UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule

14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

Martin Midstream Partners L.P.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11 |

Item 1: On December 11, 2024, Martin Midstream Partners L.P. issued the following press release:

Martin Midstream Partners L.P. Files Investor Presentation

Highlights the Reasons Why the Pending Transaction

Maximizes Value and is in the Best Interests of Unitholders

Urges Unitholders to Vote “FOR” Transaction

in Advance of Special Meeting of Unitholders on December 30, 2024

KILGORE, Texas – December 11, 2024 – Martin Midstream Partners L.P. (“MMLP”) (Nasdaq: MMLP) today announced the filing of an investor

presentation with the U.S. Securities and Exchange Commission highlighting that the Company’s pending transaction with Martin Resource Management Corporation (“MRMC”) maximizes value for and is in the best interests of unitholders.

The Conflicts Committee and the Board of Directors of Martin Midstream GP LLC (the “GP Board”) unanimously recommend that unitholders use the WHITE proxy card or WHITE voting instruction form to vote “FOR”

the transaction in advance of the upcoming MMLP Special Meeting of unitholders, which is scheduled for December 30, 2024.

The presentation can be

found at MaximizeValueforMMLP.com.

Highlights of the presentation include:

The Transaction Is the Culmination of an Extensive Review Process Led by the Conflicts Committee

| |

• |

|

The Conflicts Committee, which consists of three entirely independent directors, conducted a robust review of the

MRMC transaction to maximize value. |

| |

• |

|

With support from independent legal and financial advisors, the Conflicts Committee worked hard to negotiate in

the best interests of MMLP and all unitholders, including MMLP’s unaffiliated unitholders. |

| |

• |

|

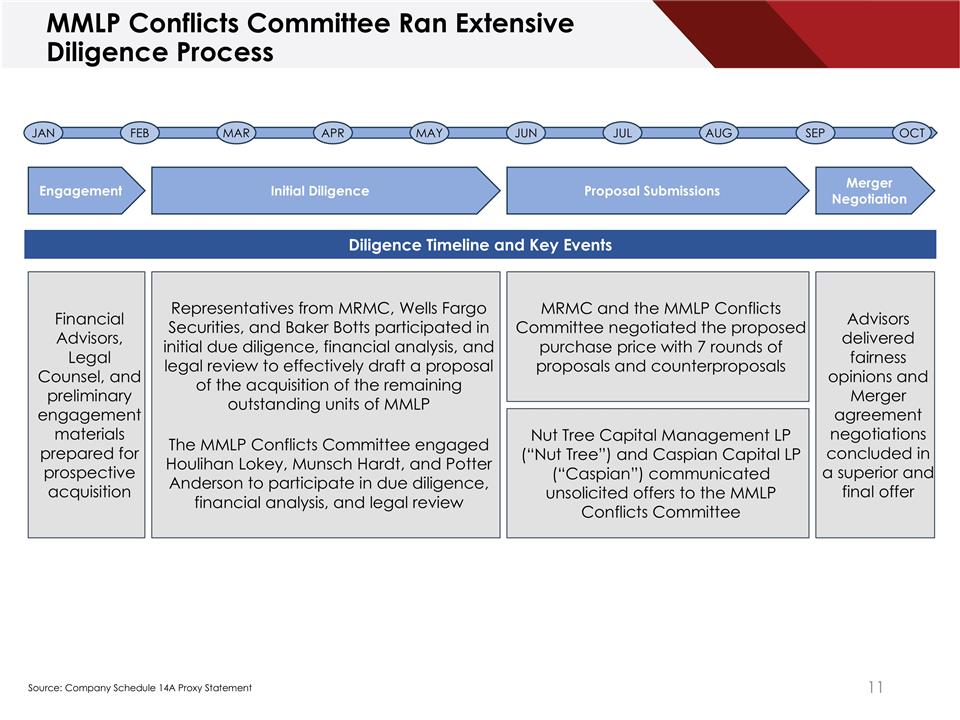

The thorough review took place over nine months and involved seven rounds of price negotiations with MRMC,

resulting in a transaction price that is nearly one dollar per unit more than the original offer price. |

| |

• |

|

The Conflicts Committee and GP Board unanimously and in good faith determined that the MRMC transaction is fair

to and in the best interests of MMLP and unaffiliated holders of MMLP common units. |

The Transaction Delivers Superior and Certain

Cash Value, and Immediate Liquidity to Unitholders

| |

• |

|

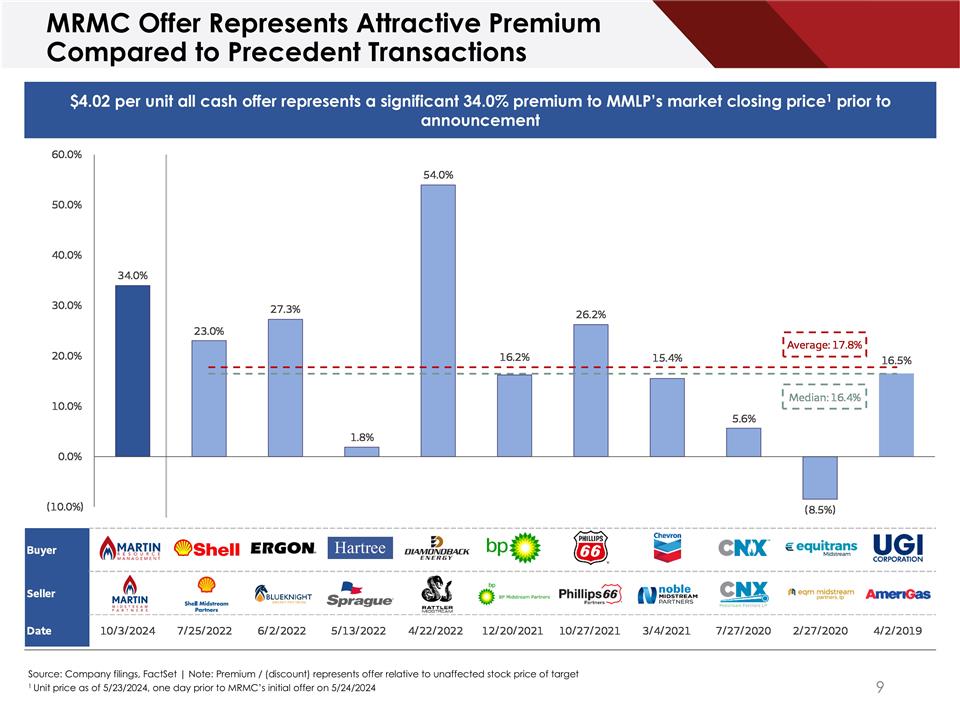

The all-cash offer of $4.02 per common unit owned reflects a significant

34.0% premium to MMLP’s market closing price prior to MRMC’s initial proposal made on May 24, 2024, and a 41.3% premium to MMLP’s trailing 30-day volume weighted average price

(“VWAP”) prior to the initial announcement on May 24, 2024, meaningfully exceeding the premium delivered in precedent transactions. |

| |

• |

|

This valuation implies a total enterprise value / expected 2025 EBITDA multiple of 5.4x, which represents a

robust uplift relative to MMLP’s historical trading multiple of 4.6x. |

The Transaction Is the Best Available Alternative; MMLP Does Not Expect Near-Term Increases in

Distributions

| |

• |

|

The MRMC transaction is expected to deliver far greater value than MMLP could deliver on a standalone basis.

|

| |

• |

|

MMLP Management forecasts flat growth for the foreseeable future, projecting a ~0% EBITDA CAGR from 2025-2028 and

no anticipated future drop downs from MRMC. |

| |

• |

|

MMLP upside remains severely limited given minimal trading liquidity and diminished appeal of MLP structure with

investors. |

| |

• |

|

Balance Sheet improvement remains management’s primary objective with no anticipated near-term material

increase in distributions. Given a refinancing of MMLP’s existing bonds would be prohibitively expensive, the primary objective is to pay down existing debt with cash flow from operations. |

| |

• |

|

Additionally, MMLP’s limited growth prospects only exacerbate the need for near-term de-levering. |

There Is No Realistic Path for MMLP to Complete a Transaction with Another Party

| |

• |

|

MRMC owns 100% of the General Partner interests in MMLP, giving it ultimate control and veto power regarding the

sale of the General Partner. |

| |

• |

|

The purchase of MMLP by an outside party would likely necessitate the purchase of the General Partner.

|

| |

• |

|

MRMC has repeatedly stated that neither the General Partner nor its General Partner ownership interest in MMLP is

for sale and therefore MMLP cannot complete a transaction with another party. |

The Conflicts Committee and GP Board unanimously

recommend that unitholders vote “FOR” the proposal to approve the transaction and the merger agreement.

Unitholders who have questions or would

like additional information or assistance voting their units should contact Martin Midstream Partners L.P.’s proxy solicitor:

Innisfree M&A Incorporated

Toll-free at (877) 750-8334 (from the U.S. and Canada)

or at +1 (412) 232-3651 (from other countries)

Advisors

The Conflicts Committee engaged Munsch Hardt

Kopf & Harr, P.C., Potter Anderson & Corroon LLP, and Houlihan Lokey, Inc. as its legal and financial advisors. MRMC engaged Baker Botts L.L.P. and Wells Fargo Securities, LLC as its legal and financial advisors.

About MMLP

Martin Midstream Partners L.P. (NASDAQ: MMLP) headquartered in Kilgore, Texas, is a publicly traded limited partnership with a diverse set of operations

focused primarily in the Gulf Coast region of the United States. MMLP’s primary business lines include: (1) terminalling, processing, and storage services for petroleum products and by-products;

(2) land and marine transportation services for petroleum products and by-products, chemicals, and specialty products; (3) sulfur and sulfur-based products processing, manufacturing, marketing, and

distribution; and (4) marketing, distribution, and transportation services for natural gas liquids and blending and packaging services for specialty lubricants and grease. To learn more, visit www.MMLP.com. Follow Martin Midstream Partners L.P.

on LinkedIn, Facebook, and X (formerly known as Twitter).

About MRMC

MRMC, through its various subsidiaries, is an independent provider of marketing and distribution of hydrocarbon and hydrocarbon

by-products including asphalt, diesel, natural gas liquids (“NGLs”), crude oil, base and process oils, and other bulk tank liquids. Martin Resource LLC is a wholly owned subsidiary of MRMC that does

not engage in any business other than owning 100% of the equity interests in the General Partner. Cross Oil Refining & Marketing, Inc. is a wholly owned subsidiary of MRMC and is engaged in the business of providing base and process oils.

Martin Product Sales LLC is a wholly owned subsidiary of MRMC and is engaged in the business of marketing and distributing commodities including asphalt, NGLs, and other petroleum based products.

FORWARD-LOOKING STATEMENTS

This press release includes

“forward-looking statements” as defined by the Securities and Exchange Commission (the “SEC”). Forward-looking statements are identified by words such as “anticipate,” “believe,” “expect,”

“intend,” “may,” “plan,” “should,” “will” or similar expressions. These forward-looking statements and all references to the transaction described herein rely on a number of assumptions concerning

future events and are subject to a number of uncertainties, including (i) the ability of the parties to consummate the transaction in the anticipated timeframe or at all, including MRMC’s ability to fund the aggregate merger consideration;

risks related to the satisfaction or waiver of the conditions to closing the transaction in the anticipated timeframe or at all; risks related to obtaining the requisite regulatory approval and MMLP unitholder approval; disruption from the

transaction making it more difficult to maintain business and operational relationships; significant transaction costs associated with the transaction; and the risk of litigation and/or regulatory actions related to the transaction,

(ii) uncertainties relating to MMLP’s future cash flows and operations, (iii) MMLP’s ability to pay future distributions, (iv) future market conditions, (v) current and future governmental regulation, (vi) future

taxation, and (vii) other factors, many of which are outside MMLP’s control, which could cause actual results to differ materially from such statements. While MMLP believes that the assumptions concerning future events are reasonable, it

cautions that there are inherent difficulties in anticipating or predicting certain important factors. A discussion of these factors, including risks and uncertainties, is set forth in MMLP’s annual and quarterly reports filed from time to time

with the SEC as well as MMLP’s definitive proxy statement filed with the SEC on November 27, 2024. Forward-looking statements speak only as of the date they are made, and MMLP disclaims any intention or obligation to revise any

forward-looking statements, including financial estimates, whether as a result of new information, future events, or otherwise except where required to do so by law.

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION

In connection with the proposed merger, MMLP has filed with the SEC and furnished to MMLP’s unitholders the definitive proxy statement on Schedule 14A and

a proxy card. MMLP, MRMC and certain of their affiliates have jointly filed a transaction statement on Schedule 13E-3 (the “Schedule 13E-3”) with the SEC. This

material is not a substitute for the Merger Agreement, the proxy statement or the Schedule 13E-3 or for any other document that MMLP has filed with the SEC in connection with the proposed transaction. The

final proxy statement was mailed to MMLP’s unitholders on or about November 27, 2024 to the unitholders of record as of the close of business on November 8, 2024. BEFORE MAKING ANY VOTING DECISION, MMLP’S UNITHOLDERS ARE URGED TO

READ THE MERGER AGREEMENT, THE PROXY STATEMENT AND THE SCHEDULE 13E-3 AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT OR

SCHEDULE 13E-3 (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER.

Investors and security holders may obtain free copies of the proxy statement and other relevant documents filed with the SEC by MMLP through the website

maintained by the SEC at www.sec.gov. In addition, the proxy statement, the Schedule 13E-3, and other documents filed with the SEC by MMLP are available free of charge through MMLP’s website at

www.MMLP.com, in the “Investor Relations” tab, or by contacting MMLP’s Investor Relations Department at (877) 256-6644.

PARTICIPANTS IN THE SOLICITATION

MMLP and the directors

and executive officers of MMLP’s general partner, and MRMC and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from MMLP’s unitholders in respect of the proposed merger. Information

regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the unitholders of MMLP in connection with the proposed transaction, including a description of their direct or indirect interests, by security

holdings or otherwise, are included in the proxy statement, as filed with the SEC on November 27, 2024, and other relevant materials filed with the SEC. Information about the directors and executive officers of MMLP’s general partner and

their ownership of MMLP common units is also set forth in MMLP’s Form 10-K for the year ended December 31, 2023, as previously filed with the SEC on February 21, 2024. To the extent that their

holdings of MMLP’s common units have changed since the amounts set forth in MMLP’s Form 10-K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the

SEC. Free copies of these documents may be obtained as described in the paragraphs above.

Investor Relations Contact:

Sharon Taylor

Executive Vice President and Chief Financial

Officer

(877) 256-6644

ir@mmlp.com

Media Contact:

Andrew Siegel / Melissa Johnson / Jenna Shinderman

Joele Frank

212.355.4449

Item 2: Also on December 11, 2024,

Martin Midstream Partners L.P. made available the following presentation:

December 2024 MRMC Transaction Presents

Best Opportunity for Unaffiliated Unitholders to Maximize Value

Disclaimers Contact Information Corporate

Headquarters Martin Midstream Partners L.P. 4200 B Stone Road Kilgore, TX 75662 Website www.MMLP.com Investor Relations Contact us at (877) 256-6644 or e-mail us at investor.relations@mmlp.com Use of Non-GAAP Financial Measures This presentation

includes certain non-GAAP financial measures not calculated in accordance with GAAP such as EBITDA. These non-GAAP financial measures should not be viewed as a substitute for GAAP financial measures and may be different from similarly titled

non-GAAP financial measures used by other companies. Furthermore, there are limitations inherent in non-GAAP financial measures because they adjust for charges and credits that are required to be included in a GAAP presentation. Accordingly, these

non-GAAP financial measures should be considered together with, and not as an alternative to, financial measures prepared in accordance with GAAP. MMLP’s management believes that these non-GAAP financial measures may provide useful information

to investors regarding MMLP’s financial condition and results of operations as they provide another measure of the profitability and ability to service its debt and are considered important measures by financial analysts covering MMLP and its

peers. MMLP has not provided a reconciliation to comparable GAAP financial information on a forward-looking basis because it would require MMLP to create estimated GAAP financial information, which would entail unreasonable effort. Adjustments

required to reconcile forward-looking non-GAAP measures cannot be predicted with reasonable certainty but may include, among others, costs related to debt amendments and unusual charges, expenses and gains. Some or all of those adjustments could be

significant. Forward-Looking Statements This presentation includes “forward-looking statements” as defined by the Securities and Exchange Commission (the “SEC”). Forward-looking statements are identified by words such as

“anticipate,” “believe,” “expect,” “intend,” “may,” “plan,” “should,” “will” or similar expressions. These forward-looking statements and all references

to the transaction described herein rely on a number of assumptions concerning future events and are subject to a number of uncertainties, including (i) the ability of the parties to consummate the transaction in the anticipated timeframe or at all,

including MRMC’s ability to fund the aggregate merger consideration; risks related to the satisfaction or waiver of the conditions to closing the transaction in the anticipated timeframe or at all; risks related to obtaining the requisite

regulatory approval and MMLP unitholder approval; disruption from the transaction making it more difficult to maintain business and operational relationships; significant transaction costs associated with the transaction; and the risk of litigation

and/or regulatory actions related to the transaction, (ii) uncertainties relating to MMLP’s future cash flows and operations, (iii) MMLP’s ability to pay future distributions, (iv) future market conditions, (v) current and future

governmental regulation, (vi) future taxation, and (vii) other factors, many of which are outside MMLP’s control, which could cause actual results to differ materially from such statements. While MMLP believes that the assumptions concerning

future events are reasonable, it cautions that there are inherent difficulties in anticipating or predicting certain important factors. A discussion of these factors, including risks and uncertainties, is set forth in MMLP’s annual and

quarterly reports filed from time to time with the SEC as well as MMLP’s definitive proxy statement filed with the SEC on November 27, 2024. Forward-looking statements speak only as of the date they are made, and MMLP disclaims any intention

or obligation to revise any forward-looking statements, including financial estimates, whether as a result of new information, future events, or otherwise except where required to do so by law.

Disclaimers Participants in the

Solicitation MMLP and the directors and executive officers of MMLP’s general partner, and MRMC and its directors and executive officers, may be deemed to be participants in the solicitation of proxies from MMLP’s unitholders in respect

of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of the unitholders of MMLP in connection with the proposed transaction, including a description of their direct

or indirect interests, by security holdings or otherwise, are included in the proxy statement, as filed with the SEC on November 27, 2024, and other relevant materials filed with the SEC. Information about the directors and executive officers of

MMLP’s general partner and their ownership of MMLP common units is also set forth in MMLP’s Form 10-K for the year ended December 31, 2023, as previously filed with the SEC on February 21, 2024. To the extent that their holdings of

MMLP’s common units have changed since the amounts set forth in MMLP’s Form 10-K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Free copies of these documents may be

obtained as described in the paragraphs above. Important Information about the Proposed Transaction In connection with the proposed merger, MMLP has filed with the SEC and furnished to MMLP’s unitholders the definitive proxy statement on

Schedule 14A and a proxy card. MMLP, MRMC and certain of their affiliates have jointly filed a transaction statement on Schedule 13E-3 (the “Schedule 13E-3”) with the SEC. This material is not a substitute for the Merger Agreement, the

proxy statement or the Schedule 13E-3 or for any other document that MMLP has filed with the SEC in connection with the proposed transaction. The final proxy statement was mailed to MMLP’s unitholders on or about November 27, 2024 to the

unitholders of record as of the close of business on November 8, 2024. BEFORE MAKING ANY VOTING DECISION, MMLP’S UNITHOLDERS ARE URGED TO READ THE MERGER AGREEMENT, THE PROXY STATEMENT AND THE SCHEDULE 13E-3 AND ANY OTHER DOCUMENTS FILED WITH

THE SEC IN CONNECTION WITH THE PROPOSED MERGER OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT OR SCHEDULE 13E-3 (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS THERETO) CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED MERGER. Investors and security holders may obtain free copies of the proxy statement and other relevant documents filed with the SEC by MMLP through the website maintained by the SEC at www.sec.gov. In addition, the proxy

statement, the Schedule 13E-3, and other documents filed with the SEC by MMLP are available free of charge through MMLP’s website at www.MMLP.com, in the “Investor Relations” tab, or by contacting MMLP’s Investor Relations

Department at (877) 256-6644.

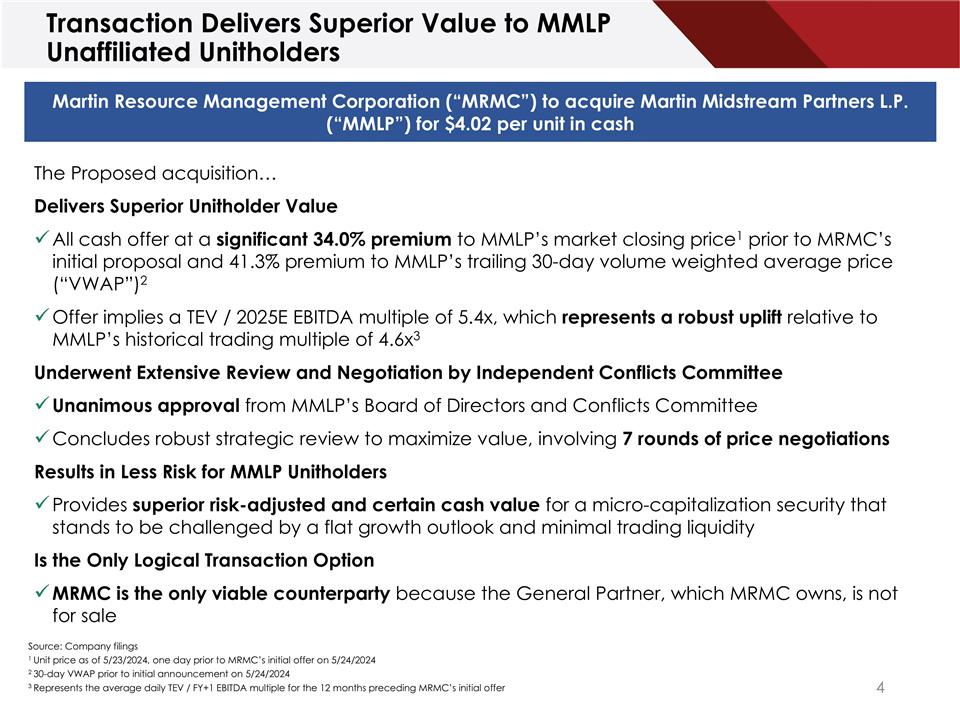

Transaction Delivers Superior Value to

MMLP Unaffiliated Unitholders Martin Resource Management Corporation (“MRMC”) to acquire Martin Midstream Partners L.P. (“MMLP”) for $4.02 per unit in cash The Proposed acquisition… Delivers Superior Unitholder Value

All cash offer at a significant 34.0% premium to MMLP’s market closing price1 prior to MRMC’s initial proposal and 41.3% premium to MMLP’s trailing 30-day volume weighted average price (“VWAP”)2 Offer implies a TEV /

2025E EBITDA multiple of 5.4x, which represents a robust uplift relative to MMLP’s historical trading multiple of 4.6x3 Underwent Extensive Review and Negotiation by Independent Conflicts Committee Unanimous approval from MMLP’s Board of

Directors and Conflicts Committee Concludes robust strategic review to maximize value, involving 7 rounds of price negotiations Results in Less Risk for MMLP Unitholders Provides superior risk-adjusted and certain cash value for a

micro-capitalization security that stands to be challenged by a flat growth outlook and minimal trading liquidity Is the Only Logical Transaction Option MRMC is the only viable counterparty because the General Partner, which MRMC owns, is not for

sale Source: Company filings 1 Unit price as of 5/23/2024, one day prior to MRMC’s initial offer on 5/24/2024 2 30-day VWAP prior to initial announcement on 5/24/2024 3 Represents the average daily TEV / FY+1 EBITDA multiple for the 12 months

preceding MRMC’s initial offer

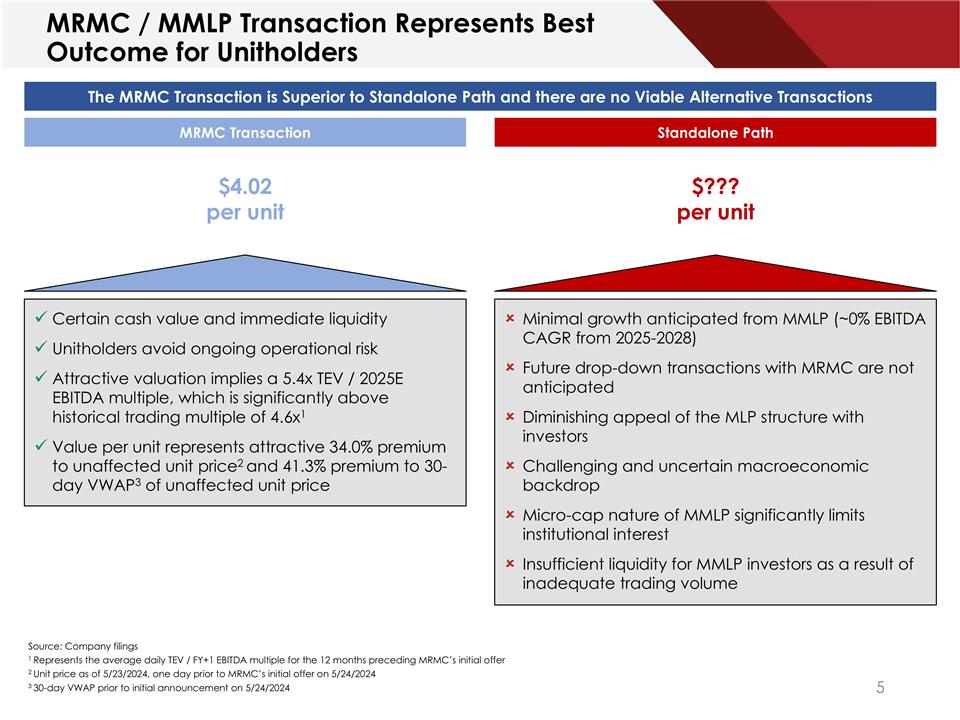

MRMC / MMLP Transaction Represents Best

Outcome for Unitholders MRMC Transaction Standalone Path Minimal growth anticipated from MMLP (~0% EBITDA CAGR from 2025-2028) Future drop-down transactions with MRMC are not anticipated Diminishing appeal of the MLP structure with investors

Challenging and uncertain macroeconomic backdrop Micro-cap nature of MMLP significantly limits institutional interest Insufficient liquidity for MMLP investors as a result of inadequate trading volume The MRMC Transaction is Superior to Standalone

Path and there are no Viable Alternative Transactions Certain cash value and immediate liquidity Unitholders avoid ongoing operational risk Attractive valuation implies a 5.4x TEV / 2025E EBITDA multiple, which is significantly above historical

trading multiple of 4.6x1 Value per unit represents attractive 34.0% premium to unaffected unit price2 and 41.3% premium to 30-day VWAP3 of unaffected unit price $4.02 per unit $??? per unit Source: Company filings 1 Represents the average daily TEV

/ FY+1 EBITDA multiple for the 12 months preceding MRMC’s initial offer 2 Unit price as of 5/23/2024, one day prior to MRMC’s initial offer on 5/24/2024 3 30-day VWAP prior to initial announcement on 5/24/2024

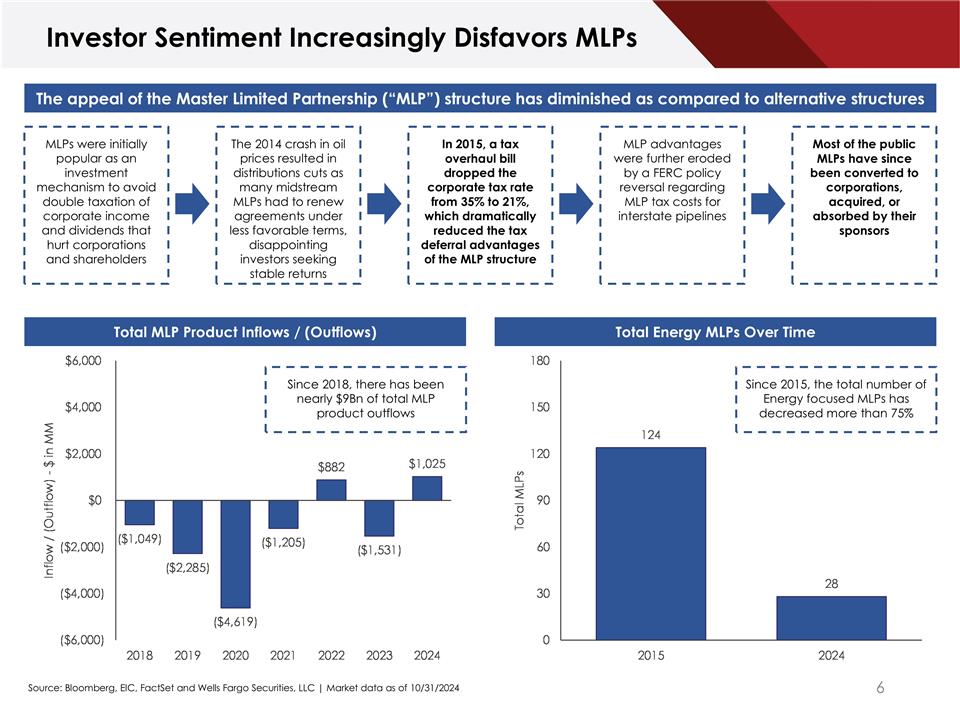

Investor Sentiment Increasingly

Disfavors MLPs The appeal of the Master Limited Partnership (“MLP”) structure has diminished as compared to alternative structures Total MLP Product Inflows / (Outflows) Total Energy MLPs Over Time Source: Bloomberg, EIC, FactSet and

Wells Fargo Securities, LLC | Market data as of 10/31/2024 MLPs were initially popular as an investment mechanism to avoid double taxation of corporate income and dividends that hurt corporations and shareholders The 2014 crash in oil prices

resulted in distributions cuts as many midstream MLPs had to renew agreements under less favorable terms, disappointing investors seeking stable returns In 2015, a tax overhaul bill dropped the corporate tax rate from 35% to 21%, which dramatically

reduced the tax deferral advantages of the MLP structure MLP advantages were further eroded by a FERC policy reversal regarding MLP tax costs for interstate pipelines Most of the public MLPs have since been converted to corporations, acquired, or

absorbed by their sponsors Since 2018, there has been nearly $9Bn of total MLP product outflows Since 2015, the total number of Energy focused MLPs has decreased more than 75%

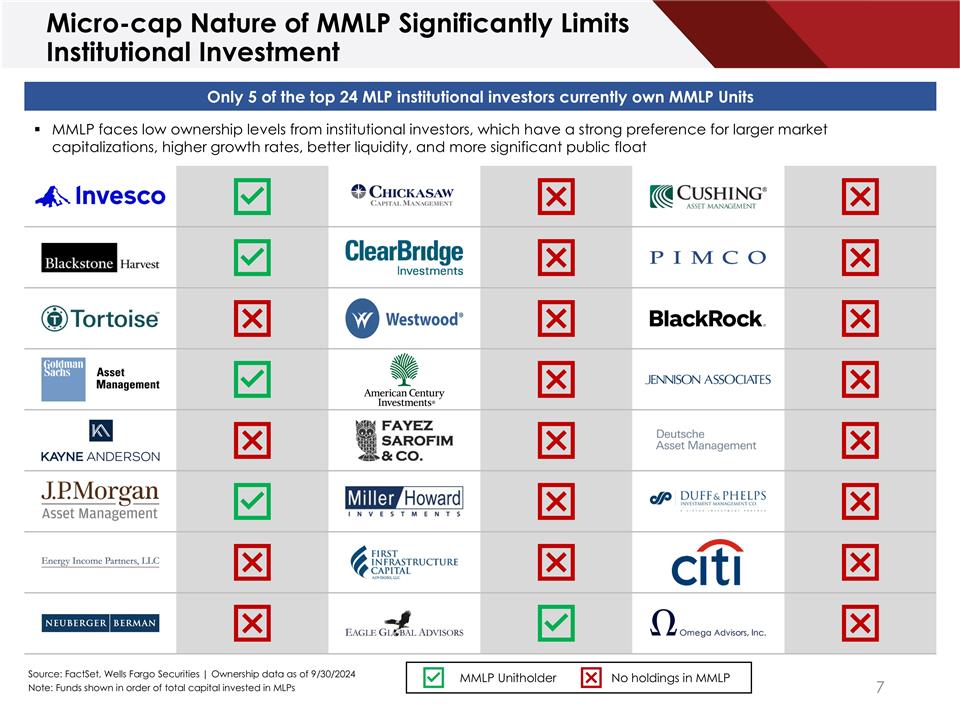

Micro-cap Nature of MMLP Significantly

Limits Institutional Investment Only 5 of the top 24 MLP institutional investors currently own MMLP Units MMLP faces low ownership levels from institutional investors, which have a strong preference for larger market capitalizations, higher growth

rates, better liquidity, and more significant public float Source: FactSet, Wells Fargo Securities | Ownership data as of 9/30/2024 Note: Funds shown in order of total capital invested in MLPs MMLP Unitholder No holdings in MMLP

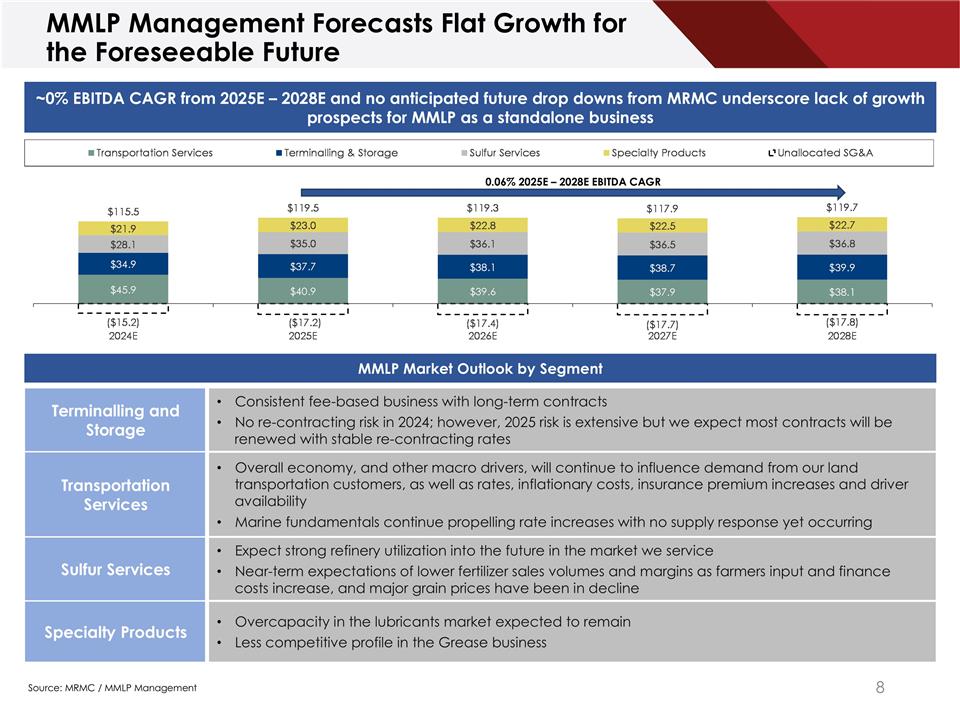

MMLP Management Forecasts Flat Growth

for the Foreseeable Future ~0% EBITDA CAGR from 2025E – 2028E and no anticipated future drop downs from MRMC underscore lack of growth prospects for MMLP as a standalone business Terminalling and Storage Consistent fee-based business with

long-term contracts No re-contracting risk in 2024; however, 2025 risk is extensive but we expect most contracts will be renewed with stable re-contracting rates Transportation Services Overall economy, and other macro drivers, will continue to

influence demand from our land transportation customers, as well as rates, inflationary costs, insurance premium increases and driver availability Marine fundamentals continue propelling rate increases with no supply response yet occurring Sulfur

Services Expect strong refinery utilization into the future in the market we service Near-term expectations of lower fertilizer sales volumes and margins as farmers input and finance costs increase, and major grain prices have been in decline

Specialty Products Overcapacity in the lubricants market expected to remain Less competitive profile in the Grease business Source: MRMC / MMLP Management 0.06% 2025E – 2028E EBITDA CAGR MMLP Market Outlook by Segment

MRMC Offer Represents Attractive

Premium Compared to Precedent Transactions $4.02 per unit all cash offer represents a significant 34.0% premium to MMLP’s market closing price1 prior to announcement Source: Company filings, FactSet | Note: Premium / (discount) represents

offer relative to unaffected stock price of target 1 Unit price as of 5/23/2024, one day prior to MRMC’s initial offer on 5/24/2024

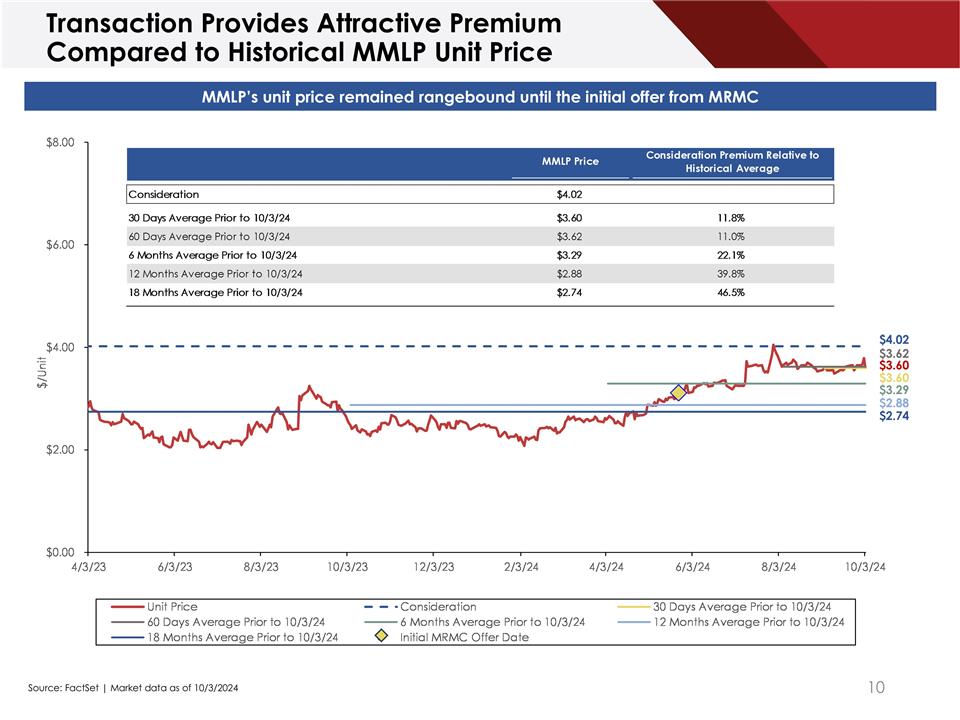

Transaction Provides Attractive Premium

Compared to Historical MMLP Unit Price $3.60 $3.62 $4.02 $3.29 $2.88 $3.60 Source: FactSet | Market data as of 10/3/2024 MMLP’s unit price remained rangebound until the initial offer from MRMC $2.74

MMLP Conflicts Committee Ran Extensive

Diligence Process Engagement Initial Diligence Representatives from MRMC, Wells Fargo Securities, and Baker Botts participated in initial due diligence, financial analysis, and legal review to effectively draft a proposal of the acquisition of the

remaining outstanding units of MMLP The MMLP Conflicts Committee engaged Houlihan Lokey, Munsch Hardt, and Potter Anderson to participate in due diligence, financial analysis, and legal review Proposal Submissions Merger Negotiation Advisors

delivered fairness opinions and Merger agreement negotiations concluded in a superior and final offer Financial Advisors, Legal Counsel, and preliminary engagement materials prepared for prospective acquisition MRMC and the MMLP Conflicts Committee

negotiated the proposed purchase price with 7 rounds of proposals and counterproposals Nut Tree Capital Management LP (“Nut Tree”) and Caspian Capital LP (“Caspian”) communicated unsolicited offers to the MMLP Conflicts

Committee Source: Company Schedule 14A Proxy Statement JAN FEB MAR APR MAY JUN JUL AUG SEP OCT Diligence Timeline and Key Events

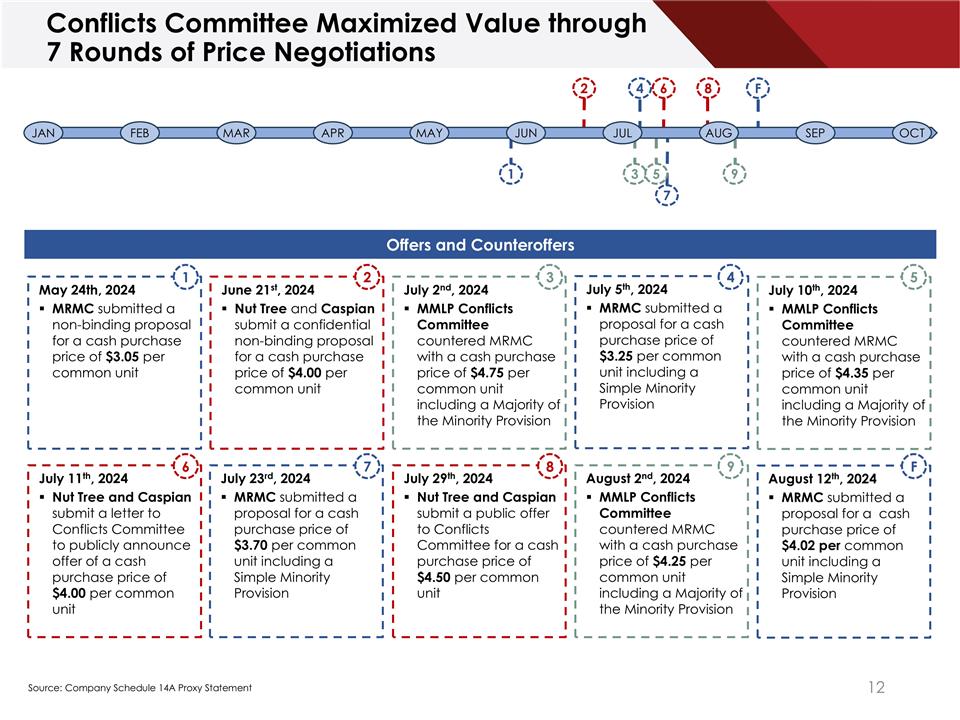

Conflicts Committee Maximized Value

through 7 Rounds of Price Negotiations May 24th, 2024 MRMC submitted a non-binding proposal for a cash purchase price of $3.05 per common unit June 21st, 2024 Nut Tree and Caspian submit a confidential non-binding proposal for a cash purchase price

of $4.00 per common unit July 2nd, 2024 MMLP Conflicts Committee countered MRMC with a cash purchase price of $4.75 per common unit including a Majority of the Minority Provision July 5th, 2024 MRMC submitted a proposal for a cash purchase price of

$3.25 per common unit including a Simple Minority Provision July 10th, 2024 MMLP Conflicts Committee countered MRMC with a cash purchase price of $4.35 per common unit including a Majority of the Minority Provision July 11th, 2024 Nut Tree and

Caspian submit a letter to Conflicts Committee to publicly announce offer of a cash purchase price of $4.00 per common unit July 23rd, 2024 MRMC submitted a proposal for a cash purchase price of $3.70 per common unit including a Simple Minority

Provision July 29th, 2024 Nut Tree and Caspian submit a public offer to Conflicts Committee for a cash purchase price of $4.50 per common unit August 2nd, 2024 MMLP Conflicts Committee countered MRMC with a cash purchase price of $4.25 per common

unit including a Majority of the Minority Provision August 12th, 2024 MRMC submitted a proposal for a cash purchase price of $4.02 per common unit including a Simple Minority Provision 1 2 3 4 5 6 8 9 F 7 1 2 3 4 5 6 8 9 F 7 Offers and Counteroffers

Source: Company Schedule 14A Proxy Statement JAN FEB MAR APR MAY JUN JUL AUG SEP OCT

Independent Directors James

“Jim” Collingsworth Byron Kelley (Chairman) C. Scott Massey Served as member of the Board of MMLP since 2014 Board member at NGL Energy Partners’ G.P. Former member of the Board of Texaco Canada, Dixie Pipeline Company, Seminole

Pipeline Company and the Petrochemical Feedstock Association of America Served as a member of the Board of MMLP since 2021 Former President, CEO, and member of the Board of CVR Partners, LP Former President CEO, and member of the Board of Regency,

GP LLC Former board member of Interstate National Gas Association Served as a member of the board of MMLP since 2002 Former Partner at KPMG PeartMarwick, LLP Conflicts Committee Source: Company filings The current members of the Conflicts Committee

have all been deemed to meet the independence standards as established by NASDAQ and the MMLP Partnership Agreement The NASDAQ independence definition includes a series of objective tests, which have resulted in the subjective determination that no

relationships exist which would interfere with the exercise of independent judgment in carrying out the responsibilities of a director MMLP Conflicts Committee is Entirely Independent

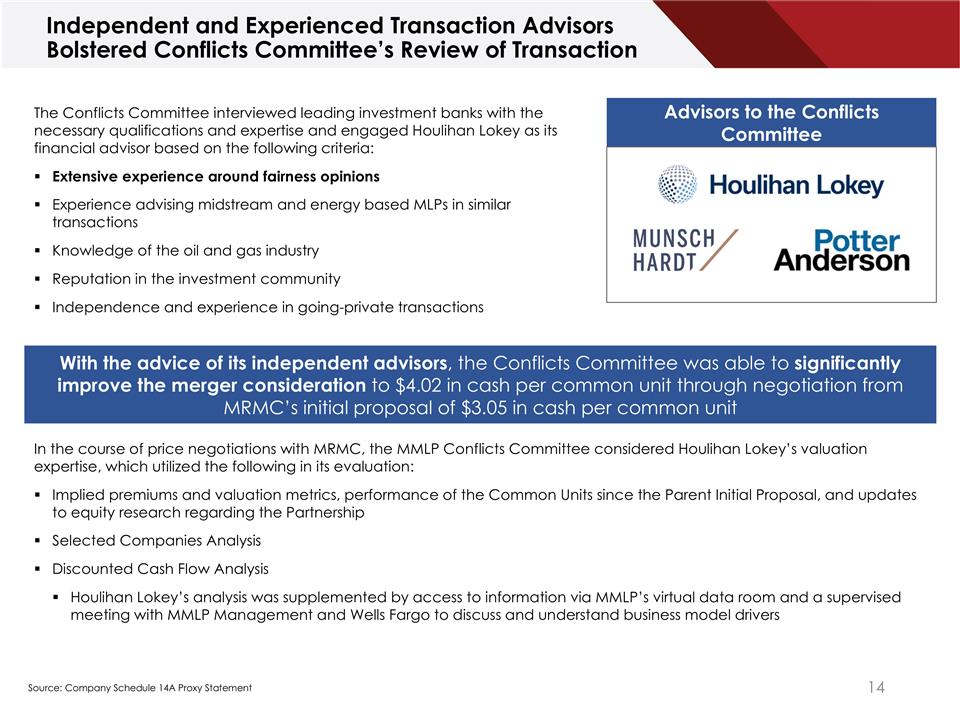

Independent and Experienced Transaction

Advisors Bolstered Conflicts Committee’s Review of Transaction The Conflicts Committee interviewed leading investment banks with the necessary qualifications and expertise and engaged Houlihan Lokey as its financial advisor based on the

following criteria: Extensive experience around fairness opinions Experience advising midstream and energy based MLPs in similar transactions Knowledge of the oil and gas industry Reputation in the investment community Independence and experience in

going-private transactions With the advice of its independent advisors, the Conflicts Committee was able to significantly improve the merger consideration to $4.02 in cash per common unit through negotiation from MRMC’s initial proposal of

$3.05 in cash per common unit In the course of price negotiations with MRMC, the MMLP Conflicts Committee considered Houlihan Lokey’s valuation expertise, which utilized the following in its evaluation: Implied premiums and valuation metrics,

performance of the Common Units since the Parent Initial Proposal, and updates to equity research regarding the Partnership Selected Companies Analysis Discounted Cash Flow Analysis Houlihan Lokey’s analysis was supplemented by access to

information via MMLP’s virtual data room and a supervised meeting with MMLP Management and Wells Fargo to discuss and understand business model drivers Advisors to the Conflicts Committee Source: Company Schedule 14A Proxy Statement

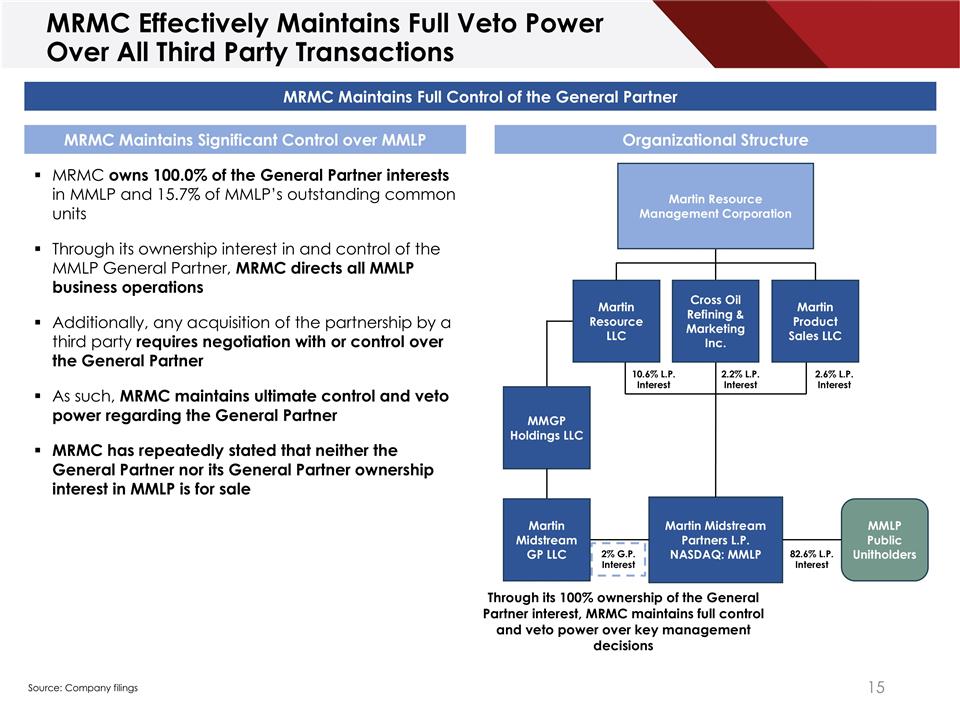

MRMC Effectively Maintains Full Veto

Power Over All Third Party Transactions MRMC Maintains Significant Control over MMLP Organizational Structure Martin Resource Management Corporation Cross Oil Refining & Marketing Inc. Martin Product Sales LLC Martin Resource LLC MMGP Holdings

LLC Martin Midstream Partners L.P. NASDAQ: MMLP MMLP Public Unitholders MRMC owns 100.0% of the General Partner interests in MMLP and 15.7% of MMLP’s outstanding common units Through its ownership interest in and control of the MMLP General

Partner, MRMC directs all MMLP business operations Additionally, any acquisition of the partnership by a third party requires negotiation with or control over the General Partner As such, MRMC maintains ultimate control and veto power regarding the

General Partner MRMC has repeatedly stated that neither the General Partner nor its General Partner ownership interest in MMLP is for sale Source: Company filings 2.2% L.P. Interest 2.6% L.P. Interest 10.6% L.P. Interest 2% G.P. Interest 82.6% L.P.

Interest Martin Midstream GP LLC Through its 100% ownership of the General Partner interest, MRMC maintains full control and veto power over key management decisions MRMC Maintains Full Control of the General Partner

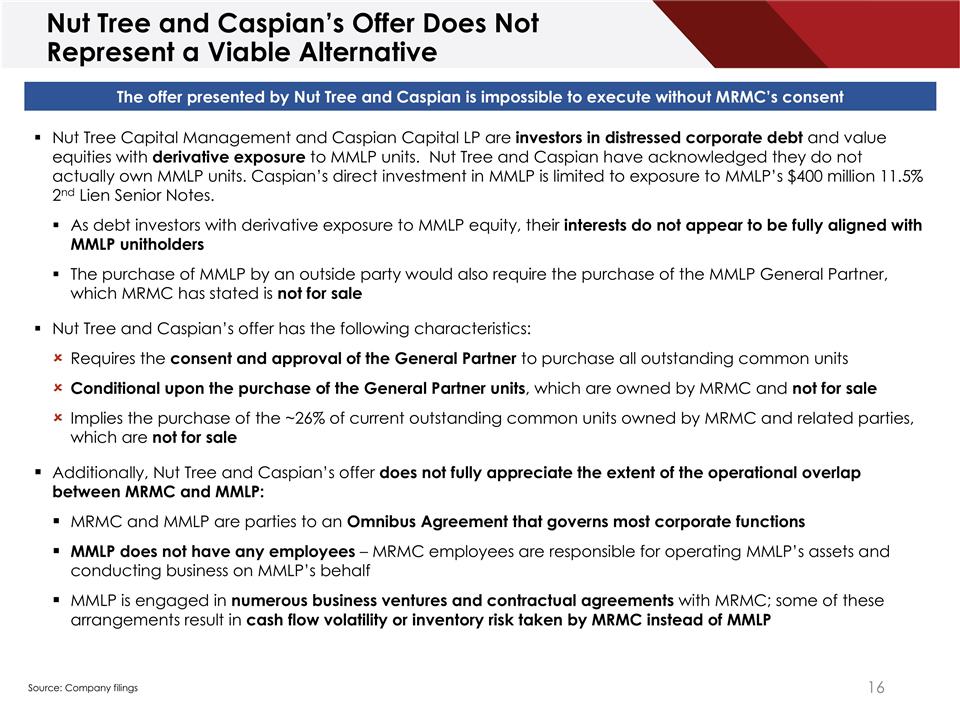

Nut Tree and Caspian’s Offer Does

Not Represent a Viable Alternative Nut Tree Capital Management and Caspian Capital LP are investors in distressed corporate debt and value equities with derivative exposure to MMLP units. Nut Tree and Caspian have acknowledged they do not actually

own MMLP units. Caspian’s direct investment in MMLP is limited to exposure to MMLP’s $400 million 11.5% 2nd Lien Senior Notes. As debt investors with derivative exposure to MMLP equity, their interests do not appear to be fully aligned

with MMLP unitholders The purchase of MMLP by an outside party would also require the purchase of the MMLP General Partner, which MRMC has stated is not for sale Nut Tree and Caspian’s offer has the following characteristics: Requires the

consent and approval of the General Partner to purchase all outstanding common units Conditional upon the purchase of the General Partner units, which are owned by MRMC and not for sale Implies the purchase of the ~26% of current outstanding common

units owned by MRMC and related parties, which are not for sale Additionally, Nut Tree and Caspian’s offer does not fully appreciate the extent of the operational overlap between MRMC and MMLP: MRMC and MMLP are parties to an Omnibus Agreement

that governs most corporate functions MMLP does not have any employees – MRMC employees are responsible for operating MMLP’s assets and conducting business on MMLP’s behalf MMLP is engaged in numerous business ventures and

contractual agreements with MRMC; some of these arrangements result in cash flow volatility or inventory risk taken by MRMC instead of MMLP The offer presented by Nut Tree and Caspian is impossible to execute without MRMC’s consent Source:

Company filings

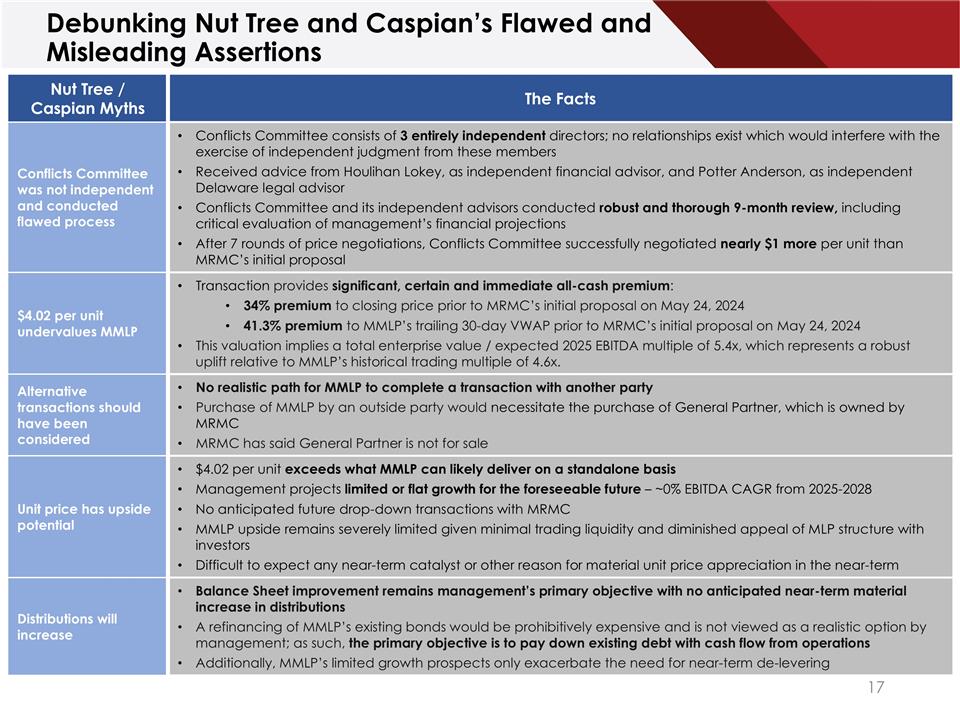

Debunking Nut Tree and Caspian’s

Flawed and Misleading Assertions Nut Tree / Caspian Myths The Facts Conflicts Committee was not independent and conducted flawed process Conflicts Committee consists of 3 entirely independent directors; no relationships exist which would interfere

with the exercise of independent judgment from these members Received advice from Houlihan Lokey, as independent financial advisor, and Potter Anderson, as independent Delaware legal advisor Conflicts Committee and its independent advisors conducted

robust and thorough 9-month review, including critical evaluation of management’s financial projections After 7 rounds of price negotiations, Conflicts Committee successfully negotiated nearly $1 more per unit than MRMC’s initial

proposal $4.02 per unit undervalues MMLP Transaction provides significant, certain and immediate all-cash premium: 34% premium to closing price prior to MRMC’s initial proposal on May 24, 2024 41.3% premium to MMLP’s trailing 30-day VWAP

prior to MRMC’s initial proposal on May 24, 2024 This valuation implies a total enterprise value / expected 2025 EBITDA multiple of 5.4x, which represents a robust uplift relative to MMLP’s historical trading multiple of 4.6x.

Alternative transactions should have been considered No realistic path for MMLP to complete a transaction with another party Purchase of MMLP by an outside party would necessitate the purchase of General Partner, which is owned by MRMC MRMC has said

General Partner is not for sale Unit price has upside potential $4.02 per unit exceeds what MMLP can likely deliver on a standalone basis Management projects limited or flat growth for the foreseeable future – ~0% EBITDA CAGR from 2025-2028 No

anticipated future drop-down transactions with MRMC MMLP upside remains severely limited given minimal trading liquidity and diminished appeal of MLP structure with investors Difficult to expect any near-term catalyst or other reason for material

unit price appreciation in the near-term Distributions will increase Balance Sheet improvement remains management’s primary objective with no anticipated near-term material increase in distributions A refinancing of MMLP’s existing bonds

would be prohibitively expensive and is not viewed as a realistic option by management; as such, the primary objective is to pay down existing debt with cash flow from operations Additionally, MMLP’s limited growth prospects only exacerbate

the need for near-term de-levering

Roadmap to Completion Secured

underwritten financing on signing Submitted Hart-Scott-Rodino (“HSR”) filings Filed Definitive Proxy Statement Obtain unitholder approval at special meeting in December Obtain state regulatory approvals Source: Company filings

Summary of Benefits Transaction

Delivers Superior Risk-Adjusted Value to MMLP Unitholders All cash offer at a significant 34.0% premium to MMLP’s market closing price1 prior to MRMC’s initial proposal and 41.3% premium to MMLP’s trailing 30-day volume weighted

average price (“VWAP”)2 Offer implies a TEV / 2025E EBITDA multiple of 5.4x, which represents a robust uplift relative to MMLP’s historical trading multiple of 4.6x3 Unanimous approval from MMLP’s Board of Directors and

Conflicts Committee Concludes robust strategic review to maximize value, involving 7 rounds of price negotiations Provides superior risk-adjusted and certain cash value for a micro-capitalization security that stands to be challenged by a flat

growth outlook and minimal trading liquidity MRMC is the only viable counterparty because the General Partner, which MRMC owns, is not for sale Source: Company filings 1 Unit price as of 5/23/2024, one day prior to MRMC’s initial offer on

5/24/2024 2 30-day VWAP prior to initial announcement on 5/24/2024 3 Represents the average daily TEV / FY+1 EBITDA multiple for the 12 months preceding MRMC’s initial offer

Grafico Azioni Martin Midstream Partners (NASDAQ:MMLP)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Martin Midstream Partners (NASDAQ:MMLP)

Storico

Da Dic 2023 a Dic 2024