UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of March, 2025

Commission File Number 001-34175

| ECOPETROL S.A. |

|

(Exact name of registrant as specified in its charter)

|

| N.A. |

|

(Translation of registrant’s name into English)

|

| COLOMBIA |

|

(Jurisdiction of incorporation or organization)

|

| Carrera 13 No. 36 – 24 |

| BOGOTA D.C. – COLOMBIA |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Yes ¨ No x

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Yes ¨ No x

Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ¨ No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- N/A

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Ecopetrol S.A. |

|

| |

|

|

| |

By: |

/s/ Alfonso Camilo Barco |

|

| |

|

Name: |

Alfonso Camilo Barco |

|

| |

|

Title: |

Chief

Financial Officer |

|

Date: March 4,

2025

Ecopetrol’s 2024 Earnings Distribution Proposal

Ecopetrol S.A. (BVC: ECOPETROL; NYSE: EC) (“Ecopetrol”

or the “Company”) hereby announces the Company’s proposal for the distribution of 2024 earnings, which has been approved

by its board of directors, and is intended to be submitted for the consideration of the General Shareholders’ Meeting that will

be held on March 28, 2025:

| 2024 EARNINGS DISTRIBUTION PROPOSAL (Colombian Pesos- COP) |

| |

|

| Net income after provision for income tax |

14,934,704,561,251 |

| + Release of reserves from previous years |

12,502,312,256,016 |

| Occasional reserve for sustainability |

11,993,230,652,653 |

| Excess fiscal depreciation reserve (Art.130 ET.) |

509,081,603,363 |

| |

|

| - Legal reserves of the current year |

2,002,552,059,488 |

| Legal reserve (10%) |

1,493,470,456,125 |

| Excess fiscal depreciation reserve (Art. 130 ET.) |

509,081,603,363 |

| |

|

| Available to the Shareholders |

25,434,464,757,779 |

| |

|

| It is proposed to distribute as follows: |

|

| Ordinary Dividend According to dividend policy (Payout1 58.9% of Net Income) |

8,798,972,663,702 |

| Allocated to occasional reserve for sustainability |

16,635,492,094,077 |

| Total: |

25,434,464,757,779 |

| Total dividend payable |

214 |

1 A 59% dividend payout ratio established within the policy range

was applied to the net income, resulting in a dividend per share with decimals, which was rounded to the nearest number in COP/share.

The payout percentage shown is rounded to the first decimal place.

The earnings distribution proposal, consistent with the Company’s

current dividend policy, proposes an ordinary dividend distribution of COP 214 per share, equivalent to a payout of 58.9% of Ecopetrol

S.A.'s net income in 2024.

The dividends payment to minority shareholders is proposed to be

made in two equal installments on April 4 and June 27 of 2025. On the other hand, the dividend due to our majority shareholder is proposed

to be made no later than December 31, 2025, in coordination with the defined payment schedule for the balance of the Fuel Price Stabilization

Fund (FEPC) debt, corresponding to its accumulation in 2024.

Moreover, the board of directors proposes the allocation of COP

16,635,492,094,077 to an occasional reserve to support the Company’s financial sustainability and flexibility in the execution of

its strategy.

Bogota D.C., March 4, 2025

Ecopetrol is the largest company in Colombia and one of the main

integrated energy companies in the American continent, with more than 19,000 employees. In Colombia, it is responsible for more than 60%

of the hydrocarbon production of most transportation, logistics, and hydrocarbon refining systems, and it holds leading positions in the

petrochemicals and gas distribution segments. With the acquisition of 51.4% of ISA’s shares, the company participates in energy

transmission, the management of real-time systems (XM), and the Barranquilla - Cartagena coastal highway concession. At the international

level, Ecopetrol has a stake in strategic basins in the American continent, with Drilling and Exploration operations in the United States

(Permian basin and the Gulf of Mexico), Brazil, and Mexico, and, through ISA and its subsidiaries, Ecopetrol holds leading positions in

the power transmission business in Brazil, Chile, Peru, and Bolivia, road concessions in Chile, and the telecommunications sector.

This release contains statements that may be considered forward-looking

statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange

Act of 1934, as amended. All forward-looking statements, whether made in this release or in future filings or press releases, or orally,

address matters that involve risks and uncertainties, including in respect of the Company’s prospects for growth and its ongoing

access to capital to fund the Company’s business plan, among others. Consequently, changes in the following factors, among others,

could cause actual results to differ materially from those included in the forward-looking statements: market prices of oil & gas,

our exploration, and production activities, market conditions, applicable regulations, the exchange rate, the Company’s competitiveness

and the performance of Colombia’s economy and industry, to mention a few. We do not intend and do not assume any obligation to update

these forward-looking statements.

For more information, please contact:

Head of Capital Markets

Carolina Tovar Aragón

Email: investors@ecopetrol.com.co

Head of Corporate Communications (Colombia)

Marcela Ulloa

Email: marcela.ulloa@ecopetrol.com.co

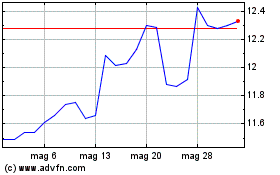

Grafico Azioni Ecopetrol (NYSE:EC)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Ecopetrol (NYSE:EC)

Storico

Da Mar 2024 a Mar 2025