0001037540false0001043121false00010375402024-01-302024-01-300001037540bxp:BostonPropertiesLimitedPartnershipMember2024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 30, 2024

BOSTON PROPERTIES, INC.

BOSTON PROPERTIES LIMITED PARTNERSHIP

(Exact Name of Registrants As Specified in its Charter)

| | | | | | | | | | | |

| Boston Properties, Inc. | Delaware | 1-13087 | 04-2473675 |

| (State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

| Boston Properties Limited Partnership | Delaware | 0-50209 | 04-3372948 |

| (State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

800 Boylston Street, Suite 1900, Boston, Massachusetts 02199

(Address of Principal Executive Offices) (Zip Code)

(617) 236-3300

(Registrants’ telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrants under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Registrant | | Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Boston Properties, Inc. | | Common Stock, par value $0.01 per share | | BXP | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Boston Properties, Inc.:

Emerging growth company ☐

Boston Properties Limited Partnership:

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Boston Properties, Inc. ☐ Boston Properties Limited Partnership ☐

Item 2.02. Results of Operations and Financial Condition.

The information in this Item 2.02 - “Results of Operations and Financial Condition” is being furnished. Such information, including Exhibits 99.1 and 99.2 hereto, shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Item 2.02, including Exhibits 99.1 and 99.2, shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing.

On January 30, 2024, Boston Properties, Inc. (the “Company”), the general partner of Boston Properties Limited Partnership, issued a press release announcing its financial results for the fourth quarter and full year ended 2023. That press release referred to certain supplemental information that is available on the Company’s website. The text of the supplemental information and the press release are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| *99.1 | | |

| *99.2 | | |

| *101.SCH | | Inline XBRL Taxonomy Extension Schema Document. |

| *101.LAB | | Inline XBRL Taxonomy Extension Label Linkbase Document. |

| *101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document. |

| *101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document. |

| *104 | | Cover Page Interactive Data File (formatted as Inline XBRL with applicable taxonomy extension information contained in Exhibits 101.*). |

______________

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | BOSTON PROPERTIES, INC. | |

| | | |

| By: | /s/ MICHAEL E. LABELLE | |

| | Michael E. LaBelle | |

| | Executive Vice President, Chief Financial Officer | |

| | and Treasurer | |

| | | |

| | | |

| | | |

| | BOSTON PROPERTIES LIMITED PARTNERSHIP | |

| | By: Boston Properties, Inc., its General Partner | |

| | | |

| By: | /s/ MICHAEL E. LABELLE | |

| | Michael E. LaBelle | |

| | Executive Vice President, Chief Financial Officer | |

| | and Treasurer | |

Date: January 30, 2024

Exhibit 99.1

Supplemental Operating and Financial Data

for the Quarter Ended December 31, 2023

THE COMPANY

Boston Properties, Inc. (NYSE: BXP) (“BXP” or the “Company”) is the largest publicly traded developer, owner, and manager of premier workplaces in the United States, concentrated in six dynamic gateway markets - Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC. BXP has delivered places that power progress for our clients and communities for more than 50 years. BXP is a fully integrated real estate company, organized as a real estate investment trust (REIT). Including properties owned by joint ventures, BXP’s portfolio totals 53.3 million square feet and 188 properties, including 10 properties under construction/redevelopment. BXP’s properties include 167 office properties, 14 retail properties (including two retail properties under construction/redevelopment), six residential properties (including one residential property under construction) and one hotel. BXP is well-known for its in-house building management expertise and responsiveness to clients’ needs. BXP holds a superior track record of developing premium Central Business District (CBD) office buildings, successful mixed-use complexes, suburban office centers and build-to-suit projects for a diverse array of creditworthy clients. BXP actively works to promote its growth and operations in a sustainable and responsible manner. BXP has earned a twelfth consecutive GRESB “Green Star” recognition and the highest GRESB 5-star Rating. BXP, an S&P 500 company, was founded in 1970 by Mortimer B. Zuckerman and Edward H. Linde and became a public company in 1997.

FORWARD-LOOKING STATEMENTS

This Supplemental package contains “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. You can identify these statements by our use of the words “anticipates,” “believes,” “budgeted,” “could,” “estimates,” “expects,” “guidance,” “intends,” “may,” “might,” “plans,” “projects,” “should,” “will,” and similar expressions that do not relate to historical matters. These statements are based on our current plans, expectations, projections and assumptions about future events. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties and other factors which are, in some cases, beyond BXP’s control. If our underlying assumptions prove inaccurate, or known or unknown risks or uncertainties materialize, actual results could differ materially from those expressed or implied by the forward-looking statements. These factors include, without limitation, the risks and uncertainties related to the impact of changes in general economic and capital market conditions, including continued inflation, increased interest rates, supply chain disruptions, labor market disruptions, dislocation and volatility in capital markets, potential longer-term changes in consumer and client behavior resulting from the severity and duration of any downturn in the U.S. or global economy, general risks affecting the real estate industry (including, without limitation, the inability to enter into or renew leases on favorable terms, changes in client preferences and space utilization, dependence on clients’ financial condition, and competition from other developers, owners and operators of real estate), the impact of geopolitical conflicts, the immediate and long-term impact of the outbreak of a highly infectious or contagious disease on our and our clients’ financial condition, results of operations and cash flows (including the impact of actions taken to contain the outbreak or mitigate its impact, the direct and indirect economic effects of the outbreak and containment measures on our clients, and the ability of our clients to successfully operate their businesses), the uncertainties of investing in new markets, the costs and availability of financing, the effectiveness of our interest rate hedging contracts, the ability of our joint venture partners to satisfy their obligations, the effects of local, national and international economic and market conditions, the effects of acquisitions, dispositions and possible impairment charges on our operating results, the impact of newly adopted accounting principles on the Company’s accounting policies and on period-to-period comparisons of financial results, the uncertainties of costs to comply with regulatory changes (including potential costs to comply with the Securities and Exchange Commission’s proposed rules to standardize climate-related disclosures) and other risks and uncertainties detailed from time to time in the Company’s filings with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of issuance of this report and are not guarantees of future results, performance or achievements. BXP does not undertake a duty to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as otherwise required by law.

NON-GAAP FINANCIAL MEASURES

This Supplemental package includes non-GAAP financial measures, which are accompanied by what the Company considers the most directly comparable financial measures calculated and presented in accordance with GAAP. Quantitative reconciliations of the differences between the most directly comparable GAAP financial measures and the non-GAAP financial measures presented are provided within this Supplemental package. Definitions of these non-GAAP financial measures and statements of the reasons why management believes the non-GAAP measures provide useful information to investors about the Company’s financial condition and results of operations, and, if applicable, the other purposes for which management uses the measures, can be found in the Definitions section of this Supplemental starting on page 56.

The Company also presents “BXP’s Share” of certain of these measures, which are non-GAAP financial measures that are calculated as the consolidated amount calculated in accordance with GAAP, plus the Company’s share of the amount from the Company’s unconsolidated joint ventures (calculated based upon the Company’s percentage ownership interest and, in some cases, after priority allocations), minus the Company’s partners’ share of the amount from the Company’s consolidated joint ventures (calculated based upon the partners’ percentage ownership interests and, in some cases, after income allocation to private REIT shareholders and their share of fees due to the Company). Management believes that presenting “BXP’s Share” of these measures provides useful information to investors regarding the Company’s financial condition and/or results of operations because the Company has several significant joint ventures and, in some cases, the Company exercises significant influence over, but does not control, the joint venture, in which case GAAP requires that the Company account for the joint venture entity using the equity method of accounting and the Company does not consolidate it for financial reporting purposes. In other cases, GAAP requires that the Company consolidate the venture even though the Company’s partner(s) owns a significant percentage interest. As a result, management believes that presenting BXP’s Share of various financial measures in this manner can help investors better understand the Company’s financial condition and/or results of operations after taking into account its true economic interest in these joint ventures. The Company cautions investors that the ownership percentages used in calculating “BXP’s Share” of these measures may not completely and accurately depict all of the legal and economic implications of holding an interest in a consolidated or unconsolidated joint venture. For example, in addition to partners’ interests in profits and capital, venture agreements vary in the allocation of rights regarding decision making (both routine and major decisions), distributions, transferability of interests, financings and guarantees, liquidations and other matters. As a result, presentations of “BXP’s Share” of a financial measure should not be considered a substitute for, and should only be considered together with and as a supplement to, the Company’s financial information presented in accordance with GAAP. Unless noted otherwise, reconciliations of “BXP’s Share” of these financial measures can be found in the Reconciliations section of this Supplemental package starting on page 60.

GENERAL INFORMATION

| | | | | | | | | | | |

| Corporate Headquarters | Trading Symbol | Investor Relations | Inquiries |

| 800 Boylston Street | BXP | BXP | Inquiries should be directed to |

| Suite 1900 | | 800 Boylston Street, Suite 1900 | Helen Han |

| Boston, MA 02199 | Stock Exchange Listing | Boston, MA 02199 | Vice President, Investor Relations |

| www.bxp.com | New York Stock Exchange | investors.bxp.com | at 617.236.3429 or |

| (t) 617.236.3300 | | investorrelations@bxp.com | hhan@bxp.com |

| | (t) 617.236.3429 | |

| | | Michael E. LaBelle |

| | | Executive Vice President, Chief Financial Officer |

| | | at 617.236.3352 or |

| | | mlabelle@bxp.com |

(Cover photos left to right: Renderings of 290 and 300 Binney Street, Cambridge, MA)

| | | | | |

| Page |

| OVERVIEW | |

| Company Profile | |

| Guidance and assumptions | |

| |

| FINANCIAL INFORMATION | |

| Financial Highlights | |

| Consolidated Balance Sheets | |

| Consolidated Income Statements | |

| Funds From Operations (FFO) | |

| Funds Available for Distribution (FAD) | |

| Net Operating Income (NOI) | |

| Same Property Net Operating Income (NOI) by Reportable Segment | |

| Capital Expenditures, Tenant Improvement Costs and Leasing Commissions | |

| Acquisitions and Dispositions | |

| |

| DEVELOPMENT ACTIVITY | |

| Construction in Progress | |

| Land Parcels and Purchase Options | |

| |

| LEASING ACTIVITY | |

| Leasing Activity | |

| |

| PROPERTY STATISTICS |

|

| Portfolio Overview | |

| Residential and Hotel Performance | |

| In-Service Property Listing | |

| Top 20 Clients Listing and Portfolio Client Diversification | |

| Occupancy by Location | |

| |

| DEBT AND CAPITALIZATION | |

| Capital Structure | |

| Debt Analysis | |

| Senior Unsecured Debt Covenant Compliance Ratios | |

Net Debt to EBITDAre | |

| Debt Ratios | |

| |

| JOINT VENTURES | |

| Consolidated Joint Ventures | |

| Unconsolidated Joint Ventures | |

| |

| LEASE EXPIRATION ROLL-OUT | |

| Total In-Service Properties | |

| Boston | |

| Los Angeles | |

| New York | |

| San Francisco | |

| Seattle | |

| Washington, DC | |

| CBD | |

| Suburban | |

| |

| RESEARCH COVERAGE, DEFINITIONS AND RECONCILIATIONS | |

| Research Coverage | |

| Definitions | |

| Reconciliations | |

| Consolidated Income Statement - Prior Year | |

| |

SNAPSHOT

(as of December 31, 2023)

| | | | | |

| Fiscal Year-End | December 31 |

| Total Properties (includes unconsolidated joint ventures and properties under development/redevelopment) | 188 |

| Total Square Feet (includes unconsolidated joint ventures and properties under development/redevelopment) | 53.3 million |

Common shares outstanding, plus common units and LTIP units (other than unearned Multi-Year Long-Term Incentive Program (MYLTIP) Units) on an as-converted basis 1, 2 | 175.5 million |

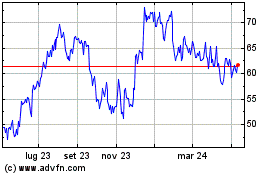

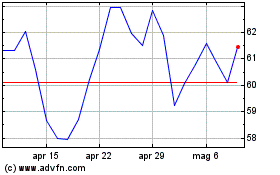

| Closing Price, at the end of the quarter | $70.17 per share |

| Dividend - Quarter/Annualized | $0.98/$3.92 per share |

| Dividend Yield | 5.6% |

Consolidated Market Capitalization 2 | $28.2 billion |

BXP’s Share of Market Capitalization 2, 3 | $28.2 billion |

Unsecured Senior Debt Ratings 4 | BBB+ (S&P); Baa2 (Moody’s) |

STRATEGY

BXP’s primary business objective is to maximize return on investment in an effort to provide its investors with the greatest possible total return in all points of the economic cycle. To achieve this objective, the key tenets of our business strategy are to:

•continue to embrace our leadership position in the premier workplace segment and leverage our strength in portfolio quality, client relationships, development skills, market penetration, and sustainability to profitably build market share;

•maintain a keen focus on select dynamic gateway markets that exhibit the strongest economic growth and investment characteristics over time - currently Boston, Los Angeles, New York, San Francisco, Seattle, and Washington, DC;

•invest in the highest quality buildings (primarily premier workplaces) with unique amenities and desirable locations that are able to maintain high occupancy rates and achieve premium rental rates through economic cycles;

•maintain scale and a full-service real estate capability (leasing, development, construction, marketing, legal, and property management) in our markets to ensure we (1) see all relevant investment deal flow, (2) maintain an ability to execute on all types of real estate opportunities, such as acquisitions, dispositions, repositioning and development, throughout the real estate investment cycle, (3) provide superior service to our clients and (4) develop and manage our assets in the most sustainable manner possible;

•pursue attractive asset class adjacencies where we have a track record of success, such as life sciences and residential development;

•maintain a leadership position in sustainability innovation to minimize emissions from BXP’s development and in-service portfolio, as well as to provide clients sustainable solutions for their space use needs;

•ensure a strong balance sheet to maintain consistent access to capital and the ability to make new investments at opportune times; and

•foster a culture and reputation of integrity, excellence and purposefulness, making us the employer of choice for talented real estate professionals, the landlord and developer of choice for our clients, as well as the counterparty of choice for real estate industry participants.

MANAGEMENT

| | | | | | | | | | | | | | |

| Board of Directors | | |

| Owen D. Thomas | Chairman of the Board | | Owen D. Thomas | Chief Executive Officer |

| Douglas T. Linde | | | Douglas T. Linde | President |

| Joel I. Klein | Lead Independent Director | | Raymond A. Ritchey | Senior Executive Vice President |

| Kelly A. Ayotte | | | Michael E. LaBelle | Executive Vice President, Chief Financial Officer and Treasurer |

| Bruce W. Duncan | Chair of Compensation Committee | | Donna D. Garesche | Executive Vice President, Chief Human Resources Officer |

| Carol B. Einiger | | | Bryan J. Koop | Executive Vice President, Boston Region |

| Diane J. Hoskins | Chair of Sustainability Committee | | Robert E. Pester | Executive Vice President, San Francisco Region |

| Mary E. Kipp | Chair of Audit Committee | | Hilary Spann | Executive Vice President, New York Region |

| Matthew J. Lustig | Chair of Nominating & Corporate | | Peter V. Otteni | Executive Vice President, Co-Head of the Washington, DC |

| Governance Committee | | | Region |

| William H. Walton, III | | | John J. Stroman | Executive Vice President, Co-Head of the Washington, DC |

| Derek A. (Tony) West | | | | Region |

| | | Rodney C. Diehl | Senior Vice President, Co-Head of the West Coast Regions |

| | | Eric G. Kevorkian | Senior Vice President, Chief Legal Officer and Secretary |

| | | Michael R. Walsh | Senior Vice President, Chief Accounting Officer |

| | | James J. Whalen | Senior Vice President, Chief Information & Technology Officer |

___________________

1Common units and LTIP units are units of limited partnership interest in Boston Properties Limited Partnership, the entity through which the Company conducts substantially all of its business.

2For additional detail, see page 27. 3For the Company’s definitions and related disclosures, see the Definitions and Reconciliations sections of this Supplemental package starting on page 56. 4In January 2024, the Company’s S&P credit rating was downgraded to BBB.

| | | | | |

| Q4 2023 |

| Guidance and assumptions |

GUIDANCE

BXP’s guidance for the first quarter 2024 and full year 2024 for diluted earnings per common share attributable to Boston Properties, Inc. (EPS) and diluted funds from operations (FFO) per common share attributable to Boston Properties, Inc. is set forth and reconciled below. Except as described below, the estimates reflect management’s view of current and future market conditions, including assumptions with respect to rental rates, occupancy levels, interest rates, the timing of the lease-up of available space, the timing of development cost outlays and development deliveries, and the earnings impact of the events referenced in the Company’s earnings release issued on January 30, 2024 and those referenced during the related conference call. The estimates do not include (1) possible future gains or losses or the impact on operating results from other possible future property acquisitions or dispositions, (2) the impacts of any other capital markets activity, (3) future write-offs or reinstatements of accounts receivable and accrued rent balances, or (4) future impairment charges. EPS estimates may be subject to fluctuations as a result of several factors, including changes in the recognition of depreciation and amortization expense, impairment losses on depreciable real estate, and any gains or losses associated with disposition activity. BXP is not able to assess at this time the potential impact of these factors on projected EPS. By definition, FFO does not include real estate-related depreciation and amortization, impairment losses on depreciable real estate, or gains or losses associated with disposition activities. For a complete definition of FFO and statements of the reasons why management believes it provides useful information to investors, see page 58. There can be no assurance that BXP’s actual results will not differ materially from the estimates set forth below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | First Quarter 2024 | | Full Year 2024 |

| | | | Low | | High | | Low | | High |

| Projected EPS (diluted) | | $ | 0.66 | | | $ | 0.68 | | | $ | 2.26 | | | $ | 2.46 | |

| Add: | | | | | | | | | |

| | Projected Company share of real estate depreciation and amortization 1 | | 1.20 | | | 1.20 | | | 4.88 | | | 4.88 | |

| | | | | | | | | | |

| | Projected Company share of (gains)/losses on sales of real estate, gain on investment from unconsolidated joint venture and impairments | | (0.14) | | | (0.14) | | | (0.14) | | | (0.14) | |

| Projected FFO per share (diluted) | | $ | 1.72 | | | $ | 1.74 | | | $ | 7.00 | | | $ | 7.20 | |

ASSUMPTIONS

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | |

| | | | | Full Year 2024 |

| | | | | | | Low | | High |

| Operating property activity: | | | | | | | | |

| Average In-service portfolio occupancy | | | | | | 87.20 | % | | 88.60 | % |

| Decrease in BXP’s Share of Same Property net operating income (excluding termination income) | | | | | | (3.00) | % | | (1.00) | % |

| Decrease in BXP’s Share of Same Property net operating income - cash (excluding termination income) | | | | | | (3.00) | % | | (1.00) | % |

| BXP’s Share of Non Same Properties’ incremental contribution to net operating income over prior year (excluding asset sales) | | | | | | $ | 75,000 | | | $ | 82,000 | |

| BXP’s Share of incremental net operating income related to asset sales over prior year | | | | | | $ | (6,000) | | | $ | (6,000) | |

| BXP’s Share of straight-line rent and fair value lease revenue (non-cash revenue) | | | | | | $ | 110,000 | | | $ | 125,000 | |

| Termination income | | | | | | $ | 5,000 | | | $ | 8,000 | |

| | | | | | | | | |

| Other revenue (expense): | | | | | | | | |

| Development, management services and other revenue | | | | | | $ | 25,000 | | | $ | 28,000 | |

| General and administrative expense 2 | | | | | | $ | (163,000) | | | $ | (159,000) | |

| Consolidated net interest expense | | | | | | $ | (590,000) | | | $ | (570,000) | |

| Unconsolidated joint venture interest expense | | | | | | $ | (78,000) | | | $ | (72,000) | |

| | | | | | | | | |

| Noncontrolling interest: | | | | | | | | |

| Noncontrolling interest in property partnerships’ share of FFO | | | | | | $ | (148,000) | | | $ | (138,000) | |

_______________

1 Excludes estimated non-real estate related amortization of $0.01 and $0.05 per share for First Quarter 2024 and Full Year 2024 respectively.

2 Excludes estimated changes in the market value of the Company’s deferred compensation plan and gains (losses) from investments in securities.

| | | | | |

| Q4 2023 |

| Financial highlights |

(unaudited and in thousands, except ratios and per share amounts)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 30-Sep-23 |

| Net income (loss) attributable to Boston Properties, Inc. | | $ | 119,925 | | | $ | (111,826) | |

| Net income (loss) attributable to Boston Properties, Inc. per share - diluted | | $ | 0.76 | | | $ | (0.71) | |

FFO attributable to Boston Properties, Inc. 1 | | $ | 286,203 | | | $ | 292,822 | |

Diluted FFO per share 1 | | $ | 1.82 | | | $ | 1.86 | |

| Dividends per common share | | $ | 0.98 | | | $ | 0.98 | |

Funds available for distribution to common shareholders and common unitholders (FAD) 2 | | $ | 224,423 | | | $ | 210,044 | |

| | | | |

| Selected items: | | | | |

| Revenue | | $ | 828,933 | | | $ | 824,283 | |

| Recoveries from clients | | $ | 130,296 | | | $ | 134,599 | |

| Service income from clients | | $ | 2,175 | | | $ | 2,870 | |

BXP’s Share of revenue 3 | | $ | 811,157 | | | $ | 808,803 | |

BXP’s Share of straight-line rent 3 | | $ | 28,765 | | | $ | 16,647 | |

BXP’s Share of fair value lease revenue 3, 4 | | $ | 3,441 | | | $ | 3,907 | |

BXP’s Share of termination income 3 | | $ | 10,350 | | | $ | 2,935 | |

| | | | |

| Ground rent expense | | $ | 3,611 | | | $ | 3,589 | |

| Capitalized interest | | $ | 9,207 | | | $ | 9,676 | |

| Capitalized wages | | $ | 2,588 | | | $ | 4,416 | |

Income (loss) from unconsolidated joint ventures 5 | | $ | 22,250 | | | $ | (247,556) | |

BXP’s share of FFO from unconsolidated joint ventures 6 | | $ | 16,602 | | | $ | 14,957 | |

| Net income attributable to noncontrolling interests in property partnerships | | $ | 19,324 | | | $ | 20,909 | |

FFO attributable to noncontrolling interests in property partnerships 7 | | $ | 38,608 | | | $ | 39,083 | |

| | | | |

| Balance Sheet items: | | | | |

| Above-market rents (included within Prepaid Expenses and Other Assets) | | $ | 9,412 | | | $ | 3,196 | |

| Below-market rents (included within Other Liabilities) | | $ | 36,533 | | | $ | 38,049 | |

| Accrued rental income liability (included within Other Liabilities) | | $ | 103,530 | | | $ | 107,462 | |

| | | | |

| Ratios: | | | | |

Interest Coverage Ratio (excluding capitalized interest) 8 | | 2.90 | | | 3.00 | |

Interest Coverage Ratio (including capitalized interest) 8 | | 2.70 | | | 2.79 | |

Fixed Charge Coverage Ratio 8 | | 2.46 | | | 2.53 | |

BXP’s Share of Net Debt to BXP’s Share of EBITDAre (Annualized) 9 | | 7.37 | | | 7.28 | |

Change in BXP’s Share of Same Property Net Operating Income (NOI) (excluding termination income) 10 | | (1.5) | % | | (0.3) | % |

Change in BXP’s Share of Same Property NOI (excluding termination income) - cash 10 | | (1.0) | % | | 1.7 | % |

FAD Payout Ratio 2 | | 76.68 | % | | 81.94 | % |

| Operating Margins [(rental revenue - rental expense)/rental revenue] | | 62.3 | % | | 62.4 | % |

Occupancy % of In-Service Properties 11 | | 88.4 | % | | 88.8 | % |

Leased % of In-Service Properties 12 | | 89.9 | % | | 90.4 | % |

| | | | |

| Capitalization: | | | | |

| Consolidated Debt | | $ | 15,856,297 | | | $ | 14,961,715 | |

BXP’s Share of Debt 13 | | $ | 15,917,577 | | | $ | 15,120,033 | |

| Consolidated Market Capitalization | | $ | 28,172,185 | | | $ | 25,401,704 | |

| Consolidated Debt/Consolidated Market Capitalization | | 56.28 | % | | 58.90 | % |

BXP’s Share of Market Capitalization 13 | | $ | 28,233,465 | | | $ | 25,560,022 | |

BXP’s Share of Debt/BXP’s Share of Market Capitalization 13 | | 56.38 | % | | 59.16 | % |

_____________

1For a quantitative reconciliation of FFO attributable to Boston Properties, Inc. and Diluted FFO per share, see page 7. 2For a quantitative reconciliation of FAD, see page 8. FAD Payout Ratio equals distributions to common shareholders and unitholders (excluding any special distributions) divided by FAD. 3See the Definitions and Reconciliations sections of this Supplemental package starting on page 56. 4Represents the net adjustment for above- and below-market leases that are amortized over the terms of the respective leases in place at the property acquisition dates.

5For the three months ended December 31, 2023, includes an approximately $29.9 million gain on the consolidation of Santa Monica Business Park, see page 37. For the three months ended September 30, 2023, includes an impairment charge totaling approximately $272.6 million related to the Company’s investment in four unconsolidated joint ventures, partially offset by a gain of approximately $35.8 million related to the Company’s investment in Metropolitan Square. 6For a quantitative reconciliation for the three months ended December 31, 2023, see page 37. 7For a quantitative reconciliation for the three months ended December 31, 2023, see page 34.

| | | | | |

| Q4 2023 |

| Financial highlights (continued) |

8For a quantitative reconciliation for the three months ended December 31, 2023 and September 30, 2023, see page 32. 9For a quantitative reconciliation for the three months ended December 31, 2023 and September 30, 2023, see page 31. 10For a quantitative reconciliation for the three months ended December 31, 2023 and September 30, 2023, see pages 11, 66 and 67. 11Represents signed leases for which revenue recognition has commenced in accordance with GAAP. Excludes hotel and residential properties.

12Represents signed leases for which revenue recognition has commenced in accordance with GAAP and signed leases for vacant space with future commencement dates. Excludes hotel and residential properties.

13For a quantitative reconciliation for December 31, 2023, see page 27.

| | | | | |

| Q4 2023 |

Consolidated Balance Sheets

|

(unaudited and in thousands)

| | | | | | | | | | | | | | |

| | 31-Dec-23 | | 30-Sep-23 |

| ASSETS | | | | |

| Real estate | | $ | 25,504,868 | | | $ | 24,809,369 | |

| Construction in progress | | 547,280 | | | 551,330 | |

| Land held for future development | | 697,061 | | | 670,691 | |

Right of use assets - finance leases 1 | | 401,680 | | | 237,532 | |

| Right of use assets - operating leases | | 324,298 | | | 322,790 | |

| Less accumulated depreciation | | (6,881,728) | | | (6,723,616) | |

| Total real estate | | 20,593,459 | | | 19,868,096 | |

| Cash and cash equivalents | | 1,531,477 | | | 882,647 | |

| Cash held in escrows | | 81,090 | | | 47,741 | |

| Investments in securities | | 36,337 | | | 32,809 | |

| Tenant and other receivables, net | | 122,407 | | | 123,138 | |

| Note receivable, net | | 1,714 | | | — | |

| Related party note receivable, net | | 88,779 | | | 88,807 | |

| Sales-type lease receivable, net | | 13,704 | | | 13,475 | |

| Accrued rental income, net | | 1,355,212 | | | 1,331,796 | |

| Deferred charges, net | | 760,421 | | | 692,386 | |

| Prepaid expenses and other assets | | 64,230 | | | 121,431 | |

| Investments in unconsolidated joint ventures | | 1,377,319 | | | 1,536,822 | |

| Total assets | | $ | 26,026,149 | | | $ | 24,739,148 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Liabilities: | | | | |

| Mortgage notes payable, net | | $ | 4,166,379 | | | $ | 3,275,974 | |

| Unsecured senior notes, net | | 10,491,617 | | | 10,488,568 | |

| Unsecured line of credit | | — | | | — | |

| Unsecured term loan, net | | 1,198,301 | | | 1,197,173 | |

Lease liabilities - finance leases 1 | | 417,961 | | | 253,178 | |

| Lease liabilities - operating leases | | 350,391 | | | 341,299 | |

| Accounts payable and accrued expenses | | 458,329 | | | 462,240 | |

| Dividends and distributions payable | | 171,176 | | | 171,916 | |

| Accrued interest payable | | 133,684 | | | 128,422 | |

Other liabilities 1 | | 445,947 | | | 380,014 | |

| Total liabilities | | 17,833,785 | | | 16,698,784 | |

| | | | |

| Commitments and contingencies | | — | | | — | |

| Redeemable deferred stock units | | 8,383 | | | 6,788 | |

| | | | |

| Equity: | | | | |

| Stockholders’ equity attributable to Boston Properties, Inc.: | | | | |

| Excess stock, $0.01 par value, 150,000,000 shares authorized, none issued or outstanding | | — | | | — | |

Common stock, $0.01 par value, 250,000,000 shares authorized, 157,019,766 and 157,018,080 issued and 156,940,866 and 156,939,180 outstanding at December 31, 2023 and September 30, 2023, respectively | | 1,569 | | | 1,569 | |

| Additional paid-in capital | | 6,715,149 | | | 6,568,645 | |

| Dividends in excess of earnings | | (816,152) | | | (782,275) | |

Treasury common stock at cost, 78,900 shares at December 31, 2023 and September 30, 2023 | | (2,722) | | | (2,722) | |

| Accumulated other comprehensive income (loss) | | (21,147) | | | 2,866 | |

| Total stockholders’ equity attributable to Boston Properties, Inc. | | 5,876,697 | | | 5,788,083 | |

| | | | |

| Noncontrolling interests: | | | | |

| Common units of the Operating Partnership | | 666,580 | | | 656,587 | |

| Property partnerships | | 1,640,704 | | | 1,588,906 | |

| Total equity | | 8,183,981 | | | 8,033,576 | |

| Total liabilities and equity | | $ | 26,026,149 | | | $ | 24,739,148 | |

____________

1On December 14, 2023, the Company acquired and consolidated it’s partner’s 45% interest in Santa Monica Business Park and consolidated the Company's investment in the asset. As a result, the Company recorded approximately $164.1 million and $163.1 million of Right of Use Assets – Finance Leases and Lease Liabilities – Finance Leases, respectively, related to the ground lease at Santa Monica Business Park. In accordance with Accounting Standards Codification 805 “Business Combinations”, the Company was required to fair value the ground lease. The fair value adjustment of approximately $46.1 million has been recorded within “Other Liabilities”. For additional details, see page 13.

| | | | | |

| Q4 2023 |

| Consolidated Income Statements |

(unaudited and in thousands, except per share amounts)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 30-Sep-23 |

| Revenue | | | | |

| Lease | | $ | 768,884 | | | $ | 767,181 | |

| Parking and other | | 30,676 | | | 29,649 | |

| Insurance proceeds | | 821 | | | 779 | |

| Hotel revenue | | 11,803 | | | 13,484 | |

| Development and management services | | 12,728 | | | 9,284 | |

| Direct reimbursements of payroll and related costs from management services contracts | | 4,021 | | | 3,906 | |

| Total revenue | | 828,933 | | | 824,283 | |

| Expenses | | | | |

| Operating | | 160,360 | | | 159,304 | |

| Real estate taxes | | 140,477 | | | 140,368 | |

| | | | |

| Restoration expenses related to insurance claims | | 574 | | | 520 | |

| Hotel operating | | 8,373 | | | 9,020 | |

General and administrative 1 | | 38,771 | | | 31,410 | |

| Payroll and related costs from management services contracts | | 4,021 | | | 3,906 | |

| Transaction costs | | 2,343 | | | 751 | |

| Depreciation and amortization | | 212,067 | | | 207,435 | |

| Total expenses | | 566,986 | | | 552,714 | |

| Other income (expense) | | | | |

Income (loss) from unconsolidated joint ventures 2 | | 22,250 | | | (247,556) | |

| Gains on sales of real estate | | — | | | 517 | |

| | | | |

Gains (losses) from investments in securities 1 | | 3,245 | | | (925) | |

| Losses from interest rate contracts | | (79) | | | — | |

| Unrealized loss on non-real estate investment | | (93) | | | (51) | |

| Interest and other income (loss) | | 20,965 | | | 20,715 | |

| | | | |

| Interest expense | | (155,080) | | | (147,812) | |

| Net income (loss) | | 153,155 | | | (103,543) | |

| Net (income) loss attributable to noncontrolling interests | | | | |

| Noncontrolling interest in property partnerships | | (19,324) | | | (20,909) | |

Noncontrolling interest - common units of the Operating Partnership 3 | | (13,906) | | | 12,626 | |

| Net income (loss) attributable to Boston Properties, Inc. | | $ | 119,925 | | | $ | (111,826) | |

| | | | |

| | | | |

| INCOME PER SHARE OF COMMON STOCK (EPS) | | | | |

| | | | |

| Net income (loss) attributable to Boston Properties, Inc. per share - basic | | $ | 0.76 | | | $ | (0.71) | |

| Net income (loss) attributable to Boston Properties, Inc. per share - diluted | | $ | 0.76 | | | $ | (0.71) | |

_____________

1Includes $3.2 million and $(0.9) million for the three months ended December 31, 2023 and September 30, 2023, respectively, related to the Company’s deferred compensation plan.

2For the three months ended December 31, 2023, includes an approximately $29.9 million gain on the consolidation of Santa Monica Business Park, see page 37. For the three months ended September 30, 2023, includes an impairment charge totaling approximately $272.6 million related to the Company’s investment in four unconsolidated joint ventures, partially offset by a gain of approximately $35.8 million related to the Company’s investment in Metropolitan Square. 3For additional detail, see page 7.

| | | | | |

| Q4 2023 |

Funds from operations (FFO) 1 |

(unaudited and dollars in thousands, except per share amounts)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 30-Sep-23 |

| Net income (loss) attributable to Boston Properties, Inc. | | $ | 119,925 | | | $ | (111,826) | |

| Add: | | | | |

| Noncontrolling interest - common units of the Operating Partnership | | 13,906 | | | (12,626) | |

| Noncontrolling interests in property partnerships | | 19,324 | | | 20,909 | |

| Net income (loss) | | 153,155 | | | (103,543) | |

| Add: | | | | |

| Depreciation and amortization expense | | 212,067 | | | 207,435 | |

Noncontrolling interests in property partnerships' share of depreciation and amortization 2 | | (19,284) | | | (18,174) | |

BXP's share of depreciation and amortization from unconsolidated joint ventures 3 | | 24,132 | | | 25,666 | |

| Corporate-related depreciation and amortization | | (453) | | | (446) | |

| Non-real estate related amortization | | (1,681) | | | — | |

| Impairment losses included within income (loss) from unconsolidated joint ventures | | — | | | 272,603 | |

| Less: | | | | |

| Gains on sales of real estate | | — | | | 517 | |

| | | | |

| Gain on investment included within income (loss) from unconsolidated joint ventures | | — | | | 35,756 | |

Gain on sale / consolidation included within income (loss) from unconsolidated joint ventures 3 | | 28,412 | | | — | |

Gain on sales-type lease included within income (loss) from unconsolidated joint ventures 3 | | 1,368 | | | — | |

| Unrealized loss on non-real estate investment | | (93) | | | (51) | |

| Noncontrolling interests in property partnerships | | 19,324 | | | 20,909 | |

| FFO attributable to the Operating Partnership (including Boston Properties, Inc.) (Basic FFO) | | 318,925 | | | 326,410 | |

| Less: | | | | |

| Noncontrolling interest - common units of the Operating Partnership’s share of FFO | | 32,722 | | | 33,588 | |

| FFO attributable to Boston Properties, Inc. | | $ | 286,203 | | | $ | 292,822 | |

| | | | |

| Boston Properties, Inc.’s percentage share of Basic FFO | | 89.74 | % | | 89.71 | % |

| Noncontrolling interest’s - common unitholders percentage share of Basic FFO | | 10.26 | % | | 10.29 | % |

| Basic FFO per share | | $ | 1.82 | | | $ | 1.87 | |

| Weighted average shares outstanding - basic | | 156,945 | | | 156,880 | |

| Diluted FFO per share | | $ | 1.82 | | | $ | 1.86 | |

| Weighted average shares outstanding - diluted | | 157,276 | | | 157,269 | |

RECONCILIATION TO DILUTED FFO

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 30-Sep-23 |

| Basic FFO | | $ | 318,925 | | | $ | 326,410 | |

| Add: | | | | |

| Effect of dilutive securities - stock-based compensation | | — | | | — | |

| Diluted FFO | | 318,925 | | | 326,410 | |

| Less: | | | | |

| Noncontrolling interest - common units of the Operating Partnership’s share of diluted FFO | | 32,658 | | | 33,522 | |

| Boston Properties, Inc.’s share of Diluted FFO | | $ | 286,267 | | | $ | 292,888 | |

RECONCILIATION OF SHARES/UNITS FOR DILUTED FFO

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 30-Sep-23 |

| Shares/units for Basic FFO | | 174,894 | | | 174,882 | |

| Add: | | | | |

| Effect of dilutive securities - stock-based compensation (shares/units) | | 331 | | | 389 | |

| Shares/units for Diluted FFO | | 175,225 | | | 175,271 | |

| Less: | | | | |

| Noncontrolling interest - common units of the Operating Partnership’s share of Diluted FFO (shares/units) | | 17,949 | | | 18,002 | |

| Boston Properties, Inc.’s share of shares/units for Diluted FFO | | 157,276 | | | 157,269 | |

| | | | |

| Boston Properties, Inc.’s percentage share of Diluted FFO | | 89.76 | % | | 89.73 | % |

_____________

1See the Definitions and Reconciliations sections of this Supplemental package starting on page 56. 2For a quantitative reconciliation for the three months ended December 31, 2023, see page 34. 3For a quantitative reconciliation for the three months ended December 31, 2023, see page 37.

| | | | | |

| Q4 2023 |

Funds available for distributions (FAD) 1 |

(dollars in thousands)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 30-Sep-23 |

| Net income (loss) attributable to Boston Properties, Inc. | | $ | 119,925 | | | $ | (111,826) | |

| Add: | | | | |

| Noncontrolling interest - common units of the Operating Partnership | | 13,906 | | | (12,626) | |

| Noncontrolling interests in property partnerships | | 19,324 | | | 20,909 | |

| Net income (loss) | | 153,155 | | | (103,543) | |

| Add: | | | | |

| Depreciation and amortization expense | | 212,067 | | | 207,435 | |

Noncontrolling interests in property partnerships’ share of depreciation and amortization 2 | | (19,284) | | | (18,174) | |

BXP’s share of depreciation and amortization from unconsolidated joint ventures 3 | | 24,132 | | | 25,666 | |

| Corporate-related depreciation and amortization | | (453) | | | (446) | |

| Non-real estate related amortization | | (1,681) | | | — | |

| Impairment losses included within loss from unconsolidated joint ventures | | — | | | 272,603 | |

| Less: | | | | |

| Gains on sales of real estate | | — | | | 517 | |

| | | | |

| Gain on investment included within loss from unconsolidated joint ventures | | — | | | 35,756 | |

Gain on sale / consolidation included within income (loss) from unconsolidated joint ventures 3 | | 28,412 | | | — | |

Gain on sales-type lease included within income (loss) from unconsolidated joint ventures 3 | | 1,368 | | | — | |

| Unrealized loss on non-real estate investment | | (93) | | | (51) | |

| Noncontrolling interests in property partnerships | | 19,324 | | | 20,909 | |

| Basic FFO | | 318,925 | | | 326,410 | |

| Add: | | | | |

BXP’s Share of lease transaction costs that qualify as rent inducements 1, 4 | | 1,314 | | | (5,963) | |

BXP’s Share of hedge amortization, net of costs 1 | | 2,030 | | | (473) | |

BXP’s share of fair value interest adjustment 1 | | 639 | | | 499 | |

BXP’s Share of straight-line ground rent expense adjustment 1, 5 | | 174 | | | 854 | |

| Stock-based compensation | | 4,469 | | | 4,843 | |

| Non-real estate depreciation and amortization | | 2,134 | | | 446 | |

Unearned portion of capitalized fees from consolidated joint ventures 6 | | 561 | | | 1,283 | |

| | | | |

| Less: | | | | |

BXP’s Share of straight-line rent 1 | | 28,765 | | | 16,647 | |

BXP’s Share of fair value lease revenue 1, 7 | | 3,441 | | | 3,907 | |

| | | | |

BXP’s Share of 2nd generation tenant improvements and leasing commissions 1 | | 53,709 | | | 79,932 | |

BXP’s Share of maintenance capital expenditures 1, 8 | | 16,165 | | | 16,995 | |

BXP’s Share of amortization and accretion related to sales type lease 1 | | 256 | | | 233 | |

| Hotel improvements, equipment upgrades and replacements | | 358 | | | 141 | |

Funds available for distribution to common shareholders and common unitholders (FAD) (A) | | $ | 224,423 | | | $ | 210,044 | |

| | | | |

Distributions to common shareholders and unitholders (excluding any special distributions) (B) | | $ | 172,095 | | | $ | 172,101 | |

| | | | |

FAD Payout Ratio1 (B÷A) | | 76.68 | % | | 81.94 | % |

_____________

1See the Definitions and Reconciliations sections of this Supplemental package starting on page 56. 2For a quantitative reconciliation for the three months ended December 31, 2023, see page 34. 3 For additional information for the three months ended December 31, 2023, see page 37. 4Consists of lease transaction costs that qualify as rent inducements in accordance with GAAP. Lease transaction costs are generally included in 2nd generation tenant improvements and leasing commissions in the period the lease commences.

5Includes the straight-line impact of the Company’s 99-year ground and air rights lease related to the Company’s 100 Clarendon Street garage and Back Bay Transit Station. The Company has allocated contractual ground lease payments aggregating approximately $34.4 million, which it expects to incur by the end of 2025 with no payments thereafter. The Company is recognizing this expense on a straight-line basis over the 99-year term of the ground and air rights lease, see page 3. 6See page 62 for additional information. 7Represents the net adjustment for above- and below-market leases that are amortized over the terms of the respective leases in place at the property acquisition dates.

8Maintenance capital expenditures do not include capital expenditures that are planned at the time of acquisition or capital expenditures incurred in connection with repositioning activities.

| | | | | |

| Q4 2023 |

| Reconciliation of net income (loss) attributable to Boston Properties, Inc. to BXP’s Share of same property net operating income (NOI) |

(in thousands)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 31-Dec-22 |

| Net income attributable to Boston Properties, Inc. | | $ | 119,925 | | | $ | 121,790 | |

| Net income attributable to noncontrolling interests | | | | |

| Noncontrolling interest - common units of the Operating Partnership | | 13,906 | | | 13,972 | |

| Noncontrolling interest in property partnerships | | 19,324 | | | 19,961 | |

| Net income | | 153,155 | | | 155,723 | |

| Add: | | | | |

| Interest expense | | 155,080 | | | 119,923 | |

| | | | |

| Unrealized loss on non-real estate investment | | 93 | | | 150 | |

| Losses from interest rate contracts | | 79 | | | — | |

| | | | |

| | | | |

| | | | |

| Depreciation and amortization expense | | 212,067 | | | 198,330 | |

| Transaction costs | | 2,343 | | | 759 | |

| Payroll and related costs from management services contracts | | 4,021 | | | 4,246 | |

| General and administrative expense | | 38,771 | | | 36,000 | |

| Less: | | | | |

| Interest and other income (loss) | | 20,965 | | | 5,789 | |

| | | | |

| Gains from investments in securities | | 3,245 | | | 2,096 | |

| Gain on sales-type lease | | — | | | 10,058 | |

| Gains on sales of real estate | | — | | | 55,726 | |

| Income (loss) from unconsolidated joint ventures | | 22,250 | | | (58,451) | |

| Direct reimbursements of payroll and related costs from management services contracts | | 4,021 | | | 4,246 | |

| Development and management services revenue | | 12,728 | | | 8,406 | |

| Net Operating Income (NOI) | | 502,400 | | | 487,261 | |

| Add: | | | | |

BXP’s share of NOI from unconsolidated joint ventures 1 | | 38,520 | | | 37,734 | |

| Less: | | | | |

Partners’ share of NOI from consolidated joint ventures (after income allocation to private REIT shareholders) 2 | | 49,263 | | | 48,589 | |

| BXP’s Share of NOI | | 491,657 | | | 476,406 | |

| Less: | | | | |

| Termination income | | 10,485 | | | 1,723 | |

BXP’s share of termination income from unconsolidated joint ventures 1 | | — | | | 803 | |

| Add: | | | | |

Partners’ share of termination income from consolidated joint ventures 2 | | 135 | | | 206 | |

| BXP’s Share of NOI (excluding termination income) | | $ | 481,307 | | | $ | 474,086 | |

| | | | |

| Net Operating Income (NOI) | | $ | 502,400 | | | $ | 487,261 | |

| Less: | | | | |

| Termination income | | 10,485 | | | 1,723 | |

NOI from non Same Properties (excluding termination income) 3 | | 23,045 | | | 9,117 | |

| Same Property NOI (excluding termination income) | | 468,870 | | | 476,421 | |

| Less: | | | | |

Partners’ share of NOI from consolidated joint ventures (excluding termination income and after income allocation to private REIT shareholders) 2 | | 49,128 | | | 48,383 | |

| Add: | | | | |

Partners’ share of NOI from non Same Properties from consolidated joint ventures (excluding termination income and after income allocation to private REIT shareholders) 3 | — | | | — | |

BXP’s share of NOI from unconsolidated joint ventures (excluding termination income) 1 | | 38,520 | | | 36,931 | |

| Less: | | | | |

BXP’s share of NOI from non Same Properties from unconsolidated joint ventures (excluding termination income) 3 | | 10,005 | | | 9,667 | |

| BXP’s Share of Same Property NOI (excluding termination income) | | $ | 448,257 | | | $ | 455,302 | |

_____________

1For a quantitative reconciliation for the three months ended December 31, 2023, see page 65.

2For a quantitative reconciliation for the three months ended December 31, 2023, see pages 62-63.

3Pages 21-24 indicate by footnote the properties that are not included as part of Same Property NOI. In addition, Same Properties exclude properties that were sold prior to December 31, 2023 and therefore are no longer a part of the Company’s property portfolio.

| | | | | |

| Q4 2023 |

| Reconciliation of net income (loss) attributable to Boston Properties, Inc. to BXP’s Share of same property net operating income (NOI) - cash |

(in thousands)

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 31-Dec-22 |

| Net income attributable to Boston Properties, Inc. | | $ | 119,925 | | | $ | 121,790 | |

| Net loss attributable to noncontrolling interests | | | | |

| Noncontrolling interest - common units of the Operating Partnership | | 13,906 | | | 13,972 | |

| Noncontrolling interest in property partnerships | | 19,324 | | | 19,961 | |

| Net income | | 153,155 | | | 155,723 | |

| Add: | | | | |

| Interest expense | | 155,080 | | | 119,923 | |

| | | | |

| Unrealized loss on non-real estate investment | | 93 | | | 150 | |

| Losses from interest rate contracts | | 79 | | | — | |

| | | | |

| | | | |

| | | | |

| Depreciation and amortization expense | | 212,067 | | | 198,330 | |

| Transaction costs | | 2,343 | | | 759 | |

| Payroll and related costs from management services contracts | | 4,021 | | | 4,246 | |

| General and administrative expense | | 38,771 | | | 36,000 | |

| Less: | | | | |

| Interest and other income (loss) | | 20,965 | | | 5,789 | |

| Gains from investments in securities | | 3,245 | | | 2,096 | |

| Gain on sales-type lease | | — | | | 10,058 | |

| Gains on sales of real estate | | — | | | 55,726 | |

| Income (loss) from unconsolidated joint ventures | | 22,250 | | | (58,451) | |

| | | | |

| | | | |

| Direct reimbursements of payroll and related costs from management services contracts | | 4,021 | | | 4,246 | |

| Development and management services revenue | | 12,728 | | | 8,406 | |

| Net Operating Income (NOI) | | 502,400 | | | 487,261 | |

| Less: | | | | |

| Straight-line rent | | 29,235 | | | 32,038 | |

| Fair value lease revenue | | 2,518 | | | 3,088 | |

| Amortization and accretion related to sales type lease | | 238 | | | — | |

| Termination income | | 10,485 | | | 1,723 | |

| Add: | | | | |

Straight-line ground rent expense adjustment 1 | | 578 | | | 631 | |

Lease transaction costs that qualify as rent inducements 2 | | 1,276 | | | 11,212 | |

| NOI - cash (excluding termination income) | | 461,778 | | | 462,255 | |

| Less: | | | | |

NOI - cash from non Same Properties (excluding termination income) 3 | | 13,308 | | | 8,649 | |

| Same Property NOI - cash (excluding termination income) | | 448,470 | | | 453,606 | |

| Less: | | | | |

Partners’ share of NOI - cash from consolidated joint ventures (excluding termination income and after income allocation to private REIT shareholders) 4 | | 44,606 | | | 43,709 | |

| Add: | | | | |

Partners’ share of NOI - cash from non Same Properties from consolidated joint ventures (excluding termination income and after income allocation to private REIT shareholders) 3 | — | | | — | |

BXP’s share of NOI - cash from unconsolidated joint ventures (excluding termination income) 5 | | 33,704 | | | 33,154 | |

| Less: | | | | |

BXP’s share of NOI - cash from non Same Properties from unconsolidated joint ventures (excluding termination income) 3 | | 7,368 | | | 8,657 | |

| BXP’s Share of Same Property NOI - cash (excluding termination income) | | $ | 430,200 | | | $ | 434,394 | |

_____________

1In light of the front-ended, uneven rental payments required by the Company’s 99-year ground and air rights lease for the 100 Clarendon Street garage and Back Bay Transit Station in Boston, MA, and to make period-to-period comparisons more meaningful to investors, the adjustment does not include the straight-line impact of approximately $(543) and $(369) for the three months ended December 31, 2023 and 2022, respectively. As of December 31, 2023, the Company has remaining lease payments aggregating approximately $24.3 million, all of which it expects to incur by the end of 2025 with no payments thereafter. Under GAAP, the Company recognizes expense of $(87) per quarter on a straight-line basis over the term of the lease. However, unlike more traditional ground and air rights leases, the timing and amounts of the rental payments by the Company correlate to the uneven timing and funding by the Company of capital expenditures related to improvements at Back Bay Transit Station. As a result, the amounts excluded from the adjustment each quarter through 2025 may vary significantly.

2Consist of lease transaction costs that qualify as rent inducements in accordance with GAAP. Lease transaction costs are generally included in 2nd generation tenant improvements and leasing commissions in the Company’s FAD calculation on page 8.

3Pages 21-24 indicate by footnote the properties that are not included as part of Same Property NOI. In addition, Same Properties exclude properties that were sold prior to December 31, 2023 and therefore are no longer a part of the Company’s property portfolio.

4For a quantitative reconciliation for the three months ended December 31, 2023, see page 63.

5For a quantitative reconciliation for the three months ended December 31, 2023, see page 65.

| | | | | |

| Q4 2023 |

| Same property net operating income (NOI) by reportable segment |

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Office 1 | | Hotel & Residential |

| Three Months Ended | | $ | | % | | Three Months Ended | | $ | | % |

| 31-Dec-23 | | 31-Dec-22 | | Change | | Change | | 31-Dec-23 | | 31-Dec-22 | | Change | | Change |

Rental Revenue 2 | $ | 753,990 | | | $ | 737,064 | | | | | | | $ | 23,627 | | | $ | 22,569 | | | | | |

| Less: Termination income | 10,485 | | | 1,723 | | | | | | | — | | | — | | | | | |

Rental revenue (excluding termination income) 2 | 743,505 | | | 735,341 | | | $ | 8,164 | | | 1.1 | % | | 23,627 | | | 22,569 | | | $ | 1,058 | | | 4.7 | % |

| Less: Operating expenses and real estate taxes | 283,623 | | | 268,178 | | | 15,445 | | | 5.8 | % | | 14,639 | | | 13,311 | | | 1,328 | | | 10.0 | % |

NOI (excluding termination income) 2, 3 | $ | 459,882 | | | $ | 467,163 | | | $ | (7,281) | | | (1.6) | % | | $ | 8,988 | | | $ | 9,258 | | | $ | (270) | | | (2.9) | % |

| | | | | | | | | | | | | | | |

Rental revenue (excluding termination income) 2 | $ | 743,505 | | | $ | 735,341 | | | $ | 8,164 | | | 1.1 | % | | $ | 23,627 | | | $ | 22,569 | | | $ | 1,058 | | | 4.7 | % |

| Less: Straight-line rent and fair value lease revenue | 22,046 | | | 34,512 | | | (12,466) | | | (36.1) | % | | 148 | | | 22 | | | 126 | | | 572.7 | % |

Add: Lease transaction costs that qualify as rent inducements 4 | 1,216 | | | 11,088 | | | (9,872) | | | (89.0) | % | | — | | | — | | | — | | | — | % |

| Subtotal | 722,675 | | | 711,917 | | | 10,758 | | | 1.5 | % | | 23,479 | | | 22,547 | | | 932 | | | 4.1 | % |

| Less: Operating expenses and real estate taxes | 283,623 | | | 268,178 | | | 15,445 | | | 5.8 | % | | 14,639 | | | 13,311 | | | 1,328 | | | 10.0 | % |

Add: Straight-line ground rent expense 5 | 578 | | | 631 | | | (53) | | | (8.4) | % | | — | | | — | | | — | | | — | % |

NOI - cash (excluding termination income) 2, 3 | $ | 439,630 | | | $ | 444,370 | | | $ | (4,740) | | | (1.1) | % | | $ | 8,840 | | | $ | 9,236 | | | $ | (396) | | | (4.3) | % |

| | | | | | | | | | | | | | | |

| Consolidated Total 1 (A) | | BXP’s share of Unconsolidated Joint Ventures (B) |

| Three Months Ended | | $ | | % | | Three Months Ended | | $ | | % |

| 31-Dec-23 | | 31-Dec-22 | | Change | | Change | | 31-Dec-23 | | 31-Dec-22 | | Change | | Change |

Rental Revenue 2 | $ | 777,617 | | | $ | 759,633 | | | | | | | $ | 47,080 | | | $ | 46,282 | | | | | |

| Less: Termination income | 10,485 | | | 1,723 | | | | | | | — | | | 802 | | | | | |

Rental revenue (excluding termination income) 2 | 767,132 | | | 757,910 | | | $ | 9,222 | | | 1.2 | % | | 47,080 | | | 45,480 | | | $ | 1,600 | | | 3.5 | % |

| Less: Operating expenses and real estate taxes | 298,262 | | | 281,489 | | | 16,773 | | | 6.0 | % | | 18,565 | | | 18,216 | | | 349 | | | 1.9 | % |

NOI (excluding termination income) 2, 3 | $ | 468,870 | | | $ | 476,421 | | | $ | (7,551) | | | (1.6) | % | | $ | 28,515 | | | $ | 27,264 | | | $ | 1,251 | | | 4.6 | % |

| | | | | | | | | | | | | | | |

Rental revenue (excluding termination income) 2 | $ | 767,132 | | | $ | 757,910 | | | $ | 9,222 | | | 1.2 | % | | $ | 47,080 | | | $ | 45,480 | | | $ | 1,600 | | | 3.5 | % |

| Less: Straight-line rent and fair value lease revenue | 22,194 | | | 34,534 | | | (12,340) | | | (35.7) | % | | 2,193 | | | 2,741 | | | (548) | | | (20.0) | % |

Add: Lease transaction costs that qualify as rent inducements 4 | 1,216 | | | 11,088 | | | (9,872) | | | (89.0) | % | | (125) | | | (168) | | | 43 | | | 25.6 | % |

| Subtotal | 746,154 | | | 734,464 | | | 11,690 | | | 1.6 | % | | 44,762 | | | 42,571 | | | 2,191 | | | 5.1 | % |

| Less: Operating expenses and real estate taxes | 298,262 | | | 281,489 | | | 16,773 | | | 6.0 | % | | 18,565 | | | 18,216 | | | 349 | | | 1.9 | % |

Add: Straight-line ground rent expense 5 | 578 | | | 631 | | | (53) | | | (8.4) | % | | 139 | | | 142 | | | (3) | | | (2.1) | % |

NOI - cash (excluding termination income) 2, 3 | $ | 448,470 | | | $ | 453,606 | | | $ | (5,136) | | | (1.1) | % | | $ | 26,336 | | | $ | 24,497 | | | $ | 1,839 | | | 7.5 | % |

| | | | | | | | | | | | | | | |

| Partners’ share of Consolidated Joint Ventures (C) | | BXP’s Share 2, 6 |

| Three Months Ended | | $ | | % | | Three Months Ended | | $ | | % |

| 31-Dec-23 | | 31-Dec-22 | | Change | | Change | | 31-Dec-23 | | 31-Dec-22 | | Change | | Change |

Rental Revenue 2 | $ | 81,441 | | | $ | 78,912 | | | | | | | $ | 743,256 | | | $ | 727,003 | | | | | |

| Less: Termination income | 135 | | | 206 | | | | | | | 10,350 | | | 2,319 | | | | | |

Rental revenue (excluding termination income) 2 | 81,306 | | | 78,706 | | | $ | 2,600 | | | 3.3 | % | | 732,906 | | | 724,684 | | | $ | 8,222 | | | 1.1 | % |

| Less: Operating expenses and real estate taxes | 32,178 | | | 30,323 | | | 1,855 | | | 6.1 | % | | 284,649 | | | 269,382 | | | 15,267 | | | 5.7 | % |

NOI (excluding termination income) 2, 3 | $ | 49,128 | | | $ | 48,383 | | | $ | 745 | | | 1.5 | % | | $ | 448,257 | | | $ | 455,302 | | | $ | (7,045) | | | (1.5) | % |

| | | | | | | | | | | | | | | |

Rental revenue (excluding termination income) 2 | $ | 81,306 | | | $ | 78,706 | | | $ | 2,600 | | | 3.3 | % | | $ | 732,906 | | | $ | 724,684 | | | $ | 8,222 | | | 1.1 | % |

| Less: Straight-line rent and fair value lease revenue | 4,686 | | | 4,775 | | | (89) | | | (1.9) | % | | 19,701 | | | 32,500 | | | (12,799) | | | (39.4) | % |

Add: Lease transaction costs that qualify as rent inducements 4 | 164 | | | 101 | | | 63 | | | 62.4 | % | | 927 | | | 10,819 | | | (9,892) | | | (91.4) | % |

| Subtotal | 76,784 | | | 74,032 | | | 2,752 | | | 3.7 | % | | 714,132 | | | 703,003 | | | 11,129 | | | 1.6 | % |

| Less: Operating expenses and real estate taxes | 32,178 | | | 30,323 | | | 1,855 | | | 6.1 | % | | 284,649 | | | 269,382 | | | 15,267 | | | 5.7 | % |

Add: Straight-line ground rent expense 5 | — | | | — | | | — | | | — | % | | 717 | | | 773 | | | (56) | | | (7.2) | % |

NOI - cash (excluding termination income) 2, 3 | $ | 44,606 | | | $ | 43,709 | | | $ | 897 | | | 2.1 | % | | $ | 430,200 | | | $ | 434,394 | | | $ | (4,194) | | | (1.0) | % |

___________________

1Includes 100% share of consolidated joint ventures that are a Same Property.

2See the Definitions and Reconciliations sections of this Supplemental package starting on page 56. 3For a quantitative reconciliation of net income attributable to Boston Properties, Inc. to net operating income (NOI) (excluding termination income) and NOI - cash (excluding termination income), see pages 9-10. 4Consist of lease transaction costs that qualify as rent inducements in accordance with GAAP. Lease transaction costs are generally included in 2nd generation tenant improvements and leasing commissions in the Company’s FAD calculation on page 8. 5Excludes the straight-line impact of approximately $(543) and $(369) for the three months ended December 31, 2023 and 2022, respectively, in connection with the Company’s 99-year ground and air rights lease at 100 Clarendon Street garage and Back Bay Transit Station.

6BXP’s Share equals (A) + (B) - (C).

| | | | | |

| Q4 2023 |

| Capital expenditures, tenant improvement costs and leasing commissions |

(dollars in thousands, except PSF amounts)

CAPITAL EXPENDITURES

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 30-Sep-23 |

| Maintenance capital expenditures | | $ | 18,302 | | | $ | 19,599 | |

| Planned capital expenditures associated with acquisition properties | | 73 | | | 32 | |

| Repositioning capital expenditures | | 10,919 | | | 10,575 | |

| Hotel improvements, equipment upgrades and replacements | | 358 | | | 141 | |

| Subtotal | | 29,652 | | | 30,347 | |

| Add: | | | | |

| BXP’s share of maintenance capital expenditures from unconsolidated joint ventures (JVs) | | 781 | | | 91 | |

| BXP’s share of planned capital expenditures associated with acquisition properties from unconsolidated JVs | | 1,237 | | | 2,908 | |

| BXP’s share of repositioning capital expenditures from unconsolidated JVs | | — | | | — | |

| Less: | | | | |

| Partners’ share of maintenance capital expenditures from consolidated JVs | | 2,918 | | | 2,695 | |

| Partners’ share of planned capital expenditures associated with acquisition properties from consolidated JVs | | — | | | — | |

| Partners’ share of repositioning capital expenditures from consolidated JVs | | 1,627 | | | 622 | |

BXP’s Share of Capital Expenditures 1 | | $ | 27,125 | | | $ | 30,029 | |

2nd GENERATION TENANT IMPROVEMENTS AND LEASING COMMISSIONS 2

| | | | | | | | | | | | | | |

| | Three Months Ended |

| | 31-Dec-23 | | 30-Sep-23 |

| Square feet | | 823,176 | | | 1,184,449 | |

| Tenant improvements and lease commissions PSF | | $ | 83.39 | | | $ | 89.81 | |

___________________

1See the Definitions and Reconciliations sections of this Supplemental package starting on page 56. 2Includes 100% of unconsolidated joint ventures.

| | | | | |

| Q4 2023 |

Acquisitions and dispositions

|

For the period from January 1, 2023 through December 31, 2023

(dollars in thousands)

ACQUISITIONS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Investment | | | |

| Property | | Location | | Date Acquired | | Square Feet | | Initial | | Anticipated Future | | Total | | In-service Leased (%) | |

13100 and 13150 Worldgate Drive (50% ownership) 1 | | Herndon, VA | | January 31, 2023 | | N/A | | $ | 17,000 | | | $ | — | | | $ | 17,000 | | | N/A | |

Santa Monica Business Park (45% ownership) 2 | | West Los Angeles CA | | December 14, 2023 | | 1,182,605 | | | 38,000 | | | — | | | 38,000 | | | 84.1 | % | |

360 Park Avenue South (29% ownership) 3 | | New York, NY | | December 14, 2023 | | 450,000 | | | (25,436) | | | 70,820 | | | 45,384 | | | N/A | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Total Acquisitions | | | | | | 1,632,605 | | | $ | 29,564 | | | 70,820 | | | $ | 100,384 | | | 84.1 | % | |

DISPOSITIONS

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property | | Location | | Date Disposed | | Square Feet | | Gross Sales Price | | Net Cash Proceeds | | Book Gain (Loss) 4 | | |

Metropolitan Square (20% ownership) 5 | | Washington, DC | | October 2, 2023 | | 654,000 | | | N/A | | N/A | | $ | (1,491) | | | |

300 Binney Street (45% ownership) 6 | | Cambridge, MA | | November 13, 2023 | | 236,000 | | | $ | 473,114 | | | $ | 212,900 | | | N/A | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Total Dispositions | | | | | | 890,000 | | | $ | 473,114 | | | $ | 212,900 | | | $ | (1,491) | | | |

___________________

1Consists of two vacant office buildings aggregating approximately 350,000 rentable square feet and a 1,200-space structured parking deck situated on a 10-acre site. The joint venture intends to redevelop the property for residential use and the vacant properties are not reflected in the Company’s in-service property listing. There can be no assurance that the joint venture will commence the development as currently contemplated or at all.

2The Company acquired its joint venture partner’s 45% ownership interest in Santa Monica Business Park located in Santa Monica, California. The Company also assumed the partner’s share of the outstanding $300.0 million mortgage debt. Subsequent to closing, the Company extended the 467,000 square foot lease with anchor client, Snap Inc., through 2036. Santa Monica Business Park is a 47-acre office park consisting of 21 buildings. Approximately 70% of the square footage is subject to a ground lease with approximately 75 years remaining, inclusive of renewal periods, subject to certain conditions.

3The Company acquired of one of its joint venture partner’s approximately 29% ownership interest in 360 Park Avenue South increasing the Company’s ownership interest in the asset to approximately 71%. The Company also assumed the partner’s share of the joint venture’s cash and working capital aggregating approximately $25 million, as well as the partner’s share of the outstanding $220.0 million mortgage debt. 360 Park Avenue South is currently under re-development.

4Excludes approximately $0.5 million of gains on sales of real estate recognized during the year ended December 31, 2023 related to gain amounts from sales of real estate occurring in prior periods.

5A joint venture in which the Company owned a 20% equity interest (with an institutional investor owning the remaining 80%) completed a restructuring of the ownership in Metropolitan Square, which resulted in (i) an affiliate of the existing mezzanine lender purchasing the property, and (ii) the Company becoming a co-lender of up to $20.0 million under a new $100.0 million mezzanine loan. Upon the sale of the property, the Company recognized a loss related to transaction costs. This loss was recorded within income (loss) from unconsolidated joint ventures in the Company’s Operating Statement.

6The Company entered into agreements to sell a 45% interest in both 290 Binney Street and 300 Binney Street, two life sciences development projects located in Kendall Square in Cambridge, Massachusetts, to Norges Bank Investment Management (“NBIM”). The properties total approximately 810,000 square feet and each is 100% pre-leased. The Company will retain a 55% ownership interest in each joint venture and will provide development, property management, and leasing services for the ventures. NBIM funded approximately $212.9 million at closing for its investment in 300 Binney Street. 300 Binney is currently under redevelopment and the above gross sales price includes all cash and deemed contributions by the partners. The Company will fund all remaining costs for 300 Binney Street. Refer to page 14. 300 Binney did not qualify as a sale of real estate for financial reporting purposes as the Company continues to effectively control the property and thus will continue to account for the property on a consolidated basis in its financial statements. The 290 Binney Street joint venture has not closed.

| | | | | |

| Q4 2023 |

| Construction in progress |

as of December 31, 2023

(dollars in thousands)

CONSTRUCTION IN PROGRESS 1

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Actual/Estimated | | | | | | | | BXP’s share | | | | | | |

| | Initial Occupancy | | Stabilization Date | | | | | | Square Feet | | Investment to Date 2 | | Estimated Total Investment 2 | | Total Financing | | Amount Drawn at 12/31/2023 | | Estimated Future Equity Requirement 2 | | Percentage Leased 3 | | Percentage placed in-service 4 | | Net Operating Income (Loss) 5 (BXP’s share) |

| Construction Properties | | | Location | | | | | | | | | | | |

| Office | | | | | | | | | | | | | | | | | | | | | | | | | |

| 360 Park Avenue South (71% ownership) 6 | Q3 2024 | | Q4 2025 | | New York, NY | | | | 450,000 | | | $ | 325,070 | | | $ | 418,300 | | | $ | 156,470 | | | $ | 156,470 | | | $ | 93,230 | | | 18 | % | | — | % | | N/A |

| Reston Next Office Phase II | Q2 2024 | | Q2 2025 | | Reston, VA | | | | 90,000 | | | 39,201 | | | 61,000 | | | — | | | — | | | 21,799 | | | — | % | | — | % | | N/A |

| Total Office Properties under Construction | | | | 540,000 | | | 364,271 | | | 479,300 | | | 156,470 | | | 156,470 | | | 115,029 | | | 15 | % | | — | % | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Lab/Life Sciences | | | | | | | | | | | | | | | | | | | | | | | | | |

| 103 CityPoint | Q4 2024 | | Q3 2025 | | Waltham, MA | | | | 113,000 | | | 88,084 | | | 115,100 | | | — | | | — | | | 27,016 | | | — | % | | 4 | % | | $ | (70) | |

| 180 CityPoint | Q4 2023 | | Q3 2025 | | Waltham, MA | | | | 329,000 | | | 217,911 | | | 290,500 | | | — | | | — | | | 72,589 | | | 43 | % | | 46 | % | | 1,177 | |

| 300 Binney Street (Redevelopment) (55% ownership) 7 | Q1 2025 | | Q1 2025 | | Cambridge, MA | | | | 236,000 | | | (24,497) | | | 112,915 | | | — | | | — | | | 137,412 | | | 100 | % | | — | % | | N/A |

| 651 Gateway (50% ownership) | Q1 2024 | | Q4 2025 | | South San Francisco, CA | | | | 327,000 | | | 107,582 | | | 167,100 | | | — | | | — | | | 59,518 | | | 21 | % | | — | % | | N/A |

| 290 Binney Street 8 | Q2 2026 | | Q2 2026 | | Cambridge, MA | | | | 566,000 | | | 265,462 | | | 1,116,300 | | | — | | | — | | | 850,838 | | | 100 | % | | — | % | | N/A |

| Total Lab/Life Sciences Properties under Construction | | | | 1,571,000 | | | 654,542 | | | 1,801,915 | | | — | | | — | | | 1,147,373 | | | 64 | % | | 10 | % | | 1,107 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Residential | | | | | | | | | | | | | | | | | | | | | | | | | |

| Skymark - Reston Next Residential (508 units) (20% ownership) | Q2 2024 | | Q2 2026 | | Reston, VA | | | | 417,000 | | | 33,081 | | | 47,700 | | | 28,000 | | | 14,734 | | | 1,353 | | | — | % | | — | % | | N/A |

| Total Residential Property under Construction | | | | 417,000 | | | 33,081 | | | 47,700 | | | 28,000 | | | 14,734 | | | 1,353 | | | — | % | | — | % | | N/A |

| Retail | | | | | | | | | | | | | | | | | | | | | | | | | |

| 760 Boylston Street (Redevelopment) | Q2 2024 | | Q2 2024 | | Boston, MA | | | | 118,000 | | | 31,490 | | | 43,800 | | | — | | | — | | | 12,310 | | | 100 | % | | — | % | | N/A |

| Reston Next Retail | Q2 2025 | | Q4 2025 | | Reston, VA | | | | 33,000 | | | 22,366 | | | 26,600 | | | — | | | — | | | 4,234 | | | — | % | | — | % | | N/A |

| Total Retail Properties under Construction | | | | 151,000 | | | 53,856 | | | 70,400 | | | — | | | — | | | 16,544 | | | 78 | % | | — | | | N/A |

| Total Properties Under Construction | | | | 2,679,000 | | | $ | 1,105,750 | | | $ | 2,399,315 | | | $ | 184,470 | | | $ | 171,204 | | | $ | 1,280,299 | | | 53 | % | 9 | 6 | % | | $ | 1,107 | |

PROJECTS FULLY PLACED IN-SERVICE DURING 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Actual/Estimated | | | | | | | | BXP’s share | | | | |

| | | | | | | | | | | | | Estimated Total Investment 2 | | | | Amount Drawn at 12/31/2023 | | Estimated Future Equity Requirement 2 | | | | Net Operating Income 5 (BXP’s share) |

| Initial Occupancy | | Stabilization Date | | | | | | | | Investment to Date 2 | | | Total Financing | | | | Percentage Leased 3 | |

| | | Location | | | Square Feet | | | | | | | |

2100 Pennsylvania Avenue | Q2 2022 | | Q3 2024 | | Washington, DC | | | | 475,849 | | | $ | 381,132 | | | $ | 394,900 | | | $ | — | | | $ | — | | | $ | 13,768 | | | 95 | % | | $ | 3,198 | |

| View Boston observatory at The Prudential Center (Redevelopment) | Q2 2023 | | N/A | | Boston, MA | | | | 63,000 | | | 180,819 | | | 182,300 | | | — | | | — | | | 1,481 | | | N/A | | N/A 10 |