Core royalty platform on track; received GSK

royalties of $69.6 million for fourth quarter

Achieved net product revenues of $19.7 million

for the fourth quarter of 2023 representing 35% year on year

growth

Strong pipeline progress in 2023: Approval and

launch of first pathogen targeted antibacterial XACDURO® for

treatment of HABP/VABP caused by Acinetobacter infections; positive

topline Phase 3 data for oral drug zoliflodacin for treatment of

uncomplicated gonorrhea

Repurchased 1.1 million our common stock for

$15.4 million in the fourth quarter of 2023

Innoviva, Inc. (NASDAQ: INVA) (“Innoviva” or the “Company”), a

diversified holding company with a core royalties portfolio, a

leading critical care and infectious disease platform known as

Innoviva Specialty Therapeutics (“IST”), and a portfolio of

strategic investments in healthcare assets, today reported

financial results for the fourth quarter and full year ended

December 31, 2023 and highlighted select corporate

achievements.

Pavel Raifeld, Chief Executive Officer of Innoviva, said: “2023

was a successful and transformational year for Innoviva. We have

seen continued strong cash flow from our core royalty portfolio,

which we have been investing prudently with a laser focus on

driving long-term shareholder value. Last year showcased the

success of our approach with the formation and significant pipeline

and commercial progress of our therapeutics platform, which is

focused on becoming the industry leader in critical care and

infectious disease.”

Matthew Ronsheim, Ph.D., President of IST, noted, “Our

therapeutics platform achieved tremendous success in its first

year: we saw the approval and launch of XACDURO®, the first

pathogen targeted antibacterial approved by the FDA for life

threatening Acinetobacter infections caused by susceptible

isolates; we reported positive Phase III data for zoliflodacin, the

potential first novel oral treatment for gonorrhea; and our

targeted and lean commercial platform delivered meaningful growth

in our core marketed products GIAPREZA® and XERAVA®. With our

best-in-class capabilities and leverageable commercial

infrastructure, we are excited about our ability to deliver

life-saving drugs to patients in areas of high unmet medical need

and about our significant growth prospects in the coming

years.”

Mr. Raifeld concluded, “Innoviva’s strong financials reflect a

new royalty base (following value-accretive 2022 TRELEGY® ELLIPTA®

royalties monetization), a full year of integrated operations for

our therapeutics platform, and significant value creation in our

strategic healthcare assets. Innoviva continued to exercise

financial discipline and ended the year with over $275 million in

cash and account receivables, while returning capital with share

repurchases of over $75 million and paying down outstanding debt of

nearly $100 million. We believe our diversified growth strategy, a

strong leadership team, and our focus on cost discipline position

us well to deliver shareholder value.”

Financial Highlights

- Royalty revenue: Fourth quarter 2023 gross royalty

revenue from Glaxo Group Limited (“GSK”) was $69.6 million and full

year was $252.7 million, compared to $54.7 million for the fourth

quarter of 2022 and $253.4 million for the full year 2022.

- Net Product Sales: Fourth quarter 2023 net product sales

and license revenue were $19.7 million, which included $13.1

million from GIAPREZA®, $5.2 million from XERAVA®, and $1.4 million

from XACDURO®, compared to $14.6 million for the fourth quarter of

2022. Full year 2023 net product sales and license revenue was

$71.6 million, which included $41.3 million from GIAPREZA®, $17.3

million from XERAVA®, $2.0 million from XACDURO®, and $11.0 million

in milestone payments from our partners.

- Equity and long-term investments: Fourth quarter and

full year 2023 change in fair values of equity and long-term

investments of $25.5 million and $88.5 million, respectively, was

primarily attributable to Armata Pharmaceuticals (“Armata”) share

price appreciation.

- Net income: Fourth quarter 2023 net income was $61.5

million, or $0.97 basic per share, compared to a net loss of $68.3

million, or $(0.98) basic per share, for the fourth quarter 2022,

driven primarily by higher revenue and positive impact of change in

fair values of equity. Full year 2023 net income was $179.7

million, or $2.75 basic per share, compared to net income of $213.9

million, or $3.07 basic per share, for the full year 2022.

- Share repurchase: During the fourth quarter 2023,

Innoviva repurchased 1,121,835 shares of its outstanding common

stock for $15.4 million. During the year 2023, Innoviva repurchased

6,173,565 shares of its outstanding common stock for $76.5 million.

Approximately $15 million of the authorized program remains

outstanding as of year-end.

- Cash and cash equivalents: Totaled $193.5 million.

Royalty and net product sales receivables totaled $84.1 million as

of December 31, 2023.

Key 2023 R&D Highlights

- Zoliflodacin: potential first-in-class oral antibiotic

to treat uncomplicated gonorrhea

- In November 2023, in collaboration with The Global Antibiotic

Research & Development Partnership (GARDP), Innoviva announced

that zoliflodacin, a first-in-class antibiotic, met its primary

endpoint in a global pivotal phase 3 clinical trial for the

treatment of uncomplicated gonorrhea. The Company expects a New

Drug Application to be submitted to the U.S. FDA in the next twelve

months.

- XACDURO® (sulbactam for injection; durlobactam for

injection), co-packaged for intravenous use: targeted antibacterial

for HABP/VABP caused by Acinetobacter

- In May 2023, the U.S. Food and Drug Administration (FDA)

approved XACDURO® for use in patients 18 years of age and older for

the treatment of hospital-acquired bacterial pneumonia and

ventilator-associated bacterial pneumonia (HABP/VABP) caused by

susceptible isolates of Acinetobacter baumannii-calcoaceticus

complex.

- Earlier in May, The Lancet Infectious Diseases published

detailed results from the pivotal Phase 3 ATTACK trial of

sulbactam-durlobactam.

Update on Strategic Healthcare Assets

- Our portfolio of strategic assets under the Company’s various

subsidiaries was valued at $561.0 million as of December 31, 2023.

In fourth quarter 2023, Innoviva invested an additional $5.0

million in one of our assets, Gate Neurosciences, to support its

strategy of developing next generation targeted CNS therapies.

About Innoviva

Innoviva is a diversified holding company with a core royalties

portfolio, a leading critical care and infectious disease platform

known as Innoviva Specialty Therapeutics (“IST”), and a portfolio

of strategic investments in healthcare assets. Innoviva’s royalty

portfolio includes respiratory assets partnered with Glaxo Group

Limited (“GSK”) Innoviva is entitled to receive royalties from GSK

on sales of RELVAR®/BREO® ELLIPTA® and ANORO® ELLIPTA®. Innoviva’s

other innovative healthcare assets include infectious disease and

critical care assets stemming from acquisitions of Entasis

Therapeutics, including XACDURO® (sulbactam for injection;

durlobactam for injection), co-packaged for intravenous use

approved for the treatment of adults with hospital-acquired

bacterial pneumonia and ventilator-associated bacterial pneumonia

caused by susceptible strains of Acinetobacter

baumannii-calcoaceticus complex and the investigational

zoliflodacin currently being developed for the treatment of

uncomplicated gonorrhea, and La Jolla Pharmaceutical Company,

including GIAPREZA® (angiotensin II), approved to increase blood

pressure in adults with septic or other distributive shock and

XERAVA® (eravacycline) for the treatment of complicated

intra-abdominal infections in adults.

ANORO®, RELVAR®, BREO® and TRELEGY® are trademarks of the GSK

group of companies.

Forward Looking Statements

This press release contains certain “forward-looking” statements

as that term is defined in the Private Securities Litigation Reform

Act of 1995 regarding, among other things, statements relating to

goals, plans, objectives, and future events. Innoviva intends such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in Section 21E

of the Securities Exchange Act of 1934 and the Private Securities

Litigation Reform Act of 1995. The words “anticipate”, “expect”,

“goal”, “intend”, “objective”, “opportunity”, “plan”, “potential”,

“target” and similar expressions are intended to identify such

forward-looking statements. Such forward-looking statements involve

substantial risks, uncertainties, and assumptions. These statements

are based on the current estimates and assumptions of the

management of Innoviva as of the date of this press release and are

subject to known and unknown risks, uncertainties, changes in

circumstances, assumptions and other factors that may cause the

actual results of Innoviva to be materially different from those

reflected in the forward-looking statements. Important factors that

could cause actual results to differ materially from those

indicated by such forward-looking statements include, among others,

risks related to: expected cost savings; lower than expected future

royalty revenue from respiratory products partnered with GSK; the

commercialization of RELVAR®/BREO® ELLIPTA®, ANORO® ELLIPTA®,

GIAPREZA®, XERAVA® and XACDURO® in the jurisdictions in which these

products have been approved; the strategies, plans and objectives

of Innoviva (including Innoviva’s growth strategy and corporate

development initiatives); the timing, manner, and amount of

potential capital returns to shareholders; the status and timing of

clinical studies, data analysis and communication of results; the

potential benefits and mechanisms of action of product candidates;

expectations for product candidates through development and

commercialization; the timing of regulatory approval of product

candidates; and projections of revenue, expenses and other

financial items; the impact of the novel coronavirus (“COVID-19”);

the timing, manner and amount of capital deployment, including

potential capital returns to stockholders; and risks related to the

Company’s growth strategy. Other risks affecting Innoviva are

described under the headings “Risk Factors” and “Management’s

Discussion and Analysis of Financial Condition and Results of

Operations” contained in Innoviva’s Annual Report on Form 10-K for

the year ended December 31, 2022 and Quarterly Reports on Form

10-Q, which are on file with the Securities and Exchange Commission

(“SEC”) and available on the SEC’s website at www.sec.gov. Past

performance is not necessarily indicative of future results. No

forward-looking statements can be guaranteed, and actual results

may differ materially from such statements. Given these

uncertainties, you should not place undue reliance on these

forward-looking statements. The information in this press release

is provided only as of the date hereof, and Innoviva assumes no

obligation to update its forward-looking statements on account of

new information, future events or otherwise, except as required by

law.

INNOVIVA, INC. Condensed Consolidated Statements of Income (in

thousands, except per share data) (Unaudited)

Three

Months Ended Year Ended December 31, December

31,

2023

2022

2023

2022

Revenue:

Royalty revenue, net (1)

$

66,165

$

51,216

$

238,846

$

311,645

Net product sales

19,675

14,587

60,617

19,694

License Revenue

-

-

11,000

-

Total revenue

85,840

65,803

310,463

331,339

Expenses:

Cost of products sold (inclusive of amortization of

inventory fair value adjustments)

13,130

10,113

41,040

13,793

Cost of license revenue

-

-

1,600

-

Selling, general and administrative

26,319

17,454

98,232

63,538

Research and development

2,356

9,985

33,922

41,432

Amortization of acquired intangible assets

6,510

4,070

21,784

5,581

Gain on TRC sale

-

-

-

(266,696

)

Loss on debt extinguishment

-

-

-

20,662

Changes in fair values of equity method

investments, net

(9,506

)

117,274

(77,392

)

161,749

Changes in fair values of equity and long-term

investments, net

(16,016

)

(31,868

)

(11,129

)

(8,462

)

Interest and dividend income

(4,786

)

(3,188

)

(15,818

)

(6,369

)

Interest expense

5,952

4,028

19,157

15,789

Other expense (income), net

680

2,623

4,969

3,373

Total expenses

24,639

130,491

116,365

44,390

Income before income taxes

61,201

(64,688

)

194,098

286,949

Income tax expense

(330

)

3,626

14,376

66,687

Net income

61,531

(68,314

)

179,722

220,262

Net income

attributable to noncontrolling interest

-

-

-

6,341

Net income

attributable to Innoviva stockholders

$

61,531

$

(68,314

)

$

179,722

$

213,921

Basic net income per share attributable to Innoviva stockholders

$

0.97

$

(0.98

)

$

2.75

$

3.07

Diluted net income per share attributable to Innoviva stockholders

$

0.76

$

(0.98

)

$

2.20

$

2.37

Shares used to compute basic net income per share

63,710

69,656

65,435

69,644

Shares used to compute diluted net income per share

84,995

69,656

86,876

95,248

(1) Total net revenue is comprised of the

following (in thousands):

Three Months Ended Year

Ended December 31, December 31,

2023

2022

2023

2022

(unaudited) (unaudited)

Royalties

$

69,620

$

54,671

$

252,669

$

325,468

Amortization of capitalized fees

(3,455

)

(3,455

)

(13,823

)

(13,823

)

Royalty revenue, net

$

66,165

$

51,216

$

238,846

$

311,645

INNOVIVA,

INC. Condensed Consolidated Balance Sheets (in

thousands) (unaudited)

December 31, December 31,

2023

2022

Assets Cash and cash

equivalents

$

193,513

$

291,049

Royalty and product sale receivables

84,075

64,073

Inventory, net

40,737

55,897

Prepaid expense and other current assets

25,894

32,492

Property and equipment, net

483

170

Equity and long-term investments

560,978

403,013

Capitalized fees

83,784

97,607

Right-of-use assets

2,536

3,265

Goodwill

17,905

26,713

Intangible assets

230,335

252,919

Other assets

3,267

4,299

Total

assets

$

1,243,507

$

1,231,497

Liabilities and stockholders’ equity

Other current liabilities

$

33,435

$

32,322

Accrued interest payable

3,422

4,359

Deferred revenues

1,277

2,094

Convertible subordinated notes, due 2023, net

-

96,193

Convertible senior notes, due 2025, net

191,295

190,583

Convertible senior notes, due 2028, net

254,939

253,597

Other long term liabilities

71,870

70,918

Deferred tax liabilities

563

5,771

Income tax payable - long term

11,751

9,872

Innoviva stockholders’ equity

674,955

565,788

Total

liabilities and stockholders’ equity

$

1,243,507

$

1,231,497

INNOVIVA, INC. Cash Flows Summary (in thousands) (unaudited)

Year Ended December 31,

2023

2022

Net cash provided by operating activities

$

141,064

$

201,726

Net cash used in investing activities

(66,761

)

(56,634

)

Net cash used in financing activities

(171,839

)

(55,568

)

Net change

$

(97,536

)

$

89,524

Cash and cash equivalents at beginning of period

291,049

201,525

Cash and cash equivalents at end of period

$

193,513

$

291,049

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240229441244/en/

Innoviva, Inc. David Patti Corporate Communications (908)

421-5971 david.patti@inva.com Investors and Media: Argot Partners

(212) 600-1902 innoviva@argotpartners.com

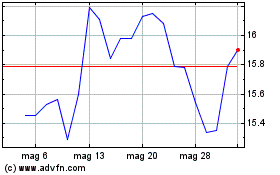

Grafico Azioni Innoviva (NASDAQ:INVA)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Innoviva (NASDAQ:INVA)

Storico

Da Gen 2024 a Gen 2025