As filed with the Securities and Exchange Commission on November 27, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S‑8

REGISTRATION STATEMENT

Under

The Securities Act of 1933

J & J SNACK FOODS CORP.

(Exact name of registrant as specified in its charter)

|

New Jersey

|

22-1935537

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

|

350 Fellowship Road

Mount Laurel, New Jersey 08054

|

|

(Address, including zip code, of registrant’s principal executive offices)

|

| |

|

J & J Snack Foods Corp. Nonqualified Deferred Compensation Plan

|

|

(Full title of the Plan)

|

| |

|

Michael Pollner

Senior Vice President, General Counsel and Secretary

J & J Snack Foods Corp.

350 Fellowship Road

Mount Laurel, New Jersey 08054

(856) 665-9533

|

|

(Name, address, and telephone number, including area code, of agent for service)

|

| |

|

Copy to:

|

|

Steven G. Schaffer

Andrew S. Rodman

Bryan Cave Leighton Paisner LLP

1201 West Peachtree Street, NW

Atlanta, GA 30309

(404) 572-6830

|

| |

| |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

Smaller reporting company

|

☐

|

| |

|

Emerging growth company

|

☐

|

If an emerging growth company, indicate by checkmark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

This Registration Statement on Form S-8 is filed by J & J Snack Foods Corp., a New Jersey corporation, (the “Registrant” or “Company”) relating to $15,000,000 deferred compensation obligations which are unsecured obligations of the Registrant to pay deferred compensation in the future in accordance with the terms of the Nonqualified Deferred Compensation Plan, to be effective January 1, 2025.

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The documents containing the information specified in Part I of this Registration Statement have been or will be sent or given to participating employees as specified by Rule 428(b)(1) of the Securities Act of 1933, as amended (the “Securities Act”), in accordance with the rules and regulations of the United States Securities and Exchange Commission (the “Commission”). Such documents are not being filed with the Commission either as part of this Registration Statement or as prospectuses or prospectus supplements pursuant to Rule 424 of the Securities Act. These documents and the documents incorporated by reference into this Registration Statement pursuant to Item 3 of Part II of this Registration Statement, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents, which are on file with the Commission, are incorporated herein by reference:

| |

a.

|

The Registrant’s Annual Report on Form 10-K for the year ended September 28, 2024, filed with the Commission on November 26, 2024.

|

| |

b.

|

The Registrant’s Current Reports on Form 8-K filed with the Commission on November 21, 2024.

|

All reports and other documents subsequently filed by the Registrant with the Commission pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), after the date hereof, and prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be deemed incorporated by reference into this Registration Statement and to be a part hereof from the date of the filing of such report or other document. The Registrant is not, however, incorporating by reference any documents or portions thereof, whether specifically listed above or filed in the future, that are not deemed “filed” with the Commission, including any information furnished pursuant to Item 2.02 or Item 7.01 of Form 8-K or related exhibits furnished pursuant to Item 9.01 of Form 8-K.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 4. Description of Securities.

The Nonqualified Deferred Compensation Plan (the “Plan”) is an unfunded, nonqualified deferred compensation plan under the Internal Revenue Code of 1986, as amended (the “Code”). The Plan is subject to the administration and civil enforcement penalties of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”) but is not subject to the participation, vesting, funding or fiduciary responsibility requirements of ERISA. In addition, the Registrant will timely file a notice with the Department of Labor resulting in an exemption from the reporting and disclosure requirements of ERISA. The Plan is intended to comply with the requirements of Section 409A of the Code.

The Plan is maintained for the purpose of (i) attracting certain highly qualified executive-level employees; and (ii) promoting in its key executives increased efficiency and an interest in the successful operation of the Company. Eligible persons identified below will have the opportunity to defer compensation under the Plan. A brief description of certain aspects of the Plan follows. This summary is qualified in its entirety by reference to the full text of the Plan, which is incorporated by reference into this Registration Statement as Exhibit 4.4 herein.

Employees of the Registrant or its affiliates who are management or highly compensated employees (the “Eligible Employees”), select independent contractors (the “Eligible Independent Contractors”) and non-employee directors of the Board of Directors (the “Eligible Directors” together with Eligible Employees and Eligible Independent Contractors, the “Participants”) who are identified by the Plan administrator are eligible to participate in the Plan. Eligible Employees may elect to defer a portion of their annual base salary (up to 50%) and any short-term performance-based bonus (up to 95%) and commissions (up to 95%) awarded to them during the Plan year. Eligible Independent Contractors and Eligible Directors may elect to defer a portion or all of their cash compensation. A Participant generally may make an initial deferral election under the Plan within thirty days of becoming eligible to participate. All subsequent elections must be made by the Participant prior to the first day of the Plan year for which the election is made, subject to the policies established by the Plan administrator. Election changes may only be made before the end of the applicable election period. A Participant will be 100% vested at all times in all amounts of compensation deferred under the Plan by the Participant.

Each Participant’s deferrals will be credited to a bookkeeping account established for the Participant under the Plan. Participants will have the opportunity to choose deemed investments of their deferrals among various notional investment options.

At its sole discretion, the Registrant may credit Participant accounts with contributions from the Registrant. Participants will become fully vested in contributions made by the Registrant on the earlier of (i) the fourth anniversary of the Participant’s date of hire provided that the Participant remains employed by the Registrant through such date, and (ii) the Participant reaching age sixty-five, the Participant’s death, disability, or upon a change in control of the Registrant, all while employed by the Registrant. The amount of any contribution by the Registrant credited to each Participant account will be treated as if invested in the notional investment options made available under the Plan and selected by the Participant and such amount will be adjusted for hypothetical investment earnings, expenses, gains or losses in an amount equal to the earnings, expenses, gains or losses attributable to such investment options.

Payment of Plan accounts will be made in a lump sum or installments over one to ten years, as elected by the Participant, and will generally occur or begin on the first day (or subsequent New York Stock Exchange open market day) of the seventh month following the date the Participant separates from service for any reason. Payment under the Plan will also be made upon a change in control of the Registrant if the Participant experiences a separation from service within twelve months following a change in control.

Participants may also elect to receive in-service distributions of amounts deferred in a particular Plan year in the form of a lump sum or annual installments over one to five years. Participants who wish to receive an in-service distribution must make the election as to the form and timing of the in-service distribution at the same time as the deferral election is made. The in-service distribution date must be at least five years following the effective date of the deferral election.

Each Participant is an unsecured general creditor of the Registrant with respect to his or her own Plan benefits. Benefits are payable solely from the Registrant’s general assets and are subject to the risk of corporate insolvency. The Registrant reserves the right to amend or partially or completely terminate or liquidate the Plan, provided that such amendment or termination does not result in any decrease in the vested balance of a Participant’s account, including previous earnings or losses, as of the date of such amendment or termination. Termination or liquidation of the Plan in its entirety must be consistent with the requirements of Section 409A of the Code.

The Registrant adopted a rabbi trust to hold certain amounts which the Registrant may use to satisfy its obligations under the Plan, however, the establishment of such a trust shall in no way deem the Plan to be “funded” for purposes of ERISA, as amended, or the Code. Obligations of the Company under the Plan represent at all times an unfunded and unsecured promise to pay money in the future. Each participant in the Plan is an unsecured general creditor of the Company with respect to deferred compensation obligations. Any amounts set aside to defray the liabilities assumed by the Registrant, including the assets held in the rabbi trust, will remain the general, unpledged unrestricted assets of the Registrant. No participant or beneficiary has any interest in any of the Registrant’s assets, including assets held in the rabbi trust, by virtue of the provisions of the Plan.

The Registrant’s Compensation Committee will act as Plan administrator.

The Plan becomes effective on January 1, 2025.

Item 5. Interests of Named Experts and Counsel.

Michael Pollner, Senior Vice President, General Counsel and Secretary of the Company, has opined as to the legality of the securities being offered by this Registration Statement. Mr. Pollner is paid a salary by the Company, is a participant in various employee benefit plans and incentive plans offered by the Company and owns shares of the Company’s common stock.

Item 6. Indemnification of Directors and Officers.

Section 14A:3-5 of the New Jersey Business Corporation Act (the “NJBCA”) provides that a New Jersey corporation has the power to indemnify a corporate agent against his expenses and liabilities in connection with any proceeding, including any proceeding by or in the right of the corporation to procure a judgment in its favor which involves the corporate agent by reason of his being or having been such corporate agent, if he acted in good faith and in a manner he reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal proceeding, he had no reasonable cause to believe his conduct was unlawful. However, in a proceeding by or in the right of the corporation, no indemnification shall be provided in respect of any claim, issue or matter as to which such corporate agent shall have been adjudged to be liable to the corporation, unless and only to the extent that the New Jersey Superior Court or the court in which such proceeding was brought determines upon application that despite the adjudication of liability, but in view of all circumstances of the case, such corporate agent is fairly and reasonably entitled to indemnity for such expenses as the New Jersey Superior Court or such other court shall deem proper. Unless otherwise provided in the corporation’s organizational documents, the determination that the corporate agent is eligible for indemnification pursuant to the NJBCA shall be made: (1) by the board of directors or a committee thereof, acting by a majority vote of a quorum consisting of directors who were not parties to or otherwise involved in the proceeding; (2) if such a quorum is not obtainable, or, even if obtainable and such quorum of the board of directors or committee by a majority vote of the disinterested directors so directs, by independent legal counsel, in a written opinion, such counsel to be designated by the board of directors; or (3) by the shareholders if the certificate of incorporation or bylaws or a resolution of the board of directors or of the shareholders so directs.

The indemnification and advancement of expenses provided by or granted pursuant to the NJBCA does not exclude any other rights, including the right to be indemnified against liabilities and expenses incurred in proceedings by or in the right of the corporation, to which a corporate agent may be entitled under a certificate of incorporation, bylaw, agreement, vote of shareholders, or otherwise; provided that no indemnification shall be made to or on behalf of a corporate agent if a judgment or other final adjudication adverse to the corporate agent establishes that his acts or omissions: (1) were in breach of his duty of loyalty to the corporation or its shareholders; (2) were not in good faith or involved a knowing violation of law; or (3) resulted in receipt by the corporate agent of an improper personal benefit.

The Restated By-Laws of the Company (the “By-Laws”) provide that the Company shall, to the fullest extent permitted by applicable law, indemnify its directors and officers who were or are a party or are threatened to be made a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (whether or not such action, suit or proceeding arises or arose by or in the right of the Company or other entity) by reason of the fact that such director or officer is or was a director or officer of the Company or is or was serving at the request of the Company as a director, officer, employee, general partner, agent or fiduciary of another corporation, partnership, joint venture, trust or other enterprise (including service with respect to employee benefit plans), against expenses (including, but not limited to, attorneys’ fees and costs), judgments, fines (including excise taxes assessed on a person with respect to any employee benefit plan) and amounts paid in settlement actually and reasonably incurred by such director or officer in accordance with such action, suit or proceeding, except as otherwise provided in the By-Laws. Expenses incurred by a director or officer of the Company in defending a threatened, pending or completed civil or criminal action, suit or proceeding shall be paid by the Company in advance of the final disposition of such action, suit or proceeding upon receipt of an undertaking by or on behalf of such person to repay such amount if it shall ultimately be determined that such person is not entitled to be indemnified by the Company, except as otherwise provided in the By-Laws. The indemnification and advancement or reimbursement of expenses provided by, or granted pursuant to, provisions contained in the By-Laws shall not be deemed exclusive of any other rights to which those seeking indemnification or advancement or reimbursement of expenses may be entitled under the Company’s Amended and Restated Certificate of Incorporation or any by-law, agreement, vote of shareholders or directors or otherwise, both as to action in such director’s or officer’s official capacity and as to action in another capacity while holding that office.

The Amended and Restated Certificate of Incorporation of the Company provides that directors shall not be personally liable to the Company or its shareholders for damages for breach of any duty owed to the Company or its shareholders, except that such provision shall not relieve a director from such liability for any breach of duty based on an act or omission (a) in breach of such director’s duty of loyalty to the Company or its shareholders, or (b) not in good faith, or involving a knowing violation of law, or (c) resulting in the receipt by such director of an improper personal benefit.

The foregoing is only a general summary of certain aspects of New Jersey law and the By-laws and Amended and Restated Certificate of Incorporation dealing with indemnification of directors and officers, and does not purport to be complete. It is qualified in its entirety by reference to the detailed provisions of the Section of the NJBCA referenced above and the By-laws and Amended and Restated Certificate of Incorporation.

The Company’s directors and officers are currently insured under a Directors and Officers Liability Including Company Reimbursement Policy with a policy limit of $15,000,000, subject to certain deductibles and exclusions, for any actual or alleged error or misstatement or misleading statement or act or omission or neglect or breach of duty by the directors and officers of the Company in the discharge of their duties, individually or collectively, or any matter claimed against them solely by reason of their being directors or officers of the Company.

Item 7. Exemption from Registration Claimed.

Not Applicable.

Item 8. Exhibits.

|

Exhibit

Number

|

Description

|

|

4.1

|

Amended and Restated Certificate of Incorporation of the Registrant, incorporated by reference to Exhibit 3.1 of the Registrant’s Annual Report on Form 10-K for the fiscal year ended September 24, 2022.

|

|

4.2

|

Certificate of Amendment to the Amended and Restated Certificate of Incorporation, incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K filed on June 24, 2022.

|

|

4.3

|

Revised By-laws of the Registrant, incorporated by reference to Exhibit 3.1 of the Registrant’s Current Report on Form 8-K filed on November 21, 2023.

|

|

4.4

|

Nonqualified Deferred Compensation Plan, incorporated by reference to Exhibit 10.1 of the Registrant’s Current Report on Form 8-K filed on November 21, 2024.

|

|

5.1*

|

Opinion of Michael Pollner, Senior Vice President, General Counsel and Secretary of the Registrant.

|

|

23.1*

|

Consent of Grant Thornton LLP, independent registered public accounting firm.

|

|

23.2*

|

Consent of Michael Pollner, Senior Vice President, General Counsel and Secretary of the Registrant. (included in Exhibit 5.1).

|

|

24.1*

|

Power of Attorney (included on the signature page to this Registration Statement).

|

|

107*

|

Filing Fee Table.

|

*Filed herewith

Item 9. Undertakings.

(a) The undersigned Registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act;

(ii) To reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in this Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement.

Provided, however, that paragraphs (a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the Registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in this Registration Statement.

(2) That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The undersigned Registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the Registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in this Registration Statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S‑8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the Township of Mount Laurel, State of New Jersey, on November 27, 2024.

|

J & J SNACK FOODS CORP.

|

| |

|

| |

|

|

By:

|

/s/ Dan Fachner

|

| |

Dan Fachner

|

| |

Chairman, President and Chief Executive Officer

|

| |

|

| |

|

|

By:

|

/s/ Ken A. Plunk

|

| |

Ken A. Plunk

|

| |

Senior Vice President and Chief Financial Officer

|

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Dan Fachner his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement on Form S-8, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitutes or substitute, may lawfully do or cause to be done by virtue hereof. This Power of Attorney may be signed in several counterparts.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

Title

|

Date

|

| |

|

|

|

/s/ Dan Fachner

|

Chairman, President, Chief Executive Officer and Director

|

November 27, 2024

|

|

Dan Fachner

|

(Principal Executive Officer)

|

|

| |

|

|

|

/s/ Ken A. Plunk

|

Senior Vice President and Chief Financial Officer

|

November 27, 2024

|

|

Ken A. Plunk

|

(Principal Financial Officer and Principal Accounting Officer)

|

|

| |

|

|

| |

Chairman Emeritus and Director

|

|

|

Gerald B. Shreiber

|

|

|

| |

|

|

|

/s/ Sidney R. Brown

|

Director

|

November 27, 2024

|

|

Sidney R. Brown

|

|

|

| |

|

|

|

/s/ Peter G. Stanley

|

Director

|

November 27, 2024

|

|

Peter G. Stanley

|

|

|

| |

|

|

|

/s/ Vincent A. Melchiorre

|

Director

|

November 27, 2024

|

|

Vincent A. Melchiorre

|

|

|

| |

|

|

|

/s/ Marjorie S. Roshkoff

|

Director

|

November 27, 2024

|

|

Marjorie S. Roshkoff

|

|

|

| |

|

|

|

/s/ Roy C. Jackson

|

Director

|

November 27, 2024

|

|

Roy C. Jackson

|

|

|

| |

|

|

|

/s/ Mary M. Meder

|

Director

|

November 27, 2024

|

|

Mary M. Meder

|

|

|

Exhibit 5.1

November 27, 2024

Board of Directors

J & J Snack Foods Corp.

350 Fellowship Road

Mt. Laurel, New Jersey 08054

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

I am Senior Vice President, General Counsel and Secretary of J & J Snack Foods Corp., a New Jersey corporation (the “Company”), and am issuing this opinion in connection with the Registration Statement on Form S-8 being filed by the Company with the Securities and Exchange Commission (the “Commission”) on the date hereof (the “Registration Statement”) for the purpose of registering with the Commission under the Securities Act of 1933, as amended (the “Securities Act”), $15,000,000 of deferred compensation obligations (the “Obligations”) pursuant to the J & J Snack Foods Corp. Nonqualified Deferred Compensation Plan (the “Plan”).

In this connection, I have reviewed the Registration Statement, as proposed to be filed with the Commission. As General Counsel, I am familiar with the Amended and Restated Certificate of Incorporation of the Company, as amended, and the Revised By-laws of the Company, each as currently in effect. I have also examined, or caused to be examined, originals or copies, certified or otherwise identified to my satisfaction, of such records of the Company and such instruments, certificates of public officials, and such other documents, certificates and records as I have deemed necessary or appropriate as a basis for the opinion set forth herein.

In my examination, I have assumed the genuineness of all signatures, the legal capacity of natural persons, the authenticity of all documents submitted to me as originals, the conformity to original documents of all documents submitted to me as certified, conformed or photostatic copies and the authenticity of the originals of such copies. In making my examination of documents executed or to be executed by parties other than the Company, I have assumed that such parties had or will have the power, corporate or other, to enter into and perform all obligations thereunder and have also assumed the due authorization by all requisite action, corporate or other, and execution and delivery by such parties and the validity and binding effect thereof. As to any facts material to the opinion expressed herein which I have not independently established or verified, I have relied upon statements and representations of other officers and representatives of the Company and others.

Based upon and subject to the foregoing, I am of the opinion that when the Obligations are issued in accordance with the terms of the Plan, the Obligations will constitute valid and legally binding obligations of the Company, except as may be limited by bankruptcy, insolvency, fraudulent transfer, reorganization, moratorium and similar laws of generally applicability relating to or affecting creditors’ rights generally.

The foregoing opinion is limited to the New Jersey Business Corporation Act (the “NJBCA”), and I am expressing no opinion as to the effect of the laws of any other jurisdiction. I am a member of the Bar of the Commonwealth of Pennsylvania and hold a Limited License for In-House Counsel in the State of New Jersey. I am generally familiar with the NJBCA as currently in effect and have made such inquiries as I consider necessary to render the opinion above. This opinion is limited to the effect of the current state of the NJBCA and the facts as they currently exist. I assume no obligation to revise or supplement this opinion in the event of future changes in such law or the interpretations thereof or such facts.

I hereby consent to the filing of this opinion as an exhibit to the Registration Statement. In giving such consent, I do not thereby admit that I am in the category of persons whose consent is required under Section 7 of the Securities Act.

This opinion is furnished by me, as counsel to the Company, in accordance with the requirements of Item 601(b)(5) of Regulation S-K under the Securities Act and, except as provided in the immediately preceding paragraph, is not to be used, circulated or quoted for any other purpose or otherwise referred to or relied upon by any other person without the express written permission of the Company.

| |

Very truly yours,

/s/ Michael A. Pollner

Michael A. Pollner

Senior Vice President, General Counsel and Secretary

|

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have issued our reports dated November 26, 2024 with respect to the consolidated financial statements and internal control over financial reporting of J&J Snack Foods Corp. included in the Annual Report on Form 10-K for the year ended September 28, 2024, which are incorporated by reference in this Registration Statement. We consent to the incorporation by reference of the aforementioned reports in this Registration Statement.

/s/ GRANT THORNTON LLP

Philadelphia, Pennsylvania

November 27, 2024

Exhibit 107.1

CALCULATION OF FILING FEE TABLE

FORM S-8

(Form Type)

J & J SNACK FOODS CORP.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security Type

|

Security Class Title

|

Fee Calculation Rule

|

Amount Registered(1)

|

Proposed Maximum Offering Price Per Unit(2)

|

Maximum Aggregate Offering Price

|

Fee Rate

|

Amount of Registration Fee

|

|

Debt

|

Deferred Compensation Obligations

|

457(h)

|

$15,000,000

|

100%

|

$15,000,000

|

$0.00015310

|

$2,296.50

|

|

Total Offering Amount

|

|

$15,000,000

|

|

$2,296.50

|

|

Total Fee Offsets

|

|

|

|

$-

|

|

Net Fee Due

|

|

|

|

$2,296.50

|

|

(1)

|

This Registration Statement registers general unsecured obligations to pay up to $15,000,000 of deferred compensation from time to time in the future in accordance with the terms of the J & J Snack Foods Corp. Non-qualified Deferred Compensation Plan (the “Plan”).

|

|

(2)

|

Estimated solely for purposes of calculating the amount of the registration fee pursuant to Rule 457(h) of the Securities Act of 1933, as amended. The amount of deferred compensation obligations registered hereunder is based on an estimate of the amount of compensation participants may defer under the Plan.

|

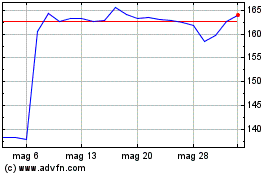

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Feb 2024 a Feb 2025