Form 8-K - Current report

27 Settembre 2023 - 2:30PM

Edgar (US Regulatory)

0000910329FALSE00009103292023-09-262023-09-260000910329exch:XNYS2023-09-262023-09-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 26, 2023

MEDIFAST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation) | 001-31573 (Commission File Number) | 13-3714405 (I.R.S. Employer Identification No.) |

100 International Drive, Baltimore, Maryland 21202

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (410) 581-8042

N/A

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Common Stock, par value $0.001 per share | MED | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

| | | | | |

Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | o |

Item 7.01. Regulation FD Disclosure.

On September 26, 2023, Medifast, Inc. (the "Company") attended an investor meeting, during which management of the Company discussed its previously disclosed Fuel for the Future program, and inadvertently shared the Company's internal target, that was established at the beginning of 2023, of anticipated flat revenue growth for Fiscal Year 2024, which could be perceived as providing guidance. There was no intention to provide 2024 guidance, as the Company has not yet finalized its forecast and planning for 2024, and therefore no reliance should be made on such information. The 2024 aspirational, internal, revenue target is subject to numerous uncertainties as described below and could meaningfully change depending on future developments.

This Current Report on Form 8-K is being furnished solely to satisfy the requirements of Regulation FD in light of the inadvertent disclosure. The information furnished pursuant to this Current Report on Form 8-K shall not be considered “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any filing by the Company under the Securities Act of 1933, as amended, or under the Exchange Act, unless the Company expressly sets forth by specific reference in such filing that such information is to be considered “filed” or incorporated by reference therein.

Forward Looking Statements

Please Note: The statements contained above regarding anticipated revenue growth for Fiscal Year 2024 include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These statements are based on the current expectations of the management of Medifast and are subject to certain events, risks, uncertainties and other factors. Some of these factors include, among others, risks associated with Medifast’s direct-to-consumer business model; the impact of rapid growth on Medifast’s systems; disruptions in Medifast’s supply chain; Medifast’s inability to continue to develop new products; effectiveness of Medifast’s advertising and marketing programs, including use of social media by independent OPTAVIA Coaches; Medifast’s inability to maintain and grow the network of independent OPTAVIA Coaches; the departure of one or more key personnel; Medifast’s inability to protect against online security risks and cyber attacks; to protect its brand and intellectual property, or to protect against product liability claims; Medifast’s planned growth into domestic and international markets; adverse publicity associated with Medifast’s products; Medifast’s inability to continue declaring dividends; fluctuations of Medifast’s common stock market price; the prolonged effects of COVID-19 on consumer spending and disruptions to our distribution network, supply chains and operations; increases in competition or litigation; the consequences of other geopolitical events, including natural disasters, global health crises, acts of war (including the war in Ukraine), changes in trade policies and tariff s,climate change, regulatory changes, increases in costs of raw materials, fuel, or other energy, transportation, or utility costs and in the costs of labor and employment, labor shortages, supply chain issues and the resulting impact on market conditions and consumer sentiment and spending; and Medifast’s ability to prevent or detect a failure of internal control over financial reporting. Although Medifast believes that the expectations, statements and assumptions reflected in these forward-looking statements are reasonable, it cautions readers to always consider all of the risk factors and any other cautionary statements carefully in evaluating each forward-looking statement in this release, as well as those set forth in its Annual Report on Form 10-K for the fiscal year ended December 31, 2022, and other filings filed with the United States Securities and Exchange Commission, including its quarterly reports on Form 10-Q and current reports on Form 8-K. All of the forward-looking statements contained herein speak only as of the date of this Report.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

(d) | Exhibits. |

| | |

| 104.1 | Cover Page Interactive Data File (embedded within the Inline XBRL Document) |

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| MEDIFAST, INC. |

| |

| By: | /s/ James P. Maloney |

| | James P. Maloney |

| | Chief Financial Officer |

| | |

| Dated: September 27, 2023 | | |

Cover

|

Sep. 26, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 26, 2023

|

| Entity Registrant Name |

MEDIFAST, INC.

|

| Entity Address, Address Line One |

100 International Drive

|

| Entity Address, City or Town |

Baltimore

|

| Entity Address, State or Province |

MD

|

| Entity Address, Postal Zip Code |

21202

|

| City Area Code |

410

|

| Local Phone Number |

581-8042

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

MED

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000910329

|

| Amendment Flag |

false

|

| Entity Tax Identification Number |

13-3714405

|

| Entity File Number |

001-31573

|

| Entity Incorporation, State or Country Code |

DE

|

| NEW YORK STOCK EXCHANGE, INC. |

|

| Entity Information [Line Items] |

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

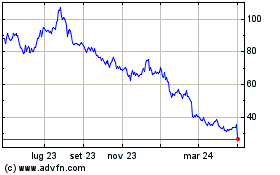

Grafico Azioni Medifast (NYSE:MED)

Storico

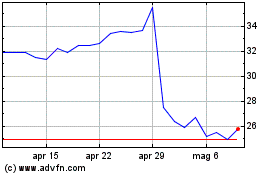

Da Apr 2024 a Mag 2024

Grafico Azioni Medifast (NYSE:MED)

Storico

Da Mag 2023 a Mag 2024