Prelude Therapeutics Incorporated (Nasdaq: PRLD), a clinical-stage

precision oncology company, today reported its financial results

for the first quarter ended March 31, 2024 and provided an update

on recent clinical development pipeline and other corporate

developments.

“The first quarter of this year was marked by growing momentum

for Prelude, led by the continued clinical progress of our two lead

drug candidates, PRT3789, a highly-selective, first-in-class

SMARCA2 degrader and PRT2527, a potentially best-in-class CDK9

inhibitor,” stated Kris Vaddi, Ph.D., Chief Executive Officer of

Prelude. “We are on track to present initial Phase 1 data for

both compounds in the second half of this year and to advance both

into the next phase of development in cancers with patients who are

in need of safe and effective new therapies, provided the data are

supportive.”

Dr. Vaddi continued, “In addition to the continued

advancement of our clinical compounds, we strengthened our

leadership team with the additions of Sean Brusky, our new Chief

Business Officer and Robert Doody, our new head of Investor

Relations, both of whom bring proven operational capabilities and

important strategic insights to the Prelude team in anticipation of

our expected progress and growth over the coming years.”

Clinical Program Updates and Upcoming

Milestones

SMARCA2 degrader PRT3789 on track to complete

monotherapy dose escalation mid- year and combination with

docetaxel has been initiated; initial proof-of concept data

expected in second half of

2024.

PRT3789 is a potent and highly selective, first-in-class SMARCA2

degrader, designed to be used in patients with a SMARCA4 mutation.

Cancers with a SMARCA4 mutation represent a high unmet medical

need. Patients with the SMARCA4 mutation have poor prognosis and

limited treatment options.

PRT3789 is in Phase 1 clinical development in biomarker selected

SMARCA4 mutant patients. Enrollment remains on track, and the

Company expects to conclude monotherapy dose escalation mid-2024

and identify recommended Phase 2 dose. In addition, enrollment of

patients into back-fill cohorts enriched for NSCLC and SMARCA4

loss-of-function mutations is ongoing. Objectives for this first

Phase 1 clinical trial are to establish the safety and tolerability

profile of PRT3789 as both monotherapy and in combination with

docetaxel, evaluate activity, pharmacokinetics and pharmacodynamics

and determine a dose and potential indications for advancement into

a registrational clinical trial.

Oral SMARCA2 degrader PRT7732 expected to enter Phase 1

clinical trial in the second half of 2024

Prelude’s discovery team has identified a series of highly

selective and orally bioavailable SMARCA2 degraders. The lead oral

molecule, PRT7732, is currently in investigational new drug (IND)

enabling preclinical studies and on track to enter Phase 1 clinical

development in the second half of 2024. PRT7732 is structurally

distinct from PRT3789 and may provide clinically meaningful

differences, including potential utility in earlier lines of

therapy.

CDK9 inhibitor PRT2527 on track to complete monotherapy

dose escalation mid-2024; initiated dosing in combination with

zanubrutinib in first quarter of 2024; initial hematological

proof-of-concept data expected in second half of

2024

PRT2527 is a potent and selective CDK9 inhibitor that has the

potential to avoid off target toxicity. The Company is currently

advancing PRT2527 as monotherapy in hematological indications such

as B-cell malignancies and acute myeloid leukemia (AML) and has

initiated the combination with zanubrutinib in B-cell

malignancies.

PRT2527 is currently in Phase 1 clinical development and is

expected to complete monotherapy dose escalation in B-cell

malignancies mid-year. A second cohort of patients with AML is

expected to initiate in the first half of 2024.

2024 AACR Annual Meeting: Prelude participated

in the 2024 American Association for Cancer Research Annual

Meeting, presenting three preclinical poster presentations. New

preclinical data was presented for the company’s highly selective

oral SMARCA2 degrader, its potentially best-in-class CDK9

inhibitor, and its next-generation oral CDK4/6 inhibitor. Copies of

this information can be found on the Company’s website under

Publications - Prelude Therapeutics (preludetx.com).

Corporate Updates: In April 2024,

Prelude appointed Sean Brusky to the newly created position of

Chief Business Officer. Mr. Brusky joins Prelude from Pardes

Biosciences where he served as both Chief Commercial Officer and

Chief Business Officer. Prior to Pardes, Mr. Brusky served in roles

of increasing seniority at Genentech/Roche, Vertex Pharmaceuticals

and Bain & Company.

Additionally, in April 2024, Prelude appointed Robert Doody to

the newly created position of Senior Vice President, Investor

Relations. Mr. Doody most recently served as Head of Investor

Relations at Aclaris Therapeutics. Prior to Aclaris Therapeutics,

Mr. Doody served as Investor Relations Lead at Provention Bio,

Idera Pharmaceuticals and ViroPharma Incorporated.

First Quarter 2024 Financial

Results

Cash and Cash

Equivalents: Cash, cash equivalents and

marketable securities as of March 31, 2024 were $201.9 million. The

Company anticipates that its existing cash, cash equivalents and

marketable securities will fund Prelude’s operations into

2026.

Research and Development (R&D)

Expenses: For the first quarter of 2024,

R&D expense increased to $27.4 million from $21.8 million for

the prior year period. Research and development expenses increased

primarily due to the timing of our clinical research programs. We

expect our R&D expenses to vary from quarter to quarter,

primarily due to the timing of our clinical development activities.

General and Administrative (G&A)

Expenses: For the first quarter of 2024,

G&A expenses decreased to $6.9 million from $7.3 million for

the prior year period. The decrease is primarily due to a decrease

in non-cash expense related to stock-based compensation, partially

offset by an increase in professional fees incurred as we expand

our operations to support our research and development efforts.

Net Loss: For the three months ended

March 31, 2024, net loss was $31.4 million, or $0.42 per share

compared to $27.7 million, or $0.58 per share, for the prior year

period. Included in the net loss for the quarter ended March 31,

2024, was $5.5 million of non-cash expenses related to the impact

of expensing share-based payments, including employee stock

options, as compared to $6.3 million for the same period in

2023.

About Prelude

Therapeutics

Prelude Therapeutics is a clinical-stage precision oncology

company developing innovative drug candidates targeting critical

cancer cell pathways. The Company’s diverse pipeline is comprised

of highly differentiated, potentially best-in-class proprietary

small molecule compounds aimed at addressing clinically validated

pathways for cancers with selectable underserved patients.

Prelude’s pipeline includes three candidates currently in clinical

development: an IV administered, potent and highly selective

SMARCA2 degrader, PRT3789, a potent and highly selective CDK9

inhibitor, PRT2527, and a next generation CDK4/6 inhibitor,

PRT3645. Prelude is also developing a potent, highly selective,

orally bioavailable SMARCA2 degrader, PRT7732. The company is also

collaborating with AbCellera to jointly discover, develop and

commercialize up to five precision, next generation antibody drug

conjugate (ADC) products combining AbCellera’s antibody discovery

and development engine with Prelude’s expertise in medicinal

chemistry and drug development. For more information, visit

preludetx.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the "safe harbor" provisions of

the Private Securities Litigation Reform Act of 1995, including,

but not limited to, anticipated discovery, preclinical and clinical

development activities for Prelude’s product candidates, the

potential safety, efficacy, benefits and addressable market for

Prelude’s product candidates, the expected timeline for initial

proof-of-concept data and clinical trial results for Prelude’s

product candidates, and the sufficiency of Prelude’s cash runway

into 2026. All statements other than statements of historical fact

are statements that could be deemed forward-looking statements. The

words “believes,” “anticipates,” “estimates,” “plans,” “expects,”

“intends,” “may,” “could,” “should,” “potential,” “likely,”

“projects,” “continue,” “will,” “schedule,” and “would” and similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. These forward-looking statements are predictions

based on the Company’s current expectations and projections about

future events and various assumptions. Although Prelude believes

that the expectations reflected in such forward-looking statements

are reasonable, Prelude cannot guarantee future events, results,

actions, levels of activity, performance or achievements, and the

timing and results of biotechnology development and potential

regulatory approval is inherently uncertain. Forward-looking

statements are subject to risks and uncertainties that may cause

Prelude's actual activities or results to differ significantly from

those expressed in any forward-looking statement, including risks

and uncertainties related to Prelude's ability to advance its

product candidates, the receipt and timing of potential regulatory

designations, approvals and commercialization of product

candidates, clinical trial sites and our ability to enroll eligible

patients, supply chain and manufacturing facilities, Prelude’s

ability to maintain and recognize the benefits of certain

designations received by product candidates, the timing and results

of preclinical and clinical trials, Prelude's ability to fund

development activities and achieve development goals, Prelude's

ability to protect intellectual property, and other risks and

uncertainties described under the heading "Risk Factors" in

Prelude’s Annual Report on Form 10-K for the year ended December

31, 2023, its Quarterly Reports on Form 10-Q and other documents

that Prelude files from time to time with the Securities and

Exchange Commission. These forward-looking statements speak only as

of the date of this press release, and Prelude undertakes no

obligation to revise or update any forward-looking statements to

reflect events or circumstances after the date hereof, except as

may be required by law.

|

PRELUDE THERAPEUTICS

INCORPORATEDSTATEMENTS OF OPERATIONS AND

COMPREHENSIVE LOSS(UNAUDITED) |

| |

|

|

|

Three Months Ended March 31, |

|

|

(in thousands, except share and per share

data) |

|

2024 |

|

|

2023 |

|

|

Operating expenses: |

|

|

|

|

|

|

|

Research and development |

|

$ |

27,409 |

|

|

$ |

21,834 |

|

|

General and administrative |

|

|

6,934 |

|

|

|

7,281 |

|

|

Total operating expenses |

|

|

34,343 |

|

|

|

29,115 |

|

|

Loss from operations |

|

|

(34,343 |

) |

|

|

(29,115 |

) |

| Other

income, net |

|

|

2,912 |

|

|

|

1,397 |

|

| Net

loss |

|

$ |

(31,431 |

) |

|

$ |

(27,718 |

) |

| Per

share information: |

|

|

|

|

|

|

| Net loss

per share of common stock, basic and diluted |

|

$ |

(0.42 |

) |

|

$ |

(0.58 |

) |

| Weighted

average common shares outstanding, basic and diluted |

|

|

75,735,954 |

|

|

|

47,737,190 |

|

|

Comprehensive loss: |

|

|

|

|

|

|

|

Net loss |

|

$ |

(31,431 |

) |

|

$ |

(27,718 |

) |

|

Unrealized (loss) gain on marketable securities, net of tax |

|

|

(458 |

) |

|

|

1,294 |

|

|

Comprehensive loss |

|

$ |

(31,889 |

) |

|

$ |

(26,424 |

) |

|

PRELUDE THERAPEUTICS INCORPORATEDBALANCE

SHEETS(UNAUDITED) |

|

| |

|

| (in thousands, except

share data) |

|

March 31,2024 |

|

|

December 31,2023 |

|

|

Assets |

|

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

24,707 |

|

|

$ |

25,291 |

|

|

Marketable securities |

|

|

177,217 |

|

|

|

207,644 |

|

|

Prepaid expenses and other current assets |

|

|

3,442 |

|

|

|

2,654 |

|

|

Total current assets |

|

|

205,366 |

|

|

|

235,589 |

|

|

Restricted cash |

|

|

4,044 |

|

|

|

4,044 |

|

| Property

and equipment, net |

|

|

7,294 |

|

|

|

7,325 |

|

|

Right-of-use asset |

|

|

30,107 |

|

|

|

30,412 |

|

| Other

assets |

|

|

295 |

|

|

|

295 |

|

|

Total assets |

|

$ |

247,106 |

|

|

$ |

277,665 |

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable |

|

$ |

5,308 |

|

|

$ |

4,580 |

|

|

Accrued expenses and other current liabilities |

|

|

10,147 |

|

|

|

15,768 |

|

|

Operating lease liability |

|

|

2,188 |

|

|

|

1,481 |

|

|

Total current liabilities |

|

|

17,643 |

|

|

|

21,829 |

|

| Other

liabilities |

|

|

3,277 |

|

|

|

3,339 |

|

|

Operating lease liability |

|

|

15,452 |

|

|

|

15,407 |

|

|

Total liabilities |

|

|

36,372 |

|

|

|

40,575 |

|

|

Commitments |

|

|

|

|

|

|

|

Stockholders’ equity: |

|

|

|

|

|

|

|

Voting common stock, $0.0001 par value: 487,149,741 shares

authorized; 42,071,505 and 42,063,995 shares issued and outstanding

at March 31, 2024 and December 31, 2023, respectively |

|

|

4 |

|

|

|

4 |

|

|

Non-voting common stock, $0.0001 par value: 12,850,259 shares

authorized; 12,850,259 shares issued and outstanding at both March

31, 2024 and December 31, 2023 |

|

|

1 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

|

698,785 |

|

|

|

693,252 |

|

|

Accumulated other comprehensive (loss) income |

|

|

(235 |

) |

|

|

223 |

|

|

Accumulated deficit |

|

|

(487,821 |

) |

|

|

(456,390 |

) |

|

Total stockholders’ equity |

|

|

210,734 |

|

|

|

237,090 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

247,106 |

|

|

$ |

277,665 |

|

|

|

|

Investor Contact: Robert A. Doody

Jr.Senior Vice President, Investor

Relations 484.639.7235rdoody@preludetx.com

Media Contact:Helen ShikShik

Communications617.510.4373Helen@ShikCommunications.com

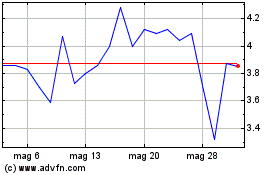

Grafico Azioni Prelude Therapeutics (NASDAQ:PRLD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Prelude Therapeutics (NASDAQ:PRLD)

Storico

Da Gen 2024 a Gen 2025