Current Report Filing (8-k)

16 Giugno 2022 - 10:11PM

Edgar (US Regulatory)

false 0001120193 0001120193 2022-06-10 2022-06-10 0001120193 ndaq:CommonStock.01parvaluepershareMember 2022-06-10 2022-06-10 0001120193 ndaq:ZeroPointNineZeroZeroSeniorUnsecuredNotesDue2033Member 2022-06-10 2022-06-10 0001120193 ndaq:ZeroPointEightSevenFivePercentSeniorNotesDue2030Member 2022-06-10 2022-06-10 0001120193 ndaq:OnePointSevenFivePercentSeniorNotesDue2029Member 2022-06-10 2022-06-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 16, 2022 (June 10, 2022)

Nasdaq, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-38855 |

|

52-1165937 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

| 151 W. 42nd Street, New York, New York |

|

10036 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code: +1 212 401 8700

No change since last report

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value per share |

|

NDAQ |

|

The Nasdaq Stock Market |

| 0.900% Senior Notes due 2033 |

|

NDAQ33 |

|

The Nasdaq Stock Market |

| 0.875% Senior Notes due 2030 |

|

NDAQ30 |

|

The Nasdaq Stock Market |

| 1.75% Senior Notes due 2029 |

|

NDAQ29 |

|

The Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On June 10, 2022, the Board of Directors of Nasdaq, Inc. (the “Company”) approved and adopted the Nasdaq, Inc. Deferred Compensation Plan (the “Plan”). The Plan is a non-qualified deferred compensation plan that is intended to comply with Section 409A of the Internal Revenue Code of 1986, as amended. Participation in the Plan is voluntary and currently open only to those individuals who are U.S. employees of the Company or its subsidiaries at the level of Senior Vice President or higher.

Pursuant to the Plan, a Plan participant may elect to defer up to 80% of his or her annual base salary, annual bonus and/or commissions, as applicable. The Plan also permits, but does not require, the Company to make discretionary contributions to participants’ Plan accounts. Participants’ deferrals of cash compensation are always fully vested. Amounts due under the Plan will be paid in cash to participants.

Each participant’s deferred compensation account will be deemed invested in investments selected by the participant from a list made available by the Plan’s administrator. Plan distributions will be made in a lump sum or annual installments at such times as elected by participants in accordance with the Plan’s terms and conditions.

Obligations of the Company under the Plan represent at all times an unfunded and unsecured contractual obligation of the Company to pay amounts in the future in accordance with the terms of the Plan. Each participant in the Plan is an unsecured general creditor of the Company with respect to deferred compensation obligations. Any amounts set aside to defray the liabilities assumed by the Company will remain the general assets of the Company and remain subject to the claims of the Company’s creditors until such amounts are distributed to participants.

The forgoing description is qualified in its entirety by reference to the Plan, a copy of which is attached hereto as Exhibit 10.1 and incorporated by reference into this Current Report on Form 8-K.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Dated: June 16, 2022 |

|

|

|

NASDAQ, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ John A. Zecca |

|

|

|

|

Name: |

|

John A. Zecca |

|

|

|

|

Title: |

|

Executive Vice President and Chief Legal Officer |

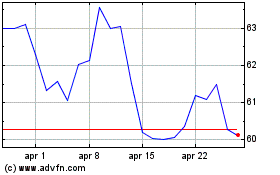

Grafico Azioni Nasdaq (NASDAQ:NDAQ)

Storico

Da Apr 2024 a Mag 2024

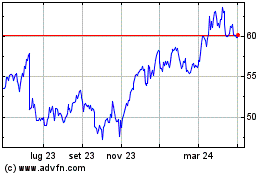

Grafico Azioni Nasdaq (NASDAQ:NDAQ)

Storico

Da Mag 2023 a Mag 2024