Eversource Energy (NYSE: ES) (“Eversource”) today announced it

has executed a definitive agreement to sell its 50 percent

ownership share in South Fork Wind and Revolution Wind to Global

Infrastructure Partners (GIP). The transaction allows Eversource to

realize approximately $1.1 billion of cash proceeds upon closing

and to exit these projects while retaining certain cost sharing

obligations for the construction of Revolution Wind. These cost

sharing obligations provide that Eversource would share equally

with GIP in GIP’s funding obligations for up to approximately $240

million of incremental capital expenditure overruns incurred, after

which GIP’s obligations for any additional capital expenditure

overruns would be borne by Eversource consistent with the existing

joint venture terms. In addition, around the time of commercial

operation of Revolution Wind and closing for South Fork Wind,

Eversource’s financial exposure will be adjusted after taking into

account the updated project economics. Commercial operation of

Revolution Wind is expected in 2025. Since South Fork Wind is

expected to enter service before the transaction closes,

Eversource’s financial ties to South Fork Wind, other than as a tax

equity partner, are expected to largely be resolved at closing.

Eversource plans to use the proceeds from this sale to repay parent

debt.

The agreement covers Eversource’s 50 percent share in the

132-megawatt South Fork Wind project and the 704-megawatt

Revolution Wind project. Ørsted’s 50 percent ownership interests

are not affected by today’s announcement. Eversource is expected to

enter into a separate construction management agreement as a

contractor to Revolution Wind to complete the onshore work that is

currently underway. Eversource will maintain its previously

announced tax equity investment in South Fork Wind.

On January 24, 2024, Eversource announced that it had reached

agreement to sell its 50 percent interest in the 924-megawatt

Sunrise Wind project to Ørsted, contingent on the successful award

of the NY04 NYSERDA Offshore Wind Renewable Energy Credits

Agreement request for proposal and other conditions.

The sale to GIP includes the following key provisions:

- Eversource expects to receive approximately $1.1 billion from

GIP upon the closing of the transaction, which is expected to occur

in mid-2024.

- Proceeds may be adjusted as a result of final construction

costs and updated project economics following the commercial

operation date of Revolution Wind and following closing for the

South Fork project.

- Factors that could cause Eversource’s total net proceeds to be

higher or lower include the following:

- Revolution Wind’s eligibility for federal investment tax

credits at other than the anticipated 40 percent level. Decreased

tax credit eligibility would decrease proceeds to Eversource and

increased tax credits would increase proceeds to Eversource;

- The ultimate cost of construction for Revolution Wind. Under

the purchase and sale agreement, Eversource and GIP will share the

difference between a base construction forecast and the aggregate

cost of the two projects up to an effective cap of approximately

$240 million. Eversource will have responsibility for GIP’s

obligations for any additional costs in excess of the cap amount

consistent with the existing joint venture terms;

- Eversource and Ørsted anticipate that South Fork Wind will be

fully operational prior to the close of this transaction with GIP.

Eversource does not expect any material differences in the cost of

construction for South Fork Wind relative to the base forecast

noted above;

- Delays in constructing Revolution Wind, which would impact the

economics associated with the purchase price adjustment;

- Lower operation costs or higher availability of the projects.

Eversource can benefit, but not be harmed, from lower costs of

operations and/or higher availability as compared to a base level

assumed in the projects’ financial models through the period that

is four years following commercial operation date of the Revolution

Wind project.

Under the agreement, Eversource’s existing credit support

obligations are expected to roll off for each project around the

time that each project completes its expected capital spend.

At or prior to closing of the sale to GIP, Ørsted and GIP intend

to enter into definitive partnerships and services agreements.

Closing of the transaction will also require regulatory approvals

from the Federal Energy Regulatory Commission as well as customary

antitrust filings and New York Public Service Commission

approvals.

“We continue to believe that offshore wind represents the most

significant opportunity to decarbonize the electric generation

footprint of New England,” said Joe Nolan, Eversource Energy

Chairman, President, and Chief Executive Officer. “Eversource will

remain an integral player in this historic shift to a clean energy

generation mix by focusing on our strengths as a regulated

transmission builder and operator and bringing the benefits of

these investments to our customers.”

“We are pleased to announce our acquisition of a 50% stake in

two significant offshore wind projects from Eversource,” said Bayo

Ogunlesi, Global Infrastructure Partners’ Chairman and Chief

Executive Officer. “This acquisition marks our fourth strategic

joint venture with Ørsted, further solidifying our strong

partnership with leading industry players. The South Fork Wind and

Revolution Wind projects benefit from long-term offtake agreements

and play a pivotal role in addressing the increasing demand for

clean electricity.”

“We want to thank Eversource for their partnership and the

critical work we have done together to advance offshore wind energy

in the Northeast,” said David Hardy, Group EVP and CEO Americas at

Ørsted. “Global Infrastructure Partners is a longstanding global

Ørsted partner that is committed to renewable energy development,

and we’re pleased the U.S. industry continues to attract

world-class investors. With GIP as a partner, we will further

realize the value of offshore wind in Rhode Island, Connecticut,

and New York, creating good-paying jobs and affordable clean

energy.”

In May 2023, Eversource announced that it would sell its 50

percent interest in approximately 175,000 of developable but

uncommitted offshore acres to Ørsted for $625 million. That

transaction closed on September 7, 2023.

Eversource has engaged Goldman Sachs as its financial advisor to

assist with the transactions and Ropes & Gray LLP serves as its

legal counsel.

Eversource Energy operates New England’s largest energy delivery

system and serves approximately 4.4 million electric, natural gas

and water utility customers in Connecticut, Massachusetts and New

Hampshire.

This document includes statements concerning Eversource Energy’s

expectations, beliefs, plans, objectives, goals, strategies,

assumptions of future events, future financial performance or

growth and other statements that are not historical facts,

including the anticipated timing for the closing of the

transaction, the amount of expected proceeds, expectations on

future federal investment tax credits and statements regarding the

use of proceeds and the outcome of rebidding in the New York RFP.

These statements are “forward-looking statements” within the

meaning of U.S. federal securities laws. Generally, readers can

identify these forward-looking statements through the use of words

or phrases such as “estimate,” “expect,” “anticipate,” “intend,”

“plan,” “project,” “believe,” “forecast,” “would,” “should,”

“could” and other similar expressions. Forward-looking statements

involve risks and uncertainties that may cause actual results or

outcomes to differ materially from those included in the

forward-looking statements. Forward-looking statements are based on

the current expectations, estimates, assumptions or projections of

management and are not guarantees of future performance. These

expectations, estimates, assumptions or projections may vary

materially from actual results. Accordingly, any such statements

are qualified in their entirety by reference to, and are

accompanied by, the following important factors that may cause our

actual results or outcomes to differ materially from those

contained in our forward-looking statements, including, but not

limited to: our ability to complete transactions referred to herein

on the timeline or the terms we expect; the risk that we and GIP,

or GIP and Ørsted, are unable to reach definitive agreements

necessary to consummate the related transactions referenced herein;

the outcome of the power purchase agreement bid process for Sunrise

Wind and the risk of losing the bid to a competing offer; the

ability to qualify for investment tax credits in the amounts we

expect; variability in the costs and projected returns of the

offshore wind projects and the risk of deterioration of market

conditions in the offshore wind industry; cyberattacks or breaches,

including those resulting in the compromise of the confidentiality

of our proprietary information and the personal information of our

customers; disruptions in the capital markets or other events that

make our access to necessary capital more difficult or costly;

changes in economic conditions, including impact on interest rates,

tax policies, and customer demand and payment ability; ability or

inability to commence and complete our major strategic development

projects and opportunities; acts of war or terrorism, physical

attacks or grid disturbances that may damage and disrupt our

electric transmission and electric, natural gas, and water

distribution systems; actions or inaction of local, state and

federal regulatory, public policy and taxing bodies; substandard

performance of third-party suppliers and service providers;

fluctuations in weather patterns, including extreme weather due to

climate change; changes in business conditions, which could include

disruptive technology or development of alternative energy sources

related to our current or future business model; contamination of,

or disruption in, our water supplies; changes in levels or timing

of capital expenditures; changes in laws, regulations or regulatory

policy, including compliance with environmental laws and

regulations; changes in accounting standards and financial

reporting regulations; actions of rating agencies; and other

presently unknown or unforeseen factors.

Other risk factors are detailed in Eversource Energy’s reports

filed with the U.S. Securities and Exchange Commission (the “SEC”).

They are updated as necessary and available on Eversource Energy’s

website at www.eversource.com and on the SEC’s website at

www.sec.gov. All such factors are difficult to predict and contain

uncertainties that may materially affect Eversource Energy’s actual

results, many of which are beyond our control. You should not place

undue reliance on the forward-looking statements, as each speaks

only as of the date on which such statement is made, and, except as

required by law, Eversource Energy undertakes no obligation to

update any forward-looking statement or statements to reflect

events or circumstances after the date on which such statement is

made or to reflect the occurrence of unanticipated events.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240212556574/en/

William Hinkle (media) (336) 682-8799

Robert S. Becker (investors) (860) 665-3249

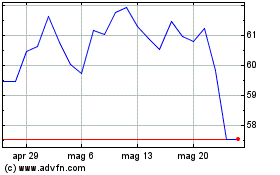

Grafico Azioni Eversource Energy (NYSE:ES)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Eversource Energy (NYSE:ES)

Storico

Da Dic 2023 a Dic 2024