (BTS) in South Korea, amounted to a loss of GBP54,000 (2022

loss: GBP29,000) as a result of the continuing weak new build

market in Korea and the Korean market shift towards mechanical

ventilation. In aggregate, the Group made a loss before tax of

GBP0.45 million (2022 loss before tax: GBP0.25 million).

The Group's loss per share for the period was 2.86 pence (2022:

loss per share of 1.46 pence) with the total loss after tax of

GBP0.39m (2022 loss: GBP0.21m) and an apportionment to minority

shareholders of a loss of GBP93,000 (2022: loss of GBP47,000) which

reflected the weak trading incurred by Titon Korea.

Whilst it is always disappointing to make a loss in the period,

the Group continues to maintain a strong balance sheet and the

Board has therefore approved the payment of an interim dividend in

respect of the 6 months ending 31 March 2023 of 0.5 pence per share

(2022: 1.50 pence per share). The interim dividend is payable on 7

July 2023 to shareholders on the register at 26 May 2023. The

ex-dividend date is 25 May 2023.

Balance sheet and cash flow

Net assets including non-controlling interests fell by 3.3% or

GBP0.5 million to GBP15.4 million (30 September 2022: GBP16.0

million) with net cash (excluding lease liabilities) of GBP1.6

million (30 September 2022: GBP1.7 million) which is equivalent to

11.1% of net assets (30 September 2022: 10.8%). The Group had no

financial indebtedness at 31 March 2023, other than lease

liabilities. The cash held by Titon Korea reduced to GBP0.05

million at 31 March 2023 (30 September 2022: GBP0.07 million).

The half year saw cash generated by operations of GBP0.02

million (2022: cash used in operations GBP0.29 million), primarily

due to actively improving our working capital management through

accurate targeting of stock levels for the main product lines.

Capital expenditure in the period was GBP0.26 million (2022:

GBP0.39 million) as we continue investing in plant and machinery

and tooling. We were pleased to receive a dividend from BTS in

March 2023 amounting to GBP0.3 million (net of withholding tax)

(2022: nil).

Net current assets were GBP8.0 million at 31 March 2023 (30

September 2022: GBP7.6 million) with a Quick Ratio(1) of 1.23 (30

September 2022: 1.2). Asset Turn was 1.85 (30 September 2022:

1.65).

Segmental and operational review

As we noted in the Annual Report, we had identified a number of

business imperatives that we wanted to deliver on in the current

financial period to stabilise the UK and European businesses and to

return the Group to growth. The key imperative that we identified

was to catch up with backlog of orders caused by the initial

implementation issues of the new ERP system in May 2022 and the

previous supply chain challenges we had faced and I am pleased to

report that we have achieved that. The other key imperative is to

reduce the site inventory held and I am pleased to see that this

has also started to improve and will continue throughout the rest

of this financial year. Revenues in South Korea have stabilised

although new building projects continue to be delayed and sales in

Titon Inc. have fallen slightly compared to last year.

Gross margins have fallen by 1.9% compared to the same period

last year due mainly to the material, labour and energy cost

increases we have experienced that we haven't been able to pass on,

as previously reported, and the lower contribution from Titon

Korea. The reduction in gross margin and an increase in overheads,

resulting from enhancing our management team and technology, has

meant that our operating result is a loss of GBP0.39m versus an

operating loss of GBP0.21m in 2022. Titon Korea contributed

GBP0.19m of this loss (2022 loss: GBP0.12m).

UK and Europe

I am pleased to report that sales in the UK and Europe have

increased over the same period last year, rising by 6% as we worked

hard to reduce the backlog of orders. Sales in UK Window and Door

Hardware have fallen by 9%. Sales of Titon manufactured products

rose by 16% against the same prior period but sales of bought-in

products fell by 51% due to the lower sales of hardware products

following the ending of our distributor relationship with Sobinco,

which benefited the prior year's H1 revenues, whilst we develop our

new distribution partnership with Roto in order to replace some of

those products.

In our Ventilation Systems division, sales in the UK have risen

by 6% against the same period last year as sales of Mechanical

Ventilation with Heat Recovery products grew. However, sales of

ducting bought-in products fell as the production back-log resulted

in lower enquiries for whole house systems in the period. Sales of

the new Titon Ultimate(R) dMEV extract fan started to increase with

revenues growing by approximately four times in the period as some

initial production issues were resolved. We expect sales of this

product to continue to increase in the second half of the year.

Sales of the Titon FireSafe(R) Air Brick range continue at healthy

levels as demand continues for this safety product.

In Europe, Ventilation Systems sales rose by 124% as the

production backlog eased and outstanding orders for our Export

customers were delivered. Exports of our Window and Door Hardware

products were up 15% in the period.

South Korea

Revenues from South Korea were marginally lower than in 2022.

This reflects the difficult conditions for new build in Korea and

the continuing delays in starting new projects. In terms of the

segmental contribution from South Korea, the two businesses, Titon

Korea and BTS are aggregated. The revenue in the Group's accounts,

which is solely that from Titon Korea (the Group's share of BTS's

profits/losses are accounted for as an associate) was flat at

GBP1.5 million (2022: GBP1.5 million).

The segment contribution, which includes the pre-tax loss of

Titon Korea plus 49% of the post-tax loss of BTS, was a loss of

GBP245,000 (2022 loss: GBP152,000) which was higher than we

previously expected.

United States

Sales in our US business remain a very small portion of the

Group's overall sales and were broadly flat against the same period

last year at GBP279,000 (2022: GBP290,000). Titon Inc. made a small

pre-tax profit in the period.

Board

As we announced on 6 April 2023, Alexandra French stepped down

from her role as Chief Executive and left the Board with immediate

effect. I thank Alexandra for all her hard work over the 11 months

that she was Chief Executive. We have started a recruitment process

for her successor and will update shareholders in due course.

I am pleased to say that there have been no other changes to the

Board in the period under review.

I personally thank my colleagues on the Board for their hard

work and counsel over recent months.

Employees

As usual our employees have continued to show a high level of

dedication to the business. In the period under review, we have

managed to catch up on our backlog of customer orders which has now

meant we can return to the high customer service levels our

customers had previously enjoyed. We have trained our factory

employees to be flexible so that they can be allocated to wherever

our production need is which has greatly assisted us in achieving

the position we are in now. Our office staff have also worked

tirelessly to ensure that business as usual has been resumed. I

offer my, and the Board's, thanks for all their efforts.

Investors

Despite the recent weak trading performance, we will pay an

interim dividend of 0.5 pence per share for the period.

We held our AGM in March 2023 in Haverhill and it was good to

have the opportunity to meet some new shareholders and to show them

around the factory and the progress we are making. We always

appreciate their interest in Titon.

Principal risk and uncertainties

The key financial and non-financial risks faced by the Group are

disclosed in the Group's Annual Report and Accounts for the year

ended 30 September 2022 within the Strategic Report (page 6)

available at www.titon.com . Assessments of exposure to financial

and other risks are always difficult given the uncertainties about

the inflationary risks in the UK economy. The Board has considered

the potential impact of these matters on the Group's specific

circumstances, including current and potential cash resources

together with the diverse range of customers and suppliers, across

different geographic areas and markets. Consequently, the Directors

continue to believe that the Group is well placed to manage

business risks successfully.

The Directors have reviewed the budgets, projected cash flows,

principal risks and other relevant information for a period of 12

months from the period end date. Based on this review the Directors

have a reasonable expectation that the Group and Company have

adequate resources to continue in operational existence for a

period of at least twelve months and beyond. For this reason, the

Directors believe it is appropriate to continue to adopt the going

concern basis in preparing the financial statements.

Outlook

The economic outlook for the UK has improved in recent months

compared to the forecasts at the beginning of 2023 when most

forecasts were that the UK would suffer a recession in 2023. The

Office for Budget Responsibility forecast in March this year that

there would be two quarters of falling GDP before the economy

starts growing again in Q3 2023. The Construction Products

Association (CPA) also expects that the UK economy will flat line

in 2023 rather than entering a technical recession, so there is

some positive news generally compared to earlier forecasts.

However, the CPA expects to see private housing output to fall by

17% in 2023 due to the sharp rise in interest rates over the last

12 months before recovering in 2024 by 4% and for private repairs,

maintenance and improvements to fall by 9% in 2023 before rising by

2% in 2024. These are significant forecast reductions in

activities, and we will be impacted by them if they are on this

scale. The changes to UK Building Regulations in 2022 have now all

just about come into effect as the transition rules for house

builders using mechanical ventilation expire in June 2023. We do

expect to see a further shift by them in future away from natural

ventilation to mechanical ventilation as they are required to build

more tightly. This will certainly give us opportunities to sell

higher value whole house systems, at the expense of some trickle

vent sales, into new build.

Our new product development continues to progress well. We are

in the process of launching our higher performing, easier to

specify HRV4 unit, which will replace a number of existing MVHR

variants in our range and will be attractive in both our UK and

European markets. We exhibited this at the recent ISH show in

Germany and received positive interest from our customers. Our new

Ultimate dMEV fan is proving popular and we expect sales to

continue to accelerate as the new build regulation revisions hit

the market, with further versions of that product to come for the

social housing sector. Also shown at the ISH exhibition was the

Ultimate Active vent prototype. As previously mentioned, we aim to

gain interest and then specifications for its use, where it

improves householder thermal comfort compared to standard trickle

vents. We also continue to develop some new hardware products for

specific market sectors and look forward to growth in the aluminium

window and door sector through our new partnership with Roto.

In South Korea we still do not expect a rebound in profitability

until the transition from natural ventilation products to

mechanical products takes effect although we do hope to see a small

increase in sales in 2023/24 as the transition starts to take

effect. We are working with our partners in Korea to streamline the

corporate structure and operations of the Korean business. We are

forecasting a higher loss from our Korean operations than we

previously indicated.

While we recruit a new Chief Executive, we are confident that

our senior leadership team, led by Board members Carolyn Isom and

Tyson Anderson will continue making progress to return the Group to

profitability. Now we have cleared the backlog and our Operations

Director is more embedded, having only joined in November 2022, we

are pleased that we can now offer competitive lead times to our

customers. We have also increased our capacity to be able to meet

market demand. Our newly appointed Commercial Director joins us in

this month as we look to enhance our sales strategies.

Current trading

I am pleased to report that the supply chain component issues I

have flagged in recent financial statements have now largely eased

and the CPA also recently noted that materials and product

availability has improved recently.

H1 trading in the UK and Europe was slightly above the Board's

expectations. We expect that revenues in the second half year will

be slightly lower than the first half, which benefited from the

backlog of orders that we had at the start of the financial year.

As a result of this we have decided to slow down our hiring plans

in the second half and to focus on reducing costs and improving

efficiency throughout the business in the UK and Europe. In South

Korea we anticipate that trading conditions will remain difficult

and we expect that losses will continue in H2. As a result of the

weak trading in South Korea we anticipate that the Group's full

year results will be lower than previously expected.

Despite the challenges the business has faced, we continue to

have a strong balance sheet, very talented employees and a good

range of products in both our divisions that give us confidence in

our medium-term future.

A list of current directors is maintained on the Group's website

www.titon.com.

On behalf of the Board

Keith A Ritchie

Chair

18 May 2023

Notes

1. The Quick Ratio measures liquidity and is calculated by

dividing Current Assets less inventories by Current Liabilities

Titon Holdings Plc

Consolidated Interim Income Statement

for the six months ended 31 March 2023

6 months 6 months Year to

to 31.3.23 to 31.3.22 30.9.22

unaudited unaudited audited

Note GBP'000 GBP'000 GBP'000

Revenue 2 12,077 11,478 22,087

Cost of sales (8,918) (8,261) (16,270)

Gross profit 3,159 3,217 5,817

Distribution costs (593) (612) (1,393)

Administrative expenses (2,704) (2,504) (4,586)

Administrative expenses - exceptional - - (349)

Research and development expenses (261) (330) (629)

Other income 12 15 21

---------------------------------------- ---- ---------- ---------- --------

Operating loss (387) (214) (1,119)

Finance expense (10) (7) (16)

Finance income 3 - 9

Share of post-tax (loss) / profit

from associates (54) (29) 173

---------------------------------------- ---- ---------- ---------- --------

Loss before tax (449) (250) (953)

Income tax credit 3 57 37 410

Loss after income tax (392) (213) (543)

---------------------------------------- ---- ---------- ---------- --------

Attributable to:

Equity holders of the parent (320) (166) (436)

Non-controlling interest (72) (47) (107)

---------------------------------------- ---- ---------- ---------- --------

Loss for the period (392) (213) (543)

---------------------------------------- ---- ---------- ---------- --------

Loss per share attributed to equity

holders of the parent:

Basic (2.86p) (1.46p) (3.89p)

Diluted (2.86p) (1.44p) (3.89p)

Consolidated Interim Statement of Comprehensive Income

for the six months ended 31 March 2023

6 months 6 months Year to

to 31.3.23 to 31.3.22 30.9.22

unaudited unaudited Audited

GBP'000 GBP'000 GBP'000

Loss for the period (392) (213) (543)

Other comprehensive income - items

which may be reclassified to profit

or loss in subsequent periods:

Exchange difference on re-translation

of net assets of overseas operations (114) 27 112

-------------------------------------- ---------- ---------- -------

Total comprehensive expense for the

period (506) (186) (431)

Attributable to :

Equity holders of the parent (428) (142) (333)

Non-controlling interest (79) (44) (98)

(506) (186) (431)

-------------------------------------- ---------- ---------- -------

Titon Holdings Plc

Consolidated Interim Statement of Financial Position

at 31 March 2023

31.3.23 31.03.22 30.09.22

unaudited unaudited audited

GBP'000 GBP'000 GBP'000

Assets

Property, plant and equipment 3,264 3,445 3,321

Right-of-use assets 573 613 553

Intangible assets 760 925 915

Investments in associates 2,482 2,668 2,909

Deferred tax assets 747 308 697

--------- --------- --------

Total non-current assets 7,826 7,959 8,395

--------- --------- --------

Inventories 6,917 5,320 6,571

Trade and other receivables 4,199 3,896 4,920

Cash and cash equivalents 1,610 3,728 1,726

--------- --------- --------

Total current assets 12,726 12,944 13,217

Total Assets 20,556 20,903 21,612

------------------------------- --------- --------- --------

Liabilities

Lease liabilities 409 430 378

--------- --------- --------

Total non-current liabilities 409 430 378

--------- --------- --------

Trade and other payables 4,500 3,937 5,051

Lease liabilities 230 229 232

Total current liabilities 4,730 4,166 5,283

Total Liabilities 5,139 4,596 5,661

------------------------------- --------- --------- --------

Equity

Share capital 1,122 1,119 1,122

Share premium reserve 1,091 1,077 1,091

Capital redemption reserve 56 56 56

Treasury shares - (27) -

Foreign exchange reserve 90 120 198

Retained earnings 12,831 13,603 13,179

------------------------------- --------- --------- --------

Total Equity attributable

to the equity holders

of the parent 15,190 15,948 15,646

Non-controlling Interest 227 359 305

Total Equity 15,417 16,307 15,951

Total Liabilities and

Equity 20,556 20,903 21,612

------------------------------- --------- --------- --------

Titon Holdings Plc

Consolidated Interim Statement of Changes in Equity

at 31 March 2023

Share Share Capital Foreign Treasury Retained Total Non- Total

capital premium redemption exchange Shares earnings controlling Equity

reserve reserve reserve interest

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

At 30

September

2021 1,119 1,077 56 96 (27) 14,093 16,414 403 16,817

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Translation

differences

on overseas

operations - - - 24 - 1 25 3 28

Profit for the

period - - - - - (166) (166) (47) (213)

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Total

comprehensive

Income /

(loss)

for the

period - - - 24 - (165) (141) (44) (185)

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Dividends paid - - - - - (335) (335) - (335)

Share-based

payment

credit - - - - - 10 10 - 10

At 31 March

2022 1,119 1,077 56 120 (27) 13,603 15,948 359 16,307

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Translation

differences

on overseas

operations - - - 78 - - 78 - 78

Loss for the

year - - - - - (270) (270) (54) (324)

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Total

comprehensive

income /

(loss)

for the

period - - - 78 - (270) (192) (54) (246)

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Dividends paid - - - - - (167) (167) - (167)

Share-based

payment

credit - - - - - 13 13 - 13

Exercise of

share options 3 14 - - - - 17 - 17

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Transfer of

treasury

shares 27 27 27

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

At 30

September

2022 1,122 1,091 56 198 - 13,179 15,646 305 15,951

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Translation

differences

on overseas

operations - - - (108) - - (108) (6) (114)

Loss for the

period - - - - - (320) (320) (72) (392)

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Total

comprehensive

income /

(loss)

for the

period - - - (108) - (320) (428) (78) (506)

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Dividends paid - - - - - (56) (56) - (56)

Share-based

payment

credit - - - - - 28 28 - 28

At 31 March

2023 1,122 1,091 56 90 - 12,831 15,190 227 15,417

--------------- --------- --------- ----------- --------- --------- ---------- -------- ------------ --------

Titon Holdings Plc

Consolidated Interim Statement of Cash Flow

for the six months ended 31 March 2023

6 months 6 months Year to

to 31.3.23 to 31.3.22 30.09.22

unaudited unaudited Audited

Note GBP'000 GBP'000 GBP'000

Cash generated from operating activities

Loss before tax (449) (250) (953)

Depreciation of property, plant &

equipment 308 279 518

Depreciation of right-of-use assets 100 85 232

Amortisation of intangible assets 163 126 298

Profit on sale of plant & equipment (10) 22 (19)

Share based payment - equity settled 28 10 23

Finance Income (3) - (9)

Finance costs 10 7 16

Share of associate's post-tax loss

/ (profit) 54 29 (173)

--------

201 308 (67)

Increase in inventories (264) (270) (1,529)

(Increase) / decrease in receivables 1,203 367 (696)

(Decrease) / increase in payables

and other current liabilities (1,116) (690) 498

----------------------------------------- ---- ---------- ---------- --------

Cash generated by / (used in) operations 24 (285) (1,794)

----------------------------------------- ---- ---------- ---------- --------

Cash flows from investing activities

Purchase of plant & equipment (258) (256) (386)

Purchase of intangible assets (8) (126) (288)

Proceeds from sale of plant & equipment 42 42 44

Finance income 3 - 9

Dividends received from associate

company 290 - -

Net cash generated by / (used) in

investing activities 69 (340) (621)

----------------------------------------- ---- ---------- ---------- --------

Cash flows from financing activities

Dividends paid to equity shareholders

of the parent 4 (56) (335) (502)

Payment of lease liability (114) (109) (226)

Finance costs (10) (7) (16)

Exercise of Share Options - - 44

Net cash used in financing activities (180) (451) (700)

----------------------------------------- ---- ---------- ---------- --------

Net decrease in cash (87) (1,076) (3,115)

Foreign exchange (29) 10 47

Cash at beginning of the period 1,726 4,794 4,794

----------------------------------------- ---- ---------- ---------- --------

Cash at end of the period 1,610 3,728 1,726

----------------------------------------- ---- ---------- ---------- --------

Notes to the Condensed Consolidated Interim Statements

at 31 March 2023

1 Accounting policies

a ) General information

Titon Holdings Plc (the 'Company') is incorporated and domiciled

in England and its shares are publicly traded on AIM. The

registered office address is 894 The Crescent, Colchester Business

Park, Colchester, Essex, CO4 9YQ. The company's registered number

is 1604952. The principal activities of the Group are as described

in Note 2.

The Board considers the principal risks and uncertainties

relating to the Group for the next six months to be the same as

detailed in the last Annual Report and Financial Statements to 30

September 2022. The Group's financial risk management objectives

and policies are consistent with those disclosed in the

consolidated financial statements as at and for the year ended 30

September 2022.

b) Basis of preparation

These condensed consolidated interim financial statements of the

Group for the six months ended 31 March 2023 comprise the Company

and its subsidiaries (together referred to as the 'Group').

The condensed consolidated interim financial statements have

been prepared in accordance with the AIM rules. Neither the six

months results for 2023 nor the six months results for 2022 have

been audited nor reviewed pursuant to guidance issued by the

Auditing Practices Board. This condensed Interim Group financial

Statements do not comprise statutory accounts within the meaning of

Section 435 of the Companies Act 2006. The comparative figures for

the year ended 30 September 2022 do not constitute statutory

accounts within the meaning of Section 435 of the Companies Act

2006, but they have been derived from the audited Report and

Accounts for that year, which have been filed with the Registrar of

Companies. The independent auditor's report on those accounts was

unqualified, did not draw attention to any matters by way of

emphasis and did not contain a statement under Section 498(2) or

(3) of the Companies Act 2006.

This report should be read in conjunction with the Group's

Annual Report and Accounts for the year ended 30 September 2022,

which have been prepared in accordance with International Financial

Reporting Standards and Interpretations (collectively IFRSs) as

adopted in the UK.

These unaudited interim Group Financial Statements were approved

for issue on 18 May 2023. Copies will be sent to shareholders

within the next few weeks and will be available on the Group's

website at www.titon.com/uk/investors/ and from the Company's

registered office at 894 The Crescent, Colchester Business Park,

Colchester, Essex, CO4 9YQ.

c) Accounting policies

These condensed consolidated interim financial statements have

been prepared in accordance with the recognition and measurement

requirements of the UK adopted international accounting

standards.

In preparing these condensed consolidated interim financial

statements the Board have considered the impact of new standards

which will be applied in the 2023 Annual Report and Accounts.

There are not expected to be any changes in the accounting

policies compared to those applied at 30 September 2022.

A full description of accounting policies is contained with our

2022 Annual Report and Financial Statements, which is available on

our website.

New accounting standards

The Group does not expect any other standards issued by the

IASB, but not yet effective, to have a material impact on the

Group.

2 Revenue and segmental information

In identifying its operating segments, management generally

follows the Group's reporting lines, which represent the main

geographic markets in which the Group operates. The segment

reporting below is shown in a manner consistent with the internal

reporting provided to the Board, which is the Chief Operating

Decision Maker (CODM). These operating segments are monitored and

strategic decisions are made on the basis of segment operating

results. The Group operates in four main business segments which

are:

Segment Activities undertaken include:

United Kingdom Sales of passive and powered ventilation products

to housebuilders, electrical contractors and

window and door manufacturers. In addition to

this, it is a leading supplier of window and

door hardware

South Korea Sales of passive ventilation products to construction

companies

North America Sales of passive ventilation products to window

and door manufacturers

All other Sales of passive and powered ventilation products

countries to distributors, window manufacturers and construction

companies

Inter-segment revenue is transacted on an arm's length basis and

charged at prevailing market prices for a specific product and

market or cost plus where no direct comparative market price is

available. Segment results include items directly attributable to a

segment as well as those that can be allocated on a reasonable

basis. Research and development entity-wide financial expenses are

allocated to the business activities for which R&D is

specifically performed. Administration Expenses are currently

allocated to operating segments in the Group's reporting to the

CODM and include central and parent company overheads relating to

Group management, the finance function and regulatory

requirements.

The measurement policies the Group uses for segment reporting

under IFRS 8 are the same as those used in its financial

statements.

The Group recognises revenue at a single point in time in its UK

and US subsidiary. The nature of business practice at its South

Korean subsidiary means that the Group recognises revenue there

over time, this being at first fix and second fix stages. As

invoicing for both first fix and second fix components usually

takes place at the first fix stage, the revenue on the second fix

products is deferred in the Financial Statements until the point

that those second fix products are accepted by the customer.

The total assets for the segments represent the consolidated

total assets attributable to these reporting segments. Parent

company results and consolidation adjustments reconciling the

segmental results and total assets to the consolidated financial

statements are included within the United Kingdom segment figures

stated.

Operating segment United South North All other Total

Kingdom Korea America countries

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months ended 31 March

2023

Segment revenue 8,240 1,489 279 2,303 12,311

Inter-segment revenue (234) - - - (234)

------------------------------------- --------- -------- --------- ----------- --------

Total Revenue 8,006 1,489 279 2,303 12,077

------------------------------------- --------- -------- --------- ----------- --------

Segment (loss) / profit (211) (245) 6 - (450)

Income tax credit 57

------------------------------------- --------- -------- --------- ----------- --------

Loss for the period (392)

------------------------------------- --------- -------- --------- ----------- --------

Depreciation and amortisation 400 39 - - 439

------------------------------------- --------- -------- --------- ----------- --------

Depreciation of Right-of-use-assets 78 22 - - 100

------------------------------------- --------- -------- --------- ----------- --------

Total assets 16,131 4,205 220 - 20,556

------------------------------------- --------- -------- --------- ----------- --------

Total assets include:

Investments in associates 2,482 - - - 2,482

Additions to non-current

assets (other than financial

instruments and deferred

tax assets) 251 15 - - 266

The South Korean Segment loss includes the Group's share of the

post-tax loss from the Group's associate undertaking, Browntech

Sales Co. Ltd. Sales to Browntech Sales Co. Ltd. of GBP1.49 million

represent 12% of Group revenue. There are no other concentrations

of revenue above 10% during the year (see Note 6 - Related party

transactions).

IFRS 8 requires entity-wide disclosures to be made about the

regions in which it earns its revenues and holds its non-current

assets which are shown below.

United Europe USA and Asia All other Total

Kingdom Canada regions

Revenues GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

by entities' country of

domicile 10,309 - 279 1,489 - 12,077

by country from which

derived 8,006 2,303 279 1,489 - 12,077

------------------------- --------- -------- -------- -------- ---------- --------

Non-current assets

By entities' country of

domicile 4,869 - 35 2,926 - 7,830

------------------------- --------- -------- -------- -------- ---------- --------

Operating segment United South North All other Total

Kingdom Korea America countries

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

6 months ended 31 March

2022

Segment revenue 8,655 1,501 290 1,181 11,627

Inter-segment revenue (149) - - - (149)

------------------------------------- --------- -------- --------- ----------- --------

Total Revenue 8,506 1,501 290 1,181 11,478

------------------------------------- --------- -------- --------- ----------- --------

Segment (loss) / profit 87 (153) (18) (166) (250)

Income tax credit 37

------------------------------------- --------- -------- --------- ----------- --------

Loss for the period (213)

------------------------------------- --------- -------- --------- ----------- --------

Depreciation and amortisation 366 39 - - 405

------------------------------------- --------- -------- --------- ----------- --------

Depreciation of right-of-use-assets 62 23 - - 85

------------------------------------- --------- -------- --------- ----------- --------

Total assets 16,270 4,399 234 - 20,903

------------------------------------- --------- -------- --------- ----------- --------

Total assets include:

Investments in associates 2,668 - - - 2,668

Additions to non-current

assets (other than financial

instruments and deferred

tax assets) 367 15 - - 382

------------------------------------- --------- -------- --------- ----------- --------

The South Korean Segment loss includes the Group's share of the

post-tax profit from the Group's associate undertaking, Browntech

Sales Co. Ltd. Sales to Browntech Sales Co. Ltd. of GBP1.50 million

represent 13% of Group Revenue. There are no other concentrations

of revenue above 10% during the year (see Note 6 - Related party

transactions).

IFRS 8 requires entity-wide disclosures to be made about the

regions in which it earns its revenues and holds its non-current

assets which are shown below.

6 months ended 31 March United Europe USA and Asia All other Total

2022 Kingdom Canada regions

Revenues GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

by entities' country of

domicile 9,687 - 290 1,501 - 11,478

by country from which

derived 8,506 1,152 290 1,501 29 11,478

------------------------- --------- -------- -------- -------- ---------- --------

Non-current assets

By entities' country of

domicile 5,081 - 33 2,845 - 7,959

------------------------- --------- -------- -------- -------- ---------- --------

For the year ended United South North All other

30 September 2022 Kingdom Korea America countries Consolidated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Segment revenue 16,497 3,037 538 2,303 22,375

Inter-segment revenue (288) - - - (288)

------------------------------ -------- ------- -------- ---------- --------------------

Total Revenue 16,209 3,037 538 2,303 22,087

------------------------------ -------- ------- -------- ---------- --------------------

Segment (loss) /

profit (651) (37) 160 (425) (953)

Tax credit 410

------------------------------ -------- ------- -------- ---------- --------------------

Loss for the year (543)

------------------------------ -------- ------- -------- ---------- --------------------

Depreciation and amortisation 920 42 - - 962

------------------------------ -------- ------- -------- ---------- --------------------

Total assets 16,953 4,491 166 - 21,611

------------------------------ -------- ------- -------- ---------- --------------------

Total assets include:

Investments in associates 2,910 - - - 2,910

Additions to non-current

assets

(other than financial

instruments

and deferred tax

assets) 671 3 - - 674

------------------------------ -------- ------- -------- ---------- --------------------

The South Korea Segment loss includes the Group's share of the

post-tax profits from Browntech Sales Co. Ltd., (BTS), the Group's

associate undertaking in South Korea, of GBP173,000. Sales to BTS

of GBP4.71m represented 21% of Group Revenue (2021: GBP3.58m -

15%). There are no other concentrations of revenue above 10% during

the year (see Note 6 - Related party transactions).

IFRS 8 requires entity wide disclosures to be made about the

regions in which it earns its revenues and holds its non-current

assets which are shown below.

For the year ended United Europe USA and South All other Total

30 September 2022 Kingdom Canada Korea regions

Revenues GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

By entities' country

of domicile 18,512 - 538 3,037 - 22,087

By country from which

derived 16,209 2,303 538 3,037 - 22,087

---------------------- -------- ------- ------- ------- --------- -------

Non-current assets

By entities' country

of domicile 5,355 - 46 3,061 - 8,461

---------------------- -------- ------- ------- ------- --------- -------

3 Taxation

6 months 6 months Year to

to 31.3.23 to 31.3.22 30.9.22

GBP'000 GBP'000 GBP'000

Deferred tax:

Origination and reversal of temporary

differences 57 37 410

Income tax credit 57 37 410

-------------------------------------- ---------- ---------- -------

Taxation for the interim period is credited at 12.7% (six months

to 31 March 2022: credited at 11.2%) representing the best estimate

of the average annual income tax rate for the full financial

year.

4 Dividends

The following dividends have been recognised and paid by the

Company:

6 months 6 months Year

to

to 31.3.23 to 31.3.22 30.9.22

Date Pence

Paid per GBP'000 GBP'000 GBP'000

share

Final 2021 dividend 04.03.22 3.00 - 334 -

Interim 2022 dividend 27.05.22 1.50 - 167

Final 2022 dividend 31.03.23 0.50 56 - -

---------- ---------- ---------

56 334 167

---------- ---------- ---------

5 Earnings per ordinary share

Basic earnings per share has been calculated by dividing the

profits or losses attributable to shareholders of Titon Holdings

Plc by the weighted average number of ordinary shares in issue

during the period, being 11,197,707 (six months ended 31 March

2022: 11,124,517; year ended 30 September 2022: 11,196,627).

Diluted earnings per share (EPS) is calculated by dividing the

profits or losses attributable to shareholders by the weighted

average number of ordinary shares and potential dilutive ordinary

shares during the period, being 11,213,324 at 31 March 2023, except

that at this date, when the inclusion of potential ordinary shares

(POSs) in the calculation would increase the EPS, or decrease the

loss per share, from continuing operations, then these POSs are

anti-dilutive and are ignored in diluted EPS. Potential dilutive

ordinary shares at: six months ended 31 March 2022: 11,219,391 and

year ended 30 September 2022: 11,214,800.

6 Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation and are not

disclosed in this note. Transactions between subsidiary companies

and the associate company, which is a related party, were as

follows:

Sale of goods Amount owed by related

party

6 months 6 months Year 6 months 6 months Year

to 31.3.23 to 31.3.22 to to 31.3.23 to 31.3.22 to

30.9.22 30.9.22

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Browntech Sales

Co. Ltd 1,489 1,501 3,037 108 155 180

------------ ------------ --------- ------------ ------------ ---------

There have been no additional significant or unusual related

party transactions to those disclosed in the Group's Annual Report

for 30 September 2022.

7 Liability statement

Neither the Group nor the Directors accept any liability to any

person in relation to the interim statement except to the extent

that such liability could arise under English Law. Accordingly, any

liability to a person who has demonstrated reliance on any untrue

or misleading statement or omission shall be determined in

accordance with section 90A of the Financial Services and Markets

Act 2000.

Directors and Advisers

Directors

Executive

C V Isom (Chief Financial Officer)

A C French (Chief Executive) (resigned 6 April 2023)

Non-executive

K A Ritchie (Group Non-Executive Chair)

T N Anderson (Deputy Chair)

N C Howlett

J Ward

G P Hooper

Secretary and registered office

C V Isom

894 The Crescent

Colchester Business Park

Colchester

Essex

CO4 9YQ

COMPANY REGISTRATION NUMBER

1604952 (Registered in England & Wales)

WEBSITE

www.titon.com/uk/investors

auditor

MHA

6(th) Floor, 2 London Wall Place

London

EC2Y 5AU

NOMINATED ADVISER

Shore Capital and Corporate Ltd

Cassini House

57-58 St. James's Street

London

SW1A 1LD

BROKER

Shore Capital Stockbrokers Ltd

Cassini House

57-58 St. James's Street

London

SW1A 1LD

REGISTRARS AND TRANSFER OFFICE

Link Market Services Ltd

10(th) Floor

Central Square

29 Wellington Street

Leeds

LS1 4DL

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR ZZGMKKRLGFZM

(END) Dow Jones Newswires

May 19, 2023 02:00 ET (06:00 GMT)

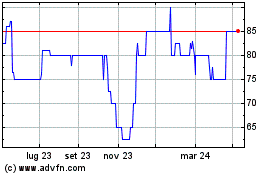

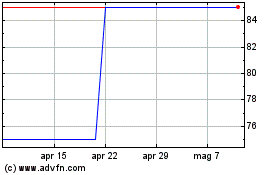

Grafico Azioni Titon (LSE:TON)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Titon (LSE:TON)

Storico

Da Mag 2023 a Mag 2024