Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 Novembre 2023 - 6:39PM

Edgar (US Regulatory)

|

|

|

| Schedule of Investments (unaudited)

September 30, 2023 |

|

BlackRock Energy and Resources Trust (BGR)

(Percentages shown are based on Net Assets) |

|

|

|

|

|

|

|

|

|

| Security |

|

Shares |

|

|

Value |

|

|

|

|

| Common Stocks |

|

|

|

|

|

|

|

|

|

|

|

| Energy Equipment & Services — 5.5% |

|

|

|

|

|

|

|

|

| NOV, Inc.(a) |

|

|

48,700 |

|

|

$ |

1,017,830 |

|

| Patterson-UTI Energy, Inc.(a) |

|

|

70,400 |

|

|

|

974,336 |

|

| Schlumberger NV(a) |

|

|

262,681 |

|

|

|

15,314,302 |

|

| TechnipFMC PLC(a) |

|

|

162,950 |

|

|

|

3,314,403 |

|

| Tenaris SA |

|

|

61,100 |

|

|

|

965,133 |

|

| Weatherford International PLC(a)(b) |

|

|

11,900 |

|

|

|

1,074,927 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22,660,931 |

|

|

|

|

| Food Products — 0.4% |

|

|

|

|

|

|

|

|

| Darling Ingredients, Inc.(a)(b) |

|

|

29,424 |

|

|

|

1,535,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Oil, Gas & Consumable Fuels — 94.2% |

|

|

|

|

|

|

|

|

| ARC Resources Ltd. |

|

|

371,230 |

|

|

|

5,925,468 |

|

| BP PLC |

|

|

3,482,005 |

|

|

|

22,444,776 |

|

| Canadian Natural Resources Ltd |

|

|

260,692 |

|

|

|

16,859,330 |

|

| Cenovus Energy, Inc. |

|

|

565,137 |

|

|

|

11,766,666 |

|

| Cheniere Energy, Inc. |

|

|

99,068 |

|

|

|

16,441,325 |

|

| Chevron Corp.(a) |

|

|

116,190 |

|

|

|

19,591,958 |

|

| ConocoPhillips(a) |

|

|

239,319 |

|

|

|

28,670,371 |

|

| Diamondback Energy, Inc.(a) |

|

|

59,551 |

|

|

|

9,223,259 |

|

| Eni SpA |

|

|

473,650 |

|

|

|

7,608,623 |

|

| EOG Resources, Inc.(a) |

|

|

132,716 |

|

|

|

16,823,080 |

|

| Exxon Mobil Corp.(a)(c) |

|

|

650,530 |

|

|

|

76,489,317 |

|

| Galp Energia SGPS SA |

|

|

213,900 |

|

|

|

3,168,311 |

|

| Gazprom PJSC(b)(d) |

|

|

879,200 |

|

|

|

91 |

|

| Hess Corp.(a) |

|

|

94,453 |

|

|

|

14,451,309 |

|

| Kinder Morgan, Inc.(a) |

|

|

491,661 |

|

|

|

8,151,739 |

|

| Kosmos Energy Ltd.(b) |

|

|

465,084 |

|

|

|

3,804,387 |

|

| Marathon Petroleum Corp.(a) |

|

|

92,545 |

|

|

|

14,005,760 |

|

| Shell PLC, ADR(a) |

|

|

662,760 |

|

|

|

42,668,489 |

|

| TC Energy Corp. |

|

|

147,450 |

|

|

|

5,070,782 |

|

| TotalEnergies SE |

|

|

473,661 |

|

|

|

31,142,888 |

|

| Tourmaline Oil Corp. |

|

|

140,833 |

|

|

|

7,087,013 |

|

|

|

|

|

|

|

|

|

|

| Security |

|

Shares |

|

|

Value |

|

|

|

| Oil, Gas & Consumable Fuels (continued) |

|

|

|

|

|

| Valero Energy Corp.(a) |

|

|

73,411 |

|

|

$ |

10,403,073 |

|

| Williams Cos., Inc.(a) |

|

|

429,731 |

|

|

|

14,477,637 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

386,275,652 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Long-Term Investments — 100.1%

(Cost: $258,941,537) |

|

|

|

410,472,516 |

|

|

|

|

|

|

|

|

|

|

|

|

| Short-Term Securities |

|

|

|

|

|

|

|

|

| Money Market Funds — 0.4% |

|

|

|

|

|

|

|

|

| BlackRock Liquidity Funds, T-Fund, Institutional Class, 5.23%(e)(f) |

|

|

1,671,104 |

|

|

|

1,671,104 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Short-Term Securities — 0.4%

(Cost: $1,671,104) |

|

|

|

1,671,104 |

|

|

|

|

|

|

|

|

|

|

|

|

| Total Investments Before Options Written — 100.5%

(Cost: $260,612,641) |

|

|

|

412,143,620 |

|

|

|

|

|

|

|

|

|

|

|

|

| Options Written — (0.9)%

(Premiums Received: $(3,330,604)) |

|

|

|

(3,648,807 |

) |

|

|

|

|

|

|

|

|

|

|

|

| Total Investments, Net of Options Written — 99.6%

(Cost: $257,282,037) |

|

|

|

408,494,813 |

|

| Other Assets Less Liabilities — 0.4% |

|

|

|

1,678,295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net Assets — 100.0% |

|

|

|

|

|

$ |

410,173,108 |

|

|

|

|

|

|

|

|

|

|

| (a) |

All or a portion of the security has been pledged and/or segregated as collateral in connection with outstanding

exchange-traded options written. |

| (b) |

Non-income producing security. |

| (c) |

All or a portion of the security has been pledged as collateral in connection with outstanding OTC derivatives.

|

| (d) |

Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy.

|

| (e) |

Affiliate of the Trust. |

| (f) |

Annualized 7-day yield as of period end.

|

For Trust compliance purposes, the

Trust’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment

adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease.

Affiliates

Investments in issuers considered to be

affiliate(s) of the Trust during the period ended September 30, 2023 for purposes of Section 2(a)(3) of the Investment Company Act of 1940, as amended, were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Affiliated Issuer |

|

Value at

12/31/22 |

|

|

Purchases

at Cost |

|

|

Proceeds

from Sales |

|

|

Net

Realized

Gain (Loss) |

|

|

Change in

Unrealized

Appreciation

(Depreciation) |

|

|

Value at

09/30/23 |

|

|

Shares

Held at

09/30/23 |

|

|

Income |

|

|

Capital Gain

Distributions

from

Underlying

Funds |

|

| BlackRock Liquidity Funds, T-Fund, Institutional Class |

|

$ |

7,695,475 |

|

|

$ |

— |

|

|

$ |

(6,024,371 |

)(a) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,671,104 |

|

|

|

1,671,104 |

|

|

$ |

227,187 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(a) |

Represents net amount purchased (sold). |

|

Derivative Financial Instruments Outstanding as of Period End

Exchange-Traded Options Written

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Number of

Contracts |

|

|

Expiration

Date |

|

|

Exercise Price |

|

|

Notional

Amount (000) |

|

|

Value |

|

| Call |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Hess Corp |

|

|

28 |

|

|

|

09/29/23 |

|

|

|

USD |

|

|

|

0.00 |

|

|

|

USD |

|

|

|

428 |

|

|

$ |

(2,310 |

) |

| Chevron Corp |

|

|

374 |

|

|

|

10/06/23 |

|

|

|

USD |

|

|

|

165.00 |

|

|

|

USD |

|

|

|

6,306 |

|

|

|

(168,300 |

) |

| ConocoPhillips |

|

|

81 |

|

|

|

10/06/23 |

|

|

|

USD |

|

|

|

117.00 |

|

|

|

USD |

|

|

|

970 |

|

|

|

(29,970 |

) |

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock Energy and Resources Trust (BGR) |

Exchange-Traded Options Written (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Number of

Contracts |

|

|

Expiration

Date |

|

|

Exercise Price |

|

|

Notional

Amount (000) |

|

|

Value |

|

| Call (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EOG Resources, Inc. |

|

|

221 |

|

|

|

10/06/23 |

|

|

|

USD |

|

|

|

130.00 |

|

|

|

USD |

|

|

|

2,801 |

|

|

$ |

(17,127 |

) |

| Hess Corp. |

|

|

110 |

|

|

|

10/06/23 |

|

|

|

USD |

|

|

|

157.50 |

|

|

|

USD |

|

|

|

1,683 |

|

|

|

(9,350 |

) |

| Schlumberger NV |

|

|

164 |

|

|

|

10/06/23 |

|

|

|

USD |

|

|

|

60.00 |

|

|

|

USD |

|

|

|

956 |

|

|

|

(6,560 |

) |

| Valero Energy Corp. |

|

|

137 |

|

|

|

10/06/23 |

|

|

|

USD |

|

|

|

134.00 |

|

|

|

USD |

|

|

|

1,941 |

|

|

|

(113,367 |

) |

| Hess Corp. |

|

|

86 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

165.00 |

|

|

|

USD |

|

|

|

1,316 |

|

|

|

(4,085 |

) |

| Kinder Morgan, Inc. |

|

|

507 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

16.74 |

|

|

|

USD |

|

|

|

841 |

|

|

|

(10,236 |

) |

| Schlumberger NV |

|

|

165 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

61.00 |

|

|

|

USD |

|

|

|

962 |

|

|

|

(8,250 |

) |

| Shell PLC, ADR |

|

|

489 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

63.00 |

|

|

|

USD |

|

|

|

3,148 |

|

|

|

(96,577 |

) |

| Williams Cos., Inc. |

|

|

426 |

|

|

|

10/13/23 |

|

|

|

USD |

|

|

|

34.00 |

|

|

|

USD |

|

|

|

1,435 |

|

|

|

(18,105 |

) |

| ARC Resources Ltd. |

|

|

81 |

|

|

|

10/20/23 |

|

|

|

CAD |

|

|

|

21.00 |

|

|

|

CAD |

|

|

|

176 |

|

|

|

(5,785 |

) |

| Canadian Natural Resources Ltd. |

|

|

741 |

|

|

|

10/20/23 |

|

|

|

CAD |

|

|

|

84.00 |

|

|

|

CAD |

|

|

|

6,509 |

|

|

|

(259,139 |

) |

| Cenovus Energy, Inc. |

|

|

359 |

|

|

|

10/20/23 |

|

|

|

CAD |

|

|

|

27.00 |

|

|

|

CAD |

|

|

|

1,015 |

|

|

|

(43,215 |

) |

| ConocoPhillips |

|

|

417 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

125.00 |

|

|

|

USD |

|

|

|

4,996 |

|

|

|

(51,499 |

) |

| Diamondback Energy, Inc. |

|

|

107 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

149.00 |

|

|

|

USD |

|

|

|

1,657 |

|

|

|

(86,305 |

) |

| Exxon Mobil Corp. |

|

|

529 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

115.00 |

|

|

|

USD |

|

|

|

6,220 |

|

|

|

(232,760 |

) |

| Hess Corp. |

|

|

88 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

160.00 |

|

|

|

USD |

|

|

|

1,346 |

|

|

|

(16,500 |

) |

| Kinder Morgan, Inc. |

|

|

571 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

17.57 |

|

|

|

USD |

|

|

|

947 |

|

|

|

(2,873 |

) |

| NOV, Inc. |

|

|

161 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

22.00 |

|

|

|

USD |

|

|

|

336 |

|

|

|

(4,830 |

) |

| Patterson-UTI Energy, Inc. |

|

|

116 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

16.00 |

|

|

|

USD |

|

|

|

161 |

|

|

|

(870 |

) |

| Schlumberger NV |

|

|

173 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

60.00 |

|

|

|

USD |

|

|

|

1,009 |

|

|

|

(22,836 |

) |

| TechnipFMC PLC |

|

|

539 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

22.00 |

|

|

|

USD |

|

|

|

1,096 |

|

|

|

(12,128 |

) |

| Tourmaline Oil Corp. |

|

|

131 |

|

|

|

10/20/23 |

|

|

|

CAD |

|

|

|

69.50 |

|

|

|

CAD |

|

|

|

895 |

|

|

|

(10,320 |

) |

| Weatherford International PLC |

|

|

39 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

100.00 |

|

|

|

USD |

|

|

|

352 |

|

|

|

(1,268 |

) |

| Williams Cos., Inc. |

|

|

438 |

|

|

|

10/20/23 |

|

|

|

USD |

|

|

|

35.00 |

|

|

|

USD |

|

|

|

1,476 |

|

|

|

(8,760 |

) |

| ConocoPhillips |

|

|

81 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

124.00 |

|

|

|

USD |

|

|

|

970 |

|

|

|

(16,281 |

) |

| Exxon Mobil Corp. |

|

|

809 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

121.00 |

|

|

|

USD |

|

|

|

9,512 |

|

|

|

(148,451 |

) |

| Kinder Morgan, Inc. |

|

|

550 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

17.50 |

|

|

|

USD |

|

|

|

912 |

|

|

|

(4,675 |

) |

| Shell PLC, ADR |

|

|

551 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

62.95 |

|

|

|

USD |

|

|

|

3,547 |

|

|

|

(135,654 |

) |

| Valero Energy Corp. |

|

|

105 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

145.00 |

|

|

|

USD |

|

|

|

1,488 |

|

|

|

(40,687 |

) |

| Williams Cos., Inc. |

|

|

556 |

|

|

|

10/27/23 |

|

|

|

USD |

|

|

|

34.00 |

|

|

|

USD |

|

|

|

1,873 |

|

|

|

(37,530 |

) |

| Chevron Corp. |

|

|

10 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

175.00 |

|

|

|

USD |

|

|

|

169 |

|

|

|

(2,115 |

) |

| ConocoPhillips |

|

|

213 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

126.64 |

|

|

|

USD |

|

|

|

2,552 |

|

|

|

(38,995 |

) |

| EOG Resources, Inc. |

|

|

218 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

134.00 |

|

|

|

USD |

|

|

|

2,763 |

|

|

|

(44,145 |

) |

| Exxon Mobil Corp. |

|

|

817 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

122.00 |

|

|

|

USD |

|

|

|

9,606 |

|

|

|

(154,413 |

) |

| Hess Corp. |

|

|

27 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

162.50 |

|

|

|

USD |

|

|

|

413 |

|

|

|

(7,628 |

) |

| Marathon Petroleum Corp. |

|

|

131 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

160.00 |

|

|

|

USD |

|

|

|

1,983 |

|

|

|

(34,191 |

) |

| Schlumberger NV |

|

|

368 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

63.00 |

|

|

|

USD |

|

|

|

2,145 |

|

|

|

(33,672 |

) |

| Shell PLC, ADR |

|

|

419 |

|

|

|

11/03/23 |

|

|

|

USD |

|

|

|

65.42 |

|

|

|

USD |

|

|

|

2,698 |

|

|

|

(55,310 |

) |

| Marathon Petroleum Corp. |

|

|

174 |

|

|

|

11/10/23 |

|

|

|

USD |

|

|

|

162.50 |

|

|

|

USD |

|

|

|

2,633 |

|

|

|

(41,238 |

) |

| ARC Resources Ltd. |

|

|

427 |

|

|

|

11/17/23 |

|

|

|

CAD |

|

|

|

21.50 |

|

|

|

CAD |

|

|

|

926 |

|

|

|

(33,481 |

) |

| ARC Resources Ltd. |

|

|

183 |

|

|

|

11/17/23 |

|

|

|

CAD |

|

|

|

22.00 |

|

|

|

CAD |

|

|

|

397 |

|

|

|

(10,711 |

) |

| Canadian Natural Resources Ltd. |

|

|

120 |

|

|

|

11/17/23 |

|

|

|

CAD |

|

|

|

88.00 |

|

|

|

CAD |

|

|

|

1,054 |

|

|

|

(31,364 |

) |

| Cenovus Energy, Inc. |

|

|

1,509 |

|

|

|

11/17/23 |

|

|

|

CAD |

|

|

|

27.00 |

|

|

|

CAD |

|

|

|

4,267 |

|

|

|

(248,861 |

) |

| Darling Ingredients, Inc. |

|

|

74 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

60.00 |

|

|

|

USD |

|

|

|

386 |

|

|

|

(5,735 |

) |

| Diamondback Energy, Inc. |

|

|

91 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

160.00 |

|

|

|

USD |

|

|

|

1,409 |

|

|

|

(38,675 |

) |

| Patterson-UTI Energy, Inc. |

|

|

117 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

17.00 |

|

|

|

USD |

|

|

|

162 |

|

|

|

(2,048 |

) |

| Shell PLC, ADR |

|

|

736 |

|

|

|

11/17/23 |

|

|

|

USD |

|

|

|

65.00 |

|

|

|

USD |

|

|

|

4,738 |

|

|

|

(134,320 |

) |

| Tourmaline Oil Corp. |

|

|

335 |

|

|

|

11/17/23 |

|

|

|

CAD |

|

|

|

71.00 |

|

|

|

CAD |

|

|

|

2,290 |

|

|

|

(42,916 |

) |

| ARC Resources Ltd. |

|

|

538 |

|

|

|

12/15/23 |

|

|

|

CAD |

|

|

|

22.00 |

|

|

|

CAD |

|

|

|

1,166 |

|

|

|

(42,382 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(2,628,803 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTC Options Written

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Counterparty |

|

Number of

Contracts |

|

|

Expiration

Date |

|

|

Exercise Price |

|

|

Notional

Amount (000) |

|

|

Value |

|

| Call |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Eni SpA |

|

JPMorgan Chase Bank N.A. |

|

|

126,300 |

|

|

|

10/03/23 |

|

|

|

EUR |

|

|

|

14.08 |

|

|

|

EUR |

|

|

|

1,919 |

|

|

$ |

(158,415 |

) |

| Eni SpA |

|

Goldman Sachs International |

|

|

51,500 |

|

|

|

10/10/23 |

|

|

|

EUR |

|

|

|

14.43 |

|

|

|

EUR |

|

|

|

782 |

|

|

|

(46,897 |

) |

| BP PLC |

|

Barclays Bank PLC |

|

|

715,200 |

|

|

|

10/13/23 |

|

|

|

GBP |

|

|

|

4.90 |

|

|

|

GBP |

|

|

|

3,778 |

|

|

|

(374,396 |

) |

| TotalEnergies SE |

|

Morgan Stanley & Co. International PLC |

|

|

31,300 |

|

|

|

10/13/23 |

|

|

|

EUR |

|

|

|

59.25 |

|

|

|

EUR |

|

|

|

1,947 |

|

|

|

(110,177 |

) |

|

|

|

| S C H E D U L E O F I N V E S T M E N T

S |

|

2 |

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock Energy and Resources Trust (BGR) |

OTC Options Written (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Description |

|

Counterparty |

|

Number of

Contracts |

|

|

Expiration

Date |

|

|

Exercise Price |

|

|

Notional

Amount (000) |

|

|

Value |

|

| Call (continued) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TC Energy Corp. |

|

Royal Bank of Canada |

|

|

25,300 |

|

|

|

10/20/23 |

|

|

|

CAD |

|

|

|

49.07 |

|

|

|

CAD |

|

|

|

1,182 |

|

|

$ |

(3,418 |

) |

| BP PLC |

|

Morgan Stanley & Co. International PLC |

|

|

438,300 |

|

|

|

10/24/23 |

|

|

|

GBP |

|

|

|

5.18 |

|

|

|

GBP |

|

|

|

2,316 |

|

|

|

(114,933 |

) |

| Darling Ingredients, Inc. |

|

JPMorgan Chase Bank N.A. |

|

|

2,300 |

|

|

|

10/25/23 |

|

|

|

USD |

|

|

|

62.21 |

|

|

|

USD |

|

|

|

120 |

|

|

|

(282 |

) |

| Galp Energia SGPS SA |

|

Goldman Sachs International |

|

|

35,400 |

|

|

|

10/25/23 |

|

|

|

EUR |

|

|

|

14.53 |

|

|

|

EUR |

|

|

|

496 |

|

|

|

(4,982 |

) |

| TC Energy Corp. |

|

Royal Bank of Canada |

|

|

28,300 |

|

|

|

10/25/23 |

|

|

|

CAD |

|

|

|

49.88 |

|

|

|

CAD |

|

|

|

1,322 |

|

|

|

(4,369 |

) |

| Galp Energia SGPS SA |

|

Goldman Sachs International |

|

|

35,400 |

|

|

|

11/07/23 |

|

|

|

EUR |

|

|

|

14.53 |

|

|

|

EUR |

|

|

|

496 |

|

|

|

(7,517 |

) |

| Tenaris SA |

|

Morgan Stanley & Co. International PLC |

|

|

20,200 |

|

|

|

11/14/23 |

|

|

|

EUR |

|

|

|

14.88 |

|

|

|

EUR |

|

|

|

302 |

|

|

|

(14,474 |

) |

| TotalEnergies SE |

|

Morgan Stanley & Co. International PLC |

|

|

125,700 |

|

|

|

11/16/23 |

|

|

|

EUR |

|

|

|

64.19 |

|

|

|

EUR |

|

|

|

7,817 |

|

|

|

(180,144 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(1,020,004 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Hierarchy as of Period End

Various inputs are used in determining the fair value of financial instruments. These inputs to valuation techniques are categorized into a fair value

hierarchy consisting of three broad levels for financial reporting purposes as follows:

| |

• |

|

Level 1 – Unadjusted price quotations in active markets/exchanges for identical assets or liabilities that the

Trust has the ability to access; |

| |

• |

|

Level 2 – Other observable inputs (including, but not limited to, quoted prices for similar assets or

liabilities in markets that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the assets or liabilities (such as interest rates, yield

curves, volatilities, prepayment speeds, loss severities, credit risks and default rates) or other market–corroborated inputs); and |

| |

• |

|

Level 3 – Unobservable inputs based on the best information available in the circumstances, to the extent

observable inputs are not available (including the Valuation Committee’s assumptions used in determining the fair value of financial instruments). |

The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the

lowest priority to unobservable inputs (Level 3 measurements). Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3. The inputs used to measure fair value may fall into

different levels of the fair value hierarchy. In such cases, for disclosure purposes, the fair value hierarchy classification is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

Investments classified within Level 3 have significant unobservable inputs used by the Valuation Committee in determining the price for Fair Valued Investments. Level 3 investments include equity or debt issued by privately held companies

or funds. There may not be a secondary market, and/or there are a limited number of investors. The categorization of a value determined for financial instruments is based on the pricing transparency of the financial instruments and is not

necessarily an indication of the risks associated with investing in those securities. For information about the Trust’s policy regarding valuation of financial instruments, refer to its most recent financial statements.

The following table summarizes the Trust’s financial instruments categorized in the fair value hierarchy. The breakdown of the Trust’s financial

instruments into major categories is disclosed in the Schedule of Investments above.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Level 1 |

|

|

Level 2 |

|

|

Level 3 |

|

|

Total |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Long-Term Investments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Common Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Energy Equipment & Services |

|

$ |

21,695,798 |

|

|

$ |

965,133 |

|

|

$ |

— |

|

|

$ |

22,660,931 |

|

| Food Products |

|

|

1,535,933 |

|

|

|

— |

|

|

|

— |

|

|

|

1,535,933 |

|

| Oil, Gas & Consumable Fuels |

|

|

321,910,963 |

|

|

|

64,364,598 |

|

|

|

91 |

|

|

|

386,275,652 |

|

| Short-Term Securities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Money Market Funds |

|

|

1,671,104 |

|

|

|

— |

|

|

|

— |

|

|

|

1,671,104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

346,813,798 |

|

|

$ |

65,329,731 |

|

|

$ |

91 |

|

|

$ |

412,143,620 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Derivative Financial Instruments(a) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity Contracts |

|

$ |

(2,299,430 |

) |

|

$ |

(1,349,377 |

) |

|

$ |

— |

|

|

$ |

(3,648,807 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(a) |

Derivative financial instruments are options written. Options written are shown at value. |

|

|

|

|

| Schedule of Investments (unaudited) (continued)

September 30, 2023 |

|

BlackRock Energy and Resources Trust (BGR) |

Currency Abbreviation

|

|

|

| CAD |

|

Canadian Dollar |

|

|

| EUR |

|

Euro |

|

|

| GBP |

|

British Pound |

|

|

| USD |

|

United States Dollar |

Portfolio Abbreviation

|

|

|

| ADR |

|

American Depositary Receipt |

|

|

| PJSC |

|

Public Joint Stock Company |

|

|

|

| S C H E D U L E O F I N V E S T M E N T

S |

|

4 |

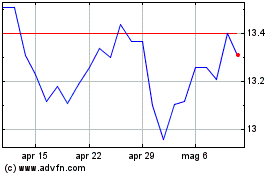

Grafico Azioni BlackRock Energy and Res... (NYSE:BGR)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni BlackRock Energy and Res... (NYSE:BGR)

Storico

Da Mag 2023 a Mag 2024