Franklin Templeton Launches Suite of Tax-Managed Active and Passive SMAs at UBS, Powered by Canvas Custom Indexing Solution

26 Giugno 2024 - 3:15PM

Business Wire

Additionally, Franklin Managed Options

Strategies Team Introduces Options Overlay Capabilities at

UBS

Franklin Templeton today announces it is now offering a

comprehensive suite of tax-managed separately managed account (SMA)

strategies on UBS Wealth Management’s single and dual contract SMA

platforms. The lineup of active and passive SMAs will give UBS

advisors access to Canvas, Franklin Templeton’s Custom Indexing

solution—designed to provide personalized portfolios with the

potential to improve after-tax returns.

“Active strategies are built to generate excess return, but if

the capital gains taxes they generate are not managed carefully,

their after-tax returns can be significantly impacted,” said Roger

Paradiso, Head of Advisor Portfolio and Technology Solutions for

Franklin Templeton. “Marrying the fundamentals of Direct and Custom

Indexing with active management and channeling distribution into

the wirehouse and broker-dealer segment of the market is a

promising development.”

The strategies combine Canvas’ technology capabilities with

Franklin Templeton’s global equity specialist manager ClearBridge

Investments’ legacy in fundamental investing, enabling advisors to

seamlessly offer customized portfolios with fully digital account

implementation and management.

The strategy lineup includes:

- ClearBridge Large Cap Growth – Canvas Tax Managed

- ClearBridge All Cap Growth – Canvas Tax Managed

- ClearBridge Dividend Strategy – Canvas Tax Managed

- Franklin Templeton S&P 500 – Canvas Tax Managed

In addition to the Canvas tax-managed strategies, two additional

strategies from the Franklin Managed Options Strategies (Franklin

MOST) team have also launched at UBS:

- Franklin MOST Managed Call Selling

- Franklin MOST Risk Managed Equity

The addition of Franklin MOST alongside Canvas provides another

valuable capability for advisors to more effectively customize

client portfolios at scale.

Franklin Templeton is a leading provider in the fast-growing SMA

industry, with over $137 billion in SMA assets under management as

of March 31, 2024. These offerings are core to Franklin Templeton’s

investment in its Custom Wealth Solutions group that is focused on

delivering innovative and modular investment and practice

management solutions to advisors serving the high net worth

community.

All investments involve risks, including the loss of

principal.

IMPORTANT TAX INFORMATION:

Franklin Templeton, its affiliates, and its employees are not in

the business of providing tax or legal advice to taxpayers. These

materials and any tax-related statements are not intended or

written to be used, and cannot be used or relied upon, by any such

taxpayer for the purpose of avoiding tax penalties or complying

with any applicable tax laws or regulations. Tax-related

statements, if any, may have been written in connection with the

“promotion or marketing” of the transaction(s) or matter(s)

addressed by these materials, to the extent allowed by applicable

law. Any such taxpayer should seek advice based on the taxpayer’s

particular circumstances from an independent tax advisor.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and over $1.6 trillion in assets under management as of

May 31, 2024. For more information, please visit

franklintempleton.com and follow us on LinkedIn, X and

Facebook.

©2024. Franklin Templeton. ClearBridge Investments, LLC and FT

MOST are Franklin Templeton affiliated companies. All rights

reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240626643675/en/

Franklin Templeton Corporate Communications: Stacey Coleman,

(650) 525-7458, stacey.coleman@franklintempleton.com Rebecca

Radosevich, (212) 632-3207,

rebecca.radosevich@franklintempleton.com

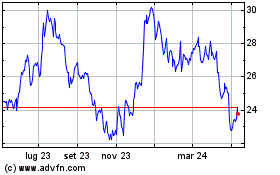

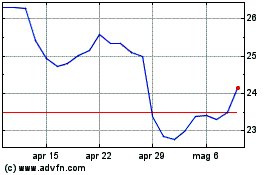

Grafico Azioni Franklin Resources (NYSE:BEN)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni Franklin Resources (NYSE:BEN)

Storico

Da Giu 2023 a Giu 2024