0000910329FALSE00009103292023-08-072023-08-070000910329exch:XNYS2023-08-072023-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2023

MEDIFAST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation) | 001-31573 (Commission File Number) | 13-3714405 (I.R.S. Employer Identification No.) |

100 International Drive, Baltimore, Maryland 21202

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (410) 581-8042

N/A

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | MED | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

| | | | | |

Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | o |

Item 2.02. Results of Operations and Financial Condition.

On August 7, 2023, Medifast, Inc. issued a press release announcing its earnings for the second quarter ended June 30, 2023.

A copy of the Press Release is being furnished as Exhibit 99.1 attached hereto and is incorporated by reference herein. This information is being furnished in this report and shall not be deemed to be “filed” for any purpose, including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

(d) | Exhibits. |

| | |

| 99.1 | |

| 104.1 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MEDIFAST, INC. |

| |

| By: | /s/ James P. Maloney |

| | James P. Maloney |

| | Chief Financial Officer |

| | |

| Dated: August 7, 2023 | | |

Medifast Announces Second Quarter 2023 Financial Results

BALTIMORE - August 7, 2023 /PRNewswire/ -- Medifast (NYSE: MED), the health and wellness company known for its habit-based and Coach-guided lifestyle solution, OPTAVIA® , today reported results for the second quarter ended June 30, 2023.

Second Quarter 2023

•Revenue of $296.2 million, with revenue per active earning coach of $5,578

•Independent active earning OPTAVIA Coaches of 53,100

•Net income of $30.3 million

•Earnings per diluted share ("EPS) of $2.77

•Cash and Cash Equivalents of $147.4 million and no interest-bearing debt

“We are ahead of our Fuel for the Future plan with key initiatives aimed at driving efficiency and cost reduction, which helped to mitigate the impact of continued economic headwinds on our revenues during the quarter,” said Dan Chard, Chairman & Chief Executive Officer of Medifast. “In addition, we have made significant progress advancing our broader health and wellness agenda with the recent launch of our new OPTAVIA ACTIVETM line of products, which marks an inflection point for Medifast as we target new areas of growth and more than triple our total addressable market. We also have pilot programs underway to assess potential growth opportunities related to medically-supported weight loss that leverage the strength of our business model. We believe our scientifically-designed solution, OPTAVIA, is a great complement to those seeking to improve their health and wellness regardless of the method they choose to utilize.”

Chard concluded, “Industry dynamics have changed numerous times over the years and Medifast has proven adept at making the necessary adjustments in its business model to thrive in new environments. Even though the operating environment remains challenging, and we continue to expect that programming adjustments, compensation dynamics, and future growth initiatives will take time to deliver meaningful results, we are confident that the changes we are making to diversify our business into new areas will have similar success.”

Second Quarter 2023 Results

Second quarter 2023 revenue decreased 34.7% to $296.2 million from $453.3 million for the second quarter of 2022, primarily driven by a decrease in the number of active earning OPTAVIA Coaches and the decline in the productivity per active earning OPTAVIA Coach. The average revenue per active earning OPTAVIA Coach was $5,578, compared to $6,667 for the second quarter last year, a decline of 16.3%, driven by continued pressure on customer acquisition, partially offset by the price increase implemented in November 2022. The total number of active earning OPTAVIA Coaches decreased 21.9% to 53,100 compared to 68,000 for the second quarter of 2022.

Gross profit decreased 34.5% to $210.7 million from $321.7 million for the second quarter of 2022. The decrease in gross profit was due to lower revenue. The Company’s gross profit as a percentage of revenue was 71.1% compared to 71.0% in the second quarter of 2022.

Selling, general, and administrative expenses (“SG&A”) decreased 36.9% to $172.0 million compared to $272.7 million for the second quarter of 2022. As a percentage of revenue, SG&A decreased 208 basis points year-over-year to 58.1% of revenue, as compared to 60.2% for the second quarter of 2022. The decrease in SG&A was primarily due to progress on several cost reduction and optimization initiatives. Additional factors that positively impacted SG&A included charitable donations in the second quarter of 2022 that did not recur in 2023 and decreased Coach compensation due to lower volumes and fewer active earning Coaches.

Income from operations decreased 21.0% to $38.7 million from $49.0 million in the prior-year period. As a percentage of revenue, income from operations was 13.1% for the second quarter of 2023 compared to 10.8% in the prior-year period due to the factors described above impacting revenue and SG&A expenses.

The effective tax rate was 22.6% for the second quarter of 2023 compared to 19.8% in the prior-year period. The increase in the effective tax rate for the three months ended June 30, 2023 was primarily driven by a decrease in the tax benefit from charitable donations of inventory donations in the second quarter as mentioned above.

In the second quarter of 2023, net income was $30.3 million, or $2.77 per diluted share, based on approximately 10.9 million shares of common stock outstanding. In the second quarter of 2022, net income was $39.1 million, or $3.42 per diluted share, based on approximately 11.4 million shares of common stock outstanding.

Capital Allocation and Balance Sheet

The Company announced a quarterly cash dividend of $1.65 per share, or $18.2 million, payable on August 8, 2023, to stockholders of record as of the close of business on June 27, 2023.

The Company’s balance sheet remains strong with $147.4 million in cash and cash equivalents and no interest-bearing debt as of June 30, 2023 compared to $87.7 million in cash and cash equivalents and no debt at December 31, 2022.

Outlook

The Company expects third quarter 2023 revenue to be in the range of $220 million to $240 million and third quarter 2023 diluted EPS to be in the range of $0.71 to $1.32 The third quarter 2023 earnings guidance assumes a 23.0% to 25.0% effective tax rate. The guidance includes the impact of investments being made for future growth initiatives, which are expected to continue throughout the year, impacting profitability.

Conference Call Information

The conference call is scheduled for today, Monday, August 7, 2023 at 4:30 p.m. ET. The call will be broadcast live over the Internet, hosted on the Investor Relations section of Medifast’s website at www.MedifastInc.com or directly at https://app.webinar.net/vb1JL58Wrwo and will be archived online and available through November 7, 2023. In addition, listeners may dial (877) 344-7529 to join via telephone.

A telephonic playback will be available from 6:30 p.m. ET, August 7, 2023, through August 14, 2023. Participants can dial (877) 344-7529 and enter passcode 7120911 to hear the playback.

About Medifast®:

Medifast

(NYSE: MED) is the health and wellness company known for its habit-based and Coach-guided lifestyle solution OPTAVIA®, which provides people with a simple, yet comprehensive approach to help them achieve lasting optimal health and wellbeing. OPTAVIA offers clinically proven plans, scientifically developed products and a framework for habit creation reinforced by independent Coaches and Community support. As a physician-founded company with a 40+ year history, Medifast is a leader in the U.S. weight management industry. The company continues to innovate and build upon its scientific and clinical heritage to deliver on its mission of offering the world Lifelong Transformation, One Healthy Habit at a Time®. Medifast was recognized in 2023 by Financial Times as one of The Americas’ Fastest Growing Companies

and in 2022 as one of America's Best Mid-Sized Companies by Forbes. For more information, visit

MedifastInc.com and OPTAVIA.com and follow @Medifast on Twitter.

MED-F

Forward Looking Statements

Please Note: This release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements generally can be identified by use of phrases or terminology such as “intend,” “anticipate,” “expect” or other similar words or the negative of such terminology. Similarly, descriptions of Medifast’s objectives, strategies, plans, goals, outlook or targets contained herein are also considered forward-looking statements. These statements are based on the current expectations of the management of Medifast and are subject to certain events, risks, uncertainties and other factors. Some of these factors include, among others, risks associated with Medifast’s direct-to-consumer business model; the impact of rapid growth on Medifast’s systems; disruptions in Medifast’s supply chain; Medifast’s inability to continue to develop new products; effectiveness of Medifast’s advertising and marketing programs, including use of social media by independent OPTAVIA Coaches; Medifast’s inability to maintain and grow the network of independent OPTAVIA Coaches; the departure of one or more key personnel; Medifast’s inability to protect against online security risks and cyberattacks; to protect its brand and intellectual property, or to protect against product liability claims; Medifast’s planned growth into domestic and international markets; adverse publicity associated with Medifast’s products; Medifast’s inability to continue declaring dividends; fluctuations of Medifast’s common stock market price; the prolonged effects of COVID-19 on consumer spending and disruptions to our distribution network, supply chains and operations; increases in competition or litigation; the consequences of other geopolitical events, including natural disasters, global health crises, acts of war (including the war in Ukraine), changes in trade policies and tariffs, climate change, regulatory changes, increases in costs of raw materials, fuel, or other energy, transportation, or utility costs and in the costs of labor and employment, labor shortages, supply chain issues and the resulting impact on market conditions and consumer sentiment and spending; and Medifast’s ability to prevent or detect a failure of internal control over financial reporting. Although Medifast believes that the expectations, statements and assumptions reflected in these forward-looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward-looking statement in this release, as well as those set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and other filings filed with the United States Securities and Exchange Commission, including its quarterly reports on Form 10-Q and current reports on Form 8-K. All of the forward-looking statements contained herein speak only as of the date of this release.

Investor Contact:

Medifast, Inc.

Steven Zenker

InvestorRelations@medifastinc.com

(443) 379-5256

MEDIFAST, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED)

(U.S. dollars in thousands, except per share amounts & dividend data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six months ended June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

Revenue | $ 296,18 | | $ 453,33 | | $ 645,17 | | $ 870,93 |

Cost of sales | 85,473 | | 131,651 | | 188,065 | | 246,965 |

Gross profit | 210,715 | | 321,682 | | 457,105 | | 623,968 |

| | | | | | | |

Selling, general, and administrative | 172,009 | | 272,718 | | 364,887 | | 519,917 |

| | | | | | | |

Income from operations | 38,706 | | 48,964 | | 92,218 | | 104,051 |

| | | | | | | |

Other income (expense) | | | | | | | |

Interest income (expense) | 462 | | (164) | | 281 | | (259) |

Other expense | (51) | | (4) | | (53) | | (20) |

| 411 | | (168) | | 228 | | (279) |

| | | | | | | |

Income from operations before income taxes | 39,117 | | 48,796 | | 92,446 | | 103,772 |

| | | | | | | |

Provision for income taxes | 8,837 | | 9,683 | | 22,198 | | 22,878 |

| | | | | | | |

Net income | $ 30,28 | | $ 39,11 | | $ 70,24 | | $ 80,89 |

| | | | | | | |

Earnings per share - basic | $ 2.7 | | $ 3.4 | | $ 6.4 | | $ 7.0 |

| | | | | | | |

Earnings per share - diluted | $ 2.7 | | $ 3.4 | | $ 6.4 | | $ 7.0 |

| | | | | | | |

Weighted average shares outstanding | | | | | | | |

Basic | 10,888 | | 11,354 | | 10,876 | | 11,455 |

Diluted | 10,917 | | 11,435 | | 10,923 | | 11,534 |

| | | | | | | |

Cash dividends declared per share | $ 1.6 | | $ 1.6 | | $ 3.3 | | $ 3.2 |

MEDIFAST, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(U.S. dollars in thousands, except par value)

| | | | | | | | | | | |

| June 30, 202 | | December 31, 202 |

| | | |

ASSETS | | | |

Current Assets | | | |

Cash and cash equivalents | $ 147,40 | | $ 87,69 |

Inventories | 68,896 | | 118,856 |

Prepaid expenses and other current assets | 12,516 | | 16,237 |

Total current assets | 228,817 | | 222,784 |

| | | |

Property, plant and equipment - net of accumulated depreciation | 54,412 | | 57,185 |

Right-of-use assets | 16,699 | | 18,460 |

Other assets | 14,269 | | 12,456 |

Deferred tax assets | 4,528 | | 5,328 |

| | | |

TOTAL ASSETS | $ 318,72 | | $ 316,21 |

| | | |

LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

Current Liabilities | | | |

Accounts payable and accrued expenses | $ 105,18 | | $ 134,69 |

Income taxes payable | 4,302 | | 428 |

Current lease obligations | 5,405 | | 5,776 |

Total current liabilities | 114,895 | | 140,894 |

| | | |

Lease obligations, net of current lease obligations | 18,269 | | 20,275 |

Total liabilities | 133,164 | | 161,169 |

| | | |

Stockholders' Equity | | | |

Common stock, par value $0.001 per share: 20,000 shares authorized; | | | |

10,889 and 10,928 issued and 10,889 and 10,873 outstanding | | | |

at June 30, 2023 and December 31, 2022, respectively | 11 | | 11 |

Additional paid-in capital | 21,542 | | 21,555 |

Accumulated other comprehensive income | 123 | | 24 |

Retained earnings | 163,885 | | 139,852 |

Less: treasury stock at cost, 0 and 54 shares at June 30, 2023 and December 31, 2022, respectively | — | | (6,398) |

Total stockholders' equity | 185,561 | | 155,044 |

| | | |

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ 318,72 | | $ 316,21 |

v3.23.2

Cover

|

Aug. 07, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2023

|

| Entity Registrant Name |

MEDIFAST, INC.

|

| Entity Address, Address Line One |

100 International Drive

|

| Entity Address, City or Town |

Baltimore

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

21202

|

| City Area Code |

410

|

| Local Phone Number |

581-8042

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MED

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000910329

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

13-3714405

|

| Entity File Number |

001-31573

|

| Entity Incorporation, State or Country Code |

DE

|

| NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

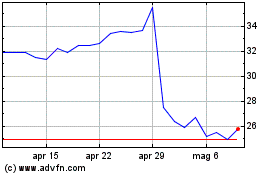

Grafico Azioni Medifast (NYSE:MED)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Medifast (NYSE:MED)

Storico

Da Mag 2023 a Mag 2024